Hva er Flow?

Flow er en blockchain skapt av Dapper Labs som har som mål å gjøre det enkelt for utviklere å bygge desentraliserte applikasjoner og bedrifter. Flow bruker en flerrollearkitektur for å skalere nettverket i stedet for å bruke sharding. En av hovedgrunnene til at Dapper Labs valgte å bevege seg bort fra Ethereum og bygge sin egen blockchain for generelle formål var å unngå kompleksiteten med sharding. Flow hevder at deres skalering-uten-sharding strategi vil forbedre nettverkets hastighet og gjennomstrømning samtidig som de opprettholder standarder for sammensetning og et utviklervennlig, ACID-kompatibelt miljø.

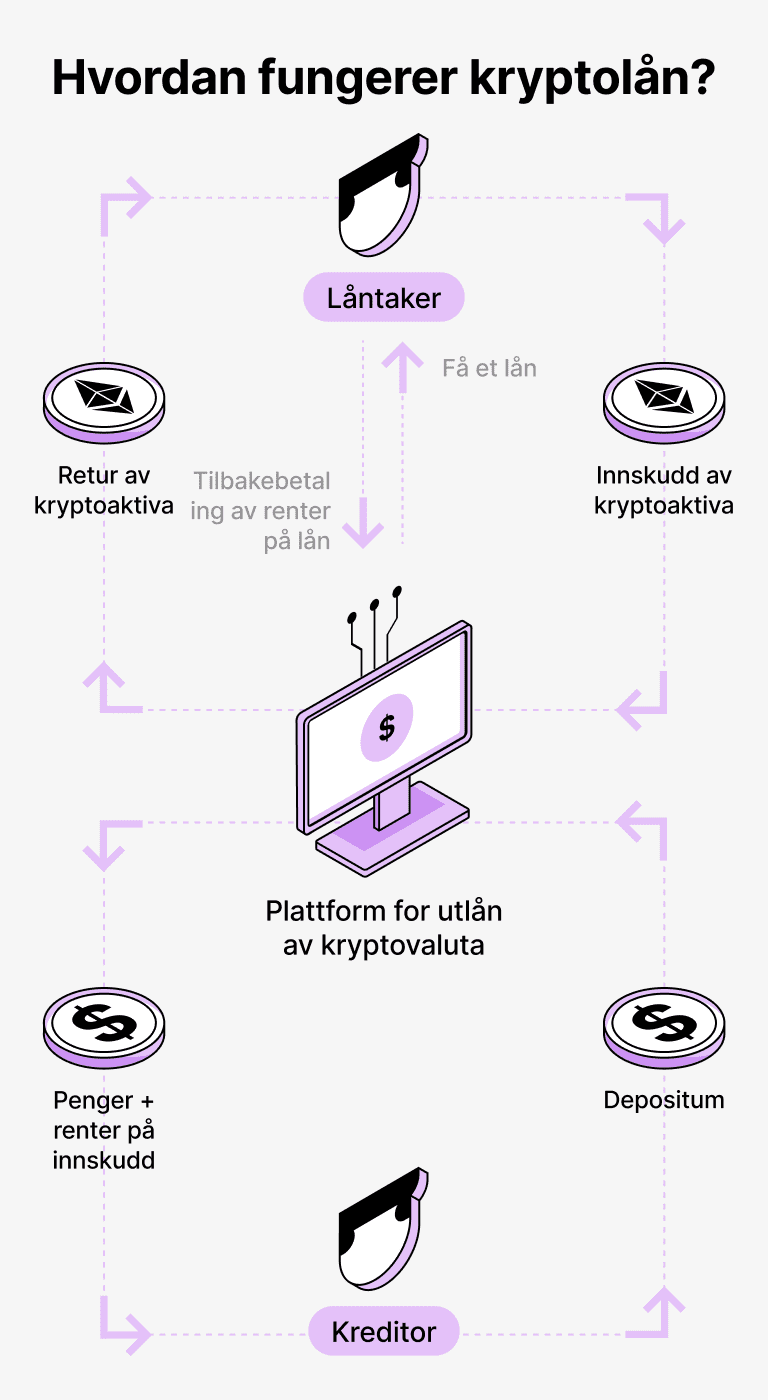

Hvordan fungerer lån som støttes av FLOW?

Krypto-finansiering gir et enkelt alternativ for lånesøkere og finansierere. Lånssøkere kan sikre finansiering i USDT ved å bruke sine digitale mynter som sikkerhet, og beholde eierskapet til sine kryptoaktiva. Dette omgår behovet for omfattende kredittvurderinger og papirarbeid, og fremskynder prosedyren samtidig som det blir mer kostnadseffektivt.

Finansierere kan overføre sin digitale valuta, som for eksempel Flow (FLOW), til en eksklusiv konto administrert av Cropty-plattformen. Forvalteren overvåker transaksjonene mellom långivere og låntakere, og gir en trygg låneatmosfære. De fungerer som en troverdig tredjepart og beskytter investeringene til alle involverte parter.

Overgangen til denne modusen gir låntakerne fordelen av å få tilgang til kontanter uten å kvitte seg med sine digitale eiendeler. Dette er særdeles nyttig i turbulente markedssituasjoner, og hjelper dem med å unngå potensielle tilbakeslag. Lånestrukturen forenkler også låneoperasjonen og eliminerer kredittsjekker.

På den annen side tjener långiverne penger på avkastningen fra lånebetalingene. Dette gjør at de kan dra nytte av sine digitale eiendeler betydelig. Det skaper et gjensidig gunstig økosystem der låntakere kan få lån, og långivere tjener på sitt bidrag.

Cropty-plattformen ordner avtalen mellom långivere og låntakere, og bruken av blokkjedeteknologi sørger for sikre transaksjoner uten mellommenn. Dette begrenser sannsynligheten for svindelaktiviteter og fremmer en trygg finansplattform.

Flow lånekalkulator

Kryptolån forklart

Hvordan få et lån i Flow? Lån usd med Flow som sikkerhet på Cropty

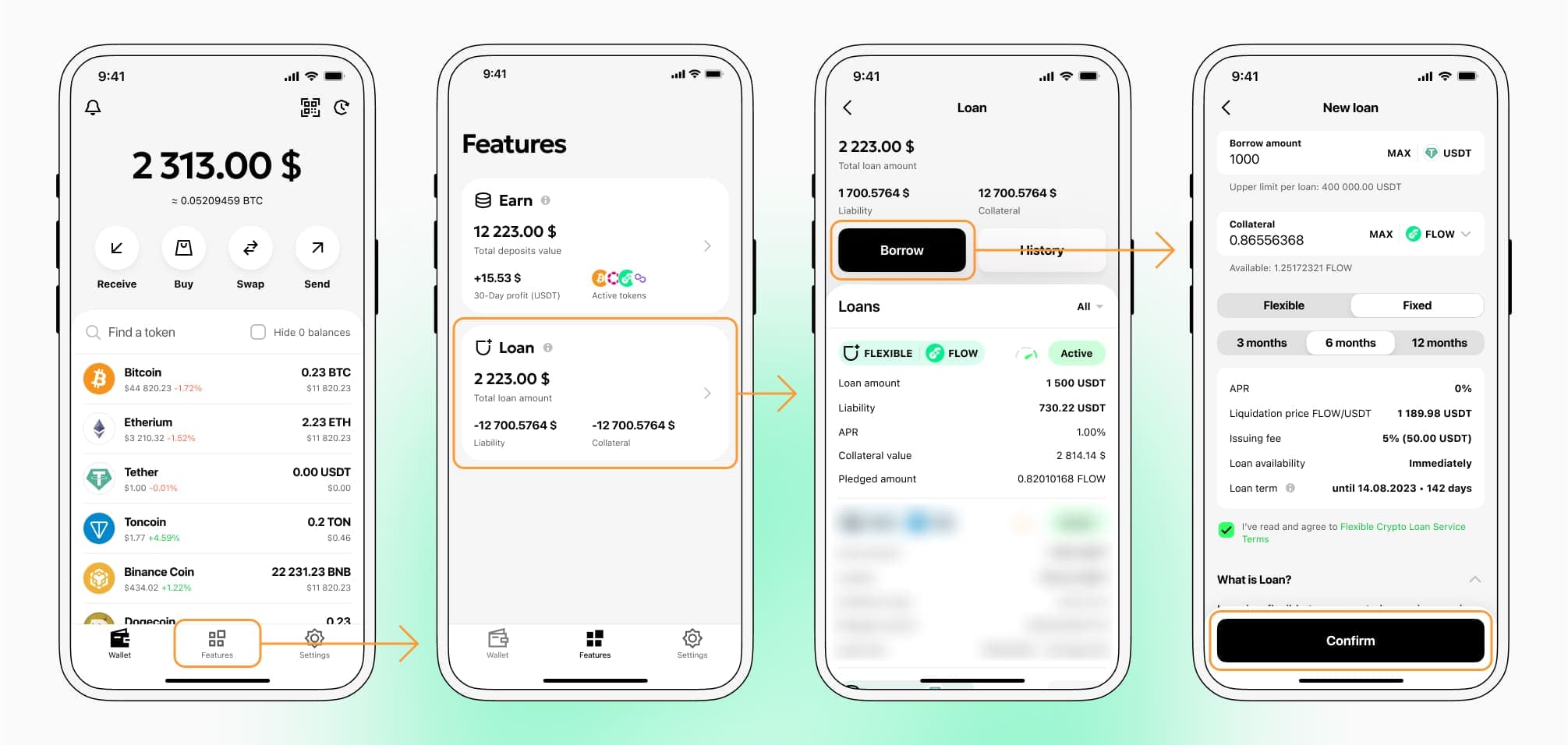

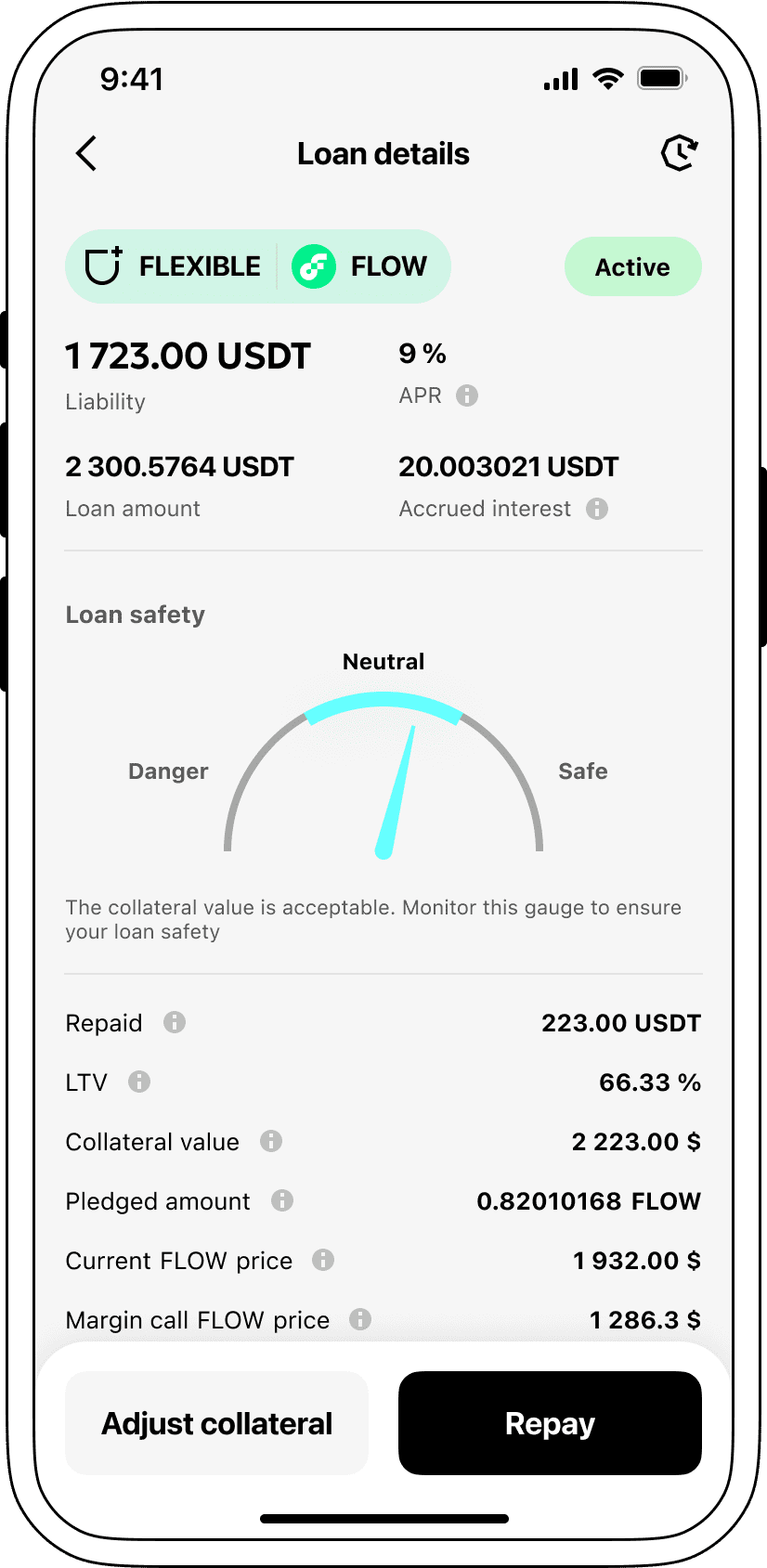

Prosessen for å få et Flow-kryptolån er ganske enkel. Først må du opprette en konto på Cropty, en plattform som tilbyr utlånstjenester for Flow-kryptovaluta. Deretter må du stille din FLOW som sikkerhet og angi lånebeløpet du ønsker å låne. Plattformen vurderer så sikkerheten din og gir deg tilgang til det nødvendige beløpet Tether USDT.

Din kredittverdighet bestemmes ut fra verdien av din sikkerhet, noe som gjør prosessen med å få et kryptolån rask og praktisk.

Det er imidlertid viktig å huske at Flow-kryptolån ikke er uten risiko. Hvis du misligholder lånet, kan sikkerheten din bli beslaglagt. Derfor bør du nøye vurdere din evne til å tilbakebetale før du tar opp et kryptolån.

For å autorisere et Flow-kryptolån må du gå til fanen Funksjoner → Lån-seksjonen → Lån-knappen

Velg ønsket lånebeløp, gå gjennom vilkårene for kryptolånet, og søk om det ved å bekrefte med en kode fra 2FA — via appen, e-post eller Telegram-bot.

Lær mer om FLOW-kryptolån

Rente på lån sikret av kontantstrøm

Ved Cropty er det viktig å erkjenne betydningen av konkurransedyktige renter. Derfor tilbyr vi utlånsordninger ved hjelp av digital valuta til en attraktiv rente på 9% årlig. Enten det er personlige utgifter eller dekning av forretningskostnader, disse lavrenten cryptocurrency-lånene tilbyr en økonomisk teknikk for å utnytte likviditet uten nødvendigheten av å gi fra seg dine verdifulle kryptovalutaer.

En særegen kvalitet ved Croptys lån med digital valuta er sikkerhetsprosedyren. Når mislighold av lån oppstår, forblir låntakers sikkerhetsstillede Flow i Croptys hvelv, mens utstedte Tether USDT forblir hos låntakeren. Denne tilnærmingen garanterer en rettferdig og gjensidig rute for lånereprofiler, til fordel for alle involverte parter.

For å motvirke risikoen forbundet med verdifall på Flow, benytter Cropty et automatisert likvidasjonssystem. Hvis verdien av sikkerheten faller under en kritisk terskel, aktiveres likvidasjonen av lånet automatisk. Denne dynamiske handlingen hindrer potensielle tap for både låntaker og utlåner i tilfelle en nedgang i markedsprisen.

Interaktiv tilgjengelighet og gjennomsiktighet er aspekter som Cropty legger vekt på. Våre kunder kan enkelt følge med på statusen for lånet gjennom vårt brukervennlige digitale kontrollpanel. I tillegg, med muligheten til å bidra med ekstra sikkerhet, tidlig nedbetaling eller fullføre kreditoren ved å betale både opprinnelig sum og påløpte renter, blir våre låntakere belønnet med fleksibilitet.

Hvis du undersøker metoder for å sikre et lån med digital valuta, er Cropty her for å tilby øyeblikkelig myntlån. Du kan låne mot din Flow og motta Tether USDT som vederlag. Våre kryptovaluta-sikrede lån er tilstrekkelige for å dekke dine økonomiske behov raskt og praktisk.

Hvorfor velge Flow Cropty-lån

Ofte stilte spørsmål

Hva er Cropty Flow Crypto Loan?

Hvordan pantsetter jeg eiendelene mine og starter et lån med Cropty Flow Crypto Loan?

Hva er LTV, og hvor mye kan jeg låne med Cropty Flow Crypto Loan?

Finnes det grenser for hvor mye jeg kan pantsette og låne?

Hva er lånelikvidasjon, og hva er likvidasjons-LTV?

Hva skjer når et lån blir likvidert?

Hva er et margin call?

Vil jeg bli varslet ved margin calls eller likvidasjoner?

Hvilken rentesats gjelder for mitt lån?

Hvordan beregnes renter på mine låneposisjoner?

Hvordan tilbakebetaler jeg lånet mitt eller justerer LTV-en min?

Hvilke kryptovalutaer kan jeg stille som sikkerhet eller låne på Cropty Crypto Loan?

Hva kan jeg gjøre med kryptovalutaene jeg låner fra Cropty Flow Crypto Loan?

Flere mynter