Apa yang dimaksud dengan Polygon?

Polygon adalah platform yang dirancang untuk mendukung pengembangan infrastruktur dan membantu Ethereum dalam skala. Komponen intinya adalah kerangka modular dan fleksibel (Polygon SDK) yang memungkinkan pengembang untuk membangun dan menghubungkan infrastruktur Layer-2 seperti Plasma, Optimistic Rollups, zkRollups, dan Validium serta sidechain mandiri seperti produk andalan proyek, Matic POS (Proof-of-Stake). Polygon mengubah mereknya dari Matic Network pada bulan Februari 2021 dan beralih untuk mendukung beberapa infrastruktur Layer-2. Polygon akan terus mendukung sidechain Matic POS dan sistem pembayaran berbasis Plasma, yang saat ini menampung lebih dari 90 aplikasi.

Bagaimana cara kerja pinjaman yang dijamin oleh MATIC

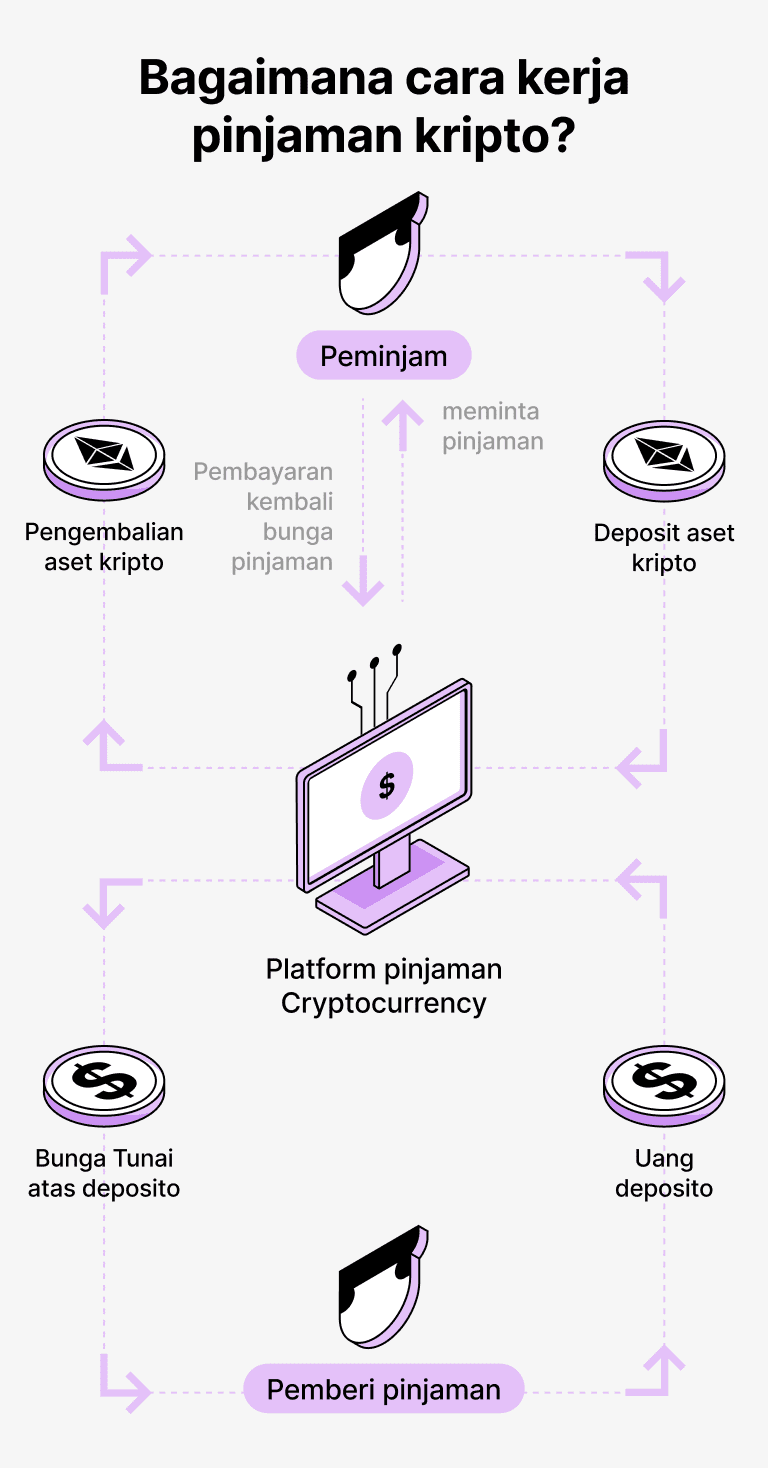

Mendapatkan pinjaman melalui teknologi blockchain, seperti kredit kripto, menawarkan alternatif mudah bagi peminjam dan pemberi pinjaman. Peminjam mendapatkan keuntungan menerima pinjaman mereka dalam USDT sambil menggunakan aset kripto, seperti Polygon (MATIC), sebagai jaminan - ini melampaui pemeriksaan kredit tradisional dan dokumentasi, mempercepat pengalaman dan membuatnya lebih terjangkau.

Sementara itu, pemberi pinjaman dapat memindahkan Polygon atau kripto lainnya ke akun tertentu di Cropty, dengan penjaga yang dapat dipercaya mengelola proses antara dua entitas dengan aman. Penjaga juga bertindak sebagai perantara yang dapat diandalkan, melindungi kepentingan kedua pihak yang terlibat.

Skema kredit ini pada akhirnya melayani peminjam dan memungkinkan mereka untuk memanfaatkan sumber daya yang tersedia tanpa harus menjual aset kripto mereka. Ini segera menjadi bermanfaat dalam pasar yang tidak stabil, karena biaya peluang kerugian potensial dapat dihindari, sementara pada saat yang sama mempermudah proses pinjaman melalui penghapusan pemeriksaan kredit.

Di luar itu, pemberi pinjaman dapat menghasilkan keuntungan dari aset blockchain mereka yang terakumulasi melalui bunga yang diperoleh dari pembayaran pinjaman - menciptakan skenario saling menguntungkan dimana pemberi pinjaman mendapatkan keuntungan dari keterlibatannya dan peminjam berhasil mendapatkan pinjaman.

Cropty – platform kripto ini membuat proses antara pemberi pinjaman dan peminjam lebih lancar sambil menggunakan teknologi blockchain untuk memastikan transaksi yang jelas, aman tanpa agen perantara. Ini menurunkan risiko penipuan dan membina suasana peminjaman yang aman.

Polygon Kalkulator Pinjaman

Pinjaman Crypto dijelaskan

Bagaimana cara mendapatkan pinjaman di Polygon? Pinjam usd terhadap Polygon di Cropty

Proses untuk mendapatkan pinjaman mata uang kripto Polygon cukup sederhana. Pertama, Anda perlu membuat akun di Cropty, sebuah platform yang menawarkan layanan pinjaman mata uang kripto Polygon. Kemudian, Anda perlu memberikan MATIC sebagai jaminan dan menentukan jumlah pinjaman yang ingin Anda pinjam. Platform ini kemudian mengevaluasi agunan Anda dan memberi Anda akses ke jumlah Tether USDT yang diperlukan.

Kelayakan kredit Anda ditentukan berdasarkan nilai agunan Anda, sehingga proses mendapatkan pinjaman mata uang kripto menjadi cepat dan nyaman.

Namun, penting untuk diingat bahwa Polygon pinjaman mata uang kripto bukannya tanpa risiko. Jika Anda gagal membayar pinjaman, agunan Anda dapat disita. Oleh karena itu, Anda harus menilai dengan cermat kapasitas pembayaran Anda sebelum mengambil pinjaman mata uang kripto.

Untuk mengotorisasi Polygon Crypto Loan, Anda harus pergi ke tab Fitur → Bagian Pinjaman → Tombol Pinjam

Pilih jumlah pinjaman yang dibutuhkan, syarat dan ketentuan pinjaman kripto, dan ajukan permohonan dengan mengonfirmasikannya dengan kode dari 2FA - aplikasi atau E-mail atau Telegram-bot.

Pelajari lebih lanjut tentang MATIC Pinjaman Kripto

Bunga untuk pinjaman yang dijamin oleh Polygon

Di Cropty, kami menghargai pentingnya tingkat bunga pinjaman yang terjangkau dan oleh karena itu, kami menawarkan Anda pinjaman yang didukung oleh cryptocurrency, dengan tingkat bunga yang menarik hanya 9%. Apakah Anda mencari modal untuk pengeluaran pribadi atau investasi bisnis, pinjaman kami yang berharga moderat menyediakan pendekatan yang kuat secara finansial untuk melikuidasi aset tanpa harus melepas aset cryptocurrency Anda yang berharga.

Aspek yang membedakan pinjaman crypto Cropty terletak pada praktik penjaminannya. Dalam kasus di mana pemegang pinjaman gagal bayar, MATIC yang dijaminkan tetap dalam penguasaan Cropty, sementara peminjam tetap memiliki Tether USDT yang telah disalurkan. Hal ini memberikan strategi yang adil terhadap pemulihan pinjaman, menguntungkan untuk semua pihak yang terlibat.

Mengingat risiko potensial dari depresiasi Polygon, Cropty menggabungkan prosedur likuidasi otomatis. Ketika nilai jaminan yang dipertaruhkan jatuh di bawah batas kritis tertentu, pinjaman memasuki keadaan likuidasi. Langkah antisipatif ini melindungi baik pemberi pinjaman maupun penerima pinjaman terhadap kemungkinan kerugian sehubungan dengan penurunan pasar keuangan.

Dalam semangat keterbukaan dan kenyamanan, Cropty memungkinkan peminjam untuk dengan mudah melacak status pinjaman mereka melalui platform digital kami yang intuitif. Selain itu, keuntungan tambahan bagi pemegang pinjaman adalah kemampuan untuk menyerahkan jaminan lebih banyak, melunasi pinjaman lebih awal jika mereka mau, atau menyelesaikan pinjaman dengan mengembalikan jumlah yang dipinjam bersama dengan bunga yang telah dikumpulkan.

Penasan tentang bagaimana cara mendapatkan pinjaman dengan menggunakan cryptocurrency? Cropty memfasilitasi pinjaman coin yang cepat, memungkinkan Anda untuk menyertakan Polygon sebagai jaminan dan mendapatkan Tether USDT sebagai gantinya. Pinjaman kami yang didukung oleh crypto menawarkan solusi yang cepat dan mudah untuk kebutuhan pendanaan Anda.

Mengapa memilih Polygon Cropty Pinjaman

FAQ

Apa itu Cropty Polygon Pinjaman Kripto?

Bagaimana cara menjaminkan aset saya dan mulai meminjam dengan Cropty Polygon Pinjaman Kripto?

Apa itu LTV, dan berapa banyak yang bisa saya pinjam dari Cropty Polygon Pinjaman Kripto?

Apakah ada batasan jumlah yang dapat saya jaminkan dan pinjam?

Apa yang dimaksud dengan likuidasi pinjaman, dan apa itu LTV likuidasi?

Apa yang terjadi ketika pinjaman dilikuidasi?

Apa yang dimaksud dengan margin call?

Apakah saya akan diberitahu jika terjadi margin call atau likuidasi?

Suku bunga apa yang berlaku untuk pinjaman saya?

Bagaimana bunga diperoleh untuk posisi pinjaman saya?

Bagaimana cara melunasi pinjaman saya atau menyesuaikan LTV saya?

Mata uang kripto apa yang bisa saya jaminkan atau pinjam di Cropty Crypto Loan?

Apa yang dapat saya lakukan dengan cryptocurrency yang dipinjam dari Cropty Polygon Crypto Loan?

Lebih banyak koin