Dogecoin چیست؟

متن "Dogecoin یک ارز دیجیتال بازیگوش است که با پذیرش میم اینترنتی شبا اینو محبوب شده است."

چگونه وامهای پشتیباندار با DOGE کار میکنند

وامهای کریپتو گزینهای آسان برای هر دو طرف، یعنی وامگیرندگان و وامدهندگان ارائه میدهند. افراد میتوانند وامهایی به صورت USDT دریافت کنند، در حالی که از ارزهای دیجیتال خود به عنوان وثیقه استفاده میکنند و به این ترتیب مالکیت توکنهای دیجیتال خود را حفظ میکنند. این روش الزامات ارزیابی اعتبار و مستندات را لغو میکند، بنابراین فرآیند را تسریع و هزینهها را کاهش میدهد.

وامدهندگان میتوانند ارزهای دیجیتال خود مانند دوجکوین (DOGE) را به یک حساب امن در پلتفرم Cropty واریز کنند. یک نهاد نگهدارنده، رابطه بین وامگیرندگان و وامدهندگان را مدیریت میکند و فرآیند انجام معامله ایمن را تضمین میکند. به عنوان یک واسط قابل اعتماد، این نهاد منافع هر دو طرف درگیر را محافظت میکند.

وامگیرندگان به طور مطلوب به منابع مالی دسترسی پیدا میکنند بدون اینکه نیاز به فروش ارزهای دیجیتال خود داشته باشند. این امر به ویژه در شرایط نوسانات بازار سودمند است و به آنها کمک میکند از ضررهای ممکن جلوگیری کنند. مدل وامگیری همچنین فرآیند قرض گرفتن را تسهیل میکند و ارزیابی اعتبار را از بین میبرد.

وامدهندگان میتوانند از طریق بازپرداختهای وامگیرندگان بر روی وجوه ارائه شده خود سود کسب کنند. این تنظیم به آنها اجازه میدهد از داراییهای ارز دیجیتال خود بهرهبرداری کنند و وضعیتی سودآور ایجاد میکند که در آن وامگیرندگان وام میگیرند و وامدهندگان از این مشارکت سود میبرند.

پلتفرم Cropty تعاملات بین وامگیرندگان و وامدهندگان را نظارت میکند و با فناوری بلاکچین تراکنشهای ایمن و بدون واسطه را تسهیل میکند و در نتیجه ریسک تقلب را به حداقل میرساند و یک فضای وامگیری محافظتشده ایجاد میکند.

ماشین حساب وام Dogecoin

معرفی وامهای کریپتو

چگونه در Dogecoin وام بگیریم؟ در Cropty در ازای وثیقهگذاری Dogecoin دلار قرض بگیرید

فرآیند دریافت وام ارز دیجیتال Dogecoin نسبتاً ساده است. ابتدا باید در Cropty حساب کاربری بسازید، پلتفرمی که خدمات اعطای وام ارز دیجیتال Dogecoin را ارائه میدهد. سپس باید DOGE خود را بهعنوان وثیقه ارائه دهید و مقدار وامی را که میخواهید دریافت کنید مشخص کنید. پلتفرم سپس وثیقه شما را ارزیابی میکند و دسترسی به مقدار مورد نیاز Tether USDT را برای شما فراهم میسازد.

اعتبارسنجی شما براساس ارزش وثیقهتان تعیین میشود، که فرآیند دریافت وام ارز دیجیتال را سریع و راحت میکند.

با این حال، مهم است به خاطر داشته باشید که وامهای ارز دیجیتال Dogecoin خالی از ریسک نیستند. در صورت عدم پرداخت وام، وثیقه شما ممکن است ضبط شود. بنابراین، باید قبل از گرفتن وام ارز دیجیتال، با دقت توان بازپرداخت خود را ارزیابی کنید.

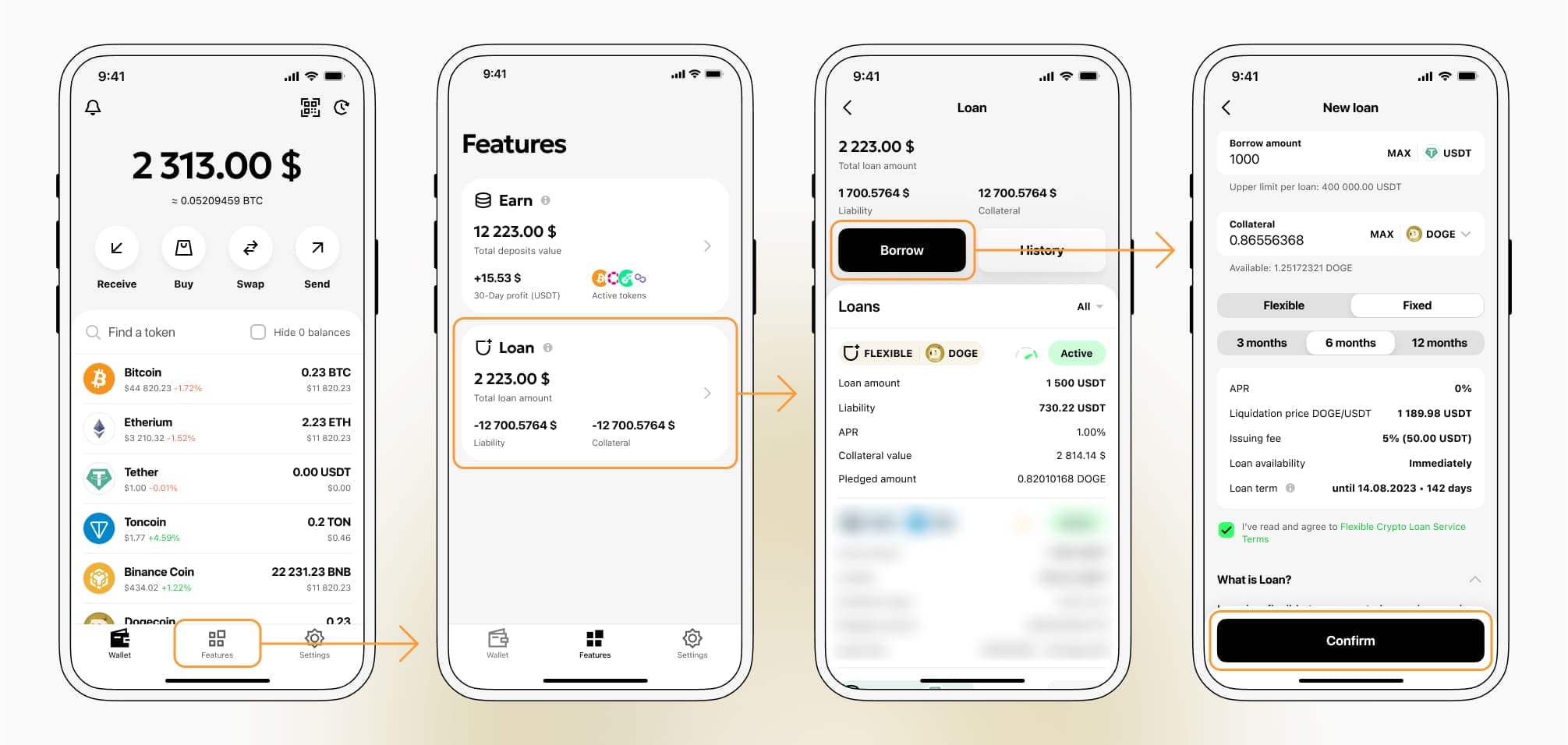

برای تأیید یک وام کریپتو Dogecoin، باید به برگه Features → بخش Loan → دکمه Borrow بروید

مقدار وام مورد نیاز، شرایط و ضوابط وام کریپتو را انتخاب کنید و با تأیید آن با کد 2FA — اپلیکیشن، ایمیل یا ربات تلگرام — درخواست دهید.

اطلاعات بیشتر درباره وامهای DOGE

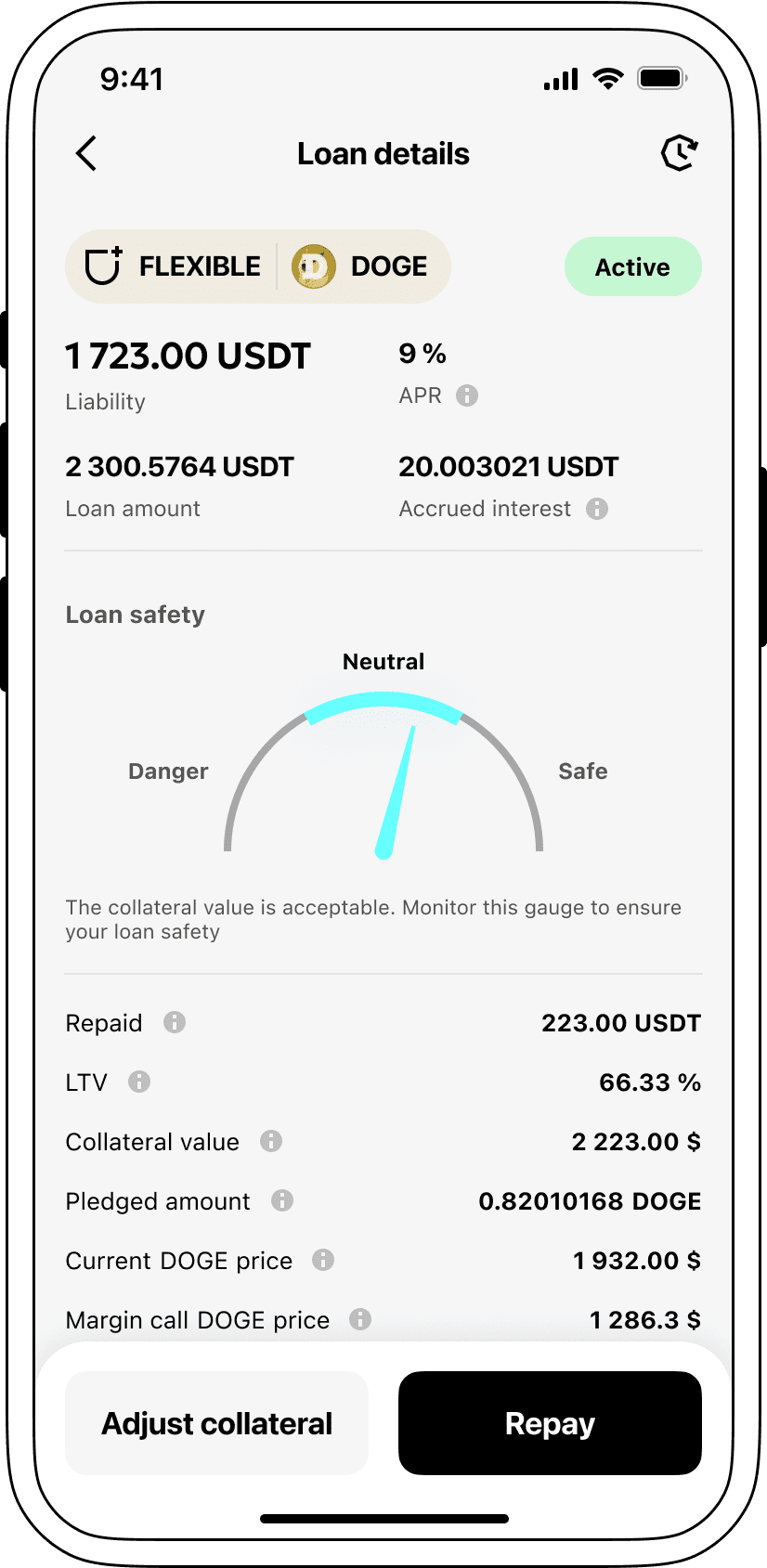

نرخ بهره وامهای تضمین شده با دوجکوین.

در کراپتی، ما اهمیت نرخهای بهره رقابتی را درک میکنیم. به همین دلیل است که وامهایی با پشتیبانی از ارز دیجیتال را با نرخ جذاب فقط ۹٪ ارائه میدهیم. چه به وجوه برای نیازهای شخصی خود نیاز داشته باشید و چه برای پروژههای تجاری، وامهای کمهزینه ما راهی مقرون به صرفه برای دسترسی به نقدینگی بدون نیاز به فروش ارزهای دیجیتال محبوب شما ارائه میدهند.

ویژگی بارز وامهای ارز دیجیتال کراپتی، روش وثیقهگذاری است. اگر یک وامگیرنده نتواند وام را بازپرداخت کند، DOGE وثیقهگذاری شده در اختیار کراپتی باقی میماند، در حالی که وامگیرنده Tether USDT را که دریافت کرده، حفظ میکند. این موضوع فرآیند بازپرداخت وام را عادلانه و منصفانه برای هر دو طرف درگیر تضمین میکند.

برای کاهش ریسکهای مرتبط با کاهش ارزش دوج کوین، کراپتی یک سیستم تصفیه خودکار را اجرا کرده است. اگر ارزش وثیقه به زیر سطح معینی کاهش یابد، وام تصفیه خواهد شد. این اقدام پیشگیرانه از هر دو طرف وامدهنده و وامگیرنده در برابر خسارات احتمالی در هنگام کاهش بازار محافظت میکند.

کراپتی به شفافیت و سهولت اهمیت میدهد. مشتریان ما میتوانند به راحتی وضعیت وامهای خود را از طریق رابط کاربری آسان ما پیگیری کنند. علاوه بر این، وامگیرندگان میتوانند وثیقه بیشتری اضافه کنند، وام خود را زودتر تسویه کنند، یا با بازپرداخت مبلغ وام همراه با هرگونه سود انباشته شده، آن را ببندند.

اگر کنجکاو هستید که چگونه میتوانید وامی با استفاده از ارز دیجیتال دریافت کنید، کراپتی وامهای سکهای فوری ارائه میدهد. شما میتوانید وامی در ازای دوجکوین تأمین کنید و Tether USDT به عنوان بازپرداخت دریافت کنید. وامهای پشتیبانیشده با ارز دیجیتال ما راهحلی سریع و ساده برای نیازهای مالی شما ارائه میدهند.

چرا وام Dogecoin از Cropty را انتخاب کنید

سوالات متداول

Cropty Dogecoin وام رمزارزی چیست؟

چگونه داراییهایم را وثیقه کنم و با Cropty Dogecoin وام رمزارزی دریافت کنم؟

LTV چیست و با Cropty Dogecoin وام رمزارزی چقدر میتوانم قرض بگیرم؟

آیا محدودیتی برای میزان وثیقهگذاری و قرضگیری وجود دارد؟

تصفیه وام چیست و LTV تصفیه چه معنایی دارد؟

وقتی یک وام تصفیه میشود چه اتفاقی میافتد؟

هشدار مارجین چیست؟

آیا در صورت هشدار مارجین یا تصفیه مطلع خواهم شد؟

نرخ بهره وام من چیست؟

سود وام من چگونه محاسبه و انباشته میشود؟

چطور وامم را بازپرداخت کنم یا نسبت LTV خود را تنظیم کنم؟

کدام رمزارزها را میتوانم در Cropty Crypto Loan بهعنوان وثیقه قرار دهم یا قرض بگیرم؟

با رمزارزهایی که از Cropty Dogecoin Crypto Loan قرض میگیرم چه کاری میتوانم انجام دهم؟

سکههای بیشتر