What is Zcash?

Zcash is a privacy-preserving cryptocurrency providing anonymous value transfer using zero-knowledge cryptography. The protocol provides the option for transactions to be either shielded, in which case they will be completely anonymous, or transparent, in which case they will be visible on the Zcash blockchain. Zcash pays out a portion of its block rewards, called the "Founder's Reward", to fund protocol development. It currently allocates the Founder's Reward to the Electric Coin Company and the Zcash Foundation who develop and steward the Zcash protocol respectively.

How do loans backed by ZEC works

"Crypto financing provides a straightforward answer for loan seekers and investors. Loan seekers can secure loans in USDT by submitting their virtual currency like Zcash (ZEC) as security, retaining ownership of their digital wealth. This eradicates the necessity for credit assessments and bureaucratic paperwork; thus, enhancing speed and affordability.

On the other end, financers deposit their virtual money into a specialized account via the Cropty platform. The custodian, playing a vital role, manages the connection between both parties, cementing a safe experience. This designated overseer bridges trust, protecting both side's stakes.

This schema permits loan seekers to access funds without liquidating their virtual currency - a smart move in a fluctuating market to dodge potential loss, simplify lending procedure and remove credit scrutiny stages.

Financers have an opportunity to amass interest on their deposited digital wealth through loan repayments, enabling them to churn profit from their digital assets. It offers a mutually beneficial dynamic wherein borrowers get loans, and lenders profit from participation.

The Cropty platform regulates all activities between loan seekers and financers. The inherent attribute of blockchain technology ensures secure transactions, discarding intermediaries' need, lowering the chance of fraudulent activities, and fostering a secure monetary lending ambiance.

Zcash Loan Calculator

Crypto Loans explained

How to get a loan on Zcash? Borrow usd against Zcash on Cropty

The process of getting an Zcash cryptocurrency loan is quite simple. First, you need to create your account on Cropty, a platform that offers Zcash cryptocurrency lending services. Then, you need to provide your ZEC as collateral and specify the loan amount you want to borrow. The platform then evaluates your collateral and gives you access to the required amount of Tether USDT.

Your creditworthiness is determined based on the value of your collateral, making the process of getting a cryptocurrency loan fast and convenient.

However, it is important to remember that Zcash cryptocurrency loans are not without risks. In case you default on the loan, your collateral can be seized. Therefore, you should carefully assess your repayment capacity before taking out a cryptocurrency loan.

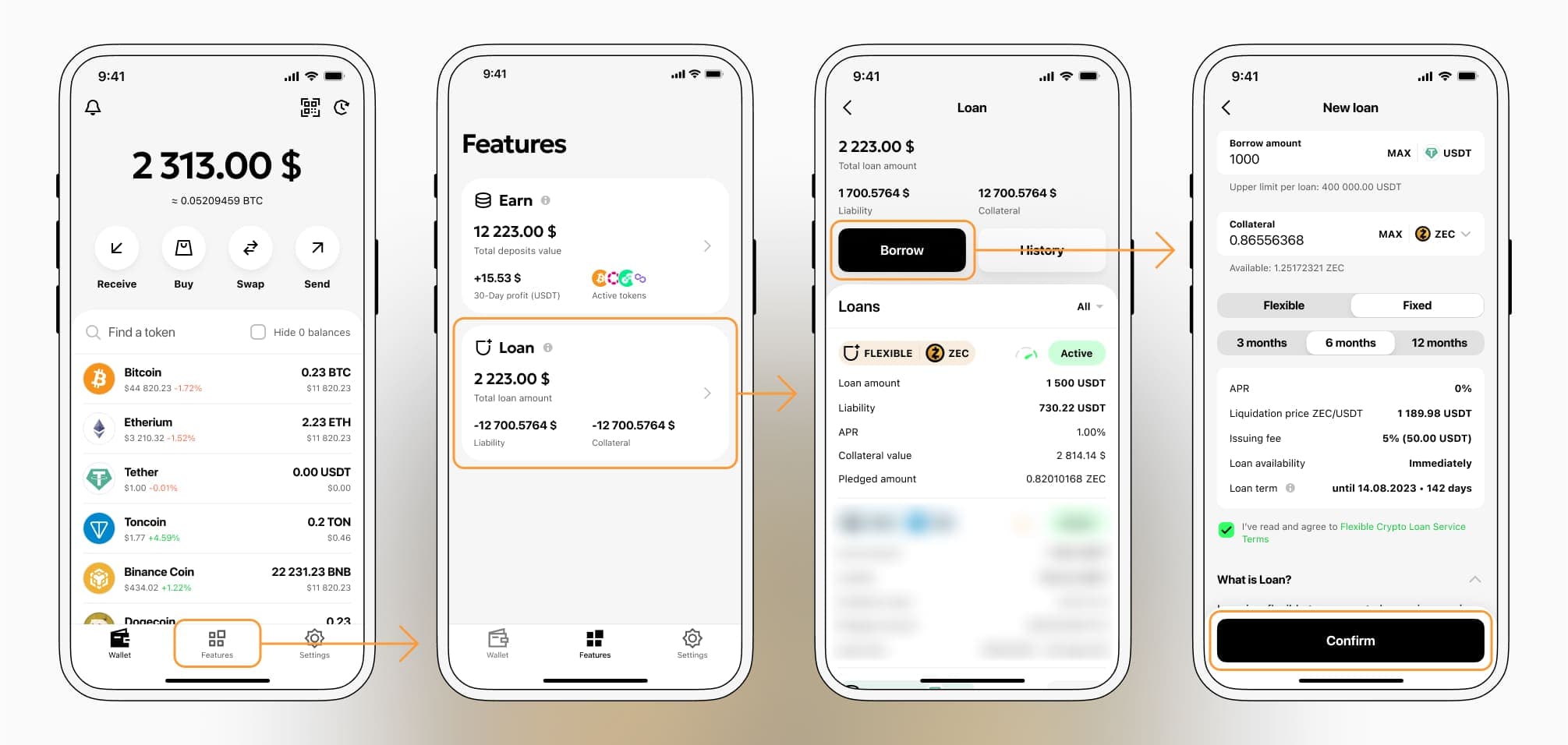

To authorize an Zcash Crypto Loan, you will need to go to Features tab → Loan section → Borrow button

Choose the required loan amount the terms and conditions of the crypto loan, and apply for it by confirming it with a code from 2FA - application or E-mail or Telegram-bot.

Learn more about ZEC Crypto Loans

Interest rates on loans secured by Zcash

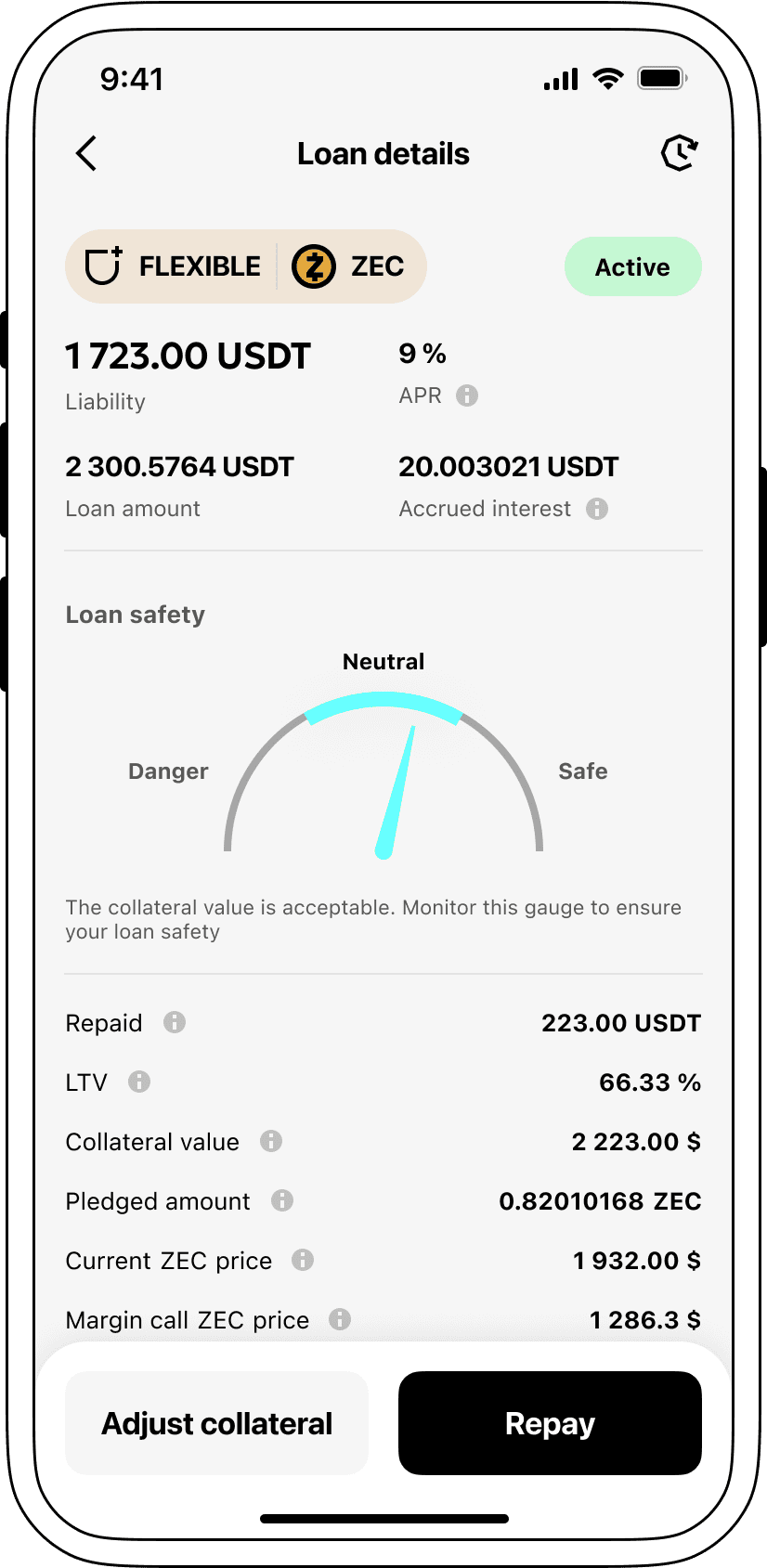

At Cropty, we realize how vital appealing credit rates are. Hence, we extend loans underpinned by cryptocurrency at an appealing fee of 9%. Regardless of your fund requirements being personal or commercial, our low-interest loans serve as an affordable method for gaining liquidity, without the need to offload your prized digital assets.

A distinctive aspect of Cropty's cryptocredit offerings is the collateral scheme. Should a loanee fail to clear their dues, the Zcash surety stays with Cropty, while the debtor retains the issued Tether USDT. This strategy instills a balanced method of loan recouping, advantageous for all parties involved.

Cropty has incorporated an automated liquidation process to address Zcash deflation risks. If the collateral's worth falls beneath a certain limit, an automatic sell-off triggers. This cautionary step safeguards both lender and debtor from inevitable losses during a market downfall.

We at Cropty prioritize openness and effortlessness. Clients can facilely track their loan status via our intuitive user platform. Besides, depending on the situation, borrowers wield the power to enhance their duration, settle the loan beforehand, or wind it up by returning the credited amount plus cumulating interest.

If you are curious about how to secure a loan with cryptocurrency, instantaneous Zcash loans are accessible with Cropty. In exchange for Zcash, you can avail Tether USDT, presenting an instant and straightforward remedy for your financial essentials. So, our crypto-financed loans stand as a prompt and handy solution meeting your fiscal needs.

Why choose Zcash Cropty Loan

FAQ

What is Cropty Zcash Crypto Loan?

How do I pledge my assets and start borrowing with Cropty Zcash Crypto Loan?

What is LTV, and how much can I borrow from Cropty Zcash Crypto Loan?

Are there limits to how much I can pledge and borrow?

What is loan liquidation, and what is the liquidation LTV?

What happens when a loan is liquidated?

What is a margin call?

Will I be notified in the event of margin calls or liquidations?

What interest rate applies to my loan?

How is interest accrued for my loan positions?

How do I repay my loan or adjust my LTV?

Which cryptocurrencies can I pledge or borrow on Cropty Crypto Loan?

What can I do with the cryptocurrencies borrowed from Cropty Zcash Crypto Loan?

More coins