What is Decentraland?

Decentraland is building a decentralized, blockchain-based virtual world for users to create, experience and monetize content and applications.

How do loans backed by MANA works

Crypto-finance opens a hassle-free loan option for those who need it and offers an easy way for the lenders to fund it. People who need credit can easily get a loan in USDT by using their digital currencies like Decentraland (MANA) without giving up the rights. No credit checks and paperwork mean that the whole process is done in a short period, hence very cost-effective.

The Cropty platform is a place where the lenders can put their digital coins in an account that is specifically made for that purpose in a very secure way. A custodian handles all the transactions between the borrowers and the lenders, thus providing a safe and secure environment. They act as a reliable point that connects and at the same time safeguards the interests of all parties involved.

Such efficient systems allow the borrowers to tap into the resources without selling the digital assets. In the constantly changing market, people are protected from the worst market falls. The peer-to-peer lending model also simplifies the whole process of borrowing money and the necessity of credit checking is totally done away with.

At the same time, the financiers get returns over their combined assets via credit reimbursements which, in turn, enables them to unlock the value of their crypto-assets. This simultaneously creates a win-win situation and that is by providing an excellent platform for the borrowers to fulfill their cash requirements while, at the same time, giving creditors a better investment option.

Cropty's platform thoroughly and carefully processes all dealings without any third-party intervention and uses cutting-edge blockchain technology that guarantees the smooth execution of all operations. This greatly reduces the chances of fraud and offers a safe financial ecosystem.

Decentraland Loan Calculator

Crypto Loans explained

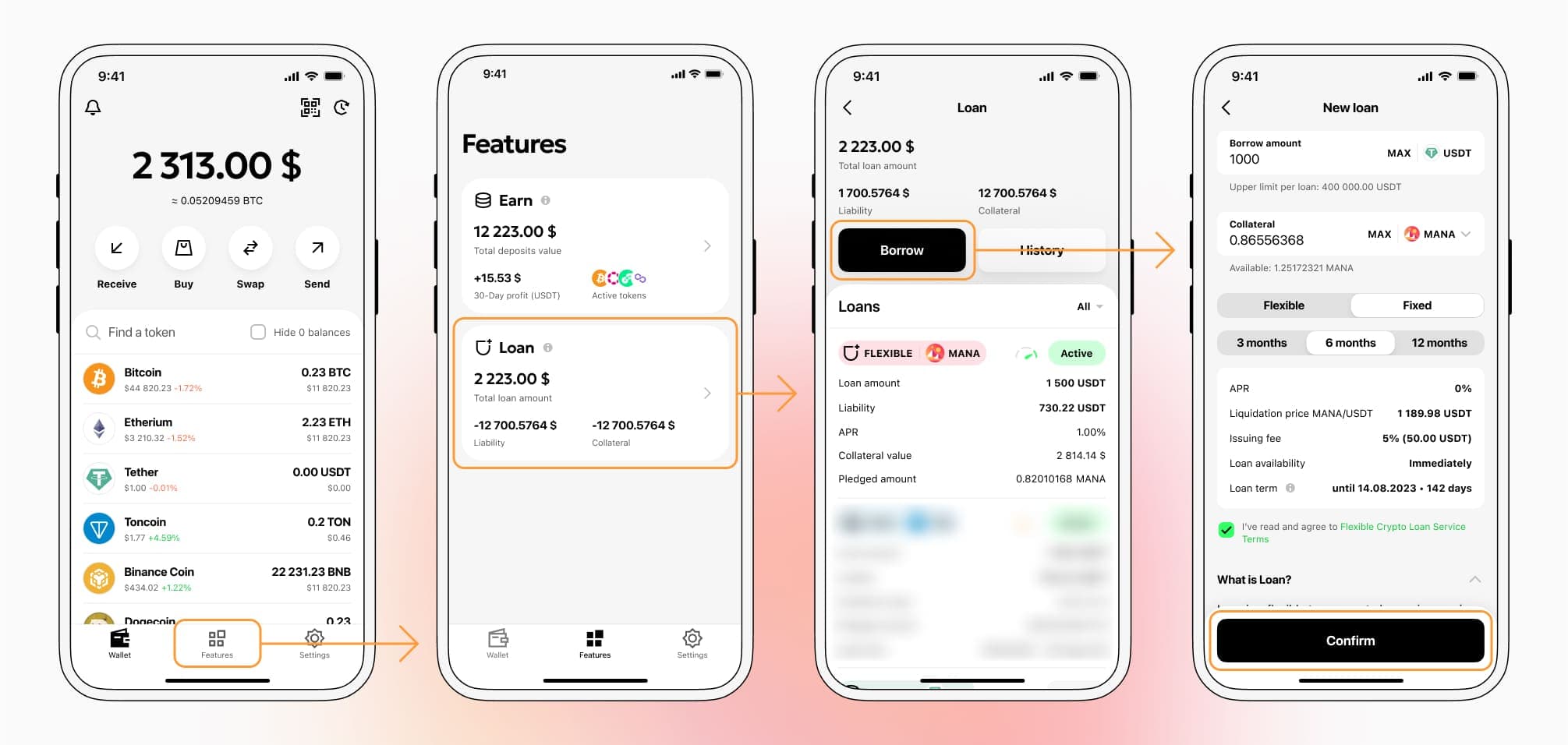

How to get a loan on Decentraland? Borrow usd against Decentraland on Cropty

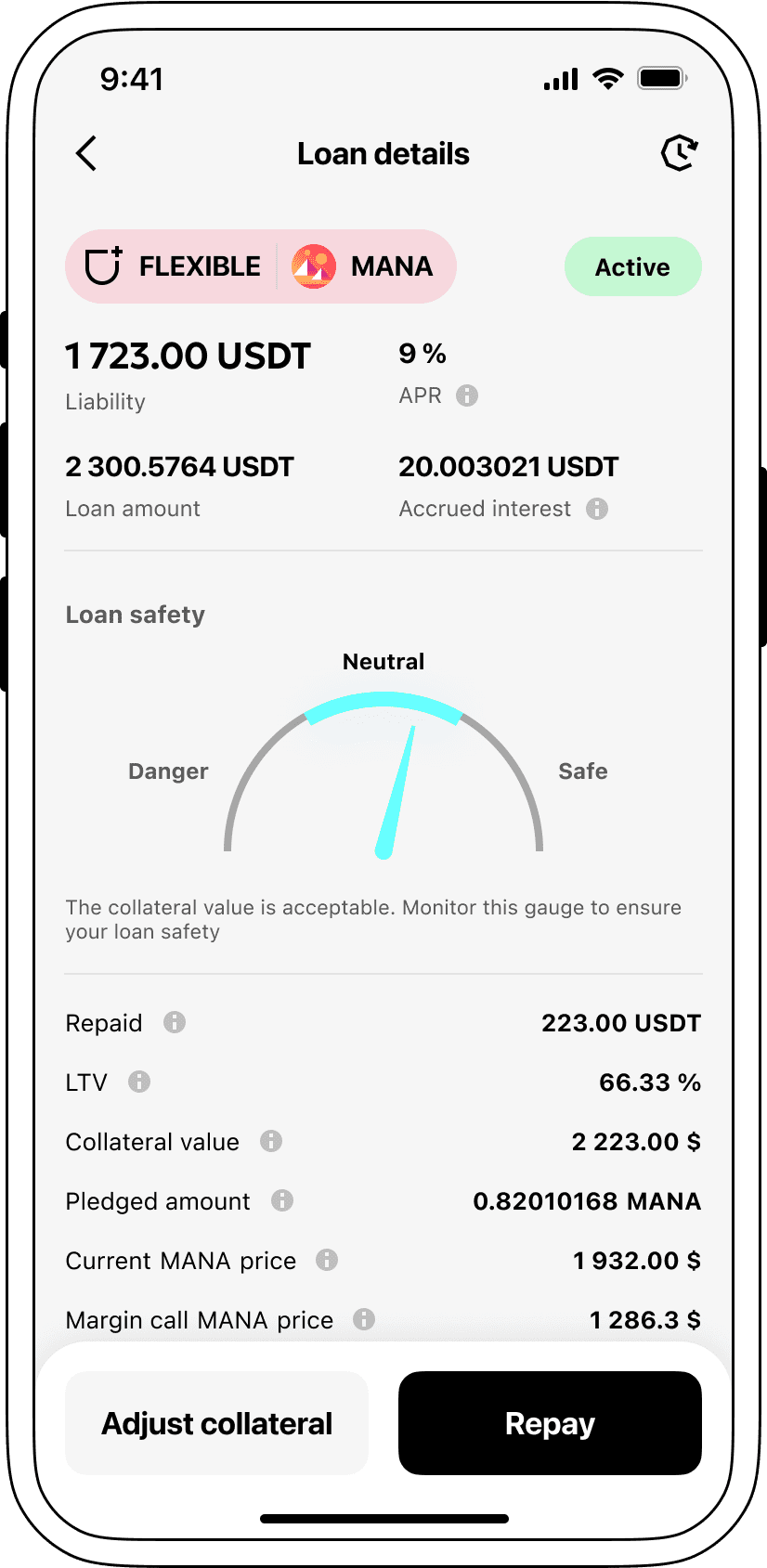

The process of getting an Decentraland cryptocurrency loan is quite simple. First, you need to create your account on Cropty, a platform that offers Decentraland cryptocurrency lending services. Then, you need to provide your MANA as collateral and specify the loan amount you want to borrow. The platform then evaluates your collateral and gives you access to the required amount of Tether USDT.

Your creditworthiness is determined based on the value of your collateral, making the process of getting a cryptocurrency loan fast and convenient.

However, it is important to remember that Decentraland cryptocurrency loans are not without risks. In case you default on the loan, your collateral can be seized. Therefore, you should carefully assess your repayment capacity before taking out a cryptocurrency loan.

To authorize an Decentraland Crypto Loan, you will need to go to Features tab → Loan section → Borrow button

Choose the required loan amount the terms and conditions of the crypto loan, and apply for it by confirming it with a code from 2FA - application or E-mail or Telegram-bot.

Learn more about MANA Crypto Loans

Interest rates for loans secured by Decentraland

We at Cropty understand the importance of providing the most competitive rates. As a result, we offer borrowing facilities in cryptocurrencies at an attractive rate of 9%. These low-interest loans are just the right tool to get you the necessary cash, no matter if you run out of money due to personal or business reasons, and you will not have to sell your crypto assets.

A notable characteristic of Cropty's cryptocurrency loans is the non-custodial nature of the security agreement. Let's say the debtor doesn't fulfill the contract of the loan. Then the security (in this case, MANA) will still belong to Cropty, while the lender will receive the Tether USDT that has been allotted to them. Such an arrangement results in a fair loan recovery process with rewards for all stakeholders involved

Cropty has decided to use an automatic liquidation process that covers the risk of Decentraland loss in value. If the market price of the collateral falls, the loan is immediately liquidated. This measure allows both the lender and the borrower to avoid possible losses in the event of a market decline.

Cropty values simplicity and transparency as highly as convenience. Through our user-friendly platform, our clients can take a look at the status of their loan accounts. Besides, borrowers are at liberty to add more security, take the loan off earlier than expected, or settle the loan by paying both the principal and the accumulated interest.

If you are confused about how to get a loan in cryptocurrency, Cropty will give you the opportunity to use your Decentraland as leverage and get Tether USDT right away. Our crypto-backed loans provide a fast and convenient alternative to cover your financial needs.

Why choose Decentraland Cropty Loan

FAQ

What is Cropty Decentraland Crypto Loan?

How do I pledge my assets and start borrowing with Cropty Decentraland Crypto Loan?

What is LTV, and how much can I borrow from Cropty Decentraland Crypto Loan?

Are there limits to how much I can pledge and borrow?

What is loan liquidation, and what is the liquidation LTV?

What happens when a loan is liquidated?

What is a margin call?

Will I be notified in the event of margin calls or liquidations?

What interest rate applies to my loan?

How is interest accrued for my loan positions?

How do I repay my loan or adjust my LTV?

Which cryptocurrencies can I pledge or borrow on Cropty Crypto Loan?

What can I do with the cryptocurrencies borrowed from Cropty Decentraland Crypto Loan?

More coins