Cryptocurrencies have long ceased to be something mysterious and unknown. Today they have become an integral part of the modern financial system. If you've decided to buy your first cryptocurrency — you're on the right track! It's not only a step toward financial independence, but also an opportunity to become familiar with one of the most promising technologies of our time. In this article you'll learn how to buy cryptocurrency safely and conveniently, which platforms are best to choose, and what a beginner should pay attention to.

We have a separate video on how to buy cryptocurrency. Watch it for all the details:

How to choose a reliable platform for buying cryptocurrency

First, you should start by choosing the platform where you will make the purchase. This is a crucial step: the security of your funds depends on the reliability of the platform you use. In general, you can acquire cryptocurrency either on a cryptocurrency exchange or by using a specialized exchange service.

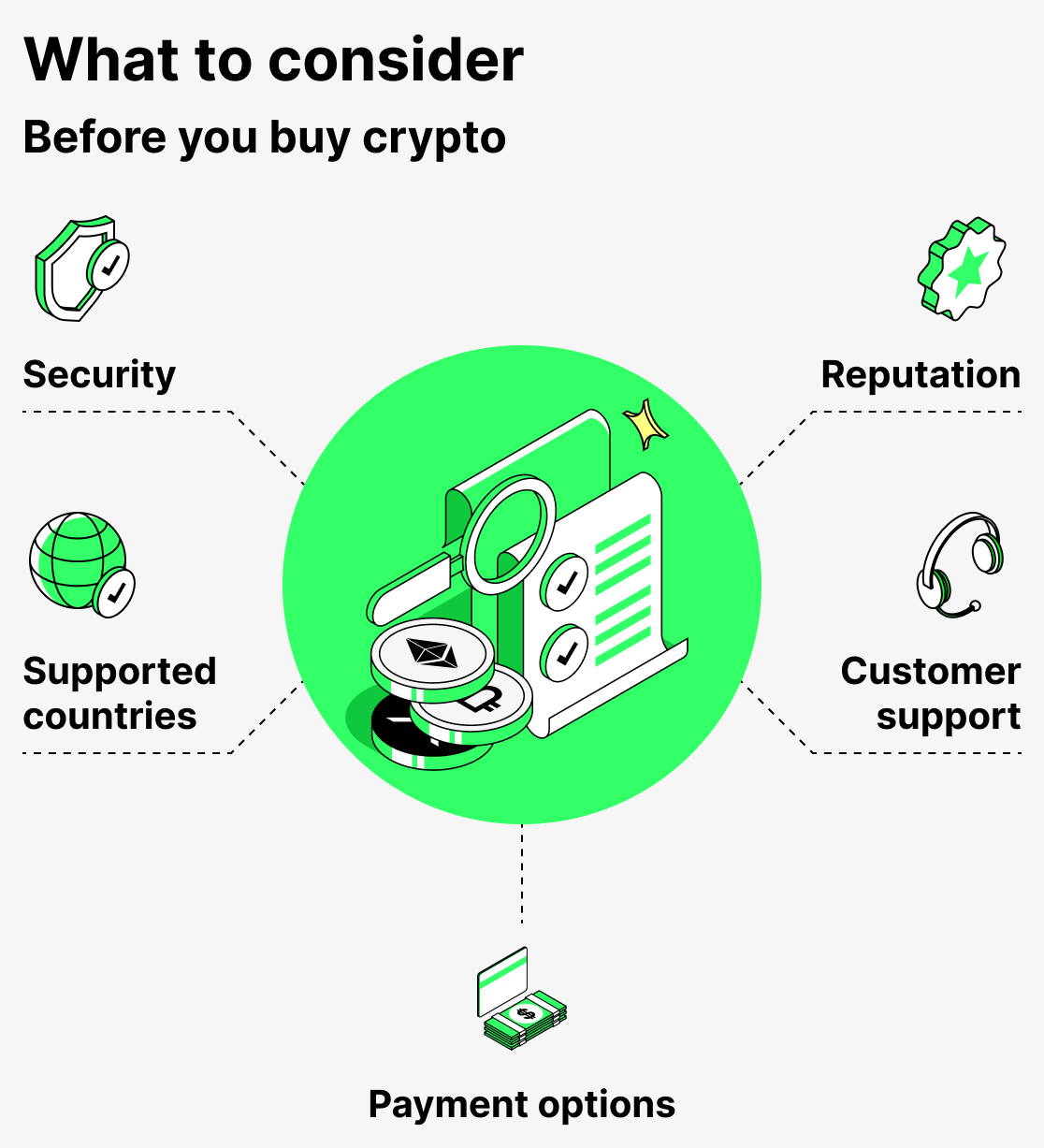

What to look for when choosing a platform to buy cryptocurrency

Before proceeding to the purchase method, it’s important to understand how to distinguish a trustworthy service from an untrustworthy one. Here are the main criteria to look out for:

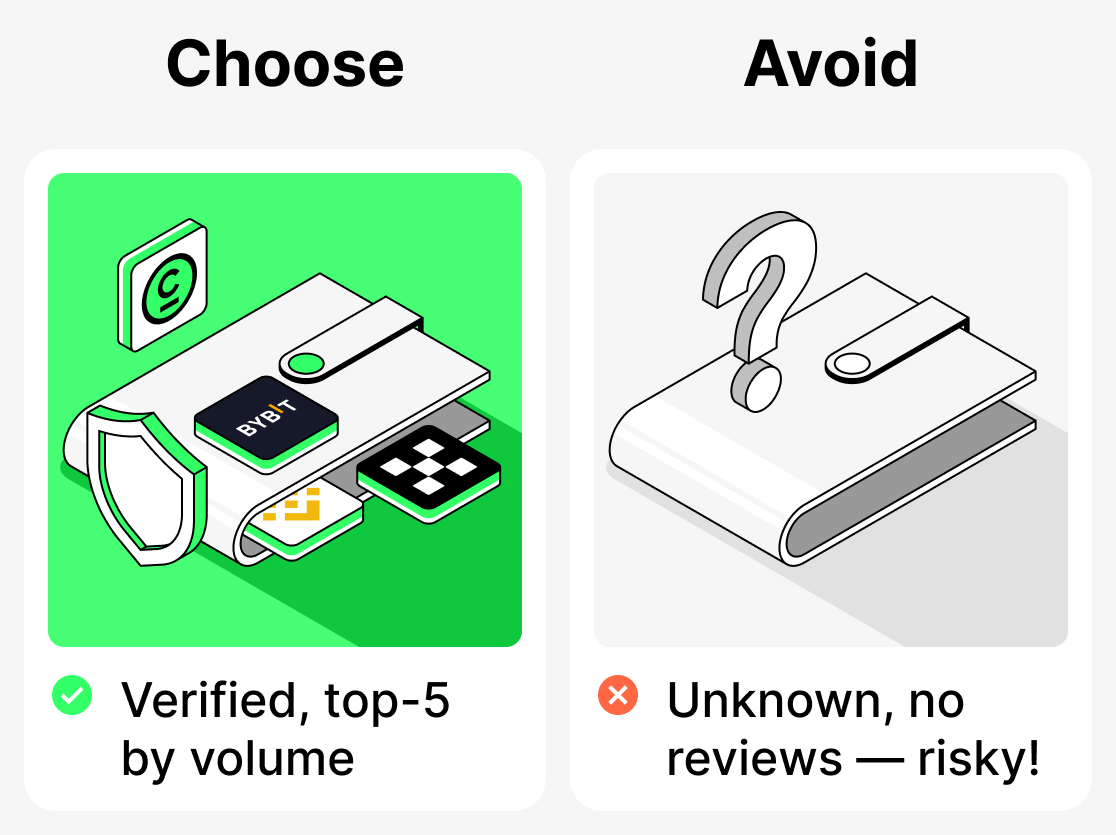

Reputation and recognition

It's better to choose platforms that have been operating for more than a year and have positive reviews from thousands of users.

An example of a reliability indicator: exchanges among the top 5 by volume (Cropty, Binance, Bybit, OKX) or aggregators that are already actively used by the crypto community.

If a platform has few or no reviews, it's best not to risk making your first purchase there.

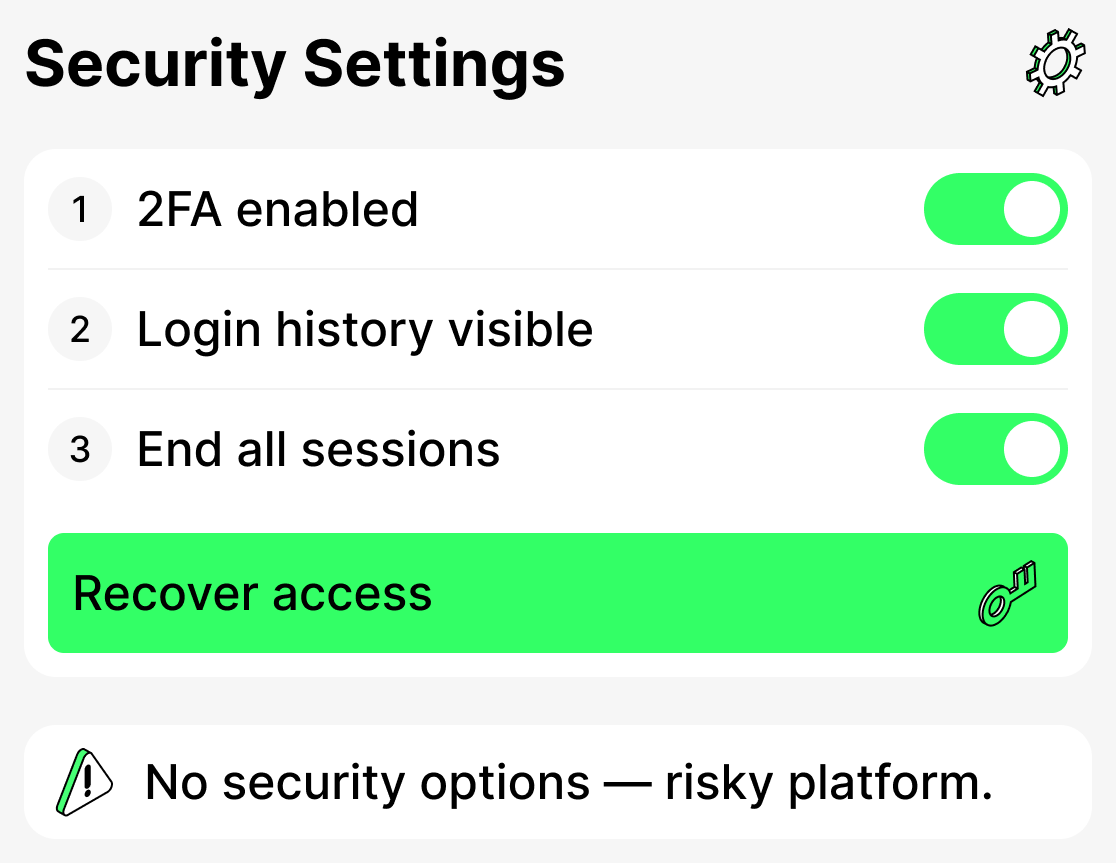

Security and easy access recovery

The availability of two-factor authentication (2FA), a feature to view account login history, and the ability to forcibly terminate all active sessions — a good indicator of security.

Reputable services always have a "Security" section and provide a way to quickly restore access.

If the platform does not offer any security measures — that's a red flag.

Availability of customer support and a user-friendly interface

Good services pay close attention to ensuring that a newcomer can make a purchase without unnecessary confusion. To this end, they organize a qualified support team and make the interface as convenient and easy to learn as possible.

The availability of a 'simplified interface mode' is a huge advantage for a newcomer.

We recommend taking a look at how the platform's app is organized. Try exploring all the features and options. If you can easily see where things are, you shouldn't have any problems making a purchase.

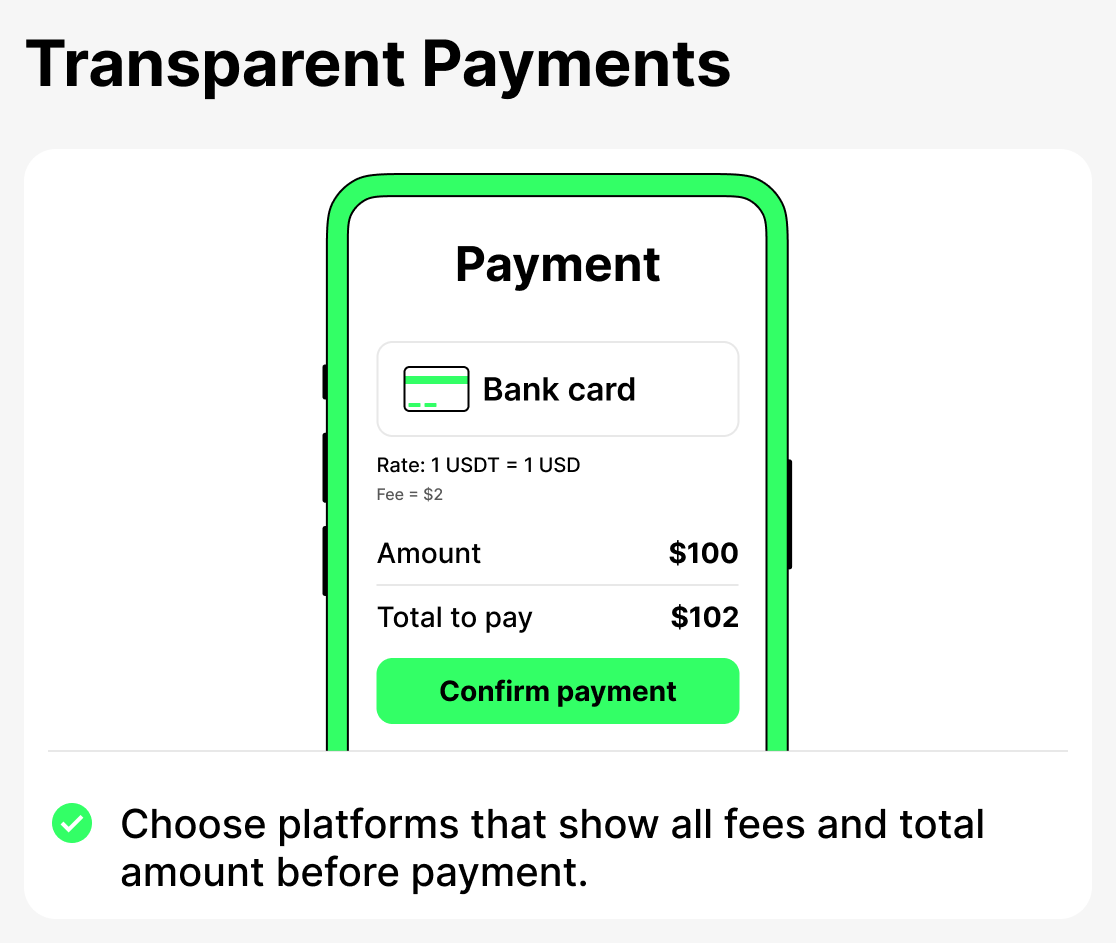

Payment methods and fees

It's best to check right away whether the platform supports bank cards or P2P.

Some platforms show the rate before payment, while others add the commission at the time of the transaction.

It's very convenient when the service immediately shows the total amount due.

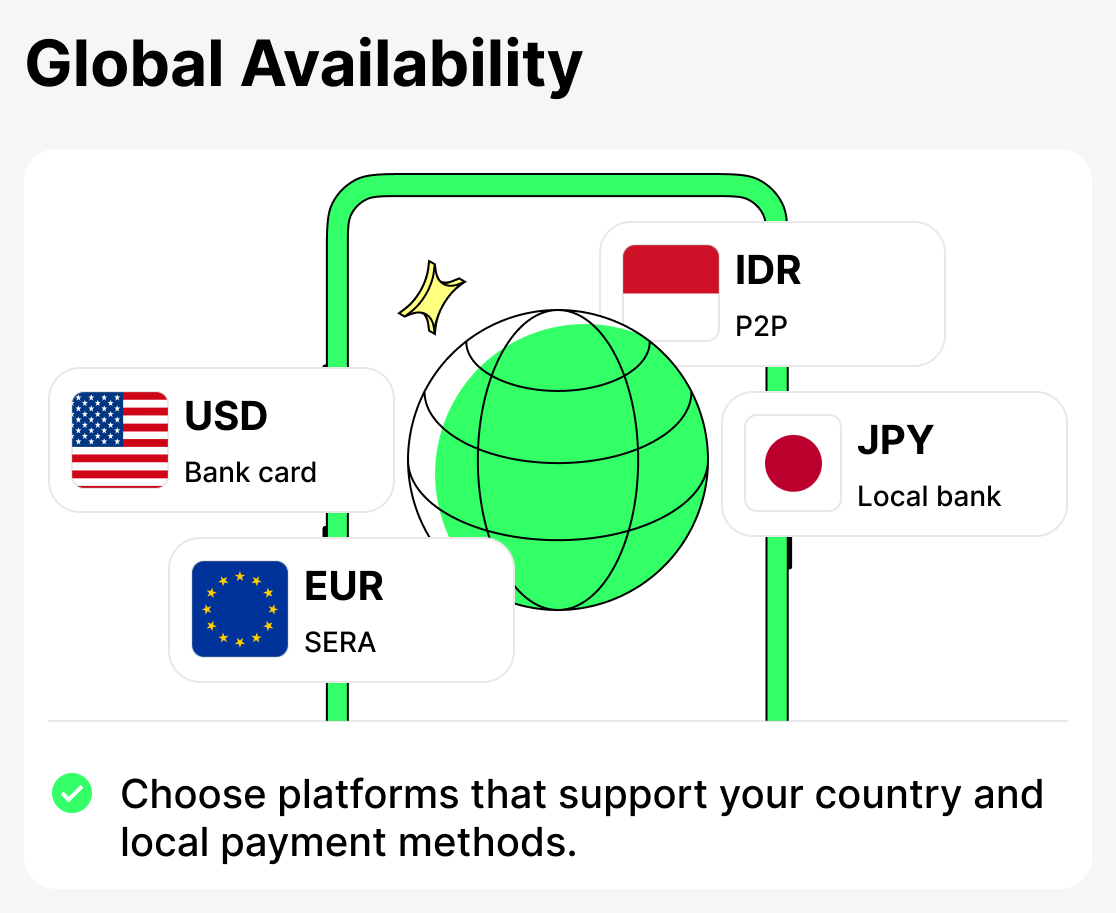

Support for your country and currency

Sometimes a service does not operate in a specific region or does not accept certain payment methods. Check whether you can purchase cryptocurrency on this platform in your region.

It's convenient when the platform automatically selects available payment options based on the user's country.

The main rule for a beginner:

If a platform seems suspicious, has no reviews, doesn't disclose purchase terms in advance, or doesn't provide ways to protect your account, it's better to avoid it and look for a more reliable option.

What is a cryptocurrency exchange and why is it a good choice for beginner

This is the most obvious place to buy cryptocurrency. Exchanges are multifunctional services that provide full asset-management capabilities. That means on an exchange you can not only buy, but also sell, swap, and store cryptocurrency. In addition, on exchanges you can earn by investing your assets and receiving interest, or even take out crypto loans.

For beginners, large, time-tested exchanges such as Binance and Bybit. are suitable. These platforms have a good reputation and also offer simple tools for buying cryptocurrency. Their interfaces are intuitive, and customer support operates 24/7.

Buying on a cryptocurrency exchange is ideal for those who plan to actively work with assets: trade, exchange, invest, and so on.

What is an exchange service and when is it better to buy cryptocurrency through it

There are dedicated services where you can quickly buy cryptocurrency and immediately transfer it to your wallet. This is very convenient and practical for those who do not plan to use cryptocurrency right away.

To find the perfect service, you can use an aggregator — a third-party website that collects, rates and verifies different exchange services and provides suitable options to users based on their request. A great example of such an aggregator is Bestchange. Just go to the aggregator, select the desired pair (what you’re buying and for which currency), and the site will give you a list of suitable exchangers. Very practical and convenient.

Buying on the exchange service is ideal for those who want to buy currency but do not plan to use it in the near future.

How to choose a reliable platform for buying cryptocurrency

The Cropty Wallet has a special feature that evaluates and selects the best services to buy the exact cryptocurrency you need. You can use this feature to immediately pick a reliable service for purchase. It's very convenient and reliable!

Why shouldn't you choose little-known websites or apps?

- First, there is a high risk of encountering scammers who may steal your data or funds.

- Secondly, such platforms often cannot provide an adequate level of security and are frequently unlicensed.

If you're just starting out, it's best to follow a proven path and trust companies that have demonstrated their reliability and have many satisfied customers. Cropty Wallet, in turn, will help you choose a service you can count on!

How to complete registration and verification (KYC) to buy cryptocurrency

Once you've decided on a purchase method, you can move on to the next step — creating an account and completing verification (if you chose an exchange) or making an instant purchase without registration (if you chose an exchange service).

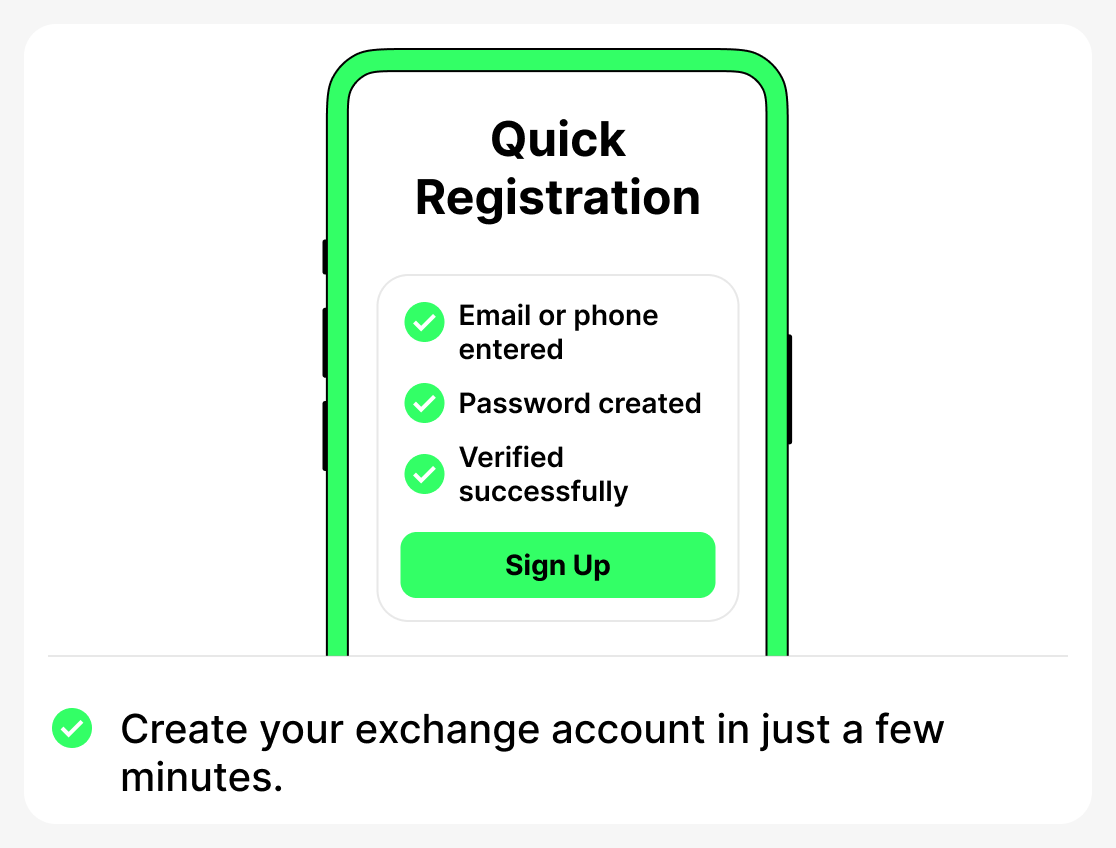

How to register on an exchange to buy cryptocurrency

On most exchanges, the registration process is the same. It resembles creating an account on any online platform. It literally takes just a couple of minutes.

To complete registration on the exchange, you will need:

- Enter e-mail or phone number;

- Create a password;

- Confirm email or phone number

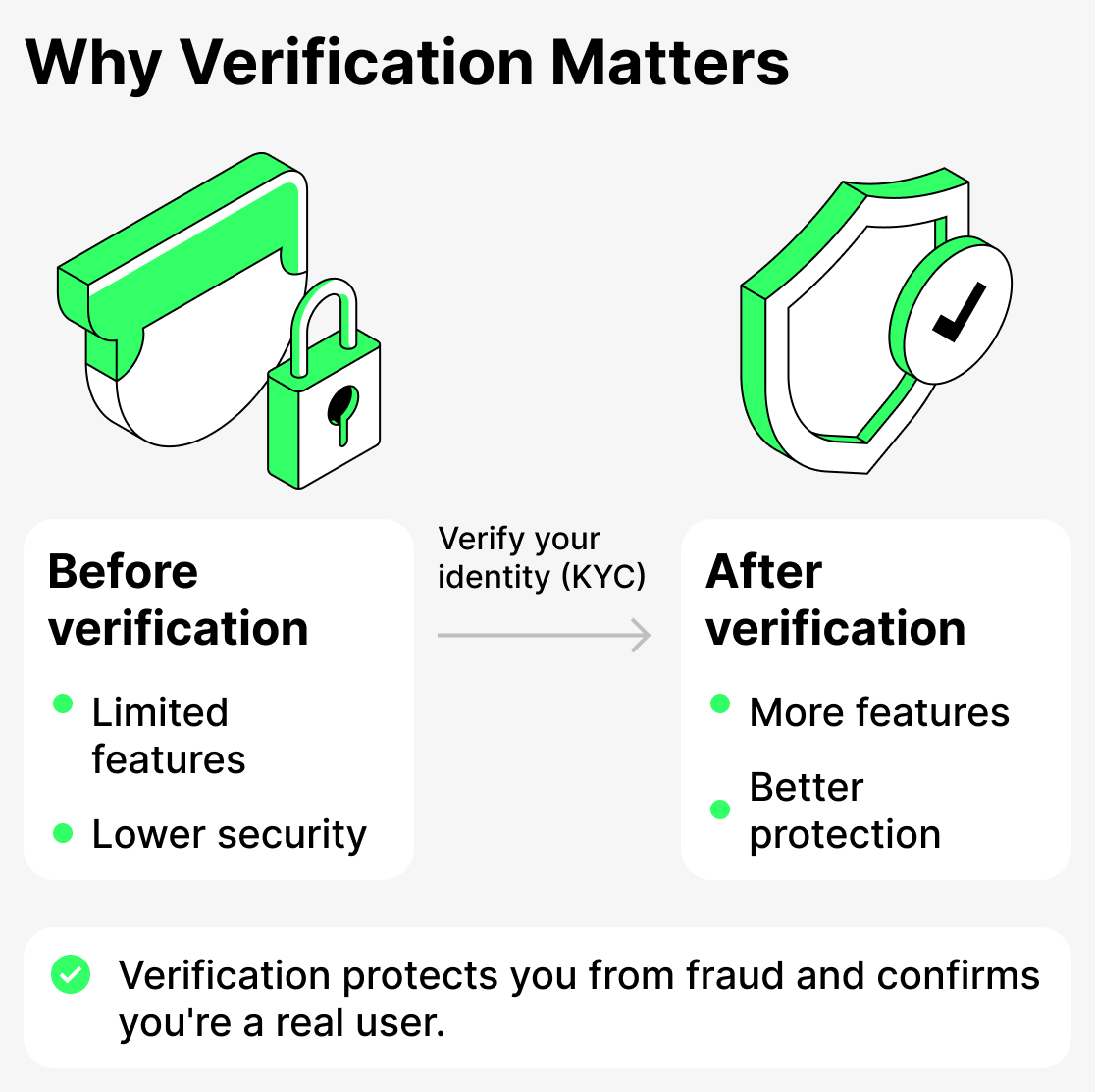

Is verification required to buy cryptocurrency

After completing registration, the exchange will prompt you to complete identity verification or KYC (Know Your Customer).

This is a standard procedure to protect against fraud. Usually, to complete verification you only need to upload a photo of your passport, driver's license, or ID card and take a selfie. This confirms that you are a real person.

Some users are intimidated by undergoing verification, but in reality there's nothing to worry about! Moreover, verified users often get more features and their accounts are better protected against hacks.

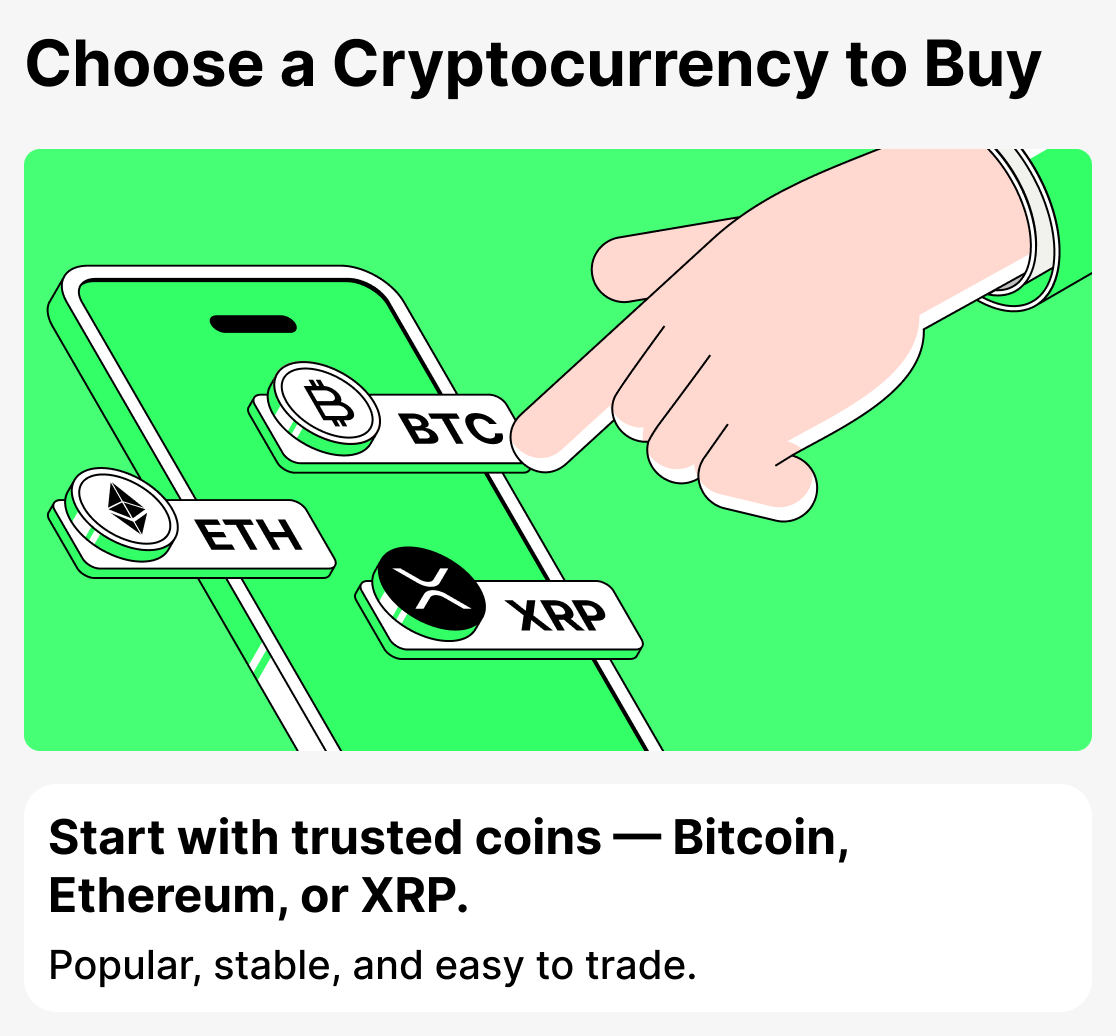

Which cryptocurrency is best for a beginner to buy

After completing registration, you will need to choose the cryptocurrency you will buy. The market offers thousands of cryptocurrencies — from giants like Bitcoin and Ethereum to many lesser-known tokens.

However, if you're a beginner, try not to chase the "new stars".

Better start with the classics:

- USDT — a stablecoin, i.e. a cryptocurrency pegged to the dollar. 1 USDT ≈ 1 dollar. USDT is most often chosen as the first cryptocurrency to buy.

- Bitcoin (BTC) — the most well-known and stable cryptocurrency in the world;

- Ethereum (ETH) — the foundation of the DeFi industry;

- XRP — fast transfers with low fees.

These assets are liquid and stable. They are used by millions of people, and they are easy to sell or exchange for fiat currency! Choose popular cryptocurrencies, and you'll be able to get up to speed in the world of crypto faster!

Later, once you have mastered the basics, you can start experimenting.

How to buy cryptocurrency as a beginner

After you have chosen a platform, completed registration and selected a cryptocurrency — you can proceed to purchase. How the purchase is carried out depends on which platform you chose to buy cryptocurrency on (an exchange or an exchange service) and on which method you select next.

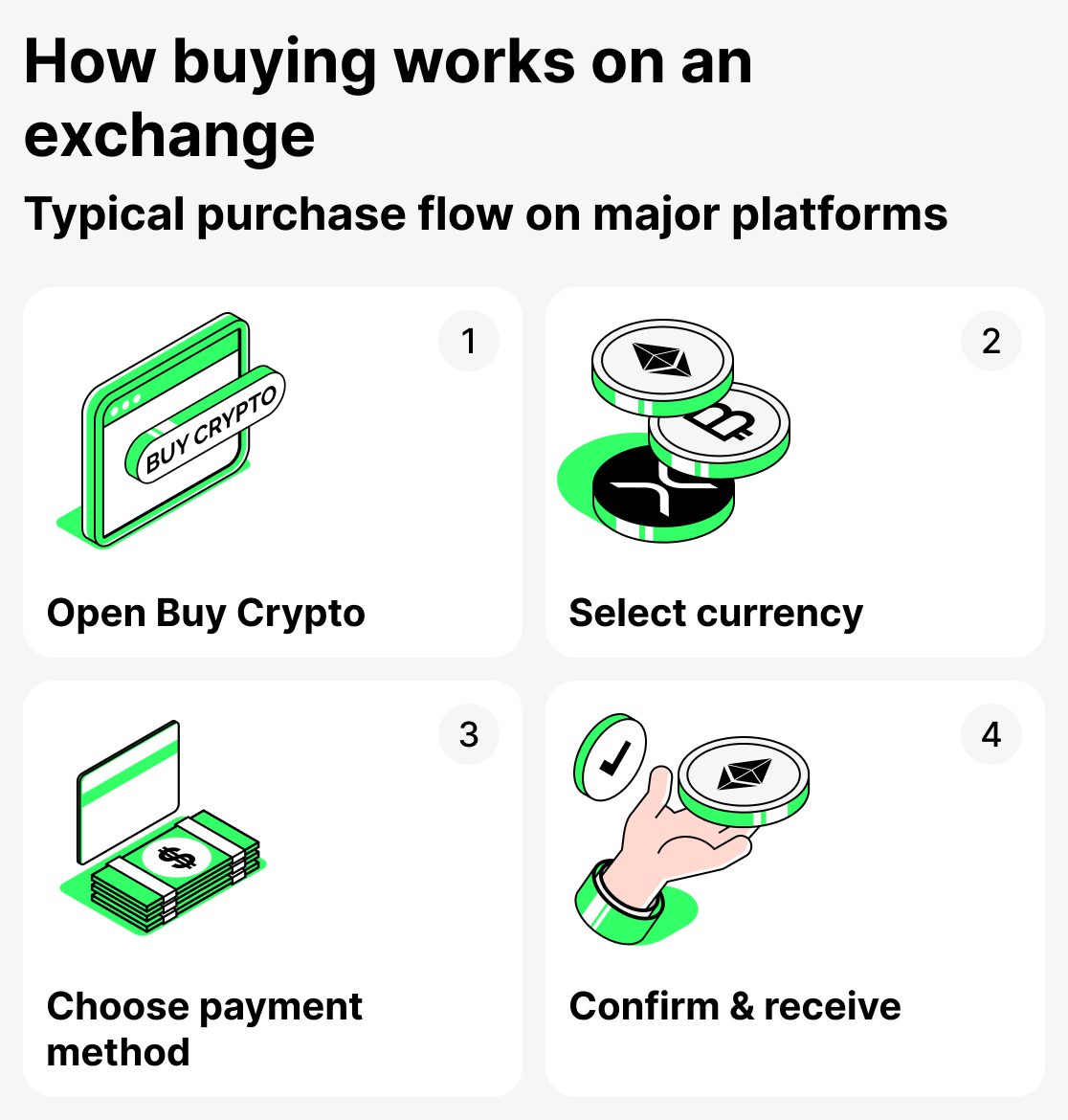

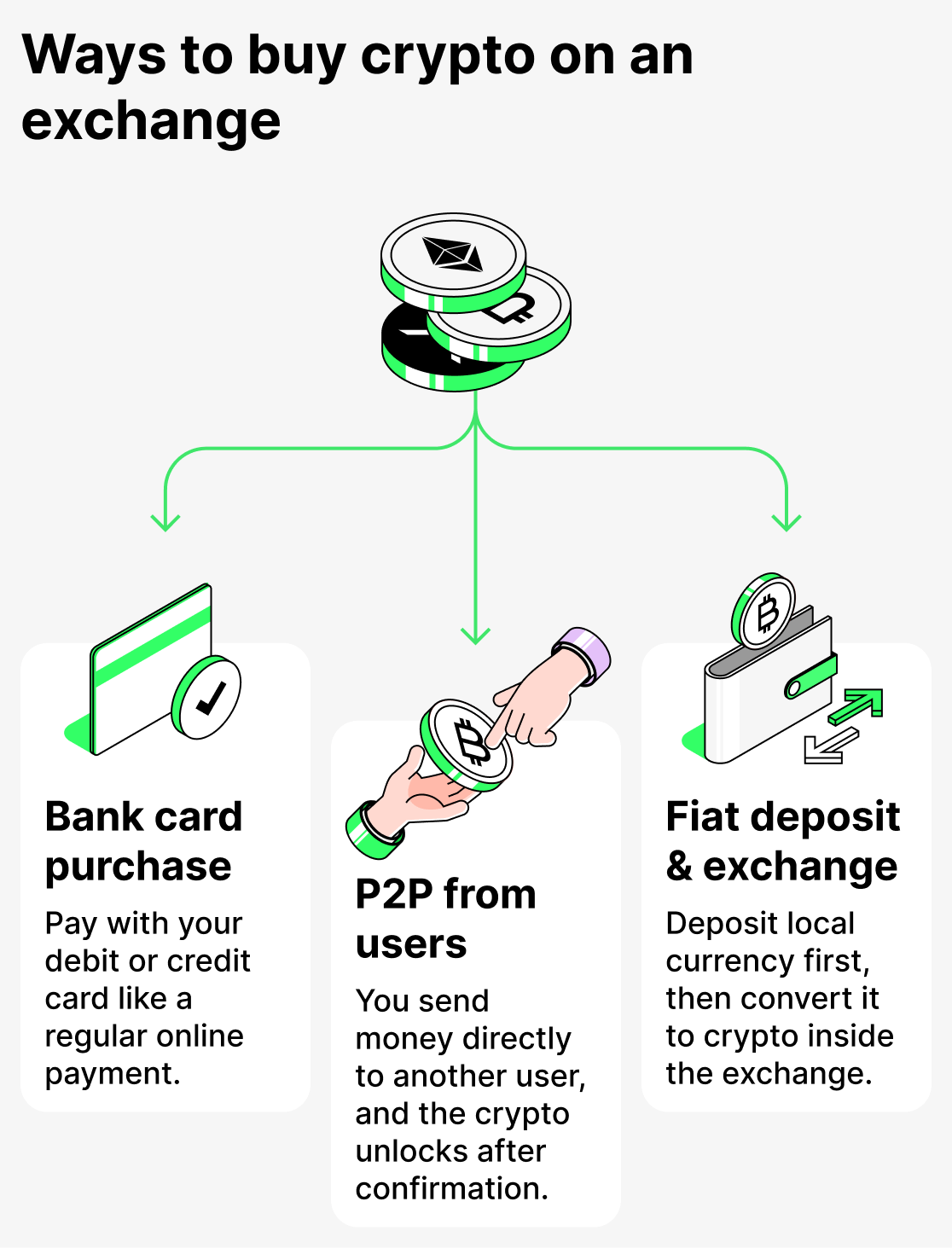

How to buy cryptocurrency on an exchange

Major exchanges like Binance and Bybit offer different ways to buy. Each of them has its own features.

Let's take a closer look at all the ways to buy:

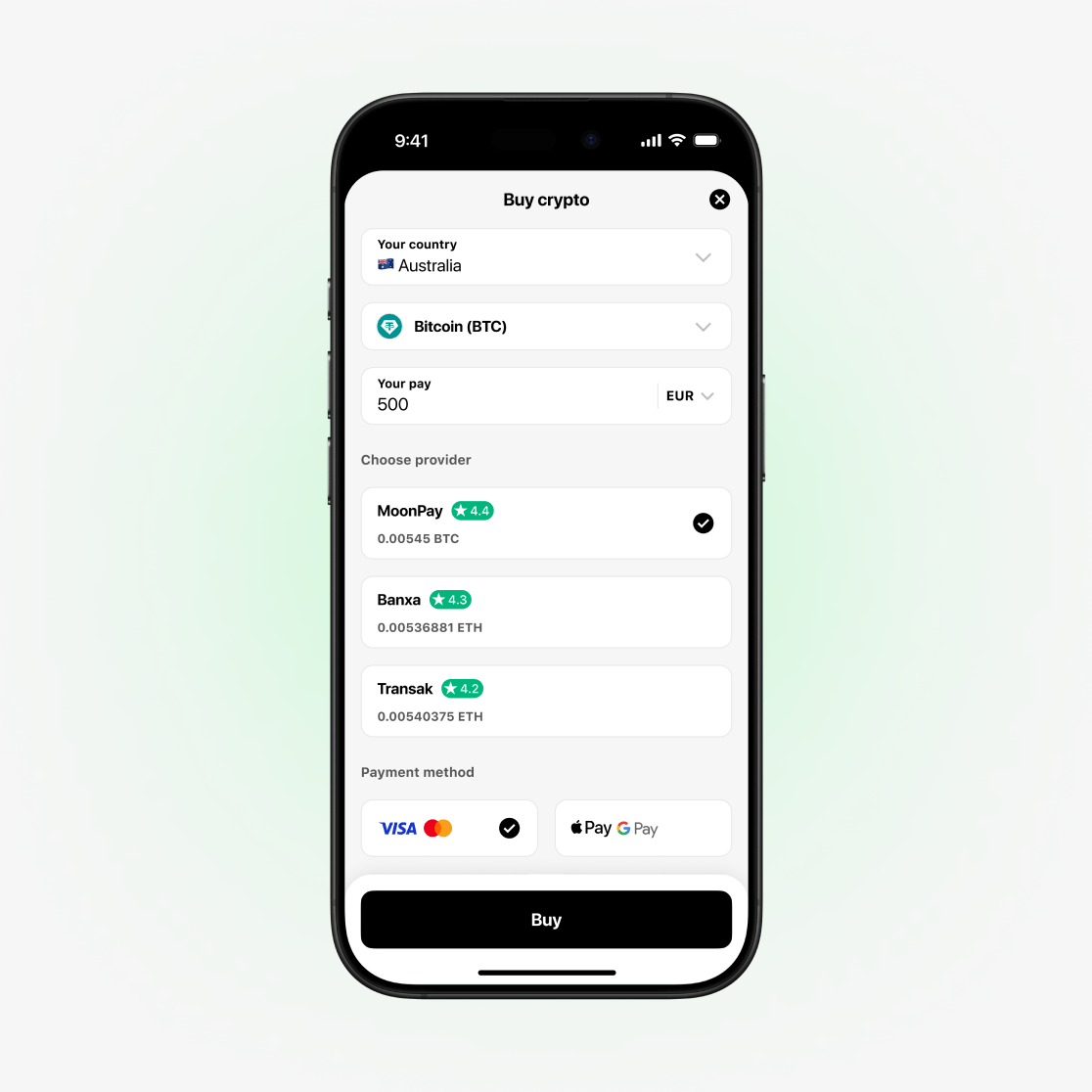

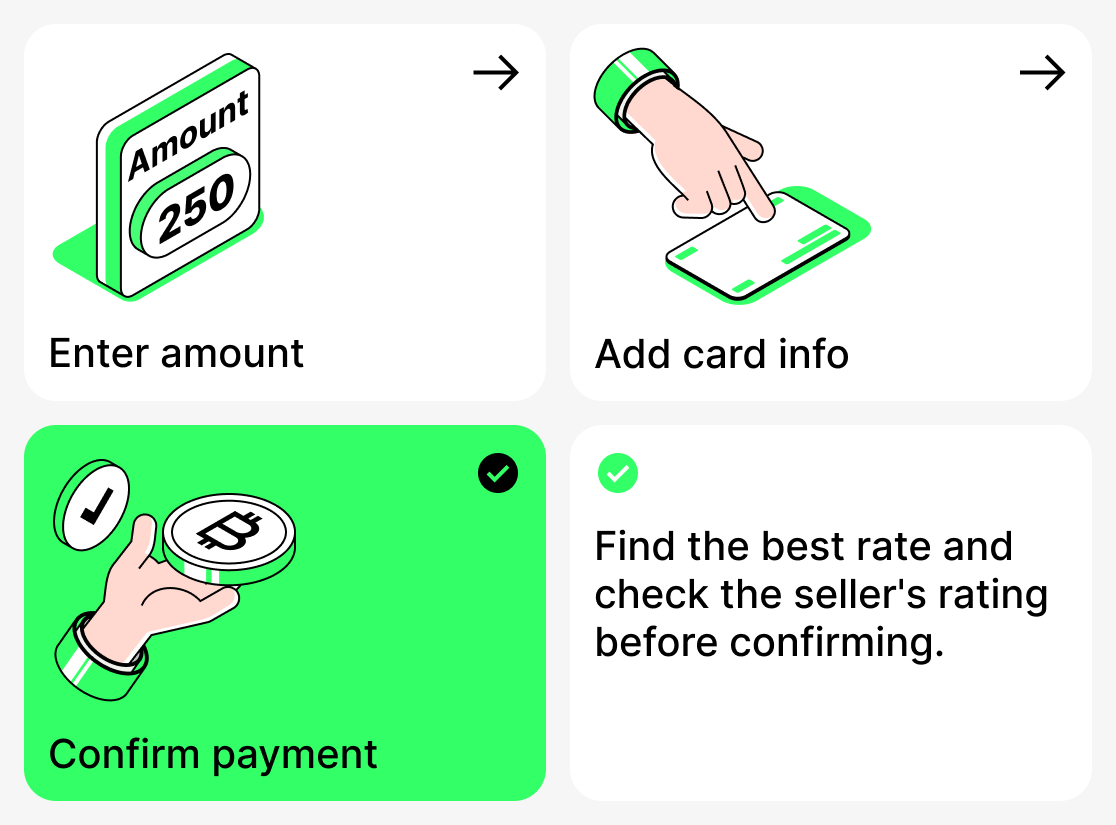

How to buy cryptocurrency with a bank card

The simplest and most intuitive method. The process is similar to a regular online purchase. You specify the amount of cryptocurrency you want to buy, enter your card details and confirm the payment. The cryptocurrency is automatically credited to the balance of your exchange account.

To simplify purchases with a bank card, exchanges recommend first linking the card to your account. If you do this, you’ll then be able to simply select the card later without needing to repeatedly enter your card details.

This method is very convenient for beginners. However, please note: the transaction fee may be higher than when using other methods to buy cryptocurrency.

Read the detailed instructions on how to purchase cryptocurrency using a bank card.

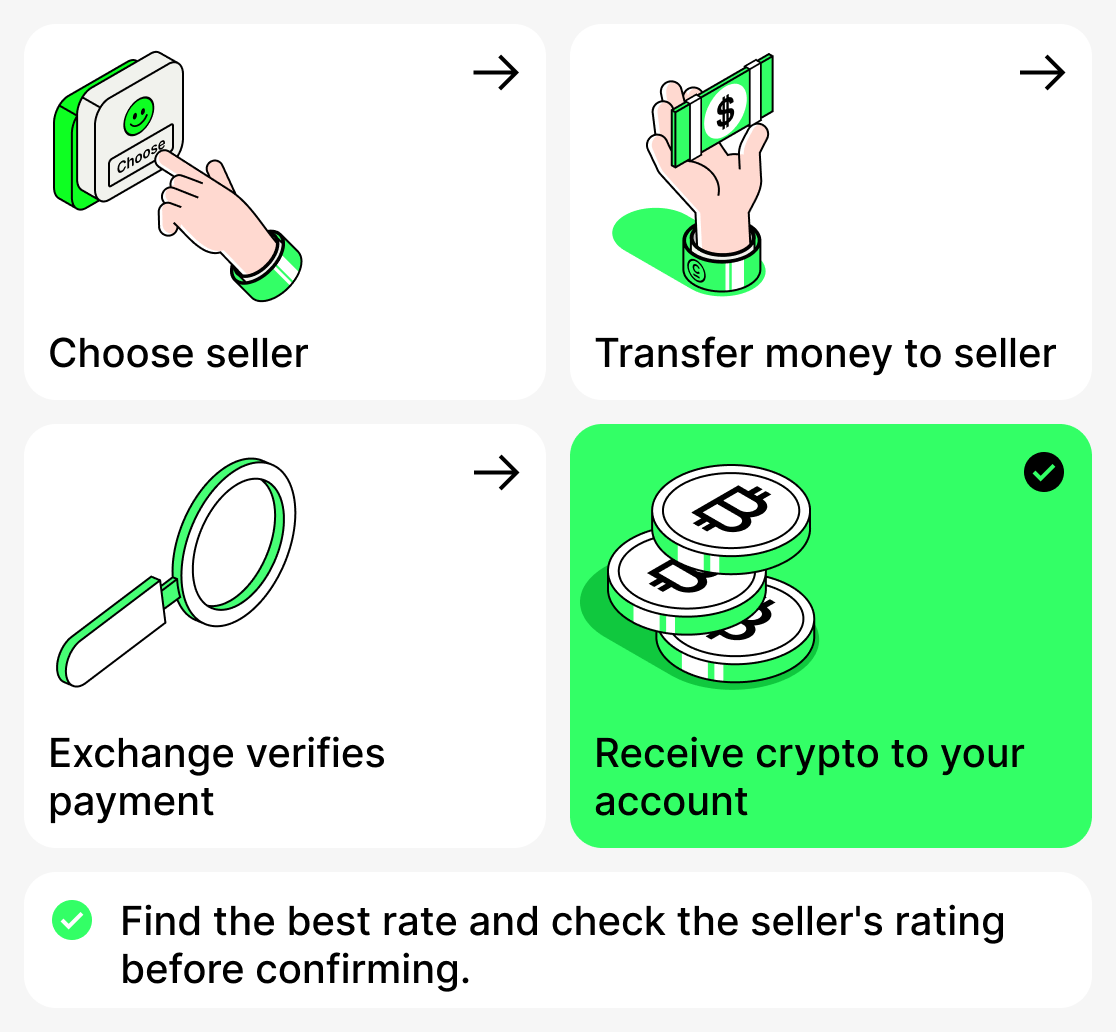

How to buy cryptocurrency directly from other users (peer-to-peer)

The exchange does not sell cryptocurrency itself; it simply connects buyers and sellers. When choosing P2P, you only need to transfer money to the seller. Once you have done so, the service will verify that the funds have been received and then approve the transfer of cryptocurrency to you. The funds will be credited to your account balance after confirmation.

When choosing this method you can select a favorable rate. However, there's a caveat: not all sellers on the exchange are trustworthy, so you should carefully check the seller's rating before completing the transaction.

Here is a detailed guide on how to buy cryptocurrency using P2P.

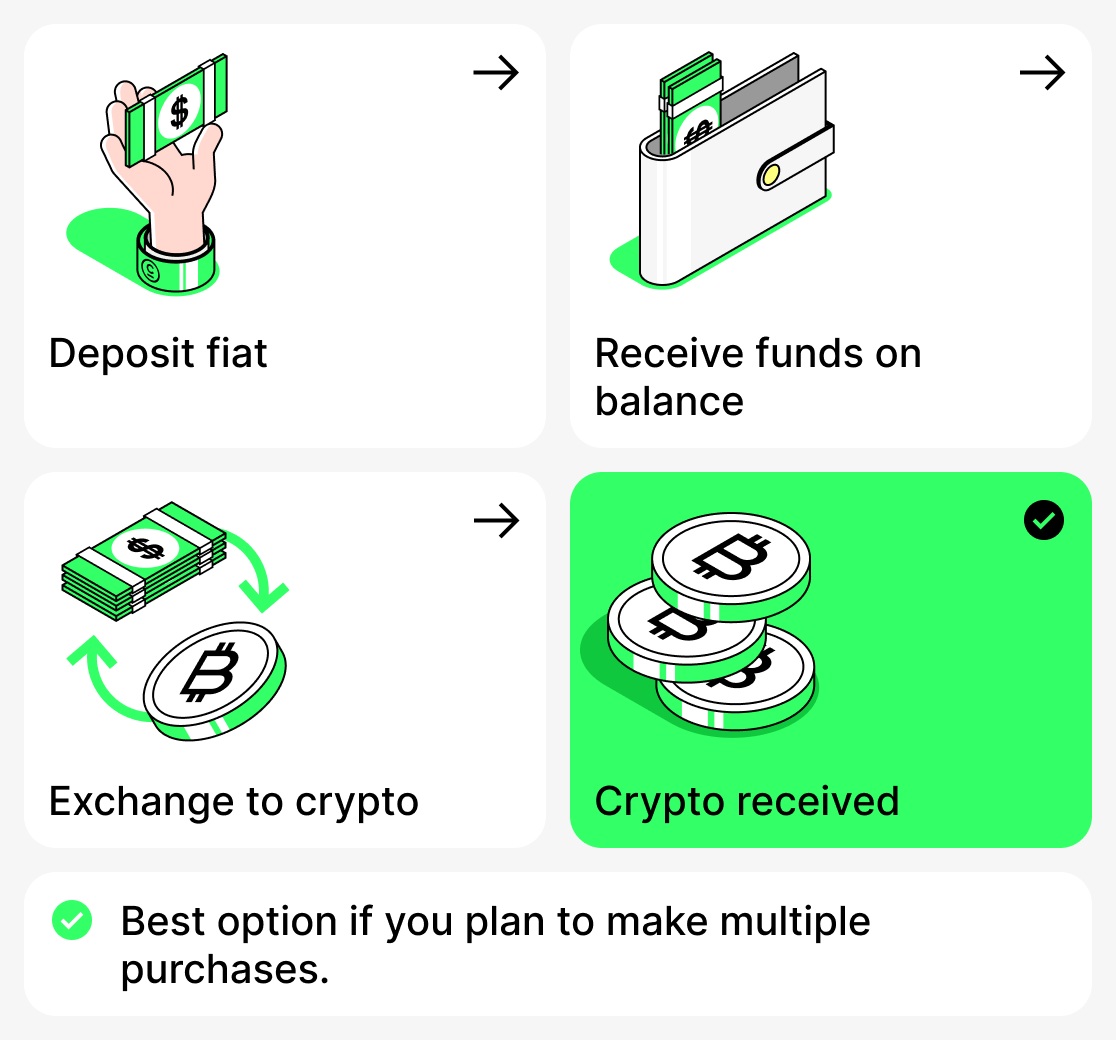

How to buy cryptocurrency with fiat (government-issued currency)

Some exchanges allow you to deposit funds to your balance in euros, dollars, or another currency. Once the fiat currency is credited to your account, you can easily exchange it within the exchange for USDT or another coin at the current rate.

This purchase method is suitable for those who make more than one purchase.

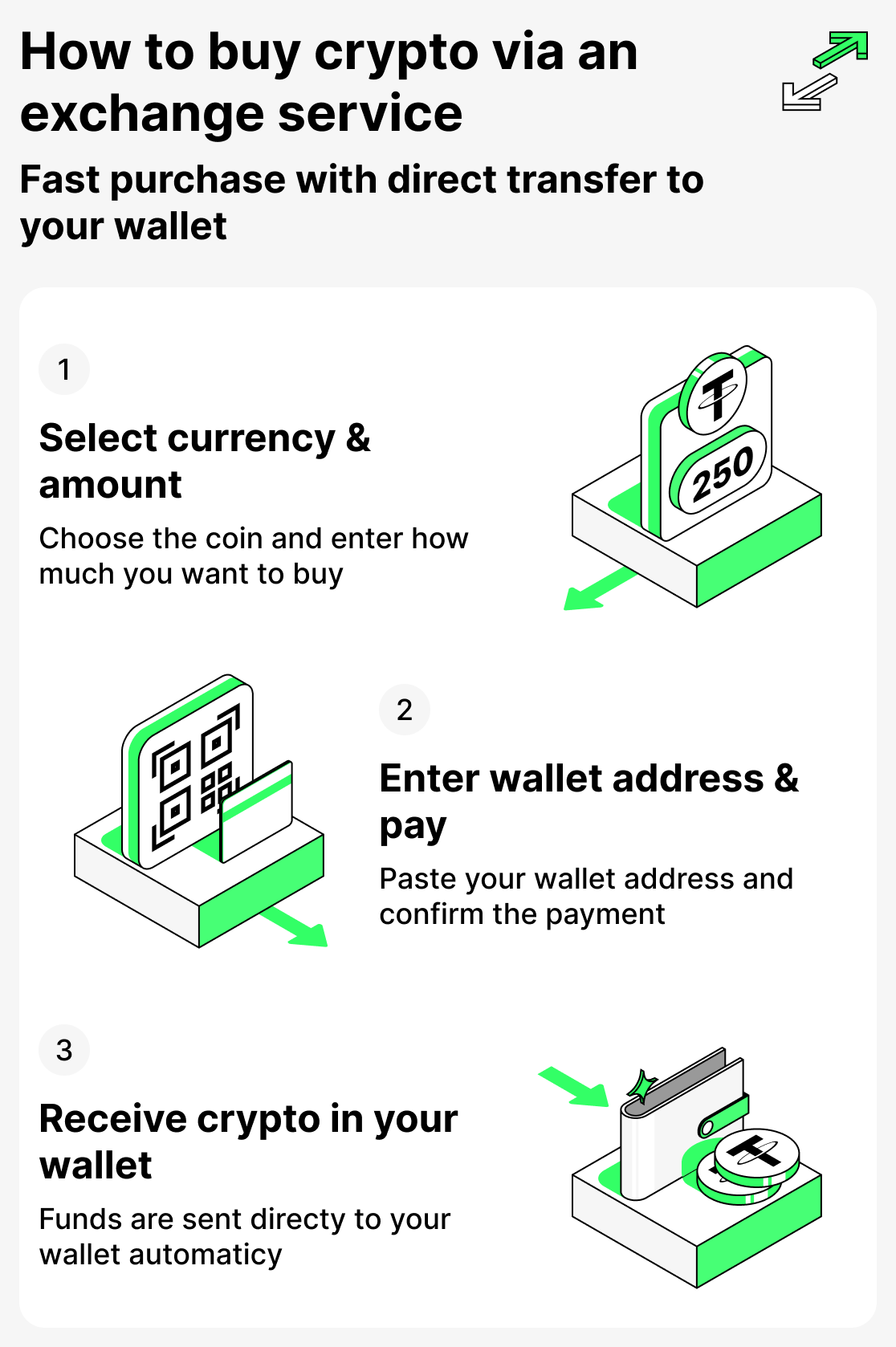

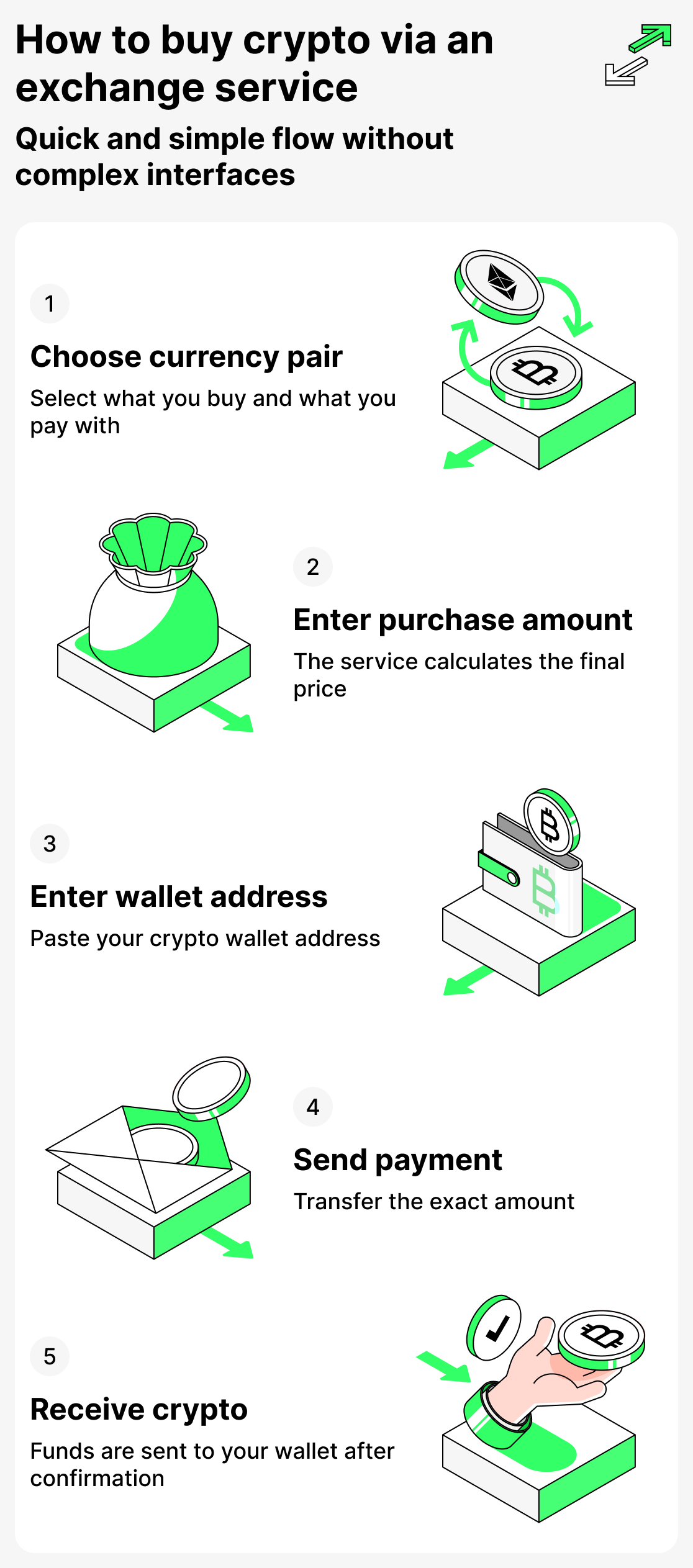

How to buy cryptocurrency through an exchange without registration

If you don't want to deal with exchange interfaces and various payment methods, you can always use cryptocurrency exchange services.

Buying on such services follows a simple process:

- You go to the exchange service and select a pair (the currency you are buying and the asset you are selling);

- Then you enter the amount of cryptocurrency you want to purchase;

- The service calculates the total cost and displays it to you;

- If everything is fine, enter your crypto wallet address in the corresponding field and proceed to the next step — transferring funds to make the purchase;

- You will be provided with the payment details to which you must send the exact amount calculated by the service.

- Once you send the funds and they reach the exchange service's account, your transaction will be approved and processed shortly.

- The cryptocurrency will be credited to your wallet.

Read the detailed guide on how to buy cryptocurrency using exchange services to understand all the details.

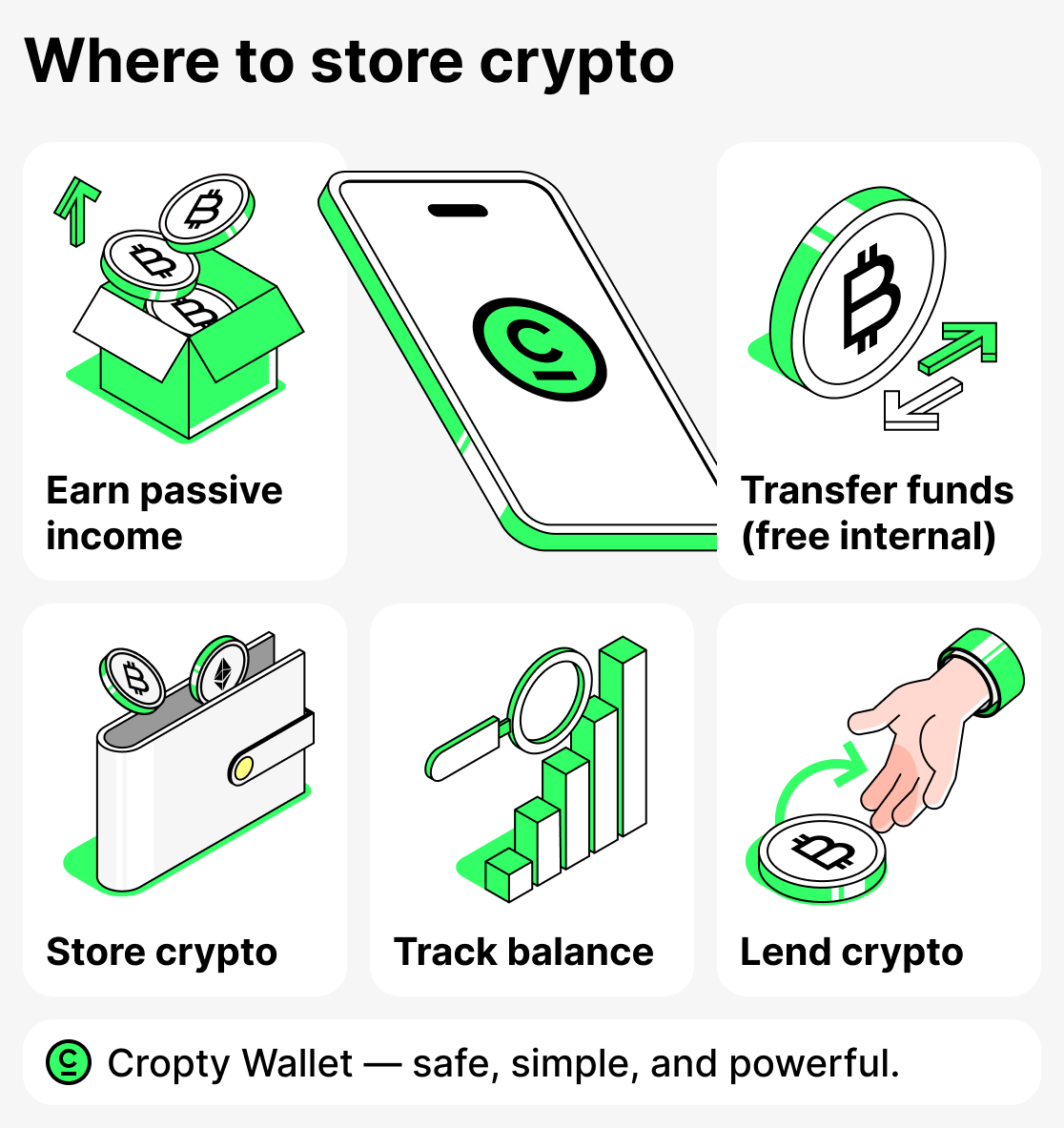

Where to store cryptocurrency after purchase: exchange or wallet

After buying cryptocurrency, it's important to consider where to store it.

Keeping coins on an exchange isn't always safe — your account can be hacked, and the exchange may restrict access to funds.

It's better to transfer assets to a reliable crypto wallet. For a beginner, Cropty Wallet! is ideal.

This is a custodial wallet that offers a high level of security, features an intuitive interface, and provides 24/7 customer support.

Here you can:

- Store different cryptocurrencies,

- Track balance and rate,

- Perform internal and external transfers. Internal transfers, by the way, are free!

- Use additional features. For example, you can take a crypto loan or even earn passive income!

Cropty Wallet combines the convenience of a banking app, customer care and high-level security! And an even more responsible approach to newcomers!

Useful tips for beginners on buying cryptocurrency

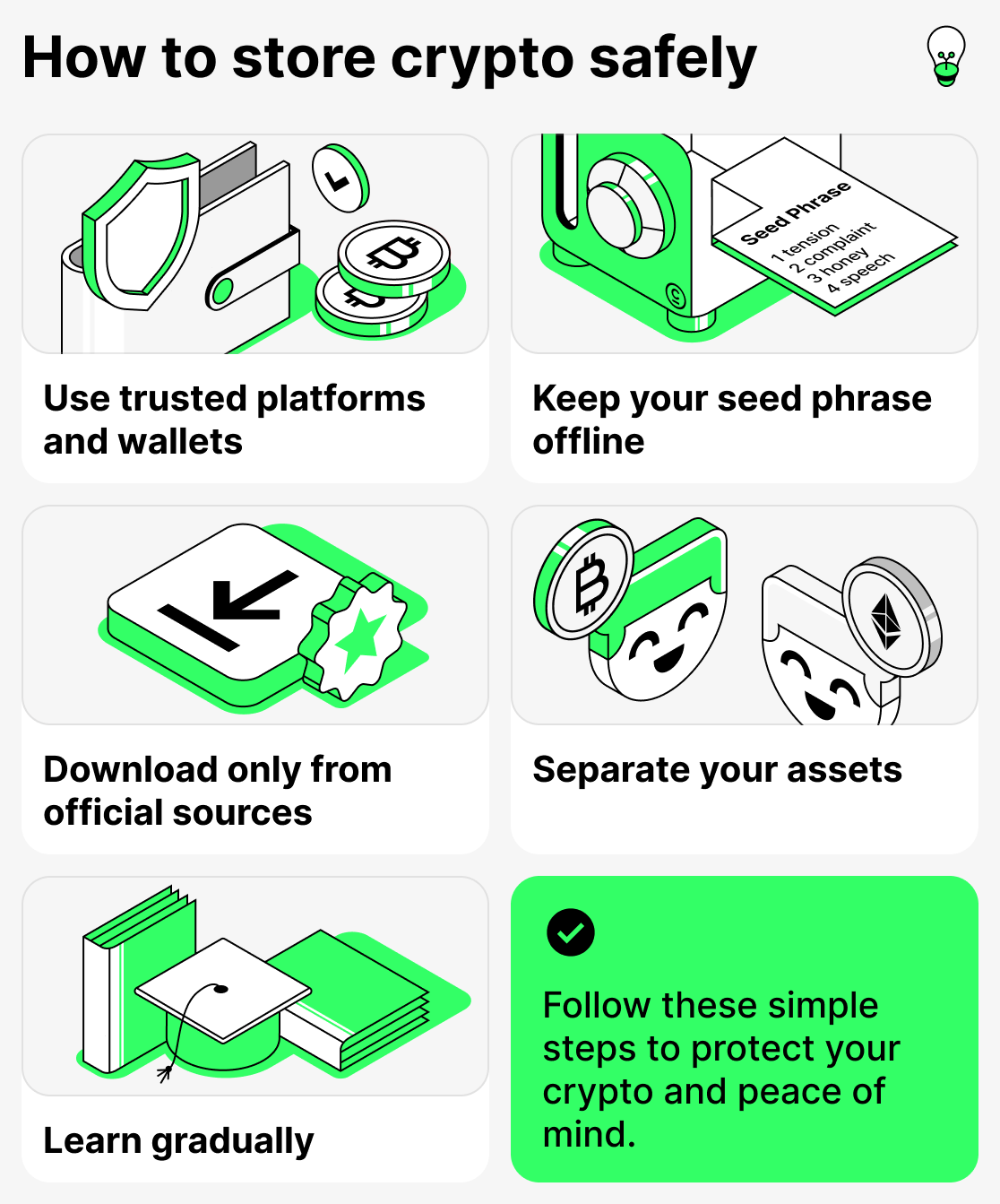

To avoid common mistakes, keep in mind a few simple but very important rules:

- Choose reputable platforms and wallets. Check reviews, ratings, and licenses.

- Keep your seed phrase (recovery phrase) and store it offline: on paper, a metal plate, or a secure USB flash drive.

- Do not download apps from unverified sources. Use only official websites and stores (App Store, Google Play).

- Separate your assets. Use a hot wallet for everyday transactions and a cold wallet for long-term storage.

- Learn step by step. Study the market and understand blockchain technology.

By following these simple rules, you will protect yourself and save money and time.

Conclusion

Now you know how to buy cryptocurrency without any unnecessary fuss!

The crypto market is vibrant and dynamic! It opens up thousands of opportunities but requires discipline. Never invest more than you can afford to lose, and don't trust projects that promise "golden mountains."

Learn new things with enthusiasm! That way you'll quickly feel confident in the world of digital finance!

And if you value convenience and security — start your journey with Cropty Wallet!

Cropty Wallet — your personal guide to the world of cryptocurrencies.