Crypto loans are a type of loan that allows borrowers to use their cryptocurrency as collateral and receive another cryptocurrency or fiat (national) currency. This way the borrower can obtain the funds they need without selling their assets.

Watch our detailed video on crypto lending to learn all the details:

One of the main advantages of crypto loans is that they are not regulated as strictly as traditional bank loans. At the same time, they are still overseen: loans are issued either by a specific service or organization, or by a smart contract (a special algorithm) in the case of DeFi, which becomes the "center" of the system. This makes crypto loans more accessible. In addition, crypto loans often have lower interest rates and more flexible repayment terms, making them an attractive option for borrowers.

There are many platforms and providers that offer crypto loans with their own unique features and benefits.

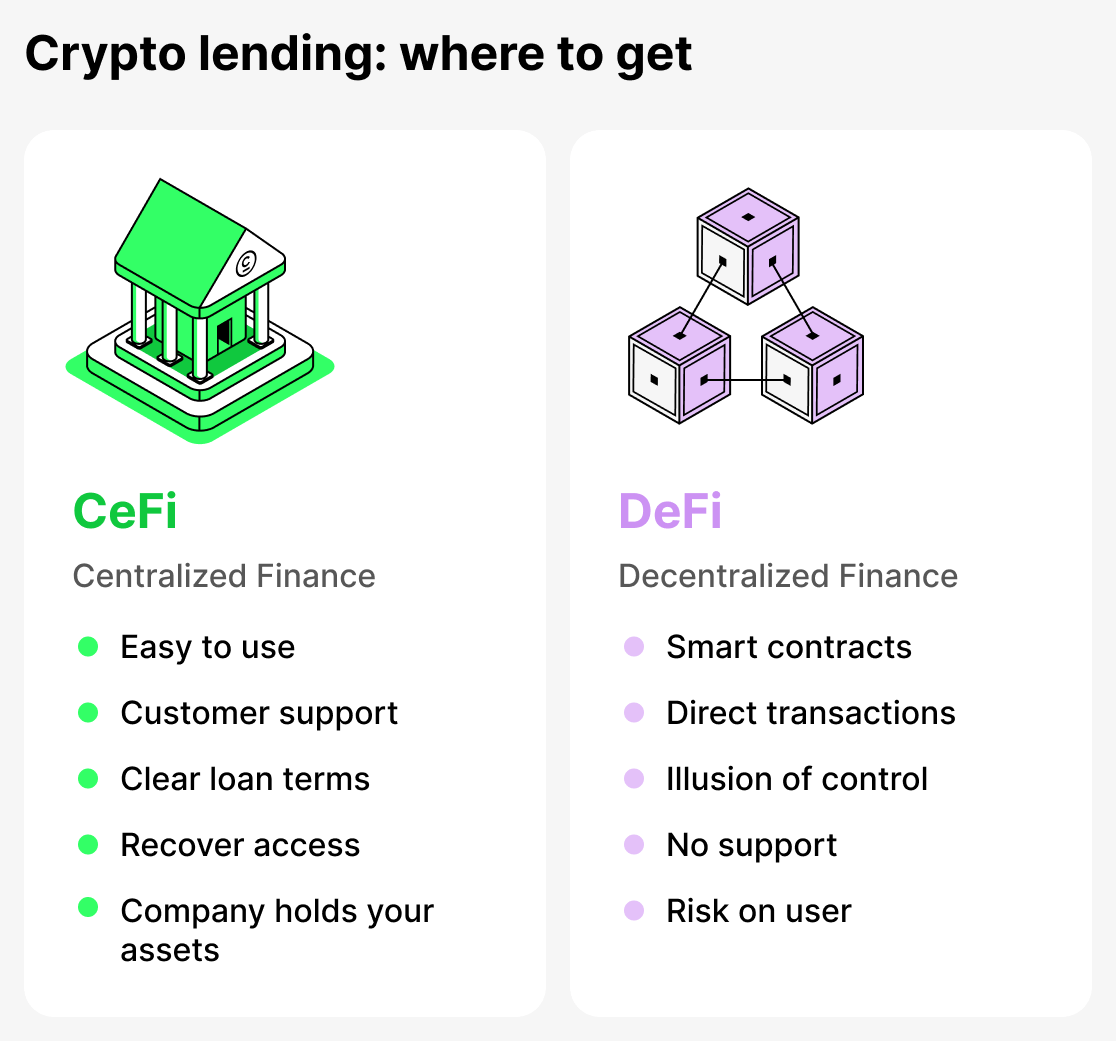

All lenders that provide crypto loans can be divided into two main groups: centralized (CeFi) and decentralized (DeFi). Centralized lenders operate like an online bank. The company holds clients' assets, accrues interest, and takes responsibility for their security. Decentralized platforms are fully automated. They operate according to a strict algorithm written into their code (smart contracts). The user connects their wallet and takes out a loan. You can learn more about CeFi and DeFi later in this article.

Some platforms offer instant loan approval, while others require full verification. In addition, some platforms offer flexible interest rates, while others offer fixed rates. It's important for borrowers to research and compare different options to find the best crypto loan for their needs.

Crypto loans in simple terms

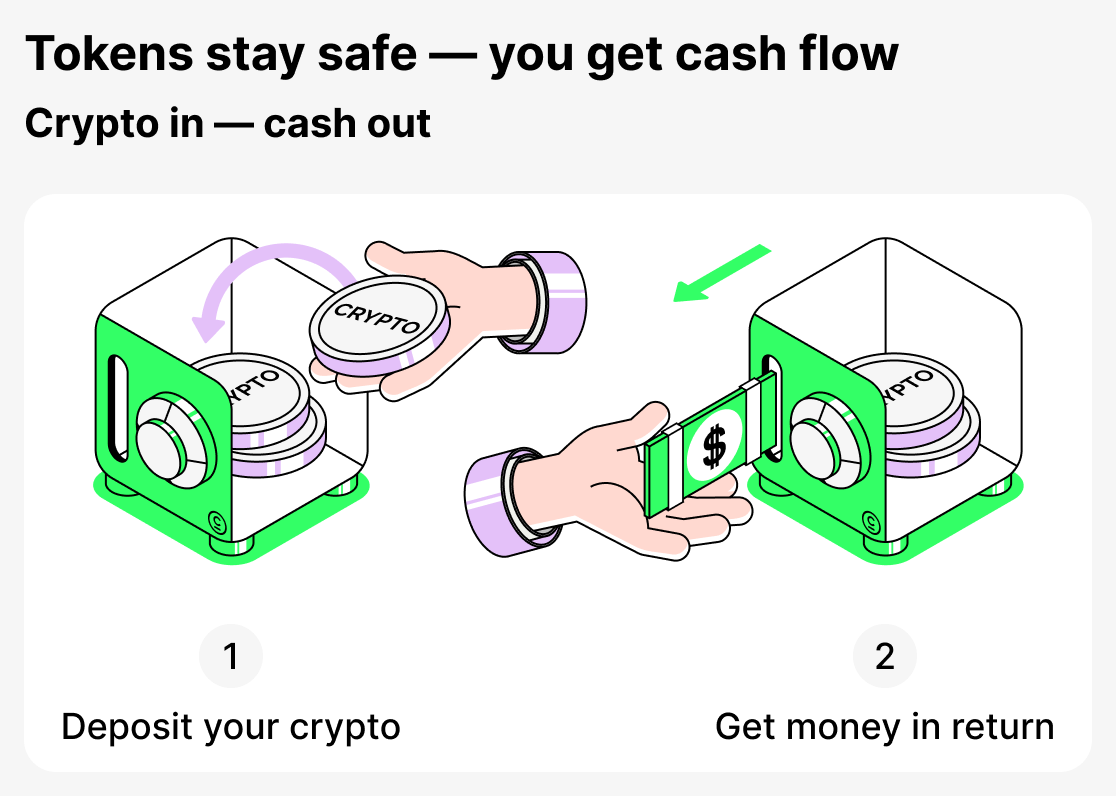

A crypto loan is a modern type of loan in which cryptocurrency is used as collateral. Instead of pledging real estate or a car to obtain a loan, the borrower deposits their tokens (for example, BTC or ETH) and receives a loan in stablecoins or another currency. This approach enables fast access to liquidity without the need to sell their digital assets.

Let's consider an example:

You have a certain amount of ETH and need funds for some purpose. But you don’t want to sell your ETH because you expect the asset’s price to rise. Instead, you use it as collateral and take a loan in USDT. Now you have available funds you can use right away, while the ETH remains yours. You can reclaim the asset by repaying the loan, and any appreciation in ETH’s price will still benefit you.

This way, crypto lending lets you preserve your assets while gaining access to additional funds. You continue to own your cryptocurrency, and after repaying the loan, your collateral is returned to you.

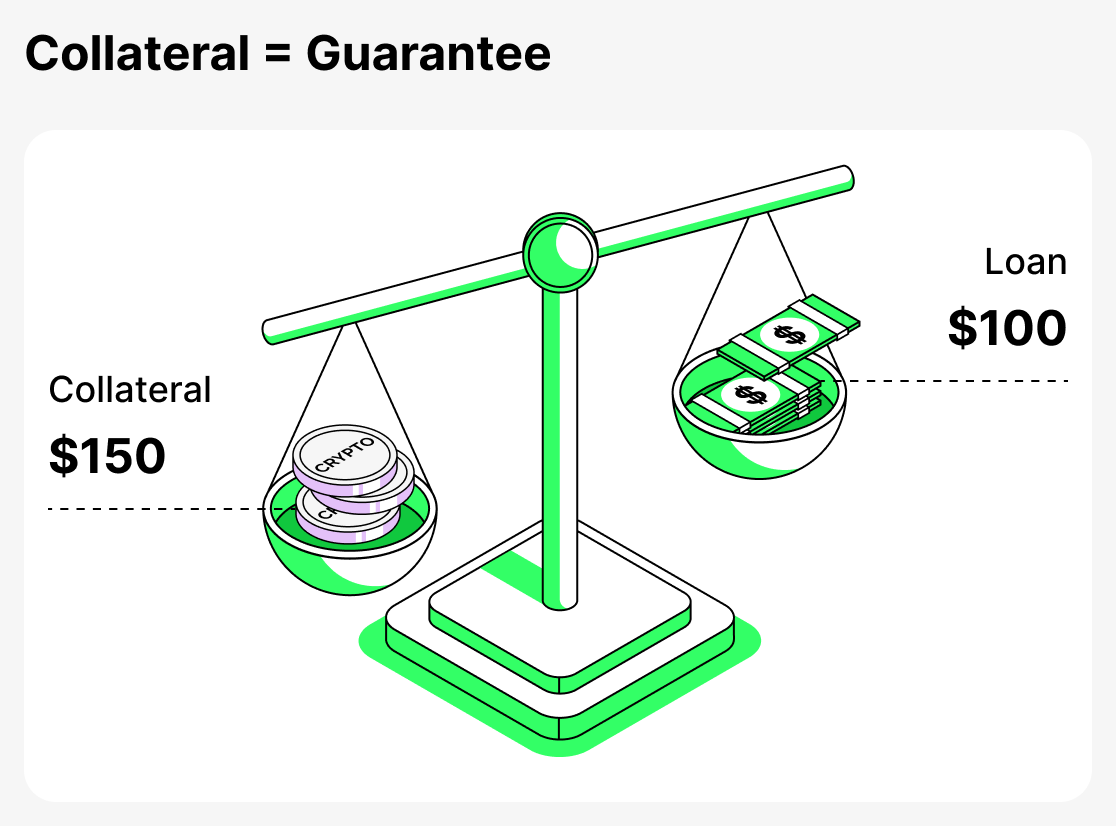

What is collateral

Collateral - this is a guarantee that a borrower provides to a lender to confirm their ability to repay the loan. In traditional finance, collateral can be an apartment or a car. In crypto lending, this role is taken by digital assets: Bitcoin, Ethereum and others.

The main purpose of collateral is to reduce risks for the platform. If the borrower does not return the funds, the lender has the right to seize the collateral and thus offset the losses. This principle makes it possible to issue loans even when the borrower lacks a credit history or traditional income documents.

Different types of assets can be used as collateral. The most common are Bitcoin, Ethereum, XRP, Cardano and Solana, as they have high liquidity and are accepted by almost all platforms.

The maximum loan amount and the interest rate usually depend on the size and type of collateral. In essence, collateral is a guarantee: the lender gains assurance that the borrower will repay the funds, while the borrower, in return, gets the ability to obtain a loan quickly without selling their assets.

How crypto lending works

Crypto loans are a unique financial product that allow borrowers to use their cryptocurrency as collateral to obtain a loan. On centralized platforms (CeFi) a borrower, when taking out a loan, goes through a standard procedure: registration, identity verification (KYC), and posting collateral. Only after completing all these steps will they receive the funds. This process is closer to the traditional bank lending model.

However, not all centralized services require KYC. The Cropty Wallet, for example, does not require full verification, which is its clear advantage.

Centralized services are often the most secure and reliable, since they themselves are responsible for the safety and custody of borrowers' funds. Moreover, the interfaces of centralized platforms are easy to navigate.

On decentralized platforms (DeFi), lending is carried out automatically through smart contracts: you only need to connect a crypto wallet and provide collateral. After that the borrower will receive a loan without document verification. To use such services properly, the borrower must have considerable experience in the world of cryptocurrencies. Often these services do not offer 24/7 support, and all responsibility for mistakes made when applying for a loan falls on the borrower. In addition, the interfaces of such applications are usually complex and often aimed at professionals. In the case of DeFi there is another problem: it is impossible to fully know what is hidden in the smart contract's code, and it is almost impossible to find someone responsible if a bug in the contract leads to loss of funds.

Where to get a crypto loan: CeFi and DeFi platforms

Centralized platforms (CeFi)

CeFi (Centralized Finance) is lending where all processes are controlled by a centralized company or a crypto exchange. The borrower registers and verifies their identity (though not on all platforms), then deposits cryptocurrency as collateral. Funds are held by the company, and the loan is issued on pre-agreed terms.

CeFi platforms are very convenient and resemble traditional banking services. They provide customer support, loan terms are regulated and adjustable, and app interfaces are usually simple and user-friendly. However, it's important to choose trusted and reliable platforms.

Decentralized platforms (DeFi)

DeFi (Decentralized Finance) is lending where everything runs on smart contracts (special program code). To obtain a loan, the borrower simply needs to visit the platform, connect a crypto wallet, and provide collateral. After that, the loan is issued automatically. All terms of the deal — from LTV calculation to liquidation conditions — are encoded in the program and executed strictly according to the algorithm.

DeFi platforms may seem like a more attractive option because of anonymity, but in practice they carry far greater risks than CeFi. They typically do not provide reliable customer support and do not protect users from making mistakes. Moreover, any failure of a smart contract or oracle can lead to the complete loss of collateral. Unlike CeFi, where a company assumes part of the risk, in DeFi all responsibility falls entirely on the borrower. Before using such services, gain experience and weigh all the pros and cons.

What types of crypto loans exist

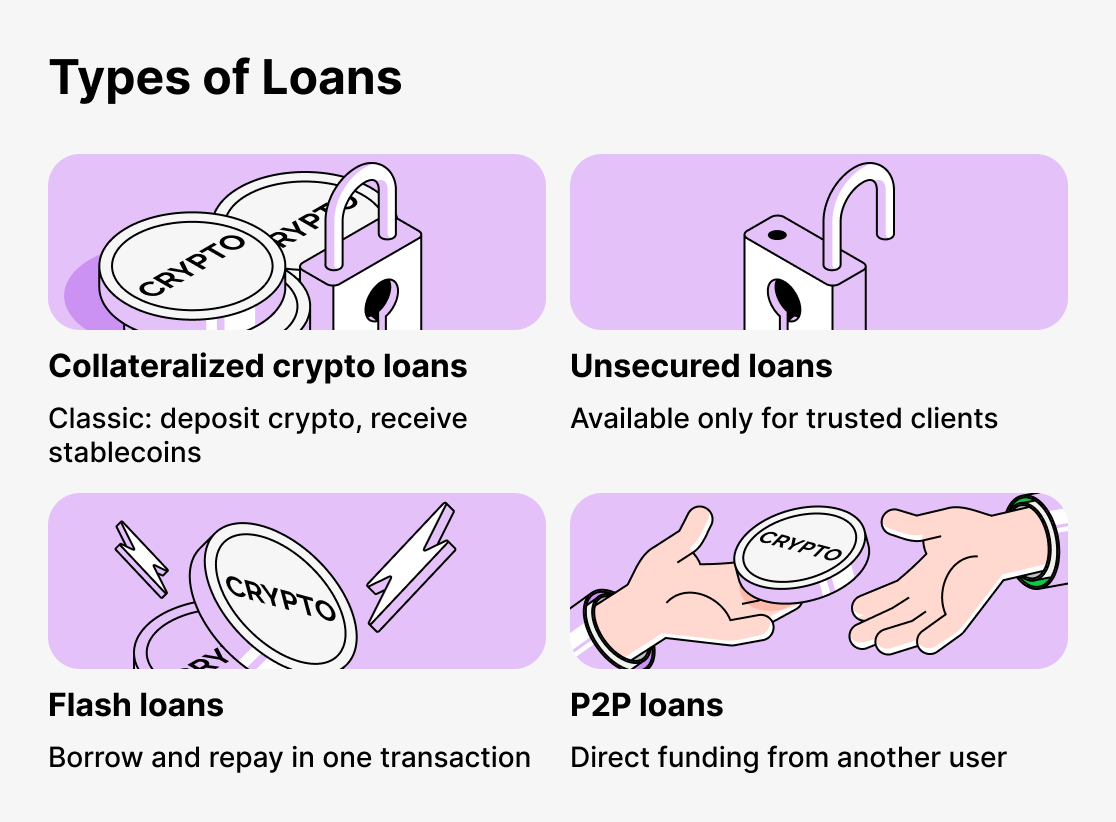

In cryptocurrency lending, there are several loan formats, each tailored to different needs and levels of borrower experience. Some options closely mirror traditional bank loans and require collateral, while others allow borrowing without collateral. There are solutions for both a broad audience and experienced traders.

Below are the main types of loans offered by CeFi and DeFi platforms.

Standard loans secured by cryptocurrency

Classic lending format. The borrower deposits BTC, ETH or another asset as collateral into a smart contract (if it's a Defi platform) or transfers it to the company's account (if it's a Cefi platform) and receives stablecoins as a loan to their balance. Such a loan allows the borrower not to sell their asset and to use it to obtain liquidity.

No-collateral loans

Such loans are provided to verified clients with a good reputation. You can obtain funds without providing collateral; however, such loans are not available to everyone.

P2P loans

The borrower receives funds from another user, and the centralized platform acts as the guarantor of the transaction. It's very convenient and secure, as the service provides support.

Flash loans

The borrower takes and repays a loan within a single transaction. This is a tool for experienced users that allows earning from arbitrage without the need to provide collateral.

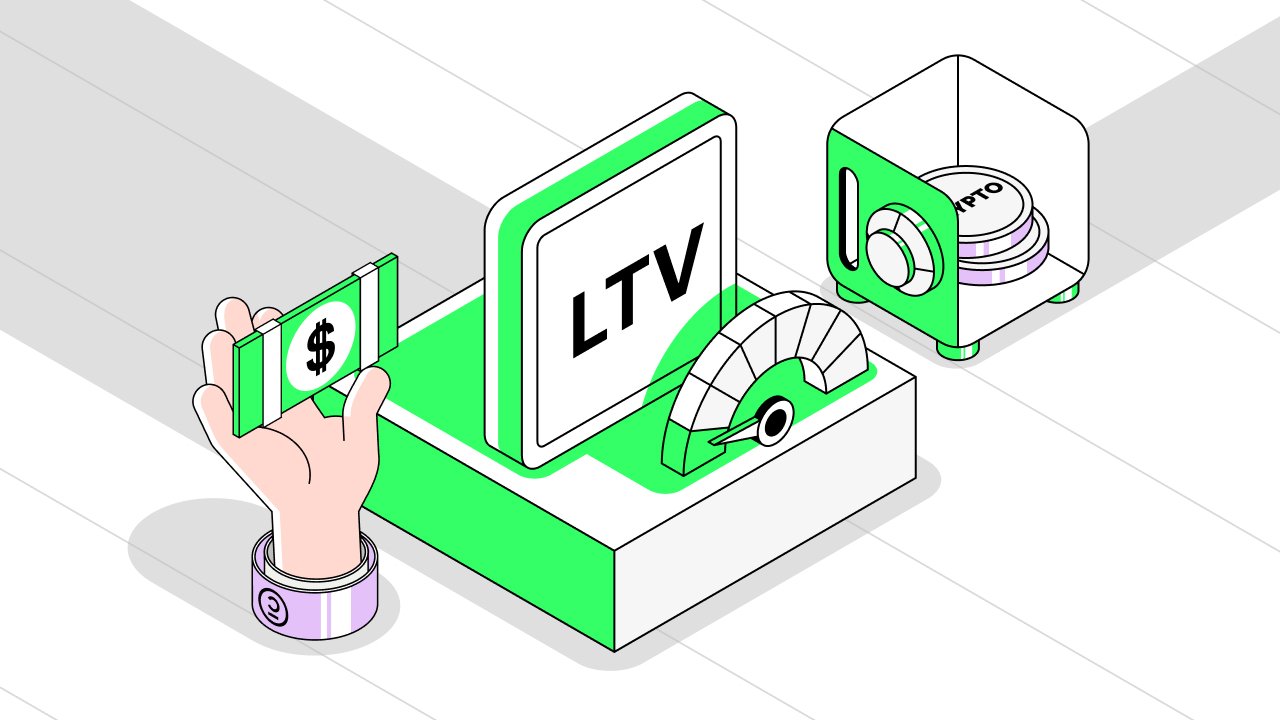

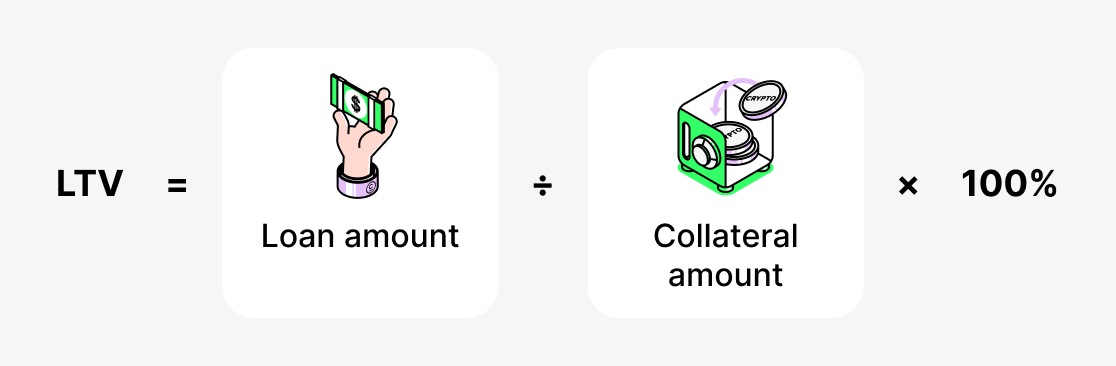

What is LTV and why is it so important in crypto lending

One of the key concepts in crypto lending is the metric LTV (Loan-to-Value ratio). It shows what portion of the collateral a borrower can receive as a loan.

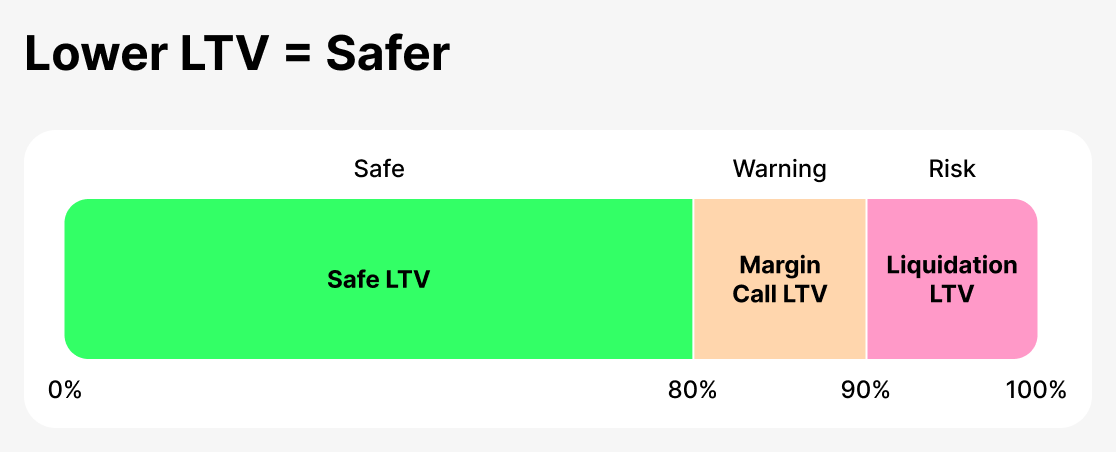

Let's take an example. If a borrower posts cryptocurrency as collateral worth $10,000, and the platform allows a loan of $5,000, the LTV will be 50%. The higher this value, the more funds the borrower receives, but the greater the risk for both the lender and the borrower. If the price of the collateral asset falls to a certain level, the lender may require additional collateral or even liquidate the collateral: sell it and thereby repay the client's debt.

LTV acts as a kind of "safety indicator". A low ratio (for example, 20–40%) means the borrower is using the collateral cautiously and leaves a buffer in case the market falls. A high LTV (70–80%) allows access to more funds but leaves minimal room for price swings. On the volatile crypto market this is especially critical, since the collateral's value can change by tens of percent in just a few days.

It's important to understand that different platforms set their own initial LTV limits. On some platforms lending is capped at 50%, while elsewhere 80% is allowed but subject to stricter conditions.

Once you take out a loan, you will be able to monitor your LTV and thus keep your loan secure. If your LTV rises too much, you will be asked to repay part of the debt or add more collateral. If you do so, your LTV will decrease. If you ignore the platform’s request, continued price drops may lead to liquidation. The platform will be forced to sell your collateral to avoid incurring losses.

Monitor your loan status and respond to the platform's alerts, and you won't run into problems!

Thus, LTV is one of the main risk-management tools in crypto lending. For a borrower, it helps determine how much can be safely borrowed without exposing their assets to excessive liquidation risk. For a lender, it is an indicator of the deal's reliability. The optimal choice of LTV depends on the borrower's goals, financial capacity, and willingness to withstand market fluctuations.

What interest rates are available in crypto lending

The interest rate is the cost of a loan — the amount the borrower must pay the lender for using the funds. In traditional banks, the rate depends on credit history and various economic factors. In crypto lending, the situation is slightly different: the rate is determined by the type of loan, the LTV level, the chosen platform, and market conditions.

Fixed-rate loans

A fixed interest rate means the rate does not change over the life of the loan. The borrower knows in advance how much they will have to repay at the end and can plan their expenses. Such loans are convenient for those who value predictability and do not want to depend on sharp market fluctuations. However, you usually pay a slightly higher rate for that stability.

Flexible-rate loans

A variable interest rate changes depending on market conditions and demand for loans. For example, when many users want to borrow stablecoins, the rate on them may rise, and when demand decreases — fall. This option can be advantageous for those who take a loan for a short term or count on a favorable market situation. But in the long term, taking a loan with a variable interest rate exposes the borrower to the risk of unexpected higher costs.

Zero-interest loans

Loans with 0% annual interest form a separate category. At first glance this sounds implausible, but such credit products do exist. These loans are usually accompanied by an origination fee: formally the interest rate is zero, but the loan term is limited and the fee is paid upfront when the loan is received. The advantage of this option is that the borrower avoids the accrual of compound interest.

Zero-interest loans are especially attractive for short-term use, when a borrower needs to obtain liquidity without selling their assets and thereby avoid additional costs. But it’s important to carefully review all the terms: such loans are often accompanied by hidden fees, strict limits, or a high risk of liquidation if the collateral’s price falls.

Thus, the choice between fixed-rate, flexible-rate and zero-rate lending depends on the borrower's goals. If stability and predictability are important — it's better to choose fixed-rate lending. If flexibility and the ability to save are important — you can consider flexible-rate lending. Zero-rate lending is suitable for those seeking short-term liquidity and willing to carefully review the terms of the offer.

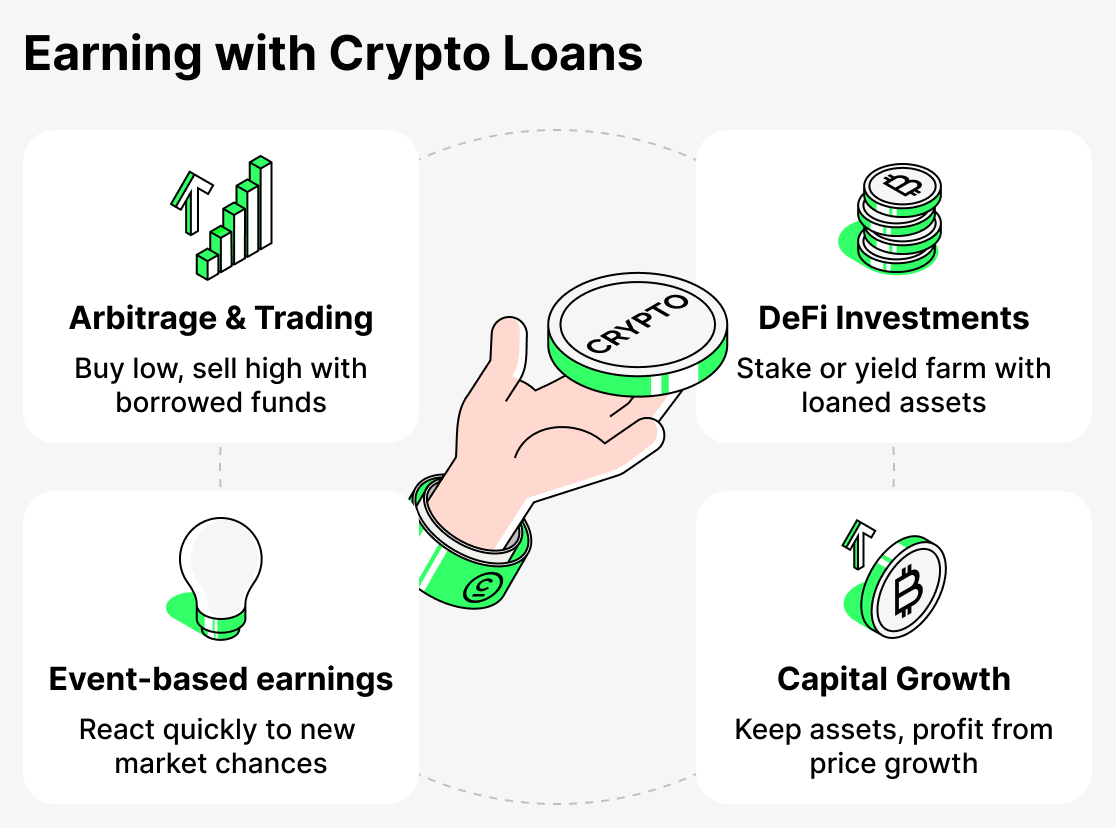

How to earn with crypto lending

For many cryptocurrency holders, loans are not only a way to obtain temporary liquidity but also an opportunity to increase income. By using borrowed funds wisely, you can significantly improve your position in a particular cryptocurrency.

We have a detailed article on how to earn effectively with crypto lending. Read it to get the full picture.

Arbitrage and trading

The borrower can use the funds obtained on credit for trading or arbitrage across different exchanges. For example, if an asset’s price is higher on one platform than on another, you can buy it cheaper with borrowed funds and immediately sell it at a higher price, locking in a profit. Such strategies require experience and quick reactions, but with the right approach they can generate good returns.

Investments in DeFi

A loan obtained can be used in DeFi services, for example for staking or yield farming. In this case, the investor uses their own capital as collateral. A typical example: an investor has BTC, but participation in an airdrop requires a different token, for example XRP. If they buy it directly, there's a risk of losing out due to price volatility: before the event, when everyone is buying up coins, the price rises, and afterwards, when everyone sells off the currency, the price falls. Instead, the investor can borrow the needed token using their BTC as collateral, without selling their holdings and without losing on price differences. The investor will only need to pay the borrowing fee.

Position preservation and capital growth

Sometimes earnings are not expressed as direct income but as preserving potential profit. For example, an investor may have long-term assets such as Bitcoin or Ethereum that they do not want to sell while waiting for the asset's price to rise. By taking a loan they gain liquidity for current needs or investments, and when the price increases they repay the loan and preserve the gain in the asset's value. Thus, a loan becomes a tool for maintaining a position and profiting from market growth.

Access to additional features

A crypto-backed loan lets you react quickly to market fluctuations. If a profitable opportunity arises, you can promptly borrow funds and invest without selling your assets. If successful, this will generate additional income.

What are the advantages of crypto lending

- Fast disbursement. Crypto loans are issued faster than traditional loans. Obtaining a loan at a traditional bank can take days or even weeks. Lenders require fewer documents, and many lending processes are often automated, allowing you to receive funds much faster.

- Low interest rates. Crypto loans offer lower interest rates compared to traditional loans.

- No credit check. Crypto loans do not require a credit check, as the loan is secured by the borrower's cryptocurrency assets. This means borrowers with poor credit histories who cannot get traditional loans can obtain crypto loans.

- Flexible repayment terms. Many platforms allow early loan repayment or partial payments. The borrower can choose a convenient time to return the funds within the set term.

- Global availability. Crypto loans are available to users worldwide, regardless of country of residence or local banking restrictions. All a borrower needs to take out a loan is a crypto wallet and internet access.

- Retention of asset ownership. The borrower pledges cryptocurrency rather than sells it. They can still profit from an increase in the currency's price.

In general, crypto loans offer several advantages over traditional loans. They are processed faster, have lower interest rates, do not require credit checks, and offer flexible repayment terms. As cryptocurrencies grow in popularity, it is becoming easier for borrowers to obtain crypto loans, making them an excellent financial solution.

What are the disadvantages of crypto lending

Although crypto loans may seem like a great way to access liquidity without selling your digital assets, they have several significant drawbacks.

- Volatility. One of the most significant risks associated with taking a crypto loan is market variability. Cryptocurrency prices are known for their instability and can fluctuate widely over a short period of time. If the value of your collateral suddenly falls, you may find yourself needing to add additional funds or repay part of the debt to avoid liquidation.

- Regulatory diversity. The level of regulation for crypto loans depends on the type of platform (CeFi or DeFi) and the country's jurisdiction. In some cases strict rules and customer protections apply, while in others the responsibility rests entirely with the user.

- Technical risks. In DeFi services, you may encounter bugs or vulnerabilities in smart contracts that can lead to loss of funds.

Overall, while crypto loans can be a useful tool for obtaining liquidity, you should weigh the risks, before taking out a loan. As with any financial decision, it's important to conduct timely analysis and take all factors into account.

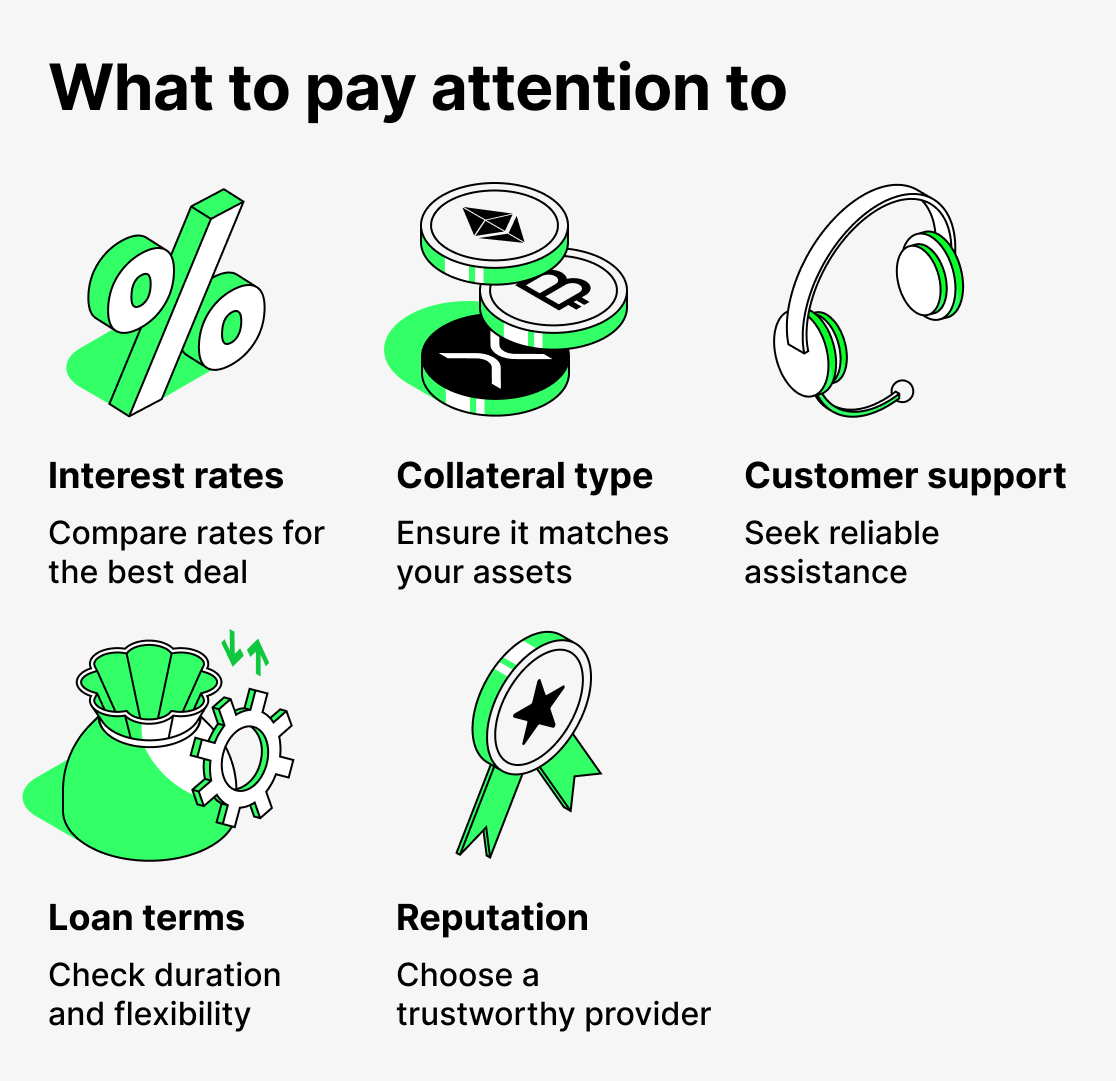

How to choose a crypto lending platform

Crypto loans can be a useful tool for those who want to retain their tokens while gaining access to funds. However, with so many providers on the market, it can be difficult to decide. Here are some factors to consider before making a decision:

- Interest rates. Look for a provider with competitive rates that fit your budget.

- Loan terms. Make sure the loan terms meet your needs, including the loan duration and repayment schedule.

- Collateral requirements. Consider how much collateral you will be required to provide and make sure you are comfortable with that level of risk.

- Customer support. Ideally, you need a provider with responsive customer support that can help resolve any issues or questions that may arise.

- Reputation. Research and choose a provider with a strong reputation in the industry.

Keep these criteria in mind to choose the right crypto lending provider for your needs. Always read the additional terms and fully understand the loan conditions before taking on financial obligations.

And regarding how to get a crypto loan in Cropty Wallet, we have a separate article where everything is explained in plain, easy-to-understand language!

Conclusion

Crypto lending is a new, rapidly growing sector that combines the advantages of traditional finance with the opportunities of the cryptocurrency world. These loans allow borrowers to access liquidity without having to sell their assets, to use tokens as collateral, and to continue managing their finances.

We examined what collateral is and how it works, why the LTV ratio plays a key role, what types of interest rates exist, and how borrowers can use loans not only to obtain additional funds but also to earn. When using crypto loans, it is also important to take into account all the risks: the high volatility of cryptocurrencies, the possibility of collateral liquidation, and the lack of comprehensive regulation.

Crypto loans give borrowers many new opportunities. Users can not only get money "here and now", but also profit from it. However, for crypto loans to work for you, you need to carefully choose platforms, study the terms, and always keep a safety margin. Ultimately, crypto lending is an excellent tool for those who want to preserve and grow their capital in the world of digital assets.

When managing your finances, it's important to choose a reliable and user-friendly platform. Cropty Wallet is an excellent choice! Here your collateral will be kept safe, and you'll be able to instantly receive loans in stablecoins and manage your finances through a simple and intuitive app.

Try crypto lending with Cropty Wallet today and see how simple and convenient it is!