What Crypto Lending is

Cryptocurrency lending, often referred to as crypto lending, provides individuals with the opportunity to acquire loans using their digital assets as collateral. This alternative form of lending is gaining popularity due to its relatively straightforward nature compared to traditional bank loans. While traditional loans can involve complex credit assessments and stringent requirements, crypto lending simplifies the process by utilizing blockchain technology and smart contracts.

Cryptocurrency enthusiasts who hold digital assets like Bitcoin are often advised to "hodl" or hold onto their assets in a secure wallet until the asset's value increases. However, just as leaving money in a low-interest-rate bank account may not yield substantial growth, cryptocurrency holders seek ways to make their digital assets work for them. This is where crypto lending comes into play. Crypto lending platforms offer a solution for both lenders and borrowers. Lenders can earn interest on their digital assets by providing them as collateral for loans, while borrowers can unlock the value of their holdings without needing to sell them.

Consider the scenario of Steve, who possesses two Bitcoins and anticipates their value to appreciate over time. Steve is hesitant to sell his Bitcoins and risks missing out on potential future gains. Crypto lending platforms offer a remedy to this situation. Steve can pledge his Bitcoins as collateral and receive a loan in stablecoins. To account for the volatility of digital assets, he might need to over-collateralize, locking up more Bitcoin than the value of the loan. Upon repaying the loan with interest, Steve regains his crypto assets, potentially making a profit if Bitcoin's value has indeed risen. In essence, crypto lending provides a win-win situation, allowing lenders to earn interest and borrowers to access liquidity without selling their valuable digital assets.

Is crypto Lending safe?

Crypto lending, while not without risks, can still be deemed safe, especially when engaging with reputable providers like Cropty Wallet. Just like any investment, crypto lending entails a certain level of risk, and that's perfectly acceptable. After all, the aim is to earn interest, which inherently involves risk. The key lies in comprehending these risks, gauging the potential returns, and making an informed decision.

It's essential to acknowledge that the extent of risk can be influenced by your investment approach. To mitigate potential pitfalls, consider the following strategies:

- Opt for Established Providers: Partnering with well-established lending platforms can significantly reduce risk. Providers like Cropty Wallet have a track record of reliability and security.

- Focus on Stablecoins and Fiat: Navigating the crypto landscape by concentrating on stablecoins or fiat currencies can provide stability in an otherwise volatile environment.

- Interest in Stablecoins: Receiving your interest in stablecoins or fiat further safeguards your returns from sudden market fluctuations.

Ultimately, the choice between an aggressive or defensive strategy rests with you. Pursuing higher returns might involve embracing additional risk. Nonetheless, it's crucial to note that the conventional risk-return principles in traditional finance don't always hold true in the realm of crypto lending.

Consider this: you might earn a higher interest rate on stablecoins despite the reduced risk they carry. This might seem counterintuitive initially, but it stems from the inherent volatility present in the crypto financial domain. In this context, you receive a premium for maintaining stability amidst the broader volatility.

Upon depositing assets into a lending platform, these are allocated to borrowers who are bound to furnish collateral for their loans, often exceeding 100%. Remarkably, certain platforms even demand a heightened collateral ratio of 150%, augmenting the level of security.

An illuminating distinction surfaces when contrasting lending and supply within the context of crypto lending's safety. Supply preserves a steadfast 1:1 ratio, while each loaned asset is backed by collateral sourced from another borrower. The interest rate procured from the platform is substantially offset by borrowers who remunerate their own fees linked to the loans they secure.

A central concern embroiling lending platforms orbits around trust. Entrusting your crypto assets to a lender demands confidence that they will be managed as intended, predominantly for lending endeavors. Yet, there lingers the specter of the platform's potential malevolent actions, diverting user funds for alternative objectives. Consider a scenario where a company diverts its funds into speculative ventures or ventures into risk-laden strategies to grasp loftier returns. Envision your holdings submerging into a volatile liquidity pool, enduring ephemeral losses, and ultimately dissipating due to the company's ill-fated choices.

For those considering crypto lending, Cropty Wallet stands as an exemplar of a dependable platform, offering a robust environment to navigate the nuanced interplay of risks and rewards. As in any financial undertaking, a judicious evaluation of your risk tolerance aligned with your strategic goals is imperative.

Benefits of Crypto Lending

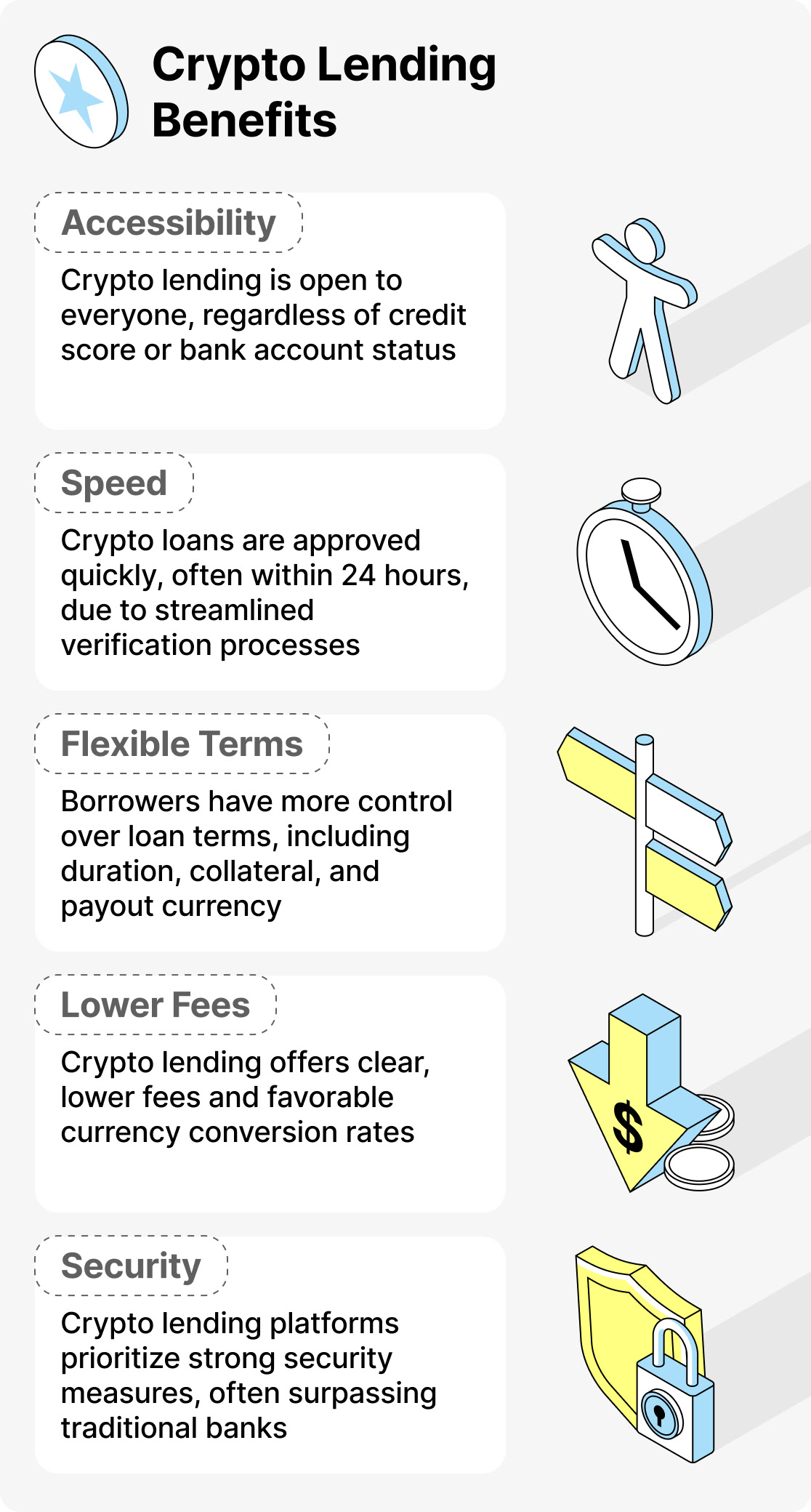

One of the major advantages of crypto lending lies in its accessibility. Unlike traditional banking, where credit scores heavily influence loan approval, crypto lending platforms often do not require borrowers to undergo credit assessments. This inclusivity benefits individuals with limited financial histories, those without bank accounts, and self-employed workers with fluctuating earnings.

Flexibility is another key benefit of crypto lending. While traditional loans can take days to process, crypto loans can be near-instant, thanks to the efficiency of blockchain technology. Borrowers can also adjust the terms of the loan to suit their specific needs, making the borrowing process more tailored to individual circumstances.

Furthermore, crypto lending platforms enable users to make their assets liquid without triggering taxable events, as selling digital assets would. These platforms allow borrowers to switch between various crypto assets and stable coins, providing a versatile borrowing experience.

Centralized and decentralized lending platforms offer different approaches. Centralized platforms, while involving more paperwork, provide a regulated environment with customer support. On the other hand, decentralized lending platforms operate through code and smart contracts, eliminating intermediaries and providing a more transparent process. However, the interest rates on decentralized platforms may not match those of centralized counterparts.

Both centralized and decentralized crypto lending platforms are still evolving, offering exciting potential for growth and innovation in the financial services industry. As this space develops, crypto lending has the potential to revolutionize borrowing and lending practices.

How Does Crypto Lending Work? A Defi Explanation

Today, let's delve into the mechanics of decentralized finance (DeFi) lending and borrowing. First, let's establish what DeFi is. DeFi stands for decentralized finance, a revolutionary approach to financial transactions that bypasses traditional banks and institutions. Instead, DeFi transactions occur on the blockchain—a decentralized network accessible to everyone. So, how does DeFi lending and borrowing operate? Imagine it as a two-sided process involving lenders and borrowers facilitated by smart contracts stored on the blockchain.

Smart contracts serve as digital agreements specifying loan terms: loan amount, interest rate, and repayment timeline. Once created, these contracts are unalterable, ensuring transparency and mutual understanding between both parties. To engage in DeFi lending or borrowing, you can turn to DeFi lending platforms. These platforms bring lenders and borrowers together, streamlining the loan process. Aave, MakerDAO, Compound, and Dharma are some prominent DeFi lending platforms.

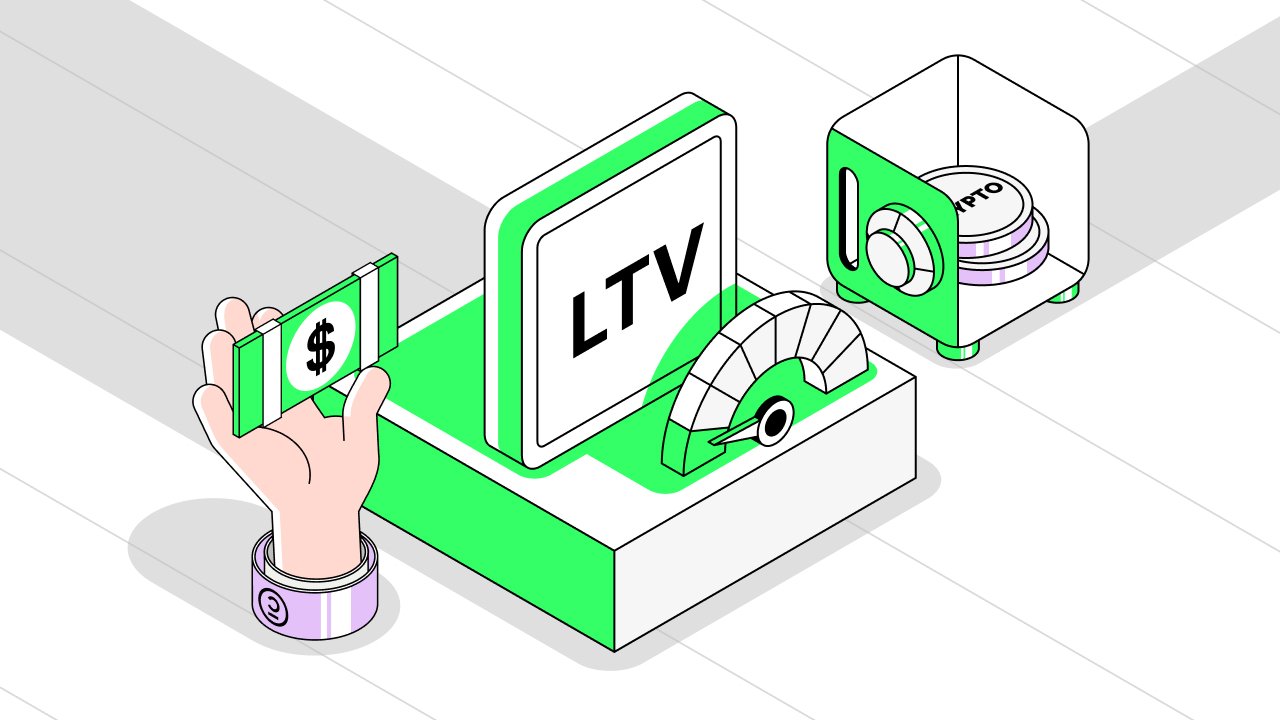

However, before you dive in, grasp some vital DeFi concepts. One such concept is Loan-to-Value ratio (LTV). LTV gauges the proportion of the loan amount to the collateral provided. For instance, if you borrow $100 and collateralize with $200 worth of Ethereum, your LTV is around 50%. Monitoring your collateral's value is crucial; if it declines significantly, your loan could become under collateralized, leading to the lender asking for more collateral or even liquidating your position.

High LTV ratios involve more risk for lenders, leading to higher interest rates. Conversely, borrowers opt for lower LTV loans to secure lower interest rates. Despite the potential risk of liquidations, high LTV loans offer leverage—borrowing more than with low LTV loans—to amplify potential gains or purchases. But remember, leverage involves added risk, so use it cautiously.

Another key term is the Annual Percentage Rate (APR), denoting the interest paid annually on a loan. APR accounts for compounding, making it generally higher than the nominal interest rate. It's crucial to consider the APR when evaluating loan options.

"Why not just sell crypto?" you might wonder. Some individuals prefer holding onto their crypto for future price appreciation. Selling also triggers taxable events, unlike taking out a loan. For such cases, loans enable cash access without relinquishing crypto assets.

Lenders, on the other hand, receive interest for lending money and retain collateral. If a borrower defaults, lenders can liquidate the collateral to recover losses. This symbiotic relationship fosters DeFi's vibrant ecosystem.

The safest way to use crypto loans

Exploring the realm of crypto lending in the safest manner boils down to two primary avenues: lending for passive income and lending for loans, each offering distinct advantages while prioritizing security.

Lending for Passive Income (A.K.A. Saving)

For those seeking a low-risk method to earn passive income from their crypto assets, the path of crypto savings accounts emerges as a reliable option. This entails depositing your crypto holdings into a savings account offered by various platforms. Here's how it works: the platform lends your assets to borrowers and compensates you with interest on your deposit. The interest rate is influenced by multiple factors, encompassing the lending platform's operational model, prevailing market conditions, and the specific cryptocurrency you contribute.

Crypto savings accounts are commonly extended by centralized exchanges, lending platforms, or specialized crypto-centric platforms. The distinguishing factors lie in their provision of user-friendly interfaces, tools for account management, and the seamless movement of funds in and out of the account. By aligning with these platforms, you can significantly mitigate the array of risks that might be associated with other forms of crypto lending.

Take, for instance, Cropty’s USDT Growth accounts. These exemplify transparent fee structures and the potential to garner up to 9% APY, presenting a secure avenue for growing your assets.

Lending for Loans (A.K.A. Borrowing)

Should you opt to employ your crypto holdings as collateral for a loan, prudence dictates aligning with well-established platforms known for their transparency, sound financial health, and a track record of effective fund management. In this regard, platforms that undergo Proof-of-Reserves attestations carry a gold standard in terms of transparency and reliability. These attestations, executed by impartial public accountants, serve as a testament to the platform's credibility.

Navigating the crypto lending sphere safely hinges on your approach. Whether you're keen on earning passive income or exploring lending for loans, the emphasis remains on partnering with reputable platforms that prioritize security and transparency. In an environment that's steadily maturing, informed decisions backed by due diligence are your best ally.