Many cryptocurrency owners wonder why take a loan secured by cryptocurrency? Does it make any sense at all? After all, you could just sell the asset and live peacefully! In practice, crypto lending is not just a way to obtain liquidity. Today it has become a full-fledged capital-management tool that lets you access funds without losing a favorable market position, without paying taxes, and without changing your long-term investment strategy.

In this article, we'll discuss why taking a crypto loan can be an excellent decision. You'll also learn not only how to get liquidity here and now, but also how to unlock a wealth of new opportunities!

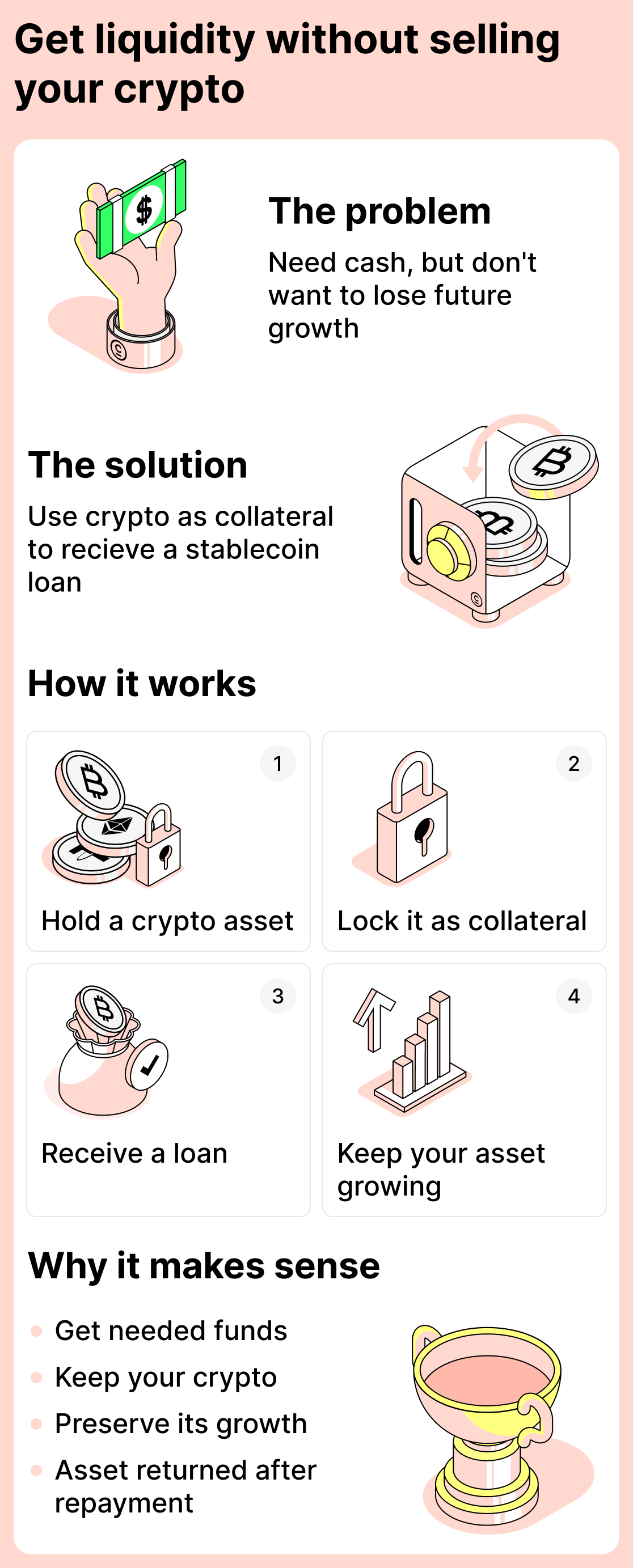

How to obtain liquidity without selling cryptocurrency and preserve the asset's growth

Selling cryptocurrency is the most obvious way to get money. However, there is one significant drawback: once you sell the asset, it stops working for you. If the market moves favorably, you will no longer be able to profit from it.

Crypto lending solves this problem. By taking out a loan you’ll get the funds you need and won’t miss out on profit growth from an increase in your asset’s price. After you repay the loan, you’ll be able to reclaim the funds you posted as collateral, along with a share of its appreciation!

Practical example:

Imagine: in November 2023 you had 1 ETH, and it was worth about $2,050 then. You needed the money urgently, but you didn't want to sell your assets because you were hoping the asset would grow. So you decided to take a loan secured by your ETH instead of selling and received USDT for your needs. In the end, the asset wasn't sold and remained with you.

Time passed. You have already repaid the loan, but your ETH remained with you. Now, at the end of 2025, 1 ETH is already worth about $3,160. That means the asset's value has increased!

So, by taking a loan, you received the funds you needed at the time and effectively preserved ETH's price growth, which increased your capital by 1.5 times!

Logic of the approach:

- You need funds, but you don't want to sell your assets;

- You take out a loan secured by your crypto asset and receive the necessary funds;

- You retain the growth potential of your crypto asset;

- After your debt is repaid, your cryptocurrency is returned to you with interest earned from natural growth.

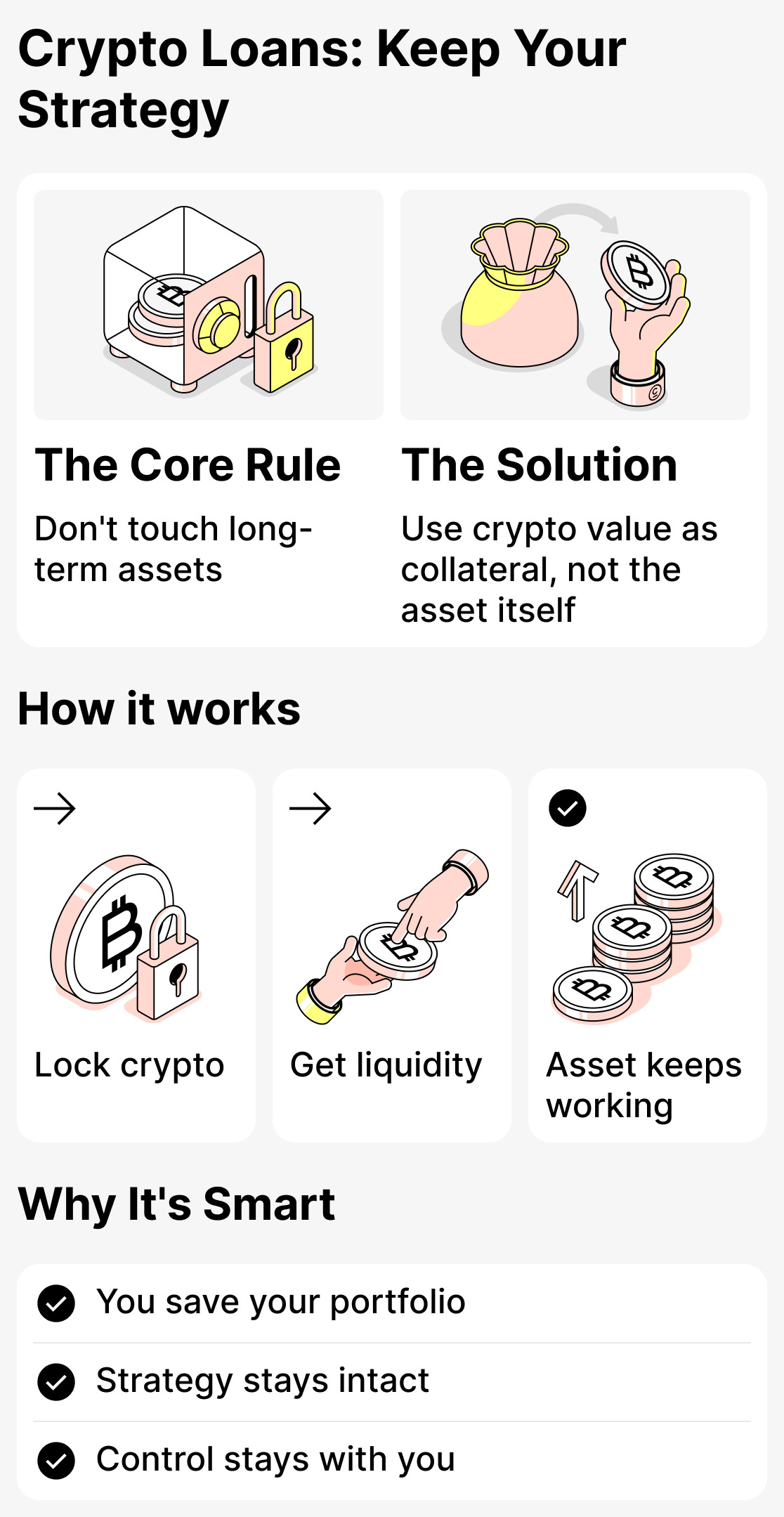

Crypto lending as a way to preserve your investment strategy

Many investors have a clear rule: long-term assets must not be touched, even if you urgently need money right now. When you have your own strategy, you can't allow unnecessary spending. When you set big goals, it's important to be responsible, disciplined, and manage your capital according to plan.

Crypto lending lets you obtain additional liquidity without using funds from your investment portfolio. In other words, you don’t withdraw the asset from long-term storage; you temporarily use its value to obtain funds while preserving your position.

Practical example:

The user holds cryptocurrency that they plan to keep until the next market cycle. They don't want to break their strategy, but occasionally tasks arise that require additional funds: small investments, payment for essential services, and so on.

Instead of using funds from their portfolio and then spending a long time rebuilding it, the user pledges part of their assets and receives the funds they need. Their strategy still works, because after the loan is repaid the assets will return to them.

Logic of the approach:

- The portfolio was built up over a long period for a specific purpose. There is a clear strategy that should not be compromised by selling or transferring funds.

- With a crypto loan, you can pledge part of the funds involved in a strategy without disrupting the overall structure.

- The entire portfolio remains under the user's full control.

- The financial structure is not disrupted - long-term assets remain unchanged.

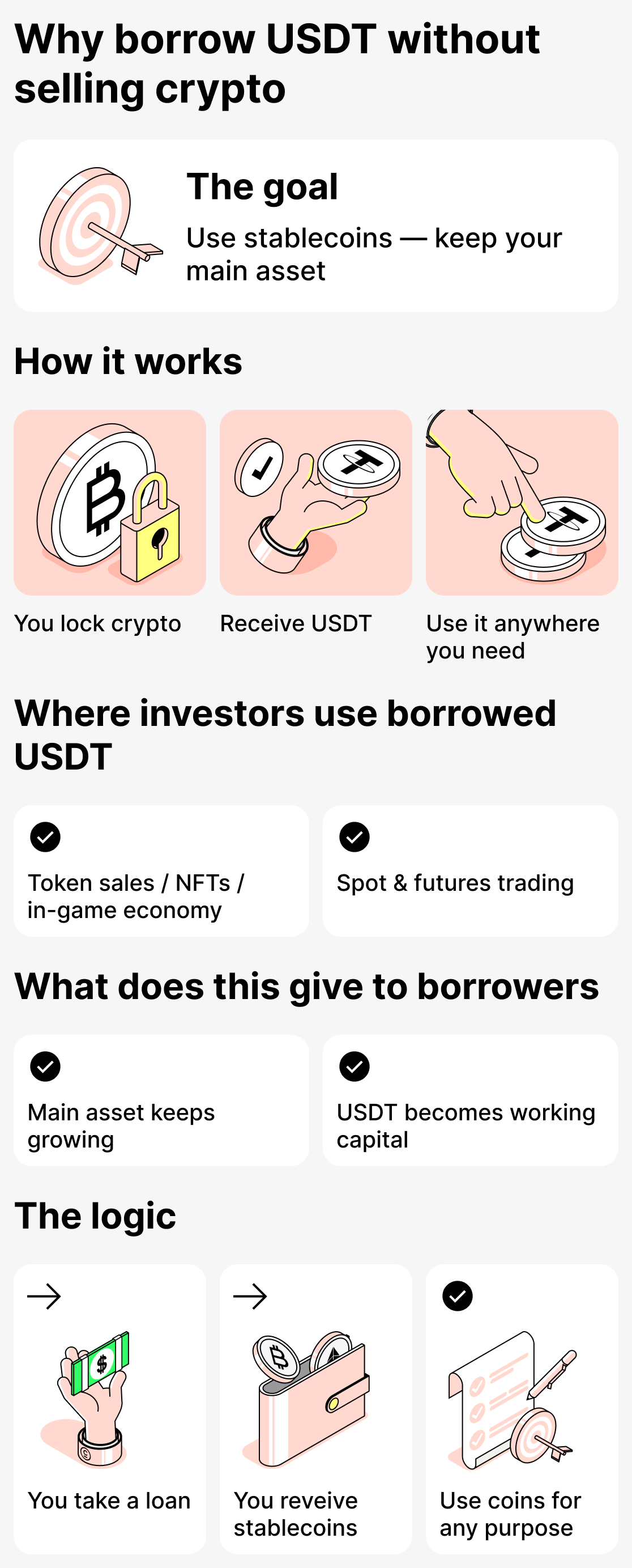

Obtaining USDT with crypto as collateral without selling — why do people do it

Not everyone who takes a crypto loan does so just to get money and spend it immediately. Very often investors have a completely different goal — to obtain stablecoins (USDT, USDC, BUSD) to use in other projects within the ecosystem. The main asset, meanwhile, is used as collateral and can still rise in value.

Where borrowed funds are actually used:

- Participation in DeFi programs (yield farming, pools).

- Purchasing subscriptions or services that accept payment in stablecoins.

- Participation in token sales, the in-game economy, and NFT drops.

- Trading on the spot or futures market.

In such scenarios the primary asset is used as collateral for the loan, while the borrowed stablecoins serve as a separate "working capital" that can be put into circulation or used to participate in various projects.

Practical example:

The user has SOL, which he doesn't intend to sell until the price goes up. But an opportunity appears to participate in a USDT liquidity pool. Instead of converting SOL to USDT and losing his market position, he borrows USDT using SOL as collateral and deposits the stablecoins into the pool, while keeping the main coin.

Logic of the approach:

- The primary asset is pledged to obtain stablecoins, but is not sold;

- Stablecoins are used to perform specific, targeted tasks;

- The asset held as collateral continues to grow;

- Collateral is capital that is held long-term, while USDT is additional capital used for various purposes.

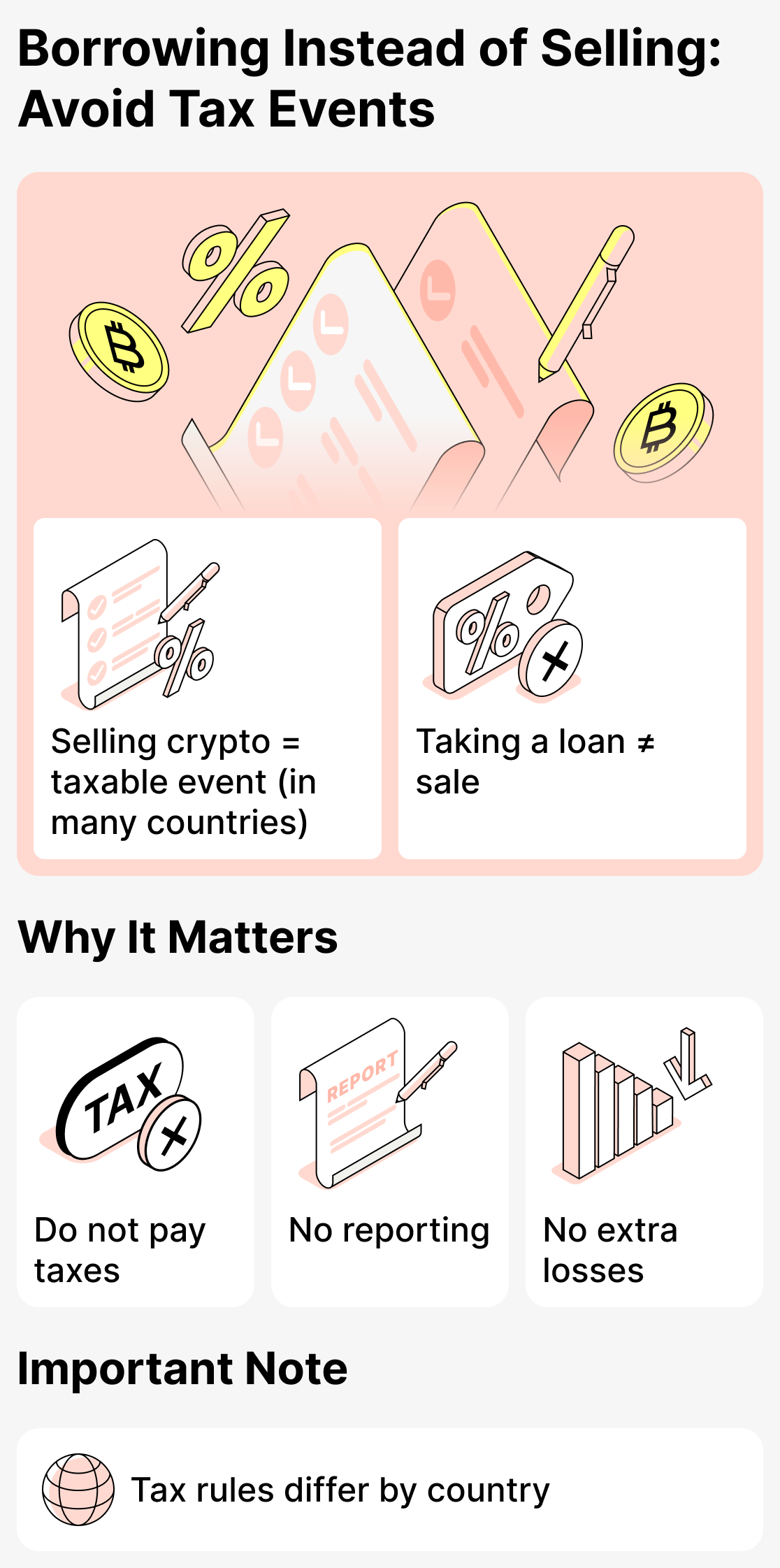

Loan Instead of Sale: A Way to Avoid Creating a Taxable Event

In some countries, selling cryptocurrency is considered a taxable event. When a user sells an asset, the state’s financial (or tax) authorities may consider that they realized a profit. As a result, the sale of cryptocurrency may trigger taxes or reporting requirements.

By taking out a crypto loan, you can avoid triggering a taxable event. After all, you are not actually selling the cryptocurrency, but simply using it as collateral for the loan. In that case, no tax will be charged and no reporting will be required.

However, note that each country has its own tax policy, so not all of them charge tax on cryptocurrency sales. Nevertheless, many countries do.

Practical example:

The user holds a certain amount of BTC. If the user sells the asset for USDT or their country's fiat currency, a tax may be imposed in their country that the user will be required to pay.

If a user takes those same USDT using their BTC as collateral, from the perspective of most countries this will not be considered a sale, and therefore the transaction will not be taxed.

Logic of the approach:

- Sale - receipt of income, and therefore a taxable event;

- Receiving funds through lending is not subject to taxes, so you won't incur any extra losses.

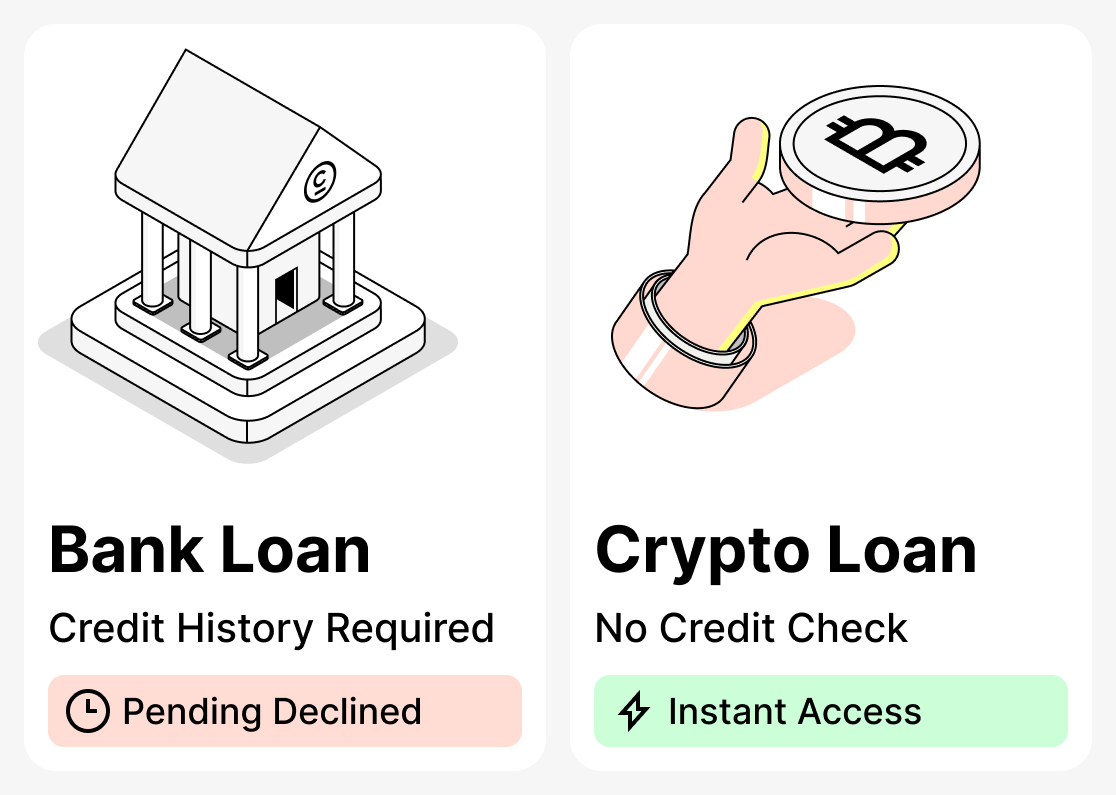

Why crypto loans are approved faster than bank loans

It's not always possible to get a loan from a traditional bank. A borrower may have problems with their credit history, or banks may simply not approve the amount the borrower needs. Sometimes a borrower has no time at all because the money is needed urgently. Banks, in turn, carry out thorough checks of their clients, which prolongs the loan issuance process.

Crypto loans are different. In crypto lending, your credit history isn’t taken into account. Platforms that work with cryptocurrency typically don’t perform complex, time-consuming checks that make you wait hours or even days for approval. All you need to do is provide cryptocurrency as collateral, and you’ll receive funds quickly.

Practical example:

A client goes to the bank and asks for a loan, but the bank refuses due to a poor credit history. He then learns that in crypto lending loans are issued quickly and with minimal checks. He also has a certain amount of ETH that he can provide as collateral. The borrower turns to a cryptocurrency lending service and receives the money within minutes.

Logic of the approach:

- To get a loan from a bank, you often need to have a good credit history and undergo numerous checks;

- To obtain funds as quickly as possible and with strong guarantees, you can take out a loan in cryptocurrency;

- You will receive the funds promptly, and you can also take advantage of cryptocurrency's features: its high volatility, which can even allow you to make a decent profit if the price of the collateral rises.

Crypto loan - a reliable and practical financial instrument

More and more people are beginning to view crypto loans not just as an opportunity to borrow money, but as a way to circumvent many restrictions, open up new financial horizons, and even profit from market fluctuations.

However, keep in mind that crypto loans are not a panacea and are not suitable in every case. They should be approached with caution and taken only when there is a genuine need. Only then will you be able to get the most out of crypto lending.

And to better understand crypto lending, read our detailed article about what crypto loans are and how they work.