The world of cryptocurrency has disrupted traditional finance in more ways than one, and one of the most exciting developments is the rise of crypto loans. Imagine being able to take out a loan using your crypto assets as collateral – it's not only possible but increasingly essential in today's crypto landscape.

Crypto loans provide a means for individuals to access liquidity, whether for personal emergencies, capitalizing a business venture, or even earning interest on their holdings. Unlike traditional loans, the crypto world offers innovative lending solutions, and in this article, we will explore the ins and outs of crypto loans and why they are becoming indispensable.

What is a crypto loan

Crypto loans, in essence, are loans that are secured by cryptocurrency collateral. Here are four key reasons why you might consider taking out a crypto loan:

- Non-Taxable Liquidity: For crypto investors or "hodlers" looking to avoid taxes on their gains, obtaining loans against their crypto collateral can be a tax-efficient way to access fiat currency.

- Arbitrage Trading: Crypto loans enable you to maximize earnings by borrowing an asset from one platform and lending it on another, taking advantage of price differentials.

- Margin Trading: This strategy involves leveraging your gains by obtaining crypto loans to buy additional collateral without going through a centralized exchange.

- Flash Loans: While most crypto loans require collateral, flash loans are uncollateralized, allowing you to borrow crypto for immediate operations and repay it within the same transaction. These are often used in arbitrage trading to leverage higher liquidity levels.

How Crypto Loans Work

One of the fundamental aspects of crypto lending is collateral. Collateral serves as security for the lender in case the borrower defaults. Here's how crypto loans work:

Collateralization Ratio: To secure a crypto loan, you provide cryptocurrency assets as collateral. The value of your collateral must exceed a certain threshold known as the collateralization ratio. If the value of your crypto assets falls below this threshold, your assets are at risk of liquidation.

Loan Repayment: Upon receiving the loan, you're expected to repay it with interest. Once the loan, including interest, is repaid, your crypto assets are released back to you in full.

Why is Collateral Essential for Crypto Lending?

Collateral is a crucial component of crypto lending for several reasons:

- Risk Mitigation: Cryptocurrencies are known for their price volatility. To mitigate the risk of borrowers defaulting on their loans, lenders require borrowers to provide collateral. If a borrower fails to repay the loan, the lender can liquidate the collateral to recover their funds.

- Overcollateralization: Due to the inherent volatility of cryptocurrencies, lenders often require borrowers to overcollateralize their loans. This means that borrowers must provide collateral worth more than the loan amount they wish to receive. Overcollateralization ensures that lenders are adequately protected even if the value of the collateral drops.

- Price Fluctuations: Cryptocurrencies can experience significant price fluctuations in a short period. If a borrower's collateral decreases in value, they may be required to provide additional collateral to maintain the loan-to-collateral ratio. Failure to do so could result in the liquidation of their collateral by the lending platform.

Benefits of Crypto Lending

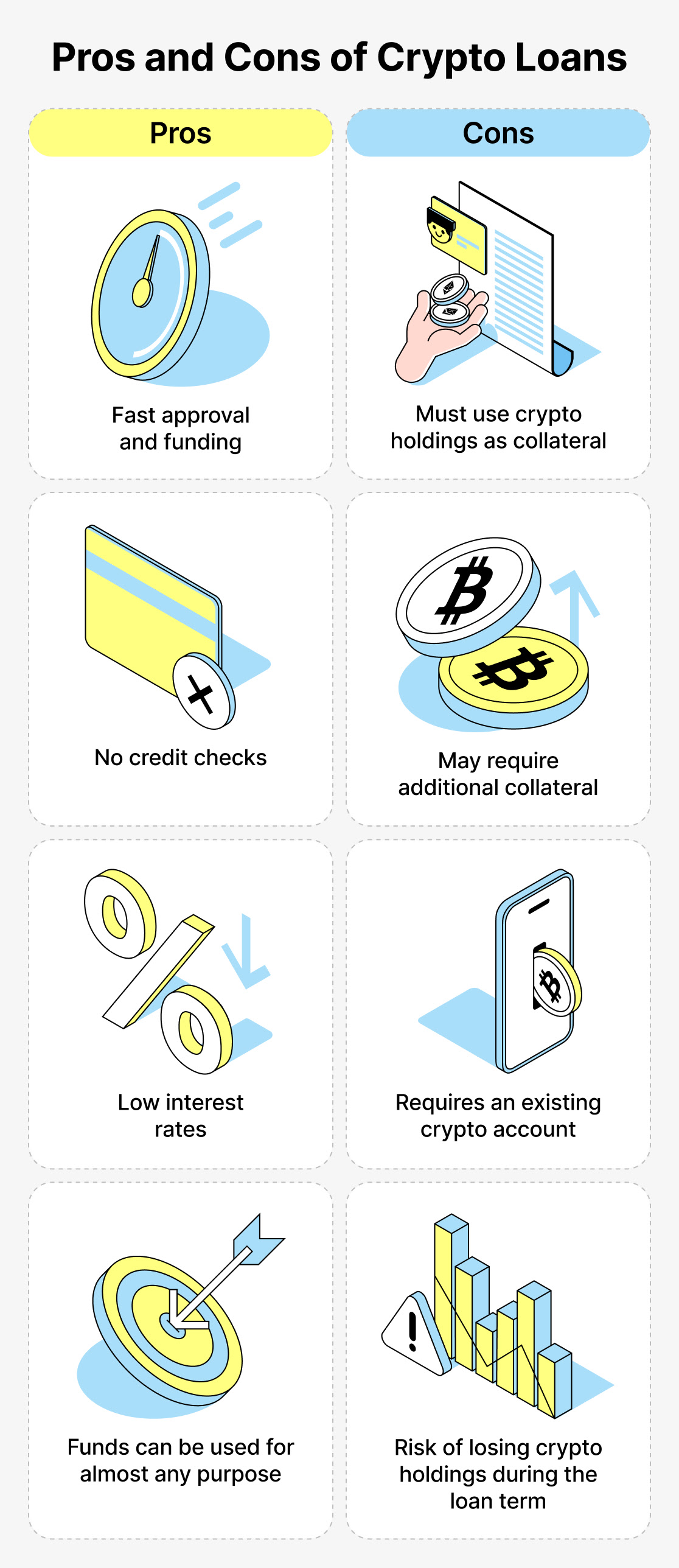

- Accessibility: Crypto lending is accessible to individuals with various financial backgrounds, including those with no credit history or those who are underbanked.

- Flexibility: Repayment terms and loan structures can be more flexible than traditional loans. Borrowers can tailor their loans to meet their specific needs.

- Speed: Crypto loans can be processed quickly, often within minutes, compared to traditional bank loans that can take days or weeks.

- Asset Liquidity: Borrowers can access liquidity without triggering taxable events by selling their crypto assets.

- Asset Diversification: Lenders can earn interest on their crypto holdings and diversify their investment portfolio.

CeFi vs. DeFi Crypto Loans

Now, let's explore the key differences between Centralized Finance (CeFi) and Decentralized Finance (DeFi) crypto loans:

CeFi Loans (Centralized Finance):

- Provided by centralized entities acting as intermediaries.

- Collateral is held by these entities, and they issue USD loans against it.

- Examples include Nexo, Binance, and FTX.

- Single points of failure exist, as these platforms may fail, potentially resulting in loss of collateral.

DeFi Loans (Decentralized Finance):

- Operate through blockchain-based financial applications, eliminating the need for centralized intermediaries.

- Smart contracts are used to automate transactions, ensuring transparency and security.

- You retain full control of your funds and collateral.

- Anyone with sufficient crypto assets can participate as a lender in DeFi lending pools.

Risks Involved:

- CeFi loans carry insolvency risk if the platform provider goes bankrupt, potentially resulting in the loss of your assets.

- DeFi loans may be vulnerable to smart contract exploits and hacks if the code is poorly written.

- Admin key risk exists in DeFi, where developers control the admin keys and could potentially misuse them.

- Liquidation risk is present when the value of your collateral falls below the minimum required, leading to asset liquidation.

Crypto Lending Use cases

1. Home Mortgage:

- Imagine you're looking to buy your first house, and you need a mortgage. Traditional banks require a down payment of 20%, and they lend you the remaining 80%. However, you could use a crypto lending platform like Cropty Wallet to deposit your cryptocurrency as collateral and borrow stablecoins or fiat currencies to cover the down payment. This way, you can keep your crypto investments while accessing the funds you need to buy your home.

2. Buying a Car:

- If you want to buy a car that's a bit too expensive but still within reach, you can use crypto lending. Similar to the home mortgage example, you can deposit your cryptocurrency as collateral and borrow the funds needed to purchase the car. This way, you can enjoy the car you desire without selling your crypto holdings.

3. Leveraged Trading:

- Crypto lending platforms allow you to create leveraged positions. Suppose you have $100 worth of Ethereum. You can deposit it into a lending platform, borrow stablecoins against it, and use those stablecoins to buy more Ethereum. Now, you have more Ethereum, which can potentially lead to more significant gains if the price goes up. However, be cautious because leverage can also amplify losses if the price goes down.

4. Flash Loans:

- Flash loans are a unique feature offered by some crypto lending platforms, like Cropty Wallet. With a flash loan, you can borrow a substantial amount of cryptocurrency without providing collateral. These loans need to be repaid within the same blockchain transaction. You can use flash loans for arbitrage opportunities, such as exploiting price differences between exchanges.

5. Passive Income:

- If you have surplus cryptocurrency that you don't want to sell, you can lend it on crypto lending platforms. By lending your crypto, you earn interest over time. This allows you to generate passive income from your crypto holdings, much like earning interest in a traditional bank savings account.

6. Diversifying Investments:

- Crypto lending can also help diversify your investment portfolio. Instead of having all your funds tied up in a single cryptocurrency, you can use some of your holdings as collateral to borrow other cryptocurrencies or stablecoins, allowing you to invest in various assets and potentially benefit from price movements in different markets.

Conclusion

In conclusion, crypto loans have become integral to the crypto ecosystem, offering numerous benefits such as tax efficiency, arbitrage opportunities, and flexibility in trading and lending. Whether you opt for CeFi or DeFi loans, it's crucial to understand the risks and advantages associated with each.

As with any financial decision, conducting thorough research and possibly seeking expert advice is essential. Crypto loans can be powerful tools, but they come with their own set of risks. Whether you're borrowing or lending crypto, make informed choices to navigate this dynamic space successfully. Remember to like, subscribe, and stay updated on the latest in crypto!