Have you ever wondered if you can take up a loan using your crypto? The answer is YES! Just like traditional loans, crypto loans can be used for personal emergencies, business capital, and earning interest. Moreover, you can even lend your crypto to others. In this video, we'll explore how crypto loans work, their benefits, and whether they can be obtained without collateral. But first, let's understand why you might need a crypto loan.

Benefits of Crypto Loans

4 Reasons to Take Up Crypto Loans:

- Non-Taxable Liquidity: For investors who prefer to hold their crypto assets, obtaining loans against their collateral allows them to receive fiat currency without triggering taxable gains.

- Arbitrage Trading: Crypto loans enable users to borrow an asset from one platform and lend it on another, maximizing potential earnings through price differences.

- Margin Trading: Borrowing crypto and using it as collateral to buy additional assets can amplify gains without relying on centralized exchanges.

- Flash Loans: Flash loans are a unique form of uncollateralized lending where borrowers borrow crypto, execute other operations, and repay the loan within the same transaction, often used for arbitrage trading and higher liquidity.

The Beauty of Crypto Loans: One of the significant benefits of crypto loans is that they do not require a credit rating check like traditional bank loans. Instead, you use your crypto assets as collateral, allowing for faster approval times and retaining full ownership of your crypto. However, crypto loans without collateral usually lack this benefit and are simular to traditional loans in banking. On the other hand, monitoring the collateralization ratio is crucial, as falling below the required ratio puts your assets at risk of liquidation.

Different Types of Crypto Loans

Crypto loans can be categorized as CeFi (Centralized Finance) loans and DeFi (Decentralized Finance) loans.

CeFi Loans: Offered by centralized entities like Nexo, Binance, or FTX, CeFi loans require collateral in the form of cryptocurrencies and provide fiat loans. However, they involve counterparty and insolvency risks.

DeFi Loans: Operate on blockchain-based financial applications, removing the need for trust in centralized entities. Smart contracts automate transactions, and users retain full control of their funds. DeFi loans, while offering more flexibility, may be exposed to risks due to smart contract vulnerabilities and liquidation events.

Both CeFi and DeFi loans carry risks. CeFi platforms may face insolvency, leading to the loss of deposited crypto. DeFi loans may be vulnerable to smart contract exploits and liquidation due to market volatility. It's essential to be aware of these risks and conduct thorough research before engaging in crypto lending.

What is Collaterazation

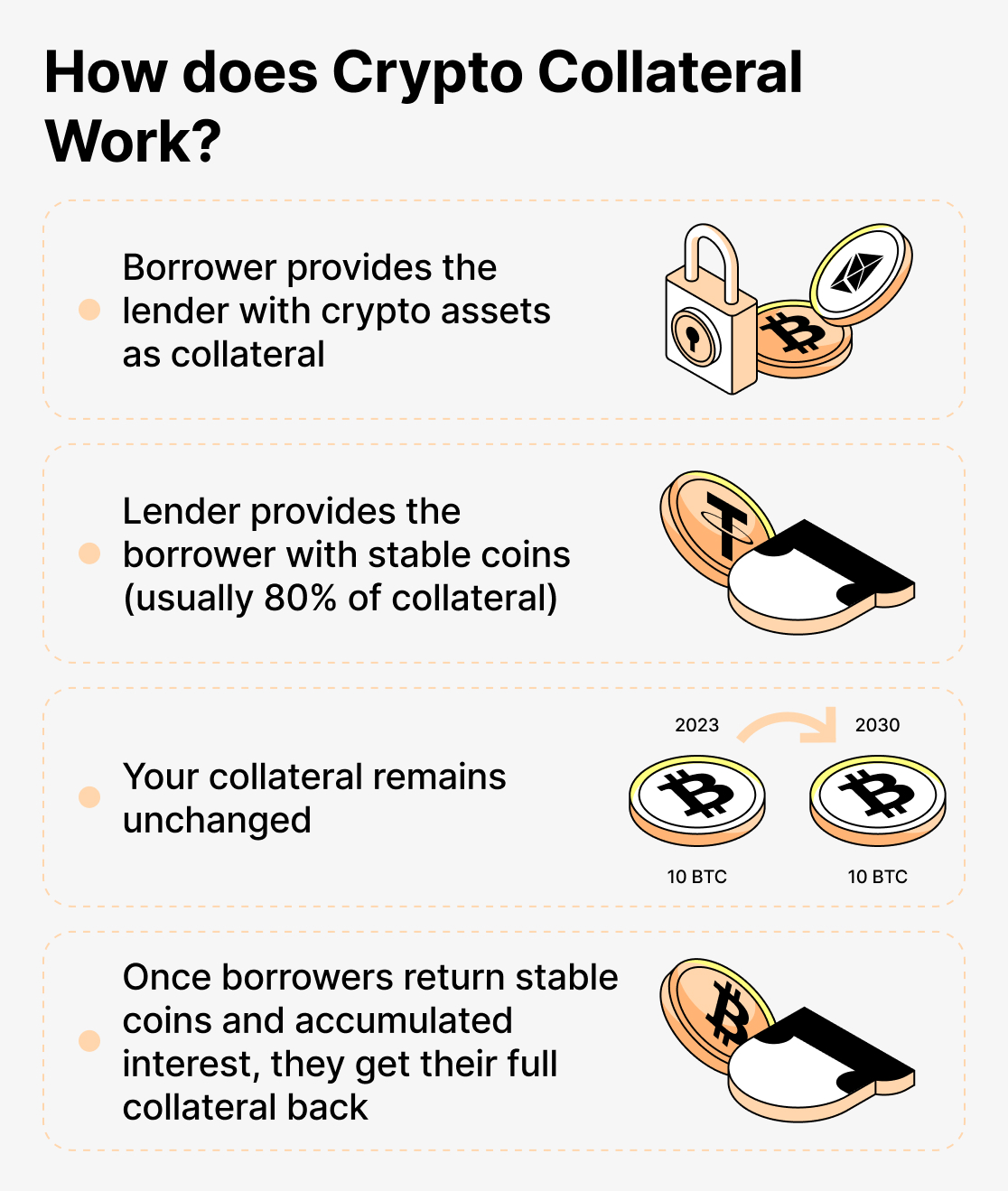

Collateralization, particularly in the context of DeFi (Decentralized Finance) and crypto lending, refers to the process where a borrower pledges an asset as security or insurance to cover the loan they are requesting. It acts as a guarantee for the lender that they can recover their capital in case the borrower defaults on the loan. In traditional financial systems, collateralization is commonly seen in various lending scenarios. For example, when someone wants to purchase a property but lacks the full funds, they can take out a mortgage. In this case, the lender requires the property being purchased to act as collateral. The lender issues the mortgage, and if the borrower fails to repay, the lender can foreclose on the property to recover the loan amount.

In DeFi and crypto lending, the concept of collateralization is similar but involves digital assets, such as cryptocurrencies, being used as collateral. When someone wants to borrow crypto assets, they need to provide a certain amount of collateral, usually in the form of other cryptocurrencies, to secure the loan. The amount of collateral required is determined by the lending platform's rules and is often represented as a collateralization ratio. For instance, if a lending protocol has a collateralization ratio of 200%, it means that for every 100 USD worth of crypto assets borrowed, the borrower needs to provide 200 USD worth of collateral. This over-collateralization is done to reduce the risk of the collateral's value falling below the required threshold due to market fluctuations. If the value of the collateral falls below the required collateralization ratio set by the protocol, the borrower's collateral may be at risk of liquidation. Liquidation involves the platform selling the borrower's collateral on the open market to recover the outstanding loan amount and avoid losses for other lenders on the platform. To avoid liquidation, borrowers can add more collateral to maintain a safe collateralization ratio. Many lending platforms use high collateralization ratios (e.g., 750%) to provide an extra layer of safety and prevent widespread liquidation in the event of significant market crashes or price volatility.

Crypto Loans Without Collateral

Crypto Loans without Collateral In the world of crypto loans, there are some platforms that offer loans without requiring collateral. However, it's important to understand how these loans work and the risks involved. Unlike traditional bank loans, which often require a good credit score, crypto loans without collateral allow borrowers to access funds without pledging any assets as security. Instead, these platforms might evaluate borrowers based on their personal information and assign a credit score to determine the borrowing limit. The process typically involves borrowers providing personal details such as name, address, employment status, and possibly other financial information. The lending platform uses this information, along with other factors, to assess the borrower's creditworthiness and assign a credit score. The credit score helps determine the maximum amount the borrower can borrow without collateral.

It's important to note that loans without collateral can be riskier for lenders because they don't have any asset to seize in case of default. To mitigate this risk, these platforms might have higher interest rates or impose stricter terms on borrowers with lower credit scores. While loans without collateral may seem appealing for those who don't want to risk their crypto assets, caution is advised. Some platforms that claim to offer non-collateralized loans might be fraudulent or scams seeking to steal personal information or crypto assets. As such, it's essential to research and choose reputable platforms that have a track record of providing legitimate loans.

Flash Loans as Loans without Collateral

A flash loan is a unique type of crypto loan that allows borrowers to access significant amounts of cryptocurrency without the need for collateral. Unlike traditional loans, flash loans do not require borrowers to provide any assets as security. Instead, borrowers use smart contracts to create a loan in cryptocurrency, enabling them to borrow large sums for a short period of time, typically lasting just a few seconds.

The catch with flash loans is that they must be repaid in the same transaction in which they were borrowed. This means that borrowers need to use the borrowed funds for a specific purpose that generates enough profit to cover the loan amount and any fees associated with the flash loan.

There are three main purposes for flash loans:

- Trading Arbitrage: Flash loans allow traders to take advantage of price differences between different cryptocurrency exchanges. Traders can borrow large sums of money, execute a series of quick trades to profit from price discrepancies, and then repay the loan, keeping the profits made during the process.

- Collateral Swap: Flash loans provide a convenient way for borrowers to swap their collateral without needing to go through multiple steps. Instead of repaying a loan, withdrawing the original collateral, and then depositing new collateral, a flash loan can be used to perform all these actions in a single transaction.

- Self-Liquidation: Borrowers with locked-up collateral in lending platforms can use flash loans to self-liquidate their positions. By borrowing funds in a flash loan, borrowers can repay their outstanding loans, release their locked collateral, and then immediately withdraw it from the platform.

Closing Thoughts

Both CeFi and DeFi crypto loans serve essential roles in the crypto lending market. CeFi loans are more straightforward for newcomers, but users are subject to platform-set rates. DeFi loans offer more control but may expose users to smart contract vulnerabilities. Regardless of the chosen loan type, it's crucial to approach crypto lending with caution, do proper research, and consult financial experts when needed.