Crypto lending has become one of the key instruments in the digital assets market today. It allows you to obtain liquidity here and now without selling cryptocurrency. At the core of this mechanism is the LTV (Loan-to-Value) ratio — it determines how much you can receive against collateral and how safe your loan is.

Watch our detailed video about what LTV is and how it works:

Let's examine what LTV is, how it’s calculated, the risks associated with it, and how to manage it correctly.

What is LTV

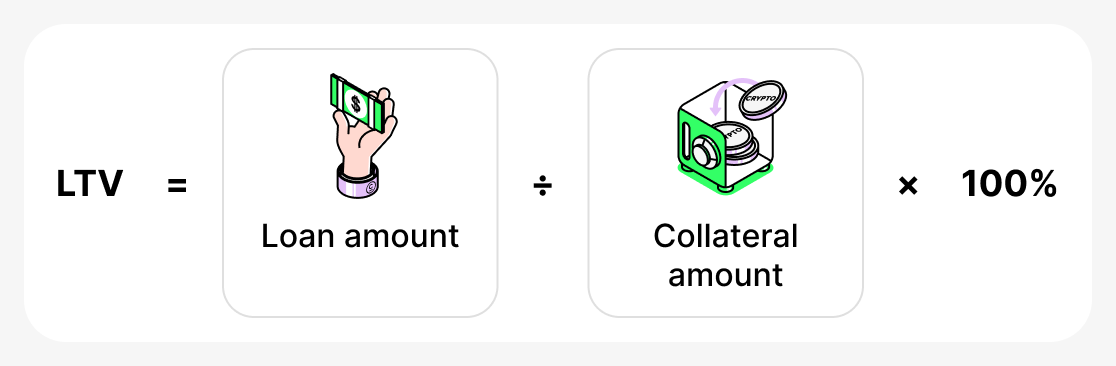

LTV (Loan-to-Value) - is an indicator that shows what share of the value of your collateral the loan represents. It is always expressed as a percentage and is calculated by the formula:

In other words, the loan amount is divided by the value of the pledged cryptocurrency and multiplied by 100.

How to calculate LTV

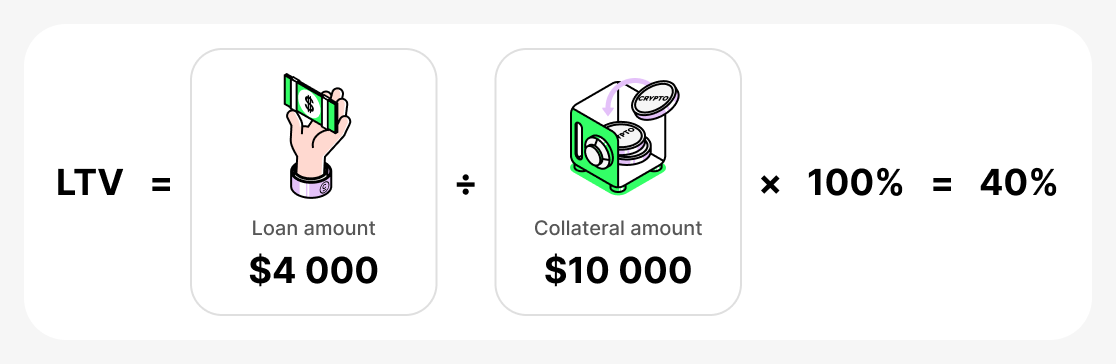

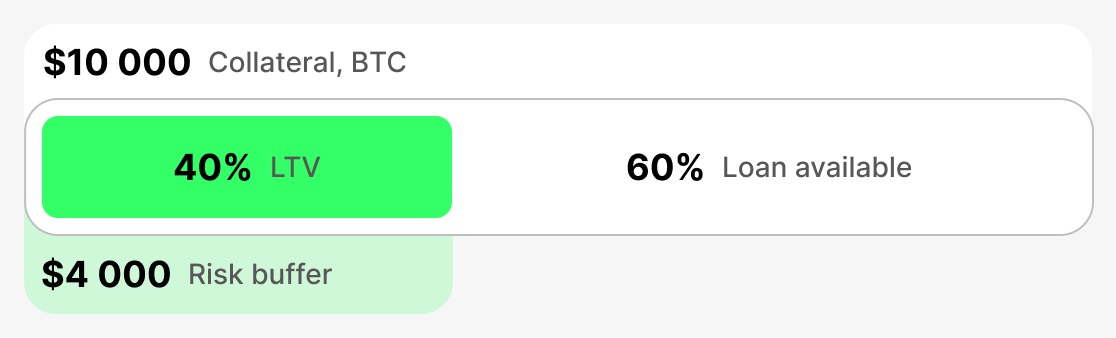

For example, if you deposit $10,000 in BTC as collateral and borrow $4,000 in USDT, your LTV will be:

What does this mean in practice:

- With a low LTV (for example, 20–40%) you have a safety buffer. Even if the price of BTC falls slightly, the platform will not require early loan repayment. This is a guarantee of safety.

- At a high LTV (for example, 70–80%) you receive more funds upfront, but any significant drop in the collateral’s price can lead to a "critically low collateral value". In that case the platform may ask you to add more funds to the collateral or to partially repay the debt. If you don’t, there is a risk of collateral liquidation: the platform may sell the cryptocurrency you pledged to cover the debt.

Thus, LTV is an indicator that helps assess and control the ratio of collateral value to the loan amount. The higher the initial LTV, the more money can be obtained when taking out a loan, but the greater the risk of losing the collateral if the pledged asset's price falls sharply.

Key LTV metrics

Initial LTV

This metric is recorded at the moment the loan is issued. It determines the maximum percentage of the collateral's value that can be borrowed. Each platform sets its own initial LTV limits: they are typically higher for stablecoins and lower for volatile assets. Initial LTV defines the "ceiling" of your liquidity and serves as the reference point for the entire loan. The lower this figure at the start, the greater the safety buffer in case of a sharp drop in the collateral's value.

- Example: You put up $10,000 in BTC as collateral. The platform sets an Initial LTV of 60%, meaning you cannot borrow more than 60% of the collateral's value. Therefore, you can borrow a maximum of $6,000.

- What's happening: If you need more funds, you'll have to provide more collateral or find a platform with a higher Initial LTV.

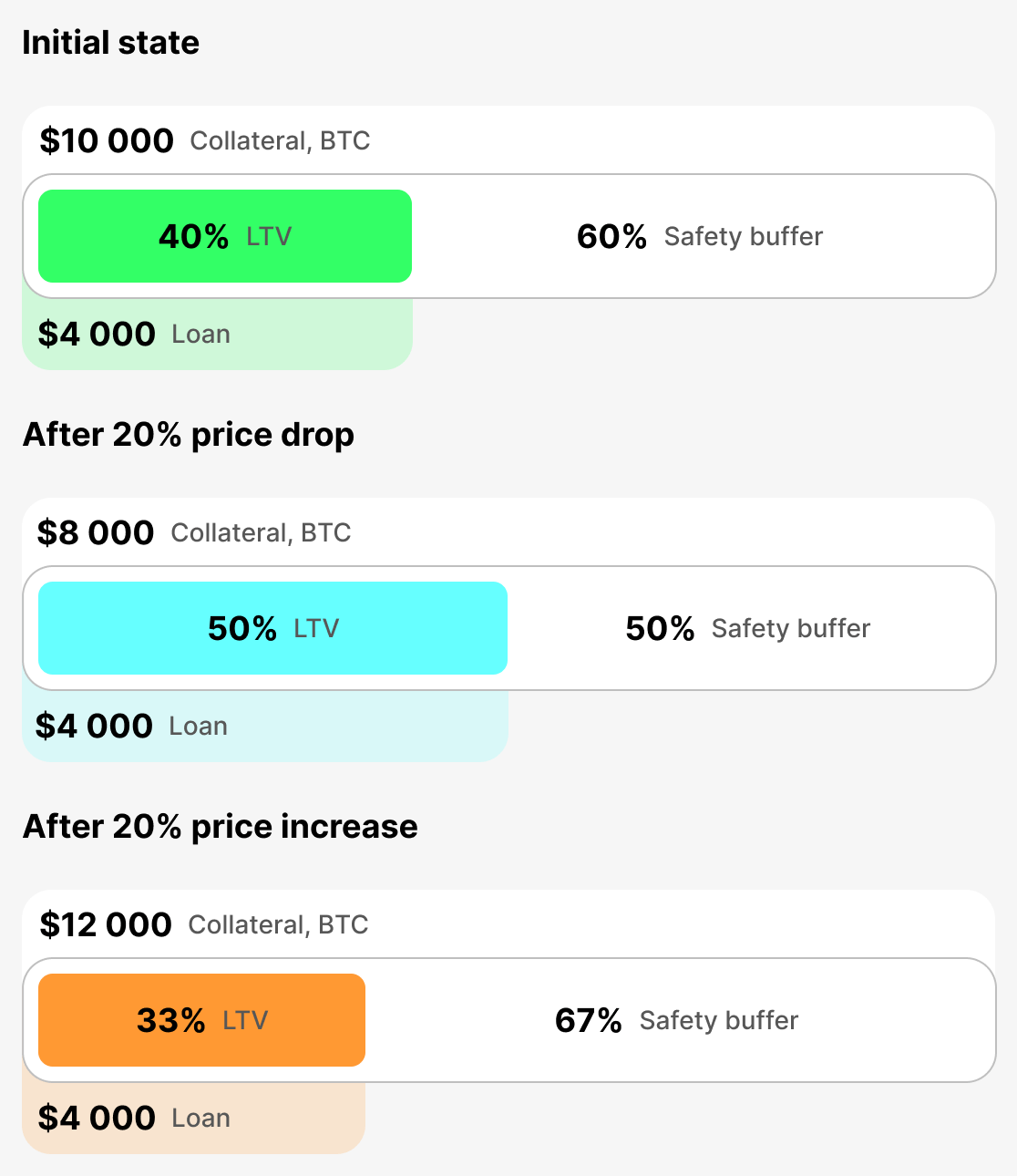

Current LTV

This metric reflects the real-time ratio of the loan amount to the collateral value "here and now". It constantly changes with the cryptocurrency price. The Current LTV shows your position at the moment. If the collateral value falls, the Current LTV rises and you move closer to the danger zone.

- Example: You borrowed $4,000 backed by $10,000 in BTC as collateral. At the time of borrowing your initial LTV equaled Current LTV = 40%. If the price of BTC falls by 20%, the collateral value will be $8,000 and the Current LTV will rise to 50%.

- What's happening: the higher the Current LTV, the closer you are to a margin call (a warning) or liquidation.

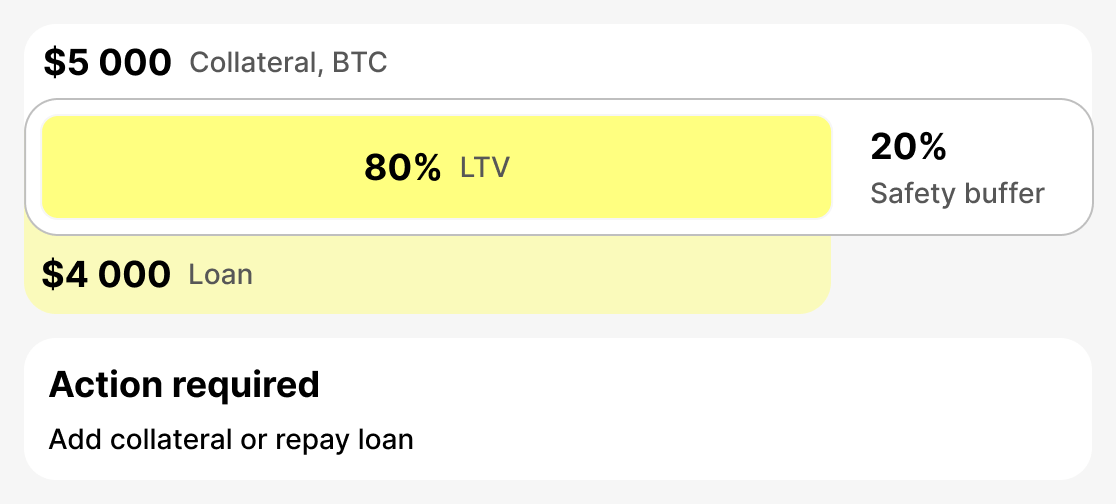

Margin Call LTV (LTV at which a warning is issued)

This is the level at which the platform warns the borrower of an increased risk of liquidation. It is usually set at 75–80%. At this stage you need to take action: add collateral or partially repay the loan. If you do so, the situation will stabilize.

- Example: You borrowed $4,000. If the value of your collateral suddenly falls to $5,000, your Current LTV will be 80%. A margin call will be triggered - you will receive a warning.

- What's happening: The platform sends a notification that you need to either increase your collateral or close part of the loan. If you ignore the notification and your collateral continues to lose value, the next step will be liquidation.

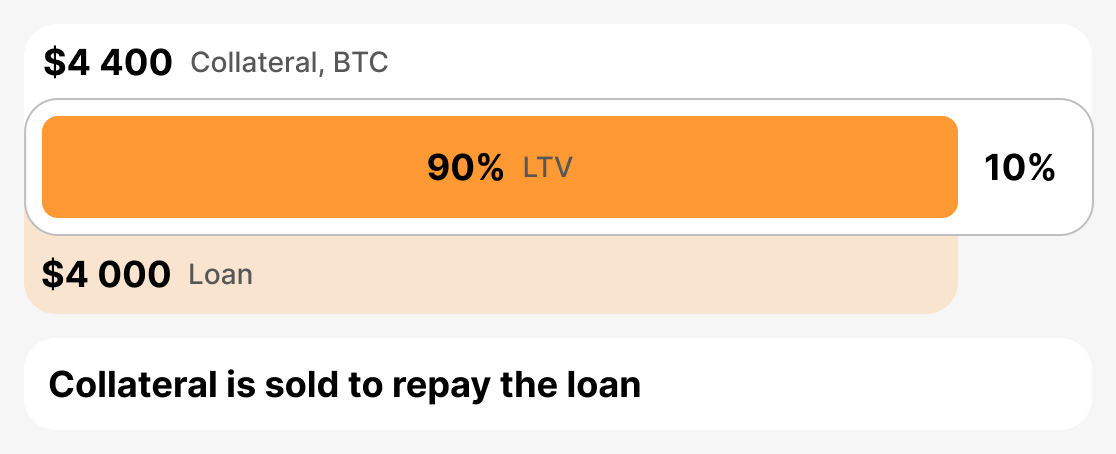

Liquidation LTV (Collateral sale LTV)

This is the critical threshold at which the platform is forced to sell your collateral to avoid losses. The liquidation LTV is usually in the range of 85-90%. As soon as the Current LTV reaches this level, the platform sells part or all of the collateral to cover the debt.

- Example: You borrowed $4,000. Your collateral began to drop sharply in value. You had already received a warning but took no action. As a result, your collateral fell to $4,444, and the Current LTV is now 90%. The lender is forced to liquidate the collateral.

- What happens: the borrower loses the collateral (or part of it), and the debt is closed by the platform selling the collateral.

In summary

LTV is the main indicator of the state of a crypto loan. Initial LTV sets the initial loan parameters, Current LTV shows its status in real time, margin call LTV (LTV at which a warning is issued) signals risk and the need to take action, and Liquidation LTV determines the point at which the collateral will be sold. Understanding these thresholds helps the borrower manage risks, respond promptly to market changes, and protect their assets.

Traditional and crypto loans

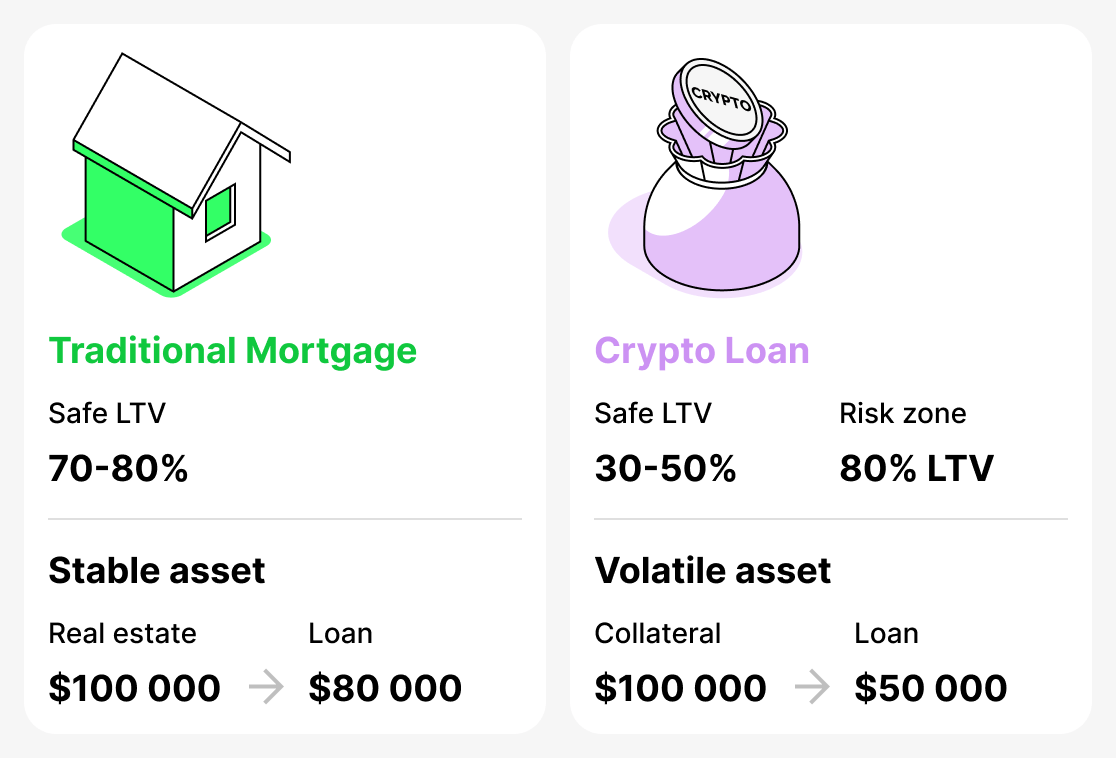

The concept of LTV (Loan-to-Value) originally emerged in traditional lending and was primarily associated with mortgages. Banks use this metric to assess risk: the higher the share of the loan relative to the value of the apartment or house, the greater the likelihood of borrower default. In conventional lending, a mortgage covering 70–80% of the property's value is considered perfectly normal. For example, if an apartment is worth $100,000, a mortgage of $80,000 (LTV 80%) will not raise concerns with the bank, since the real estate market is fairly stable and the collateral's price rarely changes abruptly.

In the cryptocurrency world, the situation is different. Prices of digital assets are highly volatile: they can fall by 20-30% in just a few days. Therefore, an LTV that would be considered normal in traditional finance (for example, 80%) is already in the danger zone in crypto lending. For cryptocurrencies, a safe LTV is considered to be 30-50%, because when taking such a loan the borrower keeps a good "safety buffer" in case of a sharp devaluation of the collateral.

Thus, LTV is used in both traditional (banking) and cryptocurrency loans. However, "safe" values differ greatly. For a bank, 80% is normal, but for a crypto platform it's a level that causes concern.

Practical strategies for managing LTV

To keep crypto lending a safe tool, it’s important to monitor LTV and know how to manage it. Ignoring this metric can lead to collateral liquidation and asset loss. Below are the main strategies to help a borrower responsibly manage their loan and avoid worrying about the safety of their collateral.

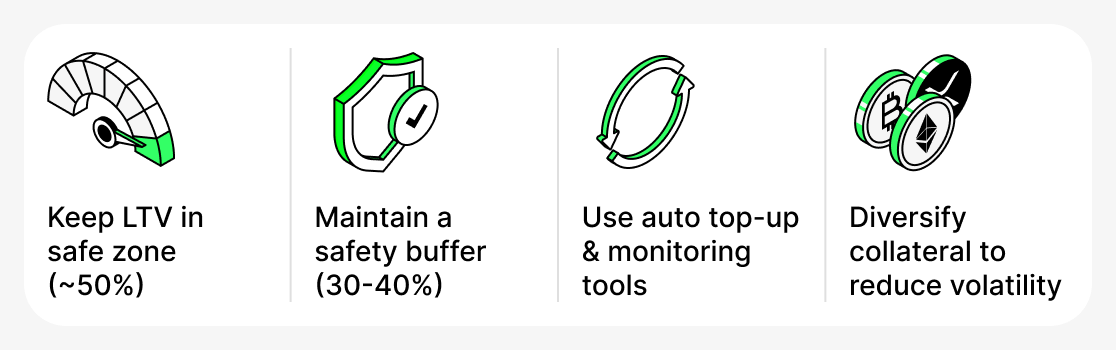

Keep your LTV in the safe zone

It is optimal to maintain LTV at 50%. At this level, even if the collateral price falls sharply, you will have a substantial safety buffer. Remember: the lower the LTV, the lower the likelihood of receiving a margin call or being liquidated.

Always have a «safety buffer»

When opening a loan, don’t take it at the maximum LTV allowed by the platform. It’s better to keep extra funds available. For example, you can borrow 30-40% of the collateral’s value. You can always use the available funds to increase your collateral or repay part of the loan if your collateral falls in value.

Use additional tools

Many platforms (especially CeFi) offer to enable an auto top-up feature - automatic replenishment of collateral when approaching critical LTV levels. You can also use various third-party bots that monitor the price and help you add funds in time.

Split collateral

You don't have to use a single asset as collateral. For example, part of the collateral can be held in BTC and part in stablecoins. This reduces the overall volatility of the collateral and makes your position more resilient. If BTC's price falls, the stablecoins will still retain their value, which will reduce the rise in your loan's overall LTV. However, it's important to note that this feature is not available on all platforms.

Crypto lending risks

Despite its advantages, crypto lending carries a number of risks that borrowers need to consider. Some of these are related to the specifics of the cryptocurrency market, while others stem from blockchain technology or the platform itself.

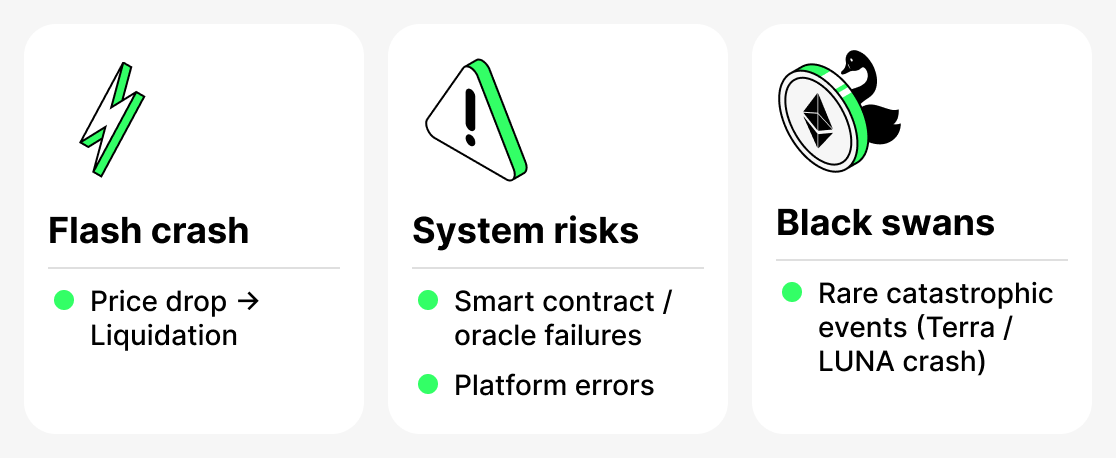

Flash crash (instant price crashes)

The cryptocurrency market is known for its high volatility. Sometimes there are sharp short-term price drops — the so-called flash crashes. Even if the price quickly returns to normal, the automatic mechanisms of some platforms can liquidate collateral within seconds. You are most likely to encounter this if you take a loan with a high LTV and only a minimal margin of safety.

Systemic risks

DeFi platforms are entirely dependent on the operation of their smart contracts and oracles — specialized services that provide current asset prices. Bugs in the code, hacks, or oracle failures can lead to incorrect LTV calculations and premature liquidations. CeFi platforms can also experience systemic failures: frozen interfaces, withdrawal issues, or technical errors when processing orders.

«Black Swans»

These are extremely rare and unlikely events that completely reshape the market. A striking example is the collapse of the Terra/LUNA ecosystem in 2022. Many borrowers held UST and LUNA as collateral, considering the network's tokens to be relatively stable assets. When the ecosystem collapsed, the value of the assets fell almost to zero, and the collateral was entirely wiped out. Even a low LTV didn't save borrowers — liquidations occurred across the board.

Thus, crypto loans require borrowers not only to understand basic concepts such as LTV, but also to be prepared for rare yet potentially severe events they may occasionally face. Manage your loans prudently and keep a constant eye on market conditions. This won’t guarantee complete protection, but it will significantly reduce the likelihood of encountering an adverse event.

Conclusion

LTV is a key metric in crypto lending. It determines how much you can borrow, shows how secure your loan is, and how your collateral's position in the market changes.

To use loans secured by cryptocurrency wisely, always monitor the loan's current LTV, maintain a safety buffer, and consider the specifics of the chosen platform and asset.