What is Aave?

Aave is an open-source and non-custodial protocol to earn interest on deposits and borrow assets with a variable or stable interest rate. It also enables ultra-short duration, uncollateralized flash loans designed to be integrated into other products and services.

How do loans secured by AAVE work?

Cryptoloaning is a simplified method that makes the life of both borrowers and lenders much easier. Loan seekers can get funded in USDT by using their crypto assets as a collateral, and at the same time, keep ownership rights of their digital property. This way, conventional credit scoring and lengthy paperwork are totally removed, thus the entire lending process is more efficient and less expensive.

Financial experts will be able to deposit their crypto-assets like Aave (AAVE) in a special account on the Cropty platform. An escrow agent's job is to manage the transaction between the two parties, providing them with protection against any possible risks. They perform the function of a dependable intermediary who is entrusted with the task of ensuring the rights of each party are respected in the relationship.

The indicated construction, for instance, provides the possibility for borrowers to have a say in the matters of capital without having to leave the comfort of their crypto-assets. It works, in particular, for times of volatility in the market, thereby helping them stay away from the losses. Nonetheless, the borrowing model further plugs the loan process requirements while covering the credit check part.

Investors get payments on the resources they have injected into the investments by loan holders, consequently, offering them to profit from their crypto investments. This depicts a win-win situation where loans are given, and developers earn by participating in the program.

The Cropty model is the instrument that governs the interaction between two parties while ensuring the transactions are safe due to the blockchain technology and the elimination of the middlemen. This system reduces the chances of illegal activities to the minimum giving a safe environment for lending.

Aave Loan Calculator

Crypto Loans explained

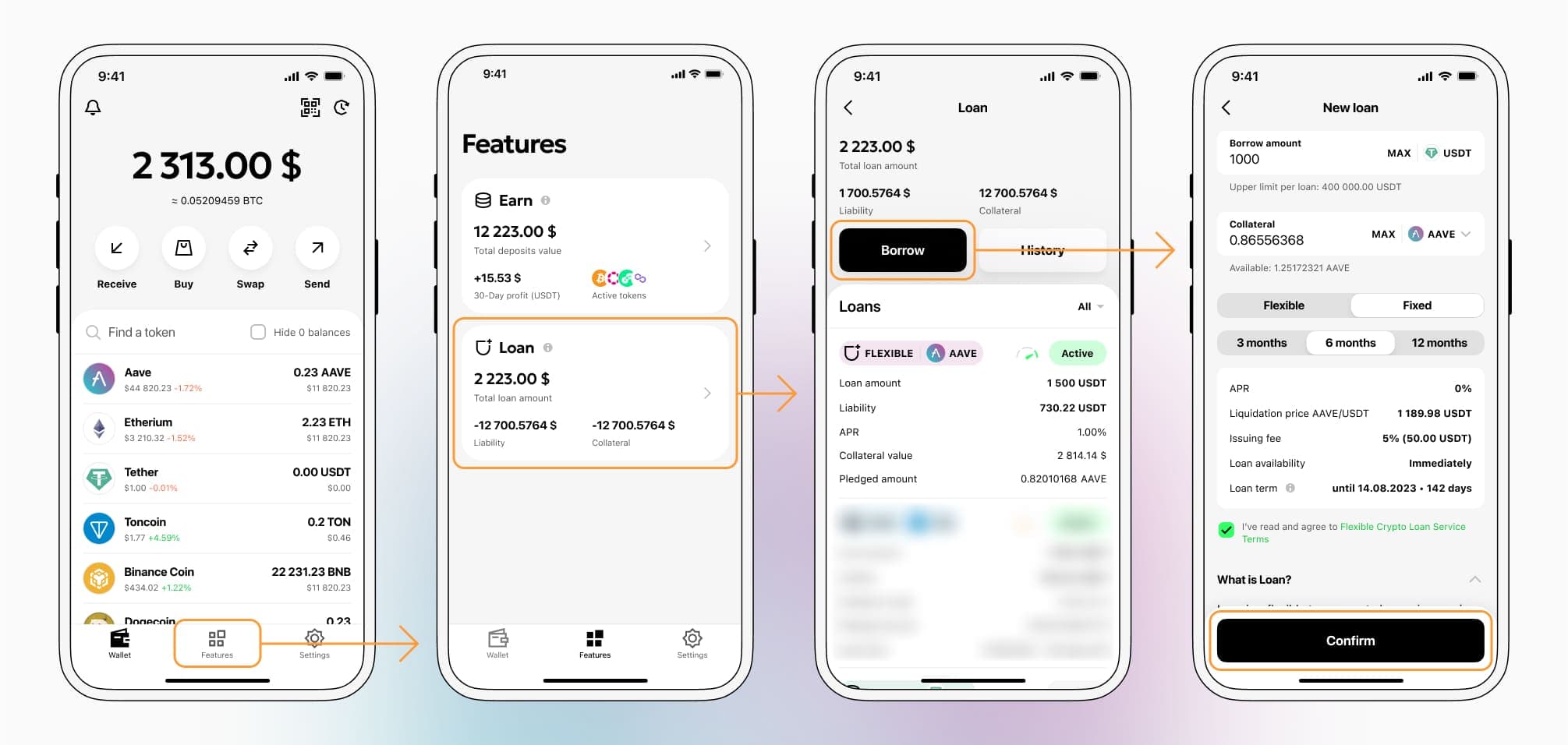

How to get a loan on Aave? Borrow usd against Aave on Cropty

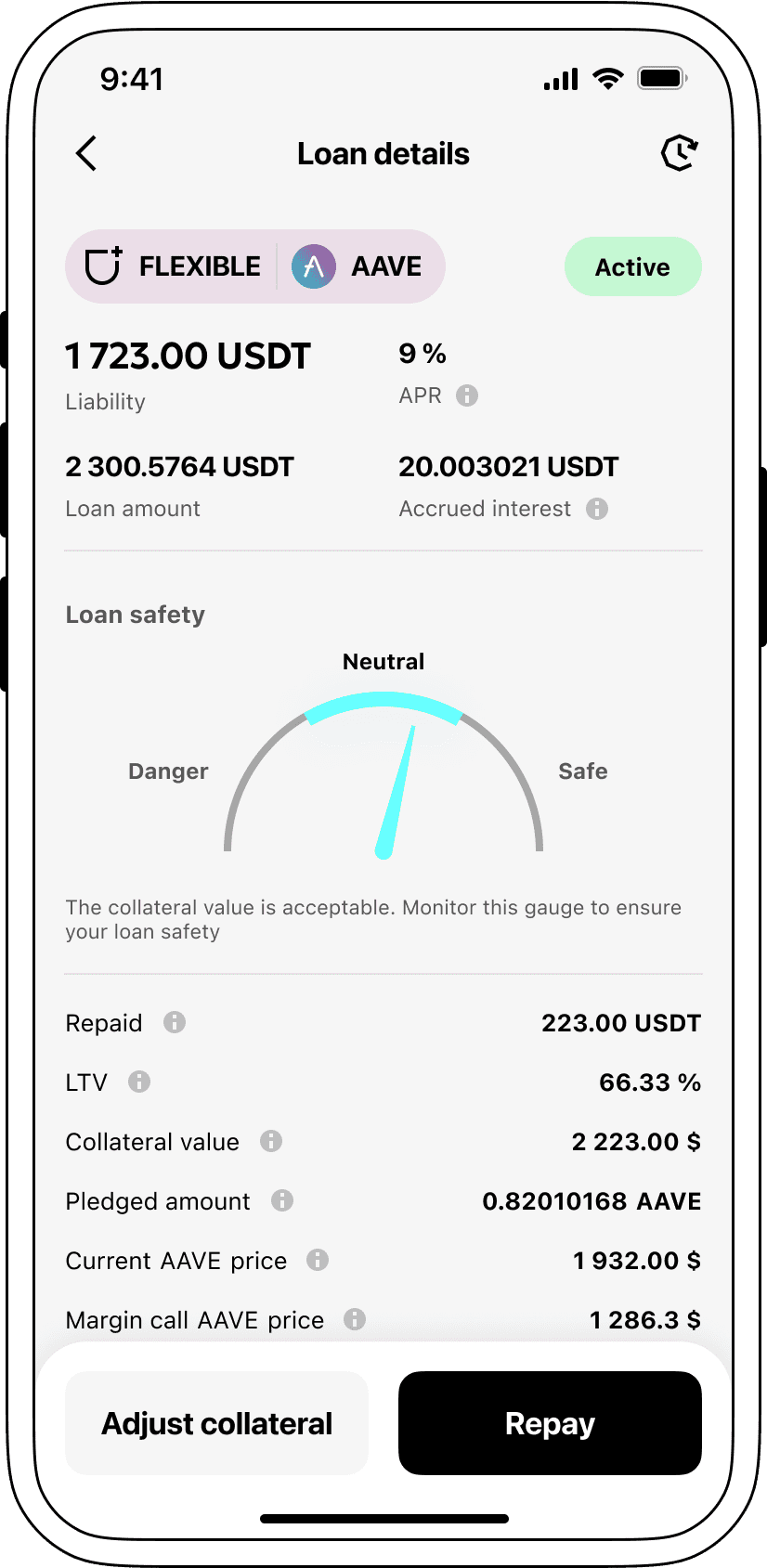

The process of getting an Aave cryptocurrency loan is quite simple. First, you need to create your account on Cropty, a platform that offers Aave cryptocurrency lending services. Then, you need to provide your AAVE as collateral and specify the loan amount you want to borrow. The platform then evaluates your collateral and gives you access to the required amount of Tether USDT.

Your creditworthiness is determined based on the value of your collateral, making the process of getting a cryptocurrency loan fast and convenient.

However, it is important to remember that Aave cryptocurrency loans are not without risks. In case you default on the loan, your collateral can be seized. Therefore, you should carefully assess your repayment capacity before taking out a cryptocurrency loan.

To authorize an Aave Crypto Loan, you will need to go to Features tab → Loan section → Borrow button

Choose the required loan amount the terms and conditions of the crypto loan, and apply for it by confirming it with a code from 2FA - application or E-mail or Telegram-bot.

Learn more about AAVE Crypto Loans

Interest rates on loans secured by Aave

AAVE, better known as Aave, is now one of the preferred ways to take out a loan that is backed by cryptocurrency. On the Aave lending platform, users can do one of two things: either take out a loan or put their money out there for a lender to lend and earn the interest. Basically, all these loans allow users to have liquidity in an instant without selling their assets, thus people will be able to take out money loans by using their Aave tokens as collateral. As it literally makes it possible to get cash loans secured by AAVE, better yet, it provides a means of further realisation of the assets and their cash-in period. Want to know the working mechanism? To put it simply, users will pledge their AAVE as collateral and will be given a loan in accordance with its current market value. In brief, for those who want to access their cash over a short period and not willing to part with their Sajð AAVE, these loans in real cryptocurrencies become an easy and practical way to do so.

We at Cropty are fully aware of the significance of competitive interest rates. This is why our providers of cryptocurrency-backed loans and we offer them at a very attractive interest rate of as low as 9%. Our easy and cheap loans will open a door to proceed to cash in if your needs are either for the sake of your personal life or your business, and the best part of the loan is that you don't even have to part with your cryptocurrencies.

The aspect that distinguishes Cropty the most when it comes to crypto loans is the collateral process. If, at the end of the loan term, the borrower still hasn't repaid the loan then the Aave collateral is the property of Cropty, while the borrower is the owner of the issued Tether USDT. This is the guarantee of a just and impartial method of lending.

For the purposes of safety against the risks that might come from the decrease in the value of Aave, Cropty has set up an automatic liquidation system.

Why choose Aave Cropty Loan

FAQ

What is Cropty Aave Crypto Loan?

How do I pledge my assets and start borrowing with Cropty Aave Crypto Loan?

What is LTV, and how much can I borrow from Cropty Aave Crypto Loan?

Are there limits to how much I can pledge and borrow?

What is loan liquidation, and what is the liquidation LTV?

What happens when a loan is liquidated?

What is a margin call?

Will I be notified in the event of margin calls or liquidations?

What interest rate applies to my loan?

How is interest accrued for my loan positions?

How do I repay my loan or adjust my LTV?

Which cryptocurrencies can I pledge or borrow on Cropty Crypto Loan?

What can I do with the cryptocurrencies borrowed from Cropty Aave Crypto Loan?

More coins