What is SHIBA INU?

SHIBA INU is an ERC-20 token named after the Shiba Inu dog, which serves as the community's symbol currency. The tokens are referred to as Meme Coins on the platform's official website. Shiba Inu is also referred to as the "doge-killer"

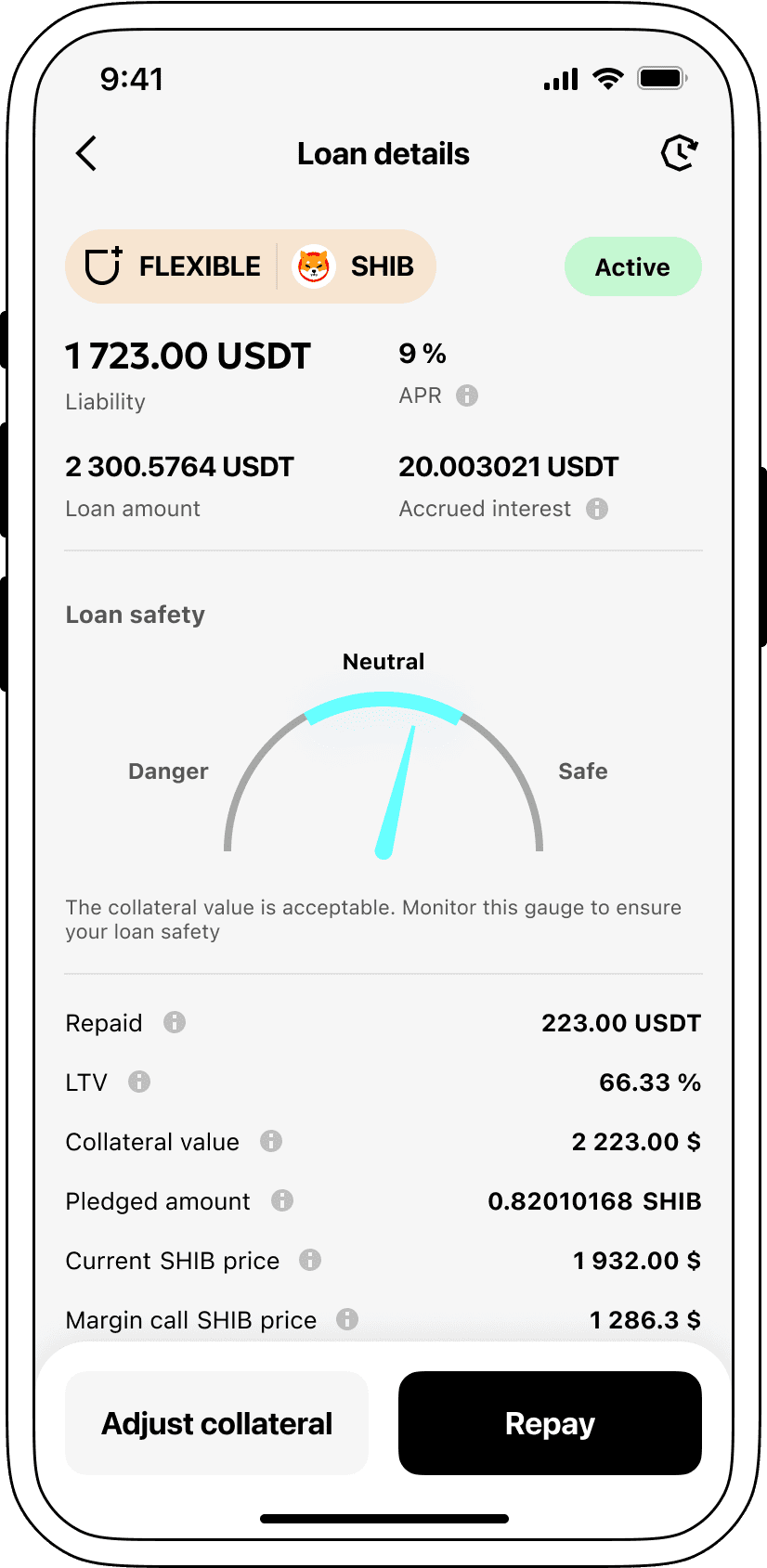

How do loans secured by SHIB work?

Lending through crypto means is one of the simplest methods for both the borrowers and the lenders to use. Different crypto assets can be used in transactions, such as SHIBA INU (SHIB) in which a borrower can get the loan in USDT and at the same time keep the ownership of digital assets. The said method omits the need for labor-intensive credit checks and paperwork, thus making the process to run faster and ultimately cutting down costs.

Lenders are the ones who can take advantage of this by transferring their cryptocurrencies such as SHIBA INU (SHIB) into a special account on the Cropty platform. The platform manager is the one who oversees the transactions between the borrowers and the lenders. Ergo, the platform is extra security. Moreover, the platform acts as a trusted middleman to the whole transaction between the two parties.

It is a beneficial option for the borrowers because it helps them to access cash while the digital assets are in their possession and they don't have to sell them. As such, it is most advantageous when the market is stable. In this way, the indebted can escape potential money problems. Besides that, this lending-fiscal system also makes borrowing easier and helps to avoid raising the credit through checks.

Those lenders who deposit cryptocurrencies which are utilized for the borrower's loan repayment system may earn interest on these deposits. In this way, the lenders may have the best use of their digital assets. Moreover, this scheme is beneficial to the two desks since borrowers may realize the opportunity of taking out loans, while lenders become the winners because they earn some profit from it.

The digital platform Cropty which is the relationship manager between the borrowers and the lenders, employs blockchain technology to ensure secured transactions without any intermediaries. This technology drastically diminishes the probability of cheating and sets a safe lending zone.

SHIBA INU Loan Calculator

Crypto Loans explained

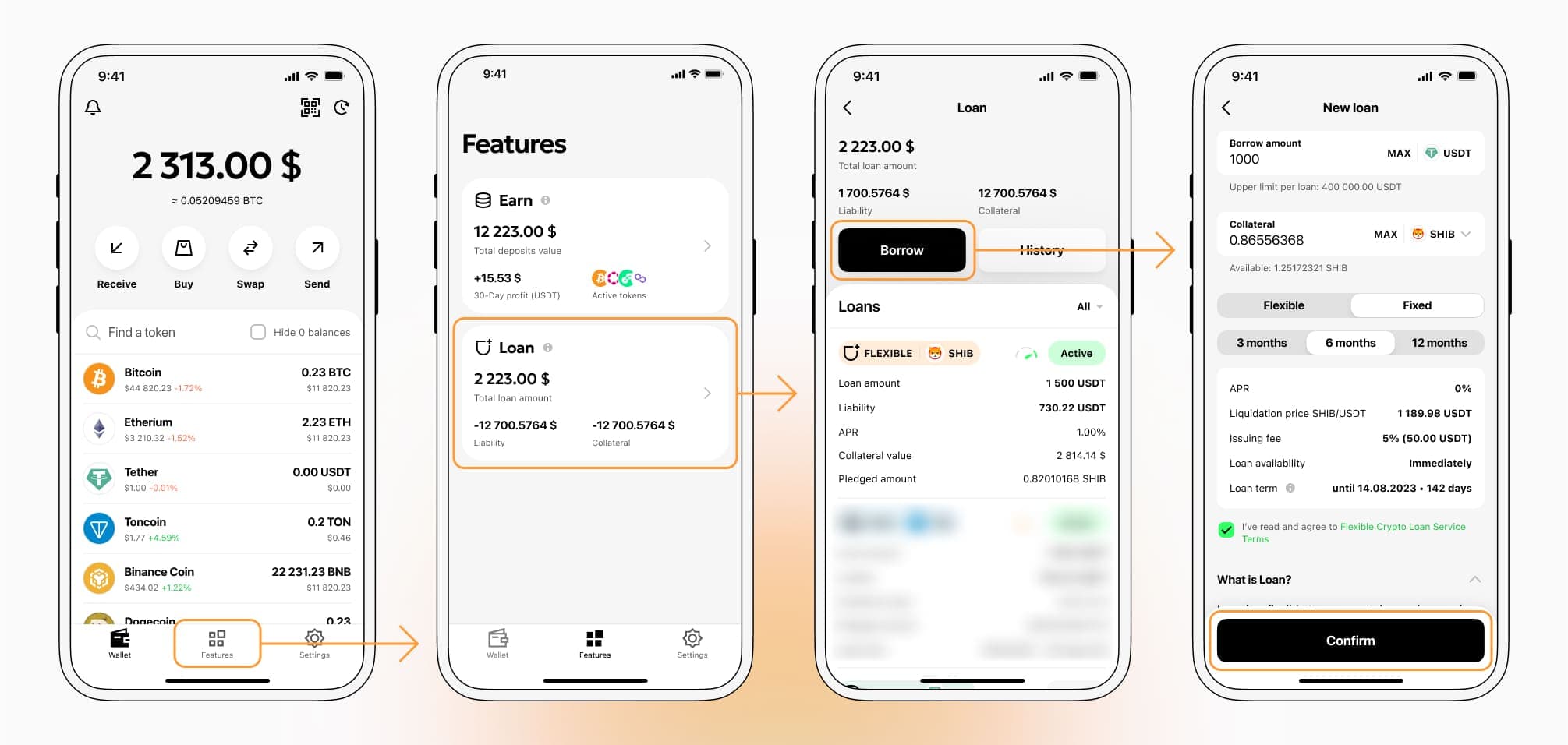

How to get a loan on SHIBA INU? Borrow usd against SHIBA INU on Cropty

The process of getting an SHIBA INU cryptocurrency loan is quite simple. First, you need to create your account on Cropty, a platform that offers SHIBA INU cryptocurrency lending services. Then, you need to provide your SHIB as collateral and specify the loan amount you want to borrow. The platform then evaluates your collateral and gives you access to the required amount of Tether USDT.

Your creditworthiness is determined based on the value of your collateral, making the process of getting a cryptocurrency loan fast and convenient.

However, it is important to remember that SHIBA INU cryptocurrency loans are not without risks. In case you default on the loan, your collateral can be seized. Therefore, you should carefully assess your repayment capacity before taking out a cryptocurrency loan.

To authorize an SHIBA INU Crypto Loan, you will need to go to Features tab → Loan section → Borrow button

Choose the required loan amount the terms and conditions of the crypto loan, and apply for it by confirming it with a code from 2FA - application or E-mail or Telegram-bot.

Learn more about SHIB Crypto Loans

Loans secured by SHIBA INU interest rates

At Cropty, we are aware of the importance of competitive interest rates which is why we have designed our cryptocurrency lending program with a very attractive rate of just 9%. If you stabilize the demand for money in your personal or business life, our low-interest loans will be a very appropriate way to get cash without selling you valuable crypto.

An amazing and different feature of Cropty's crypto-lending viewpoint is that of the pledge or the collateral. In the case of a loan default, the SHIB that was put up as a pledge will be held by Cropty, and the borrower will keep the obtained Tether USDT dollars. This way, the loan recovery system is balanced and fair, thereby, both parties will benefit.

In the case of a revaluation of SHIBA INU, Cropty has an automatic liquidation process. When the value of the collateral drops under a specific minimum threshold, the loan liquidation process is activated so that both the borrower and the lender are shielded from losses caused by the market volatility.

Transparency and convenience are the main benefits of Cropty. The platform is very accessible to all borrowers and it has a very user-friendly interface for the loan status tracking. Moreover, the collateral increase, loan repayment acceleration, and loan amount calculation with grouped interest are the additional features that provide our borrowers with flexibility.

In case you are looking for different ways to take a loan with the help of cryptocurrencies, I would suggest you to check out Cropty and our instant coin loans. SHIBA INU will be your asset to borrow against and you will receive Tether USDT, whereas our secured crypto loans are one of the fastest and easiest ways to take care of your financial needs.

Why choose SHIBA INU Cropty Loan

FAQ

What is Cropty SHIBA INU Crypto Loan?

How do I pledge my assets and start borrowing with Cropty SHIBA INU Crypto Loan?

What is LTV, and how much can I borrow from Cropty SHIBA INU Crypto Loan?

Are there limits to how much I can pledge and borrow?

What is loan liquidation, and what is the liquidation LTV?

What happens when a loan is liquidated?

What is a margin call?

Will I be notified in the event of margin calls or liquidations?

What interest rate applies to my loan?

How is interest accrued for my loan positions?

How do I repay my loan or adjust my LTV?

Which cryptocurrencies can I pledge or borrow on Cropty Crypto Loan?

What can I do with the cryptocurrencies borrowed from Cropty SHIBA INU Crypto Loan?

More coins