What is Binance USD?

Binance USD (BUSD) is a fiat-collateralized stablecoin that offers the advantages of transacting with blockchain-based assets while mitigating price risk. BUSD are issued as ERC-20 tokens on the Ethereum blockchain and are collateralized 1:1 by USD held in Paxos-owned US bank accounts. BUSD is also the one of three stablecoins approved by Wall Street regulators, alongside GUSD and PAX.

How do loans backed by BUSD works

We have our own dashboard, which guarantees simplicity and ease for both investors and borrowers. You can take a loan secured by your own BUSD, while you do not encounter any bureaucracy, all the usual checks of your creditworthiness are absent on our platform. Cropty Wallet provides an ideal service, regardless of whether you want to earn by providing your own coins, or, on the contrary, take a loan secured by them. We are a reliable partner, a mediator who takes into account the interests of all parties. Our main goal is to provide you with a user-friendly experience that will allow you to use our tools on the path to your financial freedom even more often.

A borrower can put his own BUSD funds as collateral and receive a loan as collateral, which can be repaid in parts.

Investors accumulate interest depending on their deposit. This is an incredibly profitable way to use your cryptocurrency wisely, enjoying timely dividends paid from the returned loan parts.

Cropty, in turn, guarantees you simplicity and transparency of conditions, using technology and advanced lending tools. We minimize your risks and minimize any attempts at fraud, protecting both sides of the process.

Binance USD Loan Calculator

Crypto Loans explained

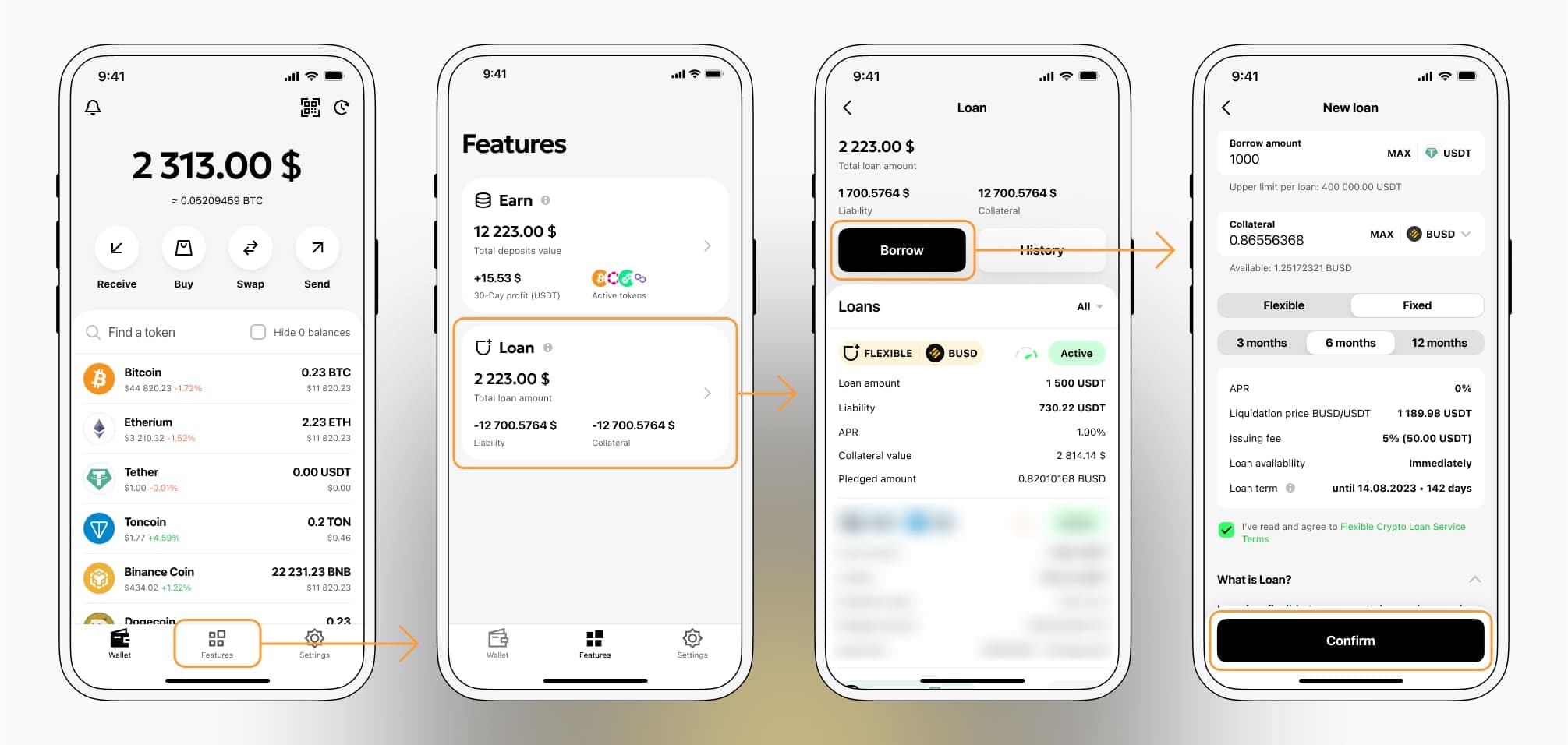

How to get a loan on Binance USD? Borrow usd against Binance USD on Cropty

The process of getting an Binance USD cryptocurrency loan is quite simple. First, you need to create your account on Cropty, a platform that offers Binance USD cryptocurrency lending services. Then, you need to provide your BUSD as collateral and specify the loan amount you want to borrow. The platform then evaluates your collateral and gives you access to the required amount of Tether USDT.

Your creditworthiness is determined based on the value of your collateral, making the process of getting a cryptocurrency loan fast and convenient.

However, it is important to remember that Binance USD cryptocurrency loans are not without risks. In case you default on the loan, your collateral can be seized. Therefore, you should carefully assess your repayment capacity before taking out a cryptocurrency loan.

To authorize an Binance USD Crypto Loan, you will need to go to Features tab → Loan section → Borrow button

Choose the required loan amount the terms and conditions of the crypto loan, and apply for it by confirming it with a code from 2FA - application or E-mail or Telegram-bot.

Learn more about BUSD Crypto Loans

Interest rates for loans secured by Binance USD

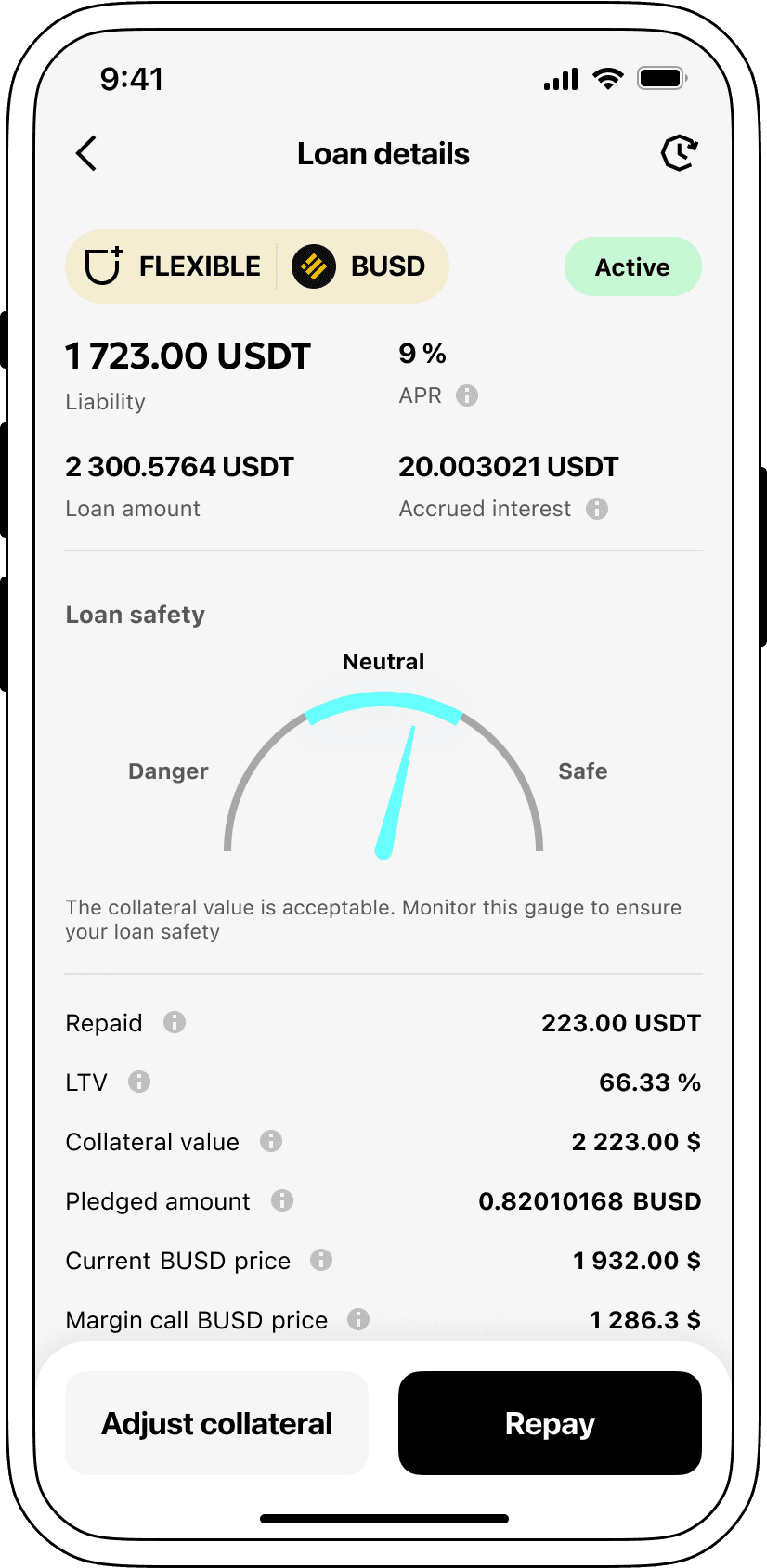

You can take a loan secured by your BUSD with an attractive interest rate of 9%. Regardless of your goals, this is a modest percentage that will allow you to use your capital here and now, without parting with your valuable cryptocurrency - you retain absolutely all ownership rights to your collateral.

Our collateralisation procedure guarantees the safety of all parties: if the borrower does not want to repay his loan, his funds will go to Cropty, but at the same time, he will retain all the USDT received. This is a fair and honest method that takes into account the interests of all participants in the process. We also use automatic liquidation of your assets in case of strong market volatility. Such a tool protects both borrowers and investors. You can rest assured - the borrower keeps all the borrowed money, and we, in turn, take the damage from losses on ourselves.

You can always track the status of your loan using our convenient platform. We have prepared a special dashboard that will give you the opportunity not only to use classic repayment by installments, but also early repayment. Cropty is your reliable tool on the way to financial independence. Using Cropty, you can be sure that your funds are safe and working for your financial well-being.

Why choose Binance USD Cropty Loan

FAQ

What is Cropty Binance USD Crypto Loan?

How do I pledge my assets and start borrowing with Cropty Binance USD Crypto Loan?

What is LTV, and how much can I borrow from Cropty Binance USD Crypto Loan?

Are there limits to how much I can pledge and borrow?

What is loan liquidation, and what is the liquidation LTV?

What happens when a loan is liquidated?

What is a margin call?

Will I be notified in the event of margin calls or liquidations?

What interest rate applies to my loan?

How is interest accrued for my loan positions?

How do I repay my loan or adjust my LTV?

Which cryptocurrencies can I pledge or borrow on Cropty Crypto Loan?

What can I do with the cryptocurrencies borrowed from Cropty Binance USD Crypto Loan?

More coins