What is EOS?

EOS is an open-source protocol designed by Dan Larimer and Block.one to support the creation of smart contracts and decentralized applications (dApps). Its network features a delegated Proof-of-Stake (DPoS) consensus mechanism to help secure the platform while giving it a level of performance desirable for running applications. Through DPoS, EOS offers greater scalability and transaction throughput than traditional blockchain networks, but to a certain extent, it relinquishes complete decentralization and censorship resistance.

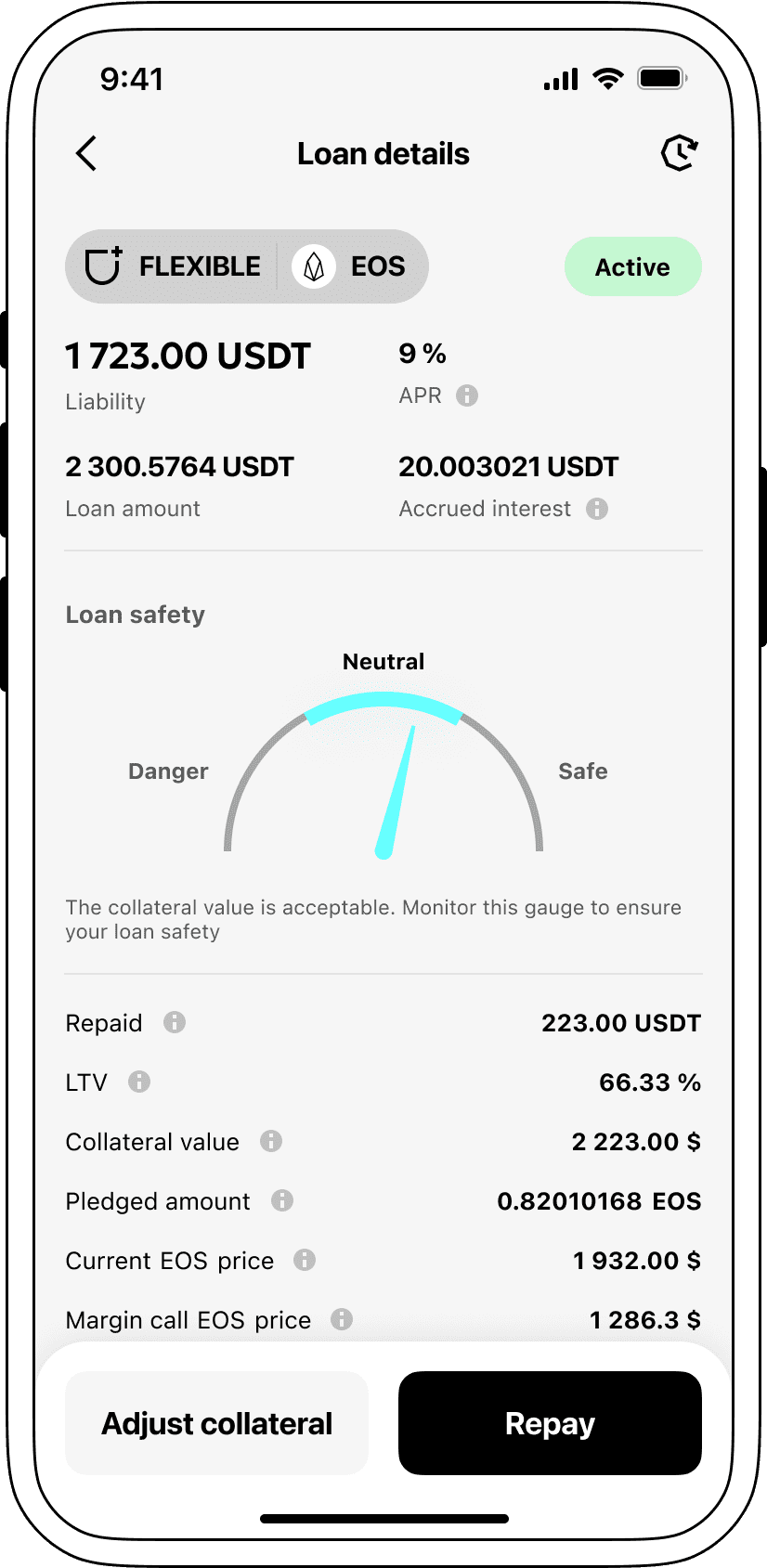

How do loans backed by EOS works

Crypto-backed loans provide a straightforward solution for both debt takers and providers. Debt takers can leverage their crypto assets as collateral to secure loans in USDT, maintaining ownership of their digital wealth. The process becomes efficient due to a removal of credit history checking and paperwork, which ultimately makes it more cost-effective.

Providers, on the other hand, have an opportunity to commit their crypto assets, such as EOS (EOS), on the Cropty platform in a special account for loans. An entrusted custodian monitors these activities between both parties to ensure security, acting as a reliable bridge while safeguarding the interests of both sides.

Instead of selling their crypto assets, borrowers could easily access liquid assets, particularly beneficial during volatile market conditions as they can sidestep potential hazards. This lending model further streamlines the loan procurement process, doing away with typical credit history inspections.

Providers get to earn from their contributed assets via the loan repayments, which turns their idle cryptocurrency assets into productive ones. This creates a mutually beneficial setup in the world of crypto lending, giving rise to both loan receivers and providers.

Cropty's system governs the connection between borrowers and providers. Moreover, the guarantee of secure transactions is enabled by blockchain technology while omitting any outside interference, reducing the chances of fraudulent activities, thus, cultivating a secure atmosphere for lending.

EOS Loan Calculator

Crypto Loans explained

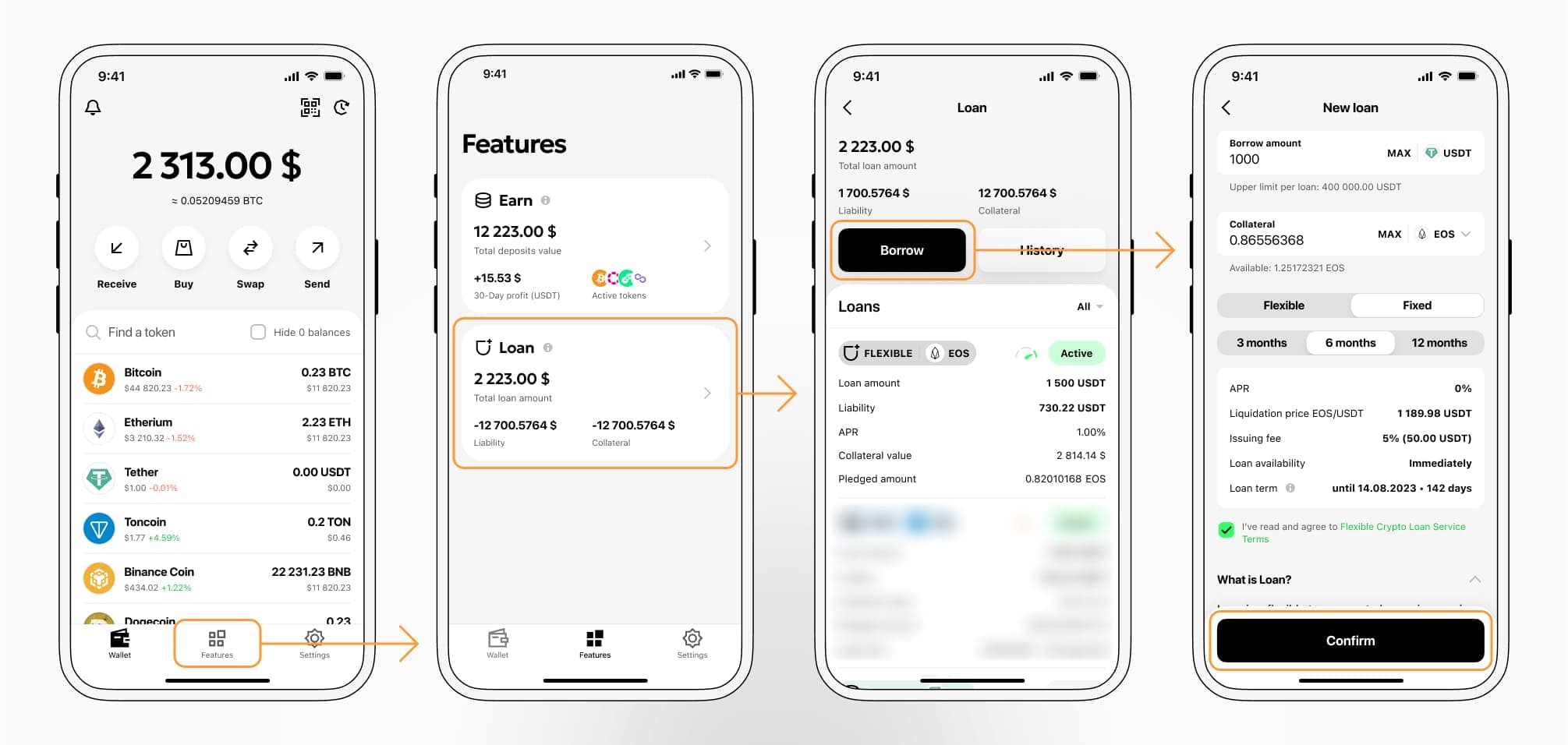

How to get a loan on EOS? Borrow usd against EOS on Cropty

The process of getting an EOS cryptocurrency loan is quite simple. First, you need to create your account on Cropty, a platform that offers EOS cryptocurrency lending services. Then, you need to provide your EOS as collateral and specify the loan amount you want to borrow. The platform then evaluates your collateral and gives you access to the required amount of Tether USDT.

Your creditworthiness is determined based on the value of your collateral, making the process of getting a cryptocurrency loan fast and convenient.

However, it is important to remember that EOS cryptocurrency loans are not without risks. In case you default on the loan, your collateral can be seized. Therefore, you should carefully assess your repayment capacity before taking out a cryptocurrency loan.

To authorize an EOS Crypto Loan, you will need to go to Features tab → Loan section → Borrow button

Choose the required loan amount the terms and conditions of the crypto loan, and apply for it by confirming it with a code from 2FA - application or E-mail or Telegram-bot.

Learn more about EOS Crypto Loans

Interest rates on loans secured by EOS

At Cropty, we recognize the crucial role of competitive loan interest rates. Therefore, we're offering finance, underwritten by cryptocurrency, at an immensely appealing 9% interest rate. If you require monetary assistance for personal or professional purposes, our inexpensive loans represent an optimal strategy for harnessing liquidity without the obligation to offload your invaluable digital assets.

A distinctive aspect of Cropty's crypto loans is the collateral strategy. In the event of a default by the borrower, Cropty retains the collateralized EOS, while the borrower retains the Tether USDT credited to them. This protocol prompts a judicious and unbiased course towards debt recovery, engendering benefits for all involved entities.

In order to preempt any EOS depreciation risk, Cropty has implemented an automatic liquidation function. If collateral value plunges below a crucial baseline, the loan undergoes liquidation. Such an anticipatory procedure safeguards the lender and borrower against potential financial hits during market declines.

Cropty embodies unquestioned transparency and ease. Users can keep track of their borrowed capital through our intuitive platform. Furthermore, borrowers are permitted to supplement their collateral, settle their loans early, or fulfil the loan terms by repaying the principal plus interest.

Are you trying to decipher how to secure finance with your cryptocurrency? Cropty has just the ticket with their immediate coin lending services. By pledging EOS as collateral, you can draw out Tether USDT. The blockchain-backed finance from Cropty offers speedy, straightforward respite for your fiscal requirements.

Why choose EOS Cropty Loan

FAQ

What is Cropty EOS Crypto Loan?

How do I pledge my assets and start borrowing with Cropty EOS Crypto Loan?

What is LTV, and how much can I borrow from Cropty EOS Crypto Loan?

Are there limits to how much I can pledge and borrow?

What is loan liquidation, and what is the liquidation LTV?

What happens when a loan is liquidated?

What is a margin call?

Will I be notified in the event of margin calls or liquidations?

What interest rate applies to my loan?

How is interest accrued for my loan positions?

How do I repay my loan or adjust my LTV?

Which cryptocurrencies can I pledge or borrow on Cropty Crypto Loan?

What can I do with the cryptocurrencies borrowed from Cropty EOS Crypto Loan?

More coins