What is Filecoin?

Filecoin is a decentralized data storage network built by Protocol Labs that allows users to sell their excess storage on an open platform. It acts as the incentive and security layer for IPFS (InterPlanetary File System), a peer-to-peer network for storing and sharing data files. Filecoin turns IPFS' storage system into an "algorithmic market," where users pay storage providers in Filcoin's native token, FIL, to store and distribute data on the network.

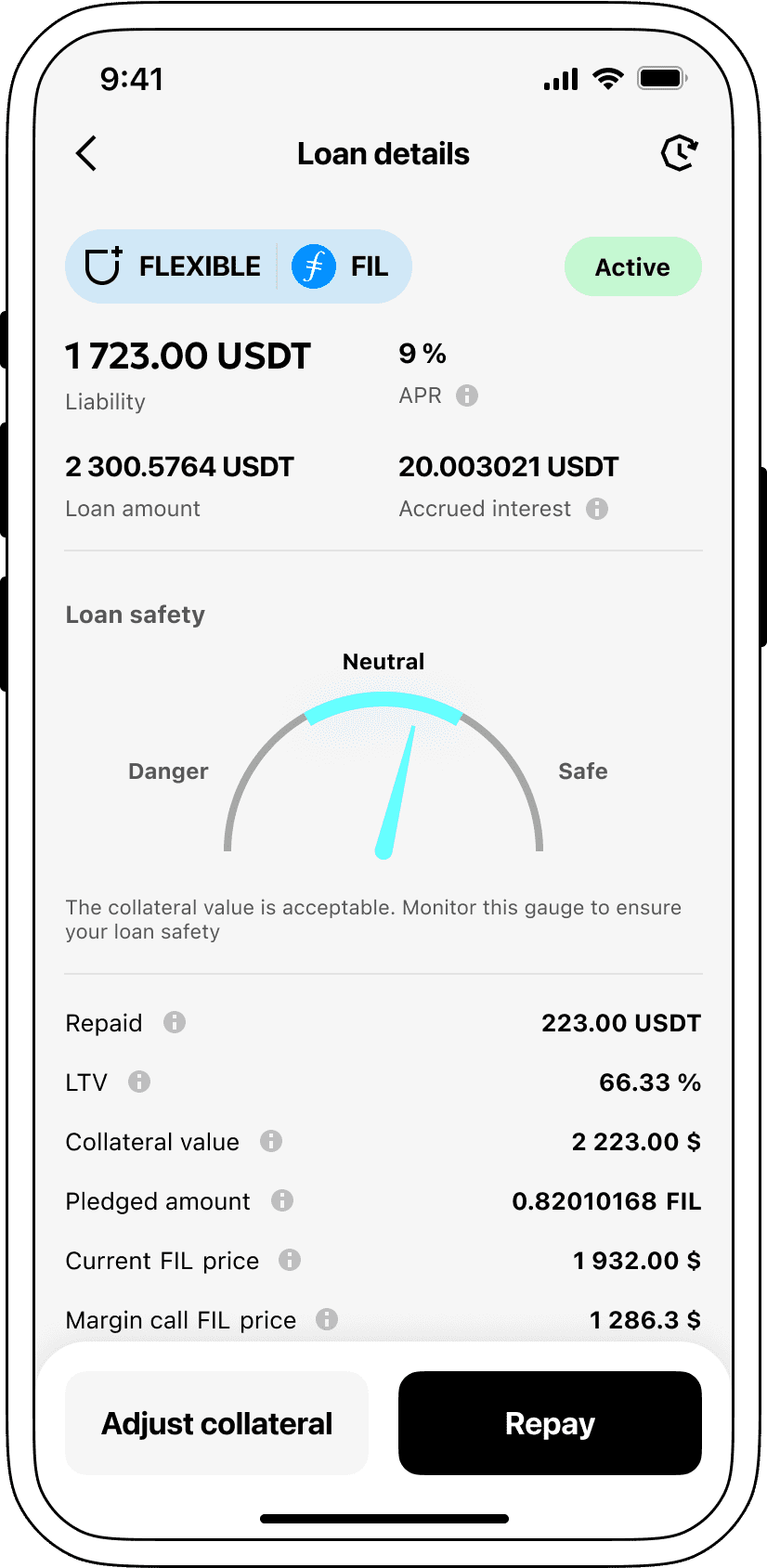

How do loans backed by FIL works

Cryptocurrency-backed lending offers seamless solutions for both loan seekers and creditors. As a borrower, you can secure USDT loans by leveraging your digital currencies as collateral whilst retaining ownership of the said assets. This makes for a smoother, more cost-effective process devoid of the need for credit history checks and physical documents.

As lenders, you commit your cryptocurrency assets such as Filecoin (FIL) into an assigned account at the Cropty platform. Serving as a custodian, they handle the engagement between lenders and borrowers, ensuring a safe and trusted process, and making certain that both parties guarantee conditions.

Benefitting from this, borrowers can access liquid funds without parting with their digital assets. In periods of market instability, they can thus evade potential financial downfalls. The lending structure further eases the loan procedure and eliminates need for previous credit history inspection.

In such a scenario, lenders reap profits on their committed assets through received loan repayments. Thus, they gain monetary benefit by lending out from their crypto-assets. Making this a mutually advantageous situation where borrowers secure their loans, and lenders enjoy perks through participation.

The Cropty platform manages the engagement between the loan seekers and creditors, utilizing blockchain technology for ensuring dependable transactions sans middle parties. This mitigates fraudulent risks and establishes a secure loaning atmosphere.

Filecoin Loan Calculator

Crypto Loans explained

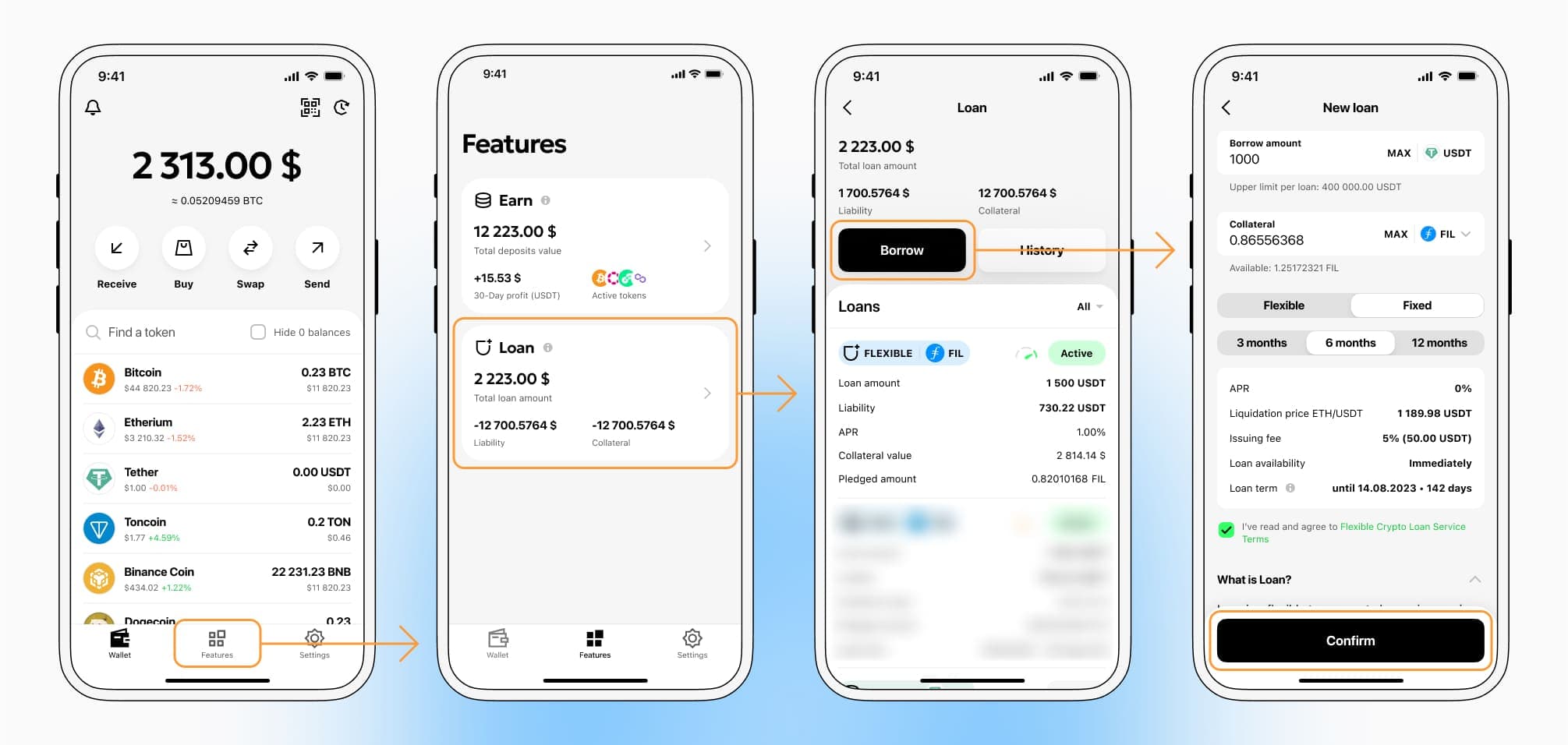

How to get a loan on Filecoin? Borrow usd against Filecoin on Cropty

The process of getting an Filecoin cryptocurrency loan is quite simple. First, you need to create your account on Cropty, a platform that offers Filecoin cryptocurrency lending services. Then, you need to provide your FIL as collateral and specify the loan amount you want to borrow. The platform then evaluates your collateral and gives you access to the required amount of Tether USDT.

Your creditworthiness is determined based on the value of your collateral, making the process of getting a cryptocurrency loan fast and convenient.

However, it is important to remember that Filecoin cryptocurrency loans are not without risks. In case you default on the loan, your collateral can be seized. Therefore, you should carefully assess your repayment capacity before taking out a cryptocurrency loan.

To authorize an Filecoin Crypto Loan, you will need to go to Features tab → Loan section → Borrow button

Choose the required loan amount the terms and conditions of the crypto loan, and apply for it by confirming it with a code from 2FA - application or E-mail or Telegram-bot.

Learn more about FIL Crypto Loans

Interest rates on loans secured by Filecoin

Here at Cropty, we value competitive rates for our crypto loans, offering enticing 9% interest rates for business or personal needs. These cost-efficient loans allow you to secure cash while holding onto your precious crypto assets.

Cropty's specialized cryptocoin loans offer a novel collateral arrangement. In the case that a loan isn't honored, the pledged Filecoin backs the loan and remains with Cropty, and the loan receiver keeps the given Tether USDT. This strategy establishes an even-handed recovery process that works in favor of all players involved.

In an effort to minimize risks associated with Filecoin fluctuation, Cropty has implemented an automatic liquidation feature. Should the worth of the collateral drops beyond a certain limit, the loan undergoes immediate liquidation. This anticipatory approach buffers both the lender and recipient against possible downfalls in market grading.

With Cropty, clarity and convenience are fundamental. Our clients have direct access to overseeing their loan products via an intuitive interface. Borrowers also enjoy the ability to boost their collateral, prepay the loan, or finalize the loan by settling the borrowed sum along with the gathered interest.

Puzzled about how to obtain a crypto-backed loan? Simply put, Cropty leverages instant coin loans. Put up your Filecoin as collateral and receive Tether USDT in return. Unequivocally, our crypto-backed loans deliver rapid and handy remedies to your monetary requirements.

Why choose Filecoin Cropty Loan

FAQ

What is Cropty Filecoin Crypto Loan?

How do I pledge my assets and start borrowing with Cropty Filecoin Crypto Loan?

What is LTV, and how much can I borrow from Cropty Filecoin Crypto Loan?

Are there limits to how much I can pledge and borrow?

What is loan liquidation, and what is the liquidation LTV?

What happens when a loan is liquidated?

What is a margin call?

Will I be notified in the event of margin calls or liquidations?

What interest rate applies to my loan?

How is interest accrued for my loan positions?

How do I repay my loan or adjust my LTV?

Which cryptocurrencies can I pledge or borrow on Cropty Crypto Loan?

What can I do with the cryptocurrencies borrowed from Cropty Filecoin Crypto Loan?

More coins