What is Ripple?

XRP is a cryptocurrency aiming to increase the speed and reduce the cost of transferring money between financial institutions. Underpinning Ripple's xRapid product, an on-demand liquidity solution, XRP is used as a bridge currency for financial institutions exchanging value between multiple fiat currencies. XRP is the native token of the XRP Ledger, an open-source cryptographic ledger powered by a peer-to-peer network of nodes.

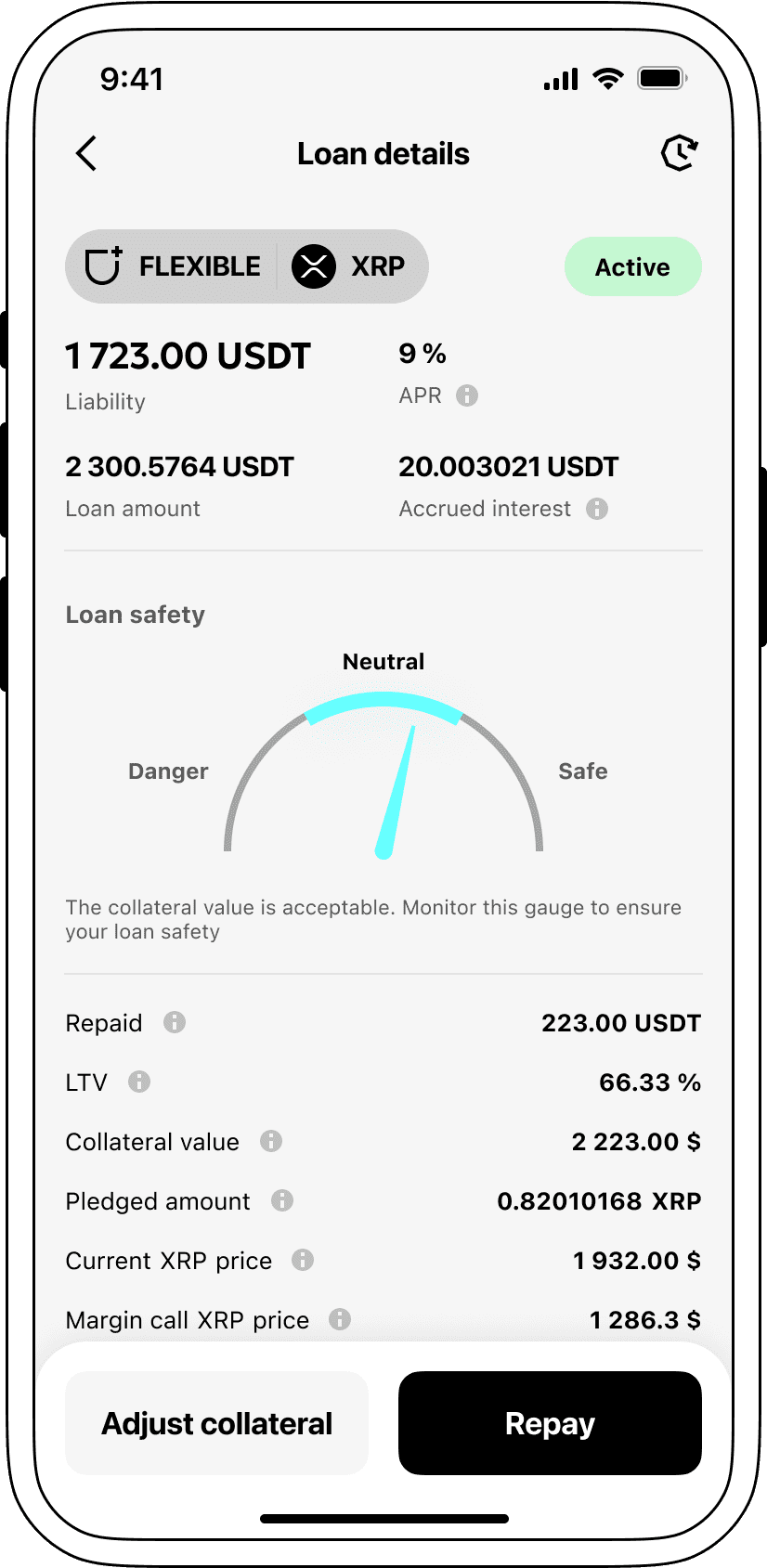

How do loans backed by XRP works

In the world of digital finance, Crypto-based lending provides an easy alternative for both debtors and creditors. By using their digital currency, such as Ripple (XRP) as collateral, borrowers can acquire loans in USDT, without relinquishing ownership of their crypto assets. This method dismisses the necessity for credit assessments or tedious formalities, thus expediting and economizing the process.

Creditors can allocate their Ripple or other crypto assets into a specially allocated account on the Cropty platform. The custodian of these accounts acts as a trustworthy intermediary, overseeing the proceedings between the borrowers and lenders, establishing a secure lending experience while safeguarding all involved parties.

The advantage to borrowers is the ability to obtain capital without the need to liquidate their digital assets. This is particularly beneficial in periods of erratic market conditions, where potential losses can be negated. The aforementioned strategy demystifies the loan process and renders credit assessments obsolete.

Depositors generate revenue from their loan reimbursements over time, enabling them to earn profits from their digital currency investments. Essentially, it promotes a scenario where both borrowers and lenders thrive simultaneously.

Through the use of Cropty's platform, the interface for borrowers and creditors is maintained and blockchain technology guarantees protected transactions, nullifying the requirement for any third-party involvement and thus minimizing the chances of deceitful practices. It pioneers a dependable and secure lending environment.

Ripple Loan Calculator

Crypto Loans explained

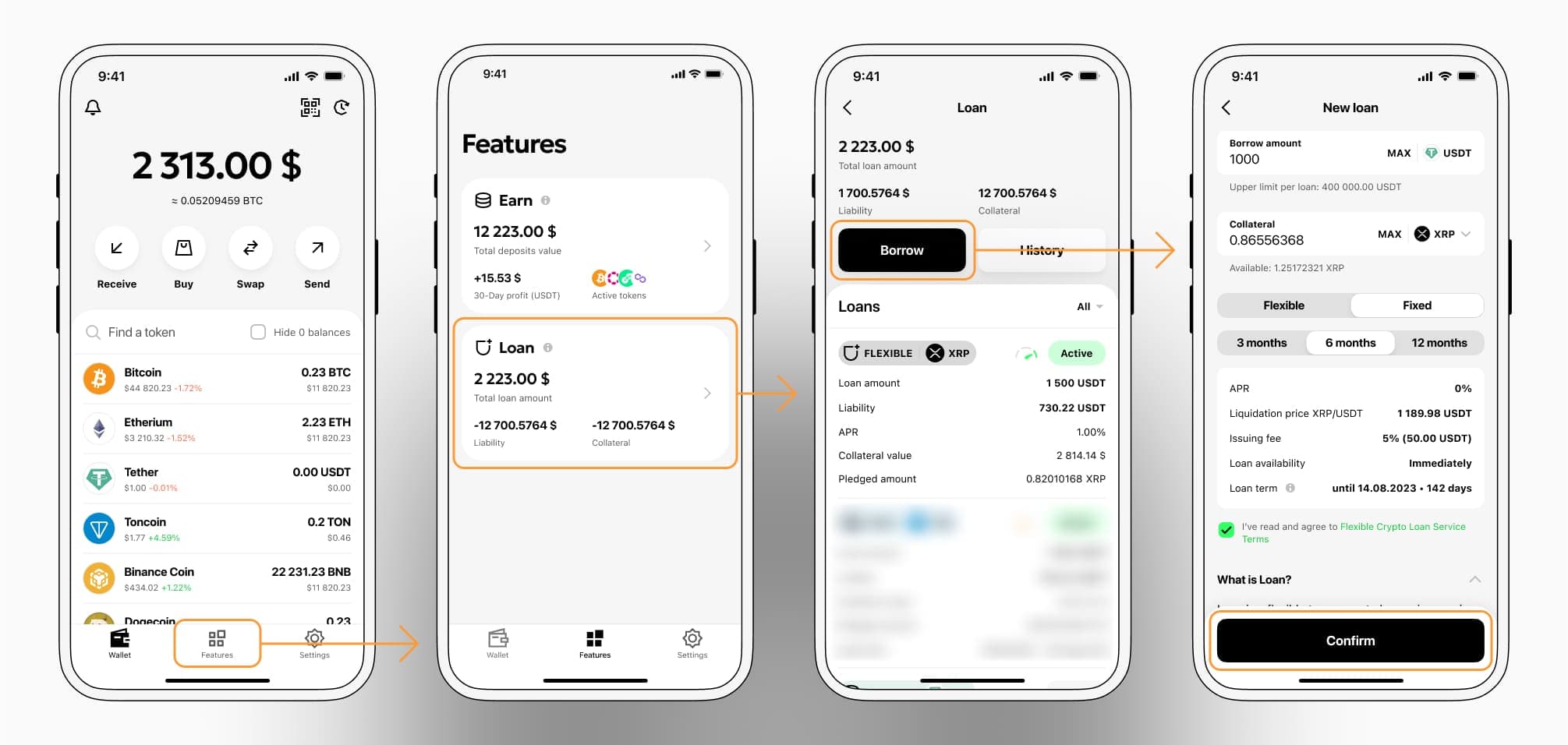

How to get a loan on Ripple? Borrow usd against Ripple on Cropty

The process of getting an Ripple cryptocurrency loan is quite simple. First, you need to create your account on Cropty, a platform that offers Ripple cryptocurrency lending services. Then, you need to provide your XRP as collateral and specify the loan amount you want to borrow. The platform then evaluates your collateral and gives you access to the required amount of Tether USDT.

Your creditworthiness is determined based on the value of your collateral, making the process of getting a cryptocurrency loan fast and convenient.

However, it is important to remember that Ripple cryptocurrency loans are not without risks. In case you default on the loan, your collateral can be seized. Therefore, you should carefully assess your repayment capacity before taking out a cryptocurrency loan.

To authorize an Ripple Crypto Loan, you will need to go to Features tab → Loan section → Borrow button

Choose the required loan amount the terms and conditions of the crypto loan, and apply for it by confirming it with a code from 2FA - application or E-mail or Telegram-bot.

Learn more about XRP Crypto Loans

Interest rates of Ripple-secured loans

At Cropty, we appreciate the significance of providing competitive interest rates and we hence provide loans that use digital currency with a significantly enticing 9% interest rate. Whether your financial need is personal or business-oriented, our low-interest loans offer a practical remedy to access liquidity without letting go of your precious digital assets.

Noteworthy about Cropty's digital currency loans is the equipped collateral system. In the occasion a debtor fails to meet their repayment obligation, the collateral in Ripple remains on Cropty’s account, while the debtor retains the Tether USDT allocated before. This upholds a just and harmonious strategy to the repayment process, making positive both, the lender and the borrower, prosper.

Cropty implements an immediate liquidation feature to manage the risk of a potential Ripple devaluation. In case the value of the promised collateral falls below a danger line, the loan will be dissolved. This serves as a prevention method from perceived damages, safeguarding all involved parties in the happening of a market fall.

At Cropty, we uphold honesty and suitability. It's easy for our patrons to keep track of their loan goods through our intuitive interface. Conversely, they have the leeway to pledge more collateral, settle the amount early, or shut the loan by repaying the lent amount as well as any earned interest charges.

For those wondering how to secure a loan using digital currency, Cropty extends immediate coin loans. You have the option of borrowing against Ripple, in return receive Tether USDT. Our loans, secured with digital currency, are efficient and easily accessible for resolving your financial hitches.

Why choose Ripple Cropty Loan

FAQ

What is Cropty Ripple Crypto Loan?

How do I pledge my assets and start borrowing with Cropty Ripple Crypto Loan?

What is LTV, and how much can I borrow from Cropty Ripple Crypto Loan?

Are there limits to how much I can pledge and borrow?

What is loan liquidation, and what is the liquidation LTV?

What happens when a loan is liquidated?

What is a margin call?

Will I be notified in the event of margin calls or liquidations?

What interest rate applies to my loan?

How is interest accrued for my loan positions?

How do I repay my loan or adjust my LTV?

Which cryptocurrencies can I pledge or borrow on Cropty Crypto Loan?

What can I do with the cryptocurrencies borrowed from Cropty Ripple Crypto Loan?

More coins