What is The Sandbox?

The Sandbox is a virtual world where players can build, own, and monetize their gaming experiences using non-fungible tokens(NFTs) and $SAND, the platform’s utility token. Players can create digital assets in the form of NFTs, upload them to the marketplace, and integrate into games with The Sandbox Game Maker. The Sandbox virtual world is made up of LAND – digital pieces of real estate – in The Sandbox metaverse that players can buy to build experiences on top of.

How do loans secured by SAND work?

Cryptoloan is a simplified solution for borrowers and investors. People seeking loans can pledge USDT as collateral while retaining ownership of the cryptocurrency. This eliminates the need for a credit assessment. No official documentation is required either. All of this speeds up and reduces the cost of the procedure.

Lenders can deposit their cryptocurrency, including Sandbox (SAND), into a dedicated account on the Cropty platform. An appointed custodian monitors transactions between lenders and borrowers, ensuring a secure loan arrangement mechanism. They act as a trusted intermediary, protecting the interests of both parties.

The advantages for borrowers include the ability to receive financial assistance without the need to liquidate their cryptocurrency assets. This is very useful in market volatility conditions and allows them to avoid potential losses. Loans of this type simplify the lending process and eliminate the need for credit history checks.

On the other hand, financial sponsors earn interest on their invested funds through loan repayments. This allows them to generate significant profit from their cryptocurrency assets. Thus, cryptocurrency loans are a mutually beneficial agreement where borrowers receive financing and sponsors earn returns from their participation.

The Cropty platform controls the interaction between borrowers and lenders, while blockchain technology ensures secure peer-to-peer exchanges. This reduces the likelihood of fraud and promotes a safe lending environment.

The Sandbox Loan Calculator

Crypto Loans explained

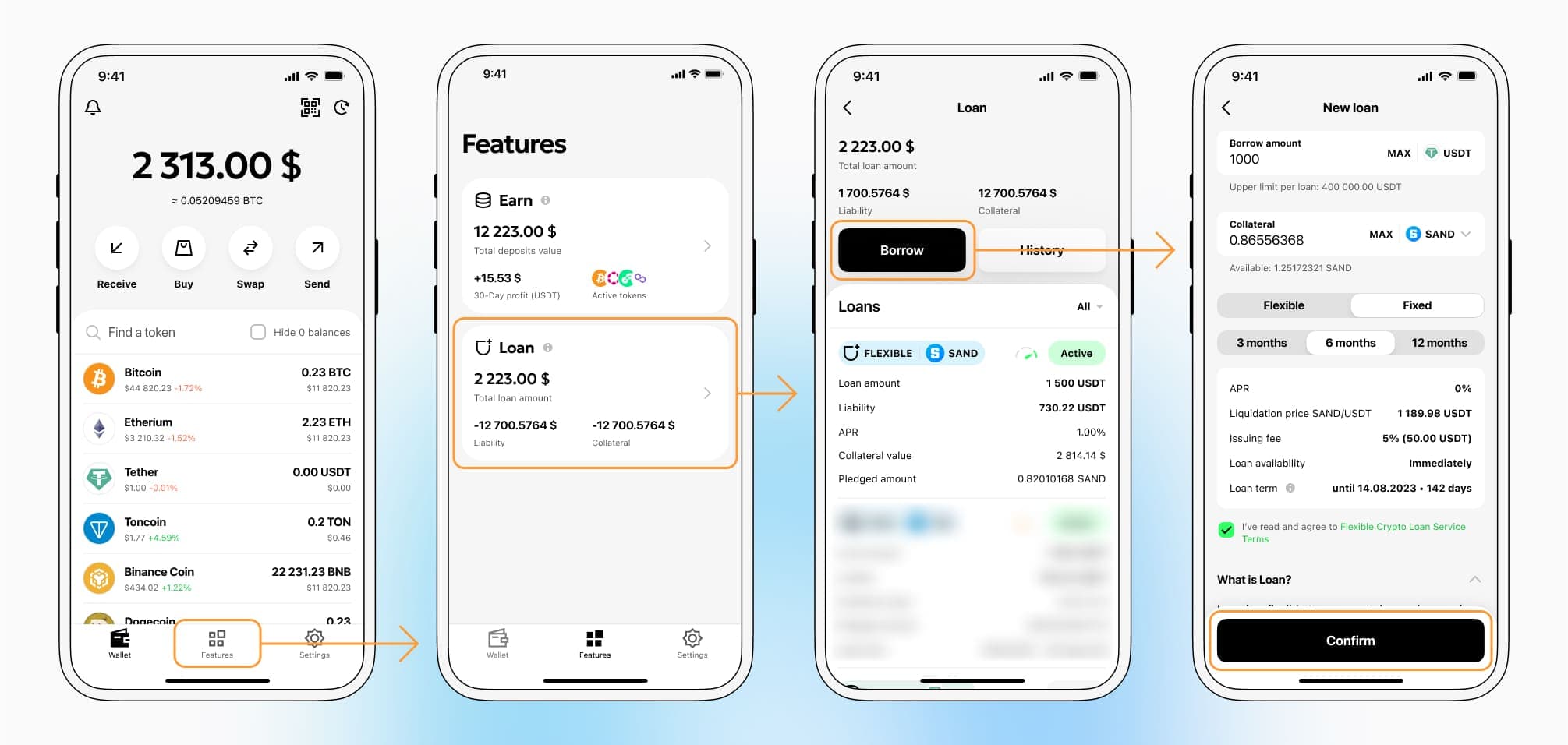

How to get a loan on The Sandbox? Borrow usd against The Sandbox on Cropty

The process of getting an The Sandbox cryptocurrency loan is quite simple. First, you need to create your account on Cropty, a platform that offers The Sandbox cryptocurrency lending services. Then, you need to provide your SAND as collateral and specify the loan amount you want to borrow. The platform then evaluates your collateral and gives you access to the required amount of Tether USDT.

Your creditworthiness is determined based on the value of your collateral, making the process of getting a cryptocurrency loan fast and convenient.

However, it is important to remember that The Sandbox cryptocurrency loans are not without risks. In case you default on the loan, your collateral can be seized. Therefore, you should carefully assess your repayment capacity before taking out a cryptocurrency loan.

To authorize an The Sandbox Crypto Loan, you will need to go to Features tab → Loan section → Borrow button

Choose the required loan amount the terms and conditions of the crypto loan, and apply for it by confirming it with a code from 2FA - application or E-mail or Telegram-bot.

Learn more about SAND Crypto Loans

Interest rates on sandbox-backed loans

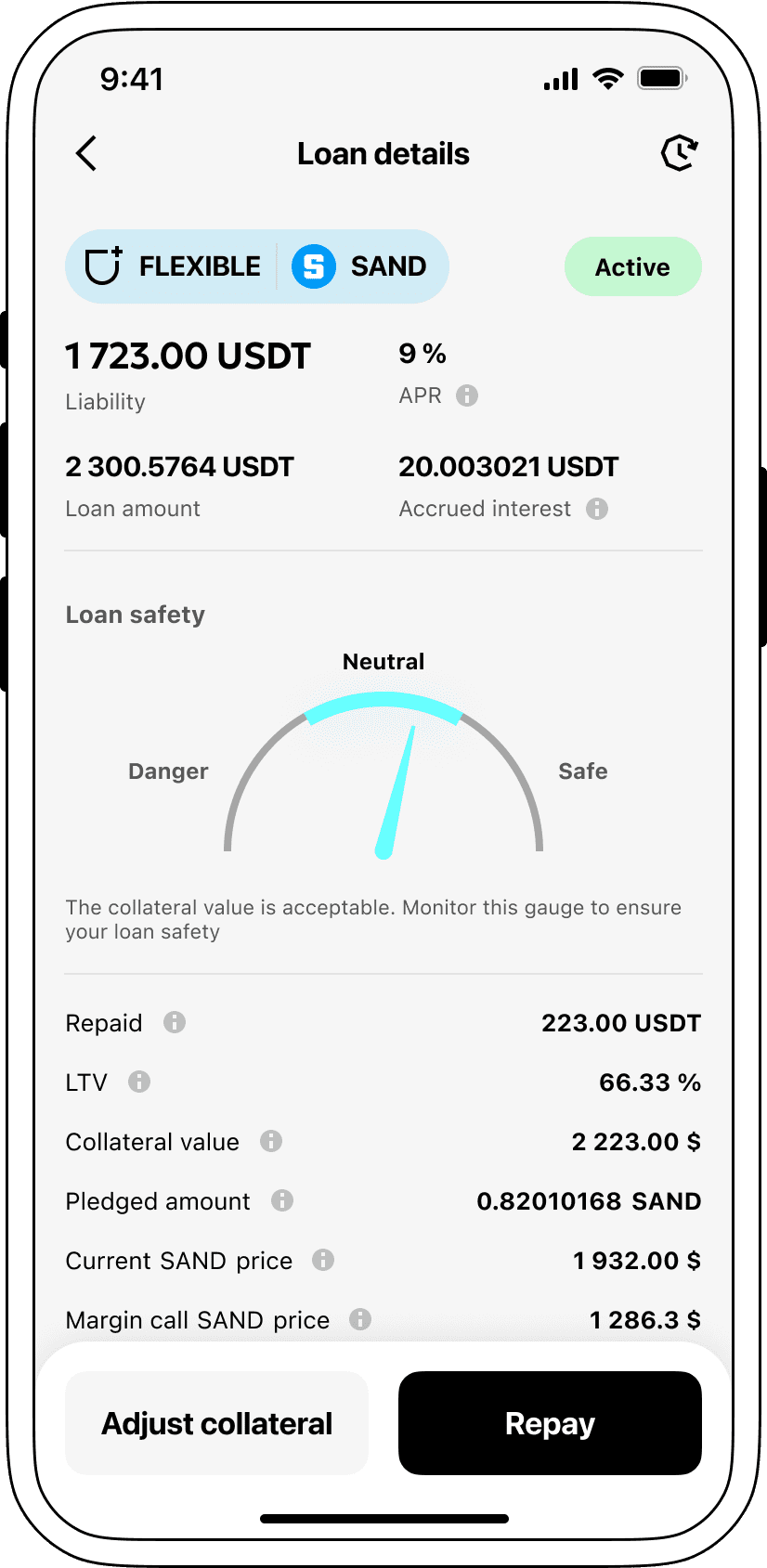

With Cropty on your side, access to affordable cryptocurrency loans becomes a reality. We offer loans tied to digital currencies at an attractive rate of 9%. This makes our solution economical and accessible for personal and corporate financial needs. It provides an extremely convenient opportunity to obtain funds without giving up your valuable cryptocurrencies.

An exclusive aspect of Cropty crypto-lending is the use of the collateral method. In case of loan default, the offered collateral SAND stays with Cropty, while the loan amount in Tether USDT remains with the borrower. This creates a mutually beneficial and fair debt recovery concept.

For effective protection against a potential drop in the value of The Sandbox, Cropty uses a built-in automatic liquidation tool. If the collateral value falls below a critical point, the loan is liquidated, providing protection for both the lender and the applicant from unexpected losses related to market fluctuations.

At Cropty, we adhere to the principles of simplicity and transparency. Our thoughtful, intuitive interface makes loan tracking easy for our participants. Borrowers have the option to top up collateral, repay the loan at any time, or close the deal by paying off the loan amount and accumulated interest.

Thinking about getting a loan using cryptocurrency? Cropty offers real-time loans. You have the opportunity to get a loan secured by The Sandbox and receive Tether USDT. Our blockchain-backed loans provide you with a fast and easy way to fulfill your financial obligations.

Why choose The Sandbox Cropty Loan

FAQ

What is Cropty The Sandbox Crypto Loan?

How do I pledge my assets and start borrowing with Cropty The Sandbox Crypto Loan?

What is LTV, and how much can I borrow from Cropty The Sandbox Crypto Loan?

Are there limits to how much I can pledge and borrow?

What is loan liquidation, and what is the liquidation LTV?

What happens when a loan is liquidated?

What is a margin call?

Will I be notified in the event of margin calls or liquidations?

What interest rate applies to my loan?

How is interest accrued for my loan positions?

How do I repay my loan or adjust my LTV?

Which cryptocurrencies can I pledge or borrow on Cropty Crypto Loan?

What can I do with the cryptocurrencies borrowed from Cropty The Sandbox Crypto Loan?

More coins