What is Catizen?

Catizen is a revolutionary gaming bot on Telegram that seamlessly integrates the Telegram x TON blockchain, transforming Web3 access by enabling practical mobile payments. By leveraging Telegram's immense traffic, Catizen aims to establish a Web3 traffic nexus on a scale of hundreds of billions. Catizen will become a mini-app center, combining the unique features of Launchpool with short videos and e-commerce, attracting and engaging users through gamification and strategic Play-to-Airdrop initiatives. This innovative approach aims to revolutionize the way users access and engage with the Web3 ecosystem.

How do loans backed by CATI works

Crypto loans are a great and simple tool for both borrowers and lenders. Get a loan in USDT, while maintaining the ownership of your collateral. All your digital assets will remain yours - this will allow you, for example, in moments of potential growth of the Catizen coin or a long hold, to receive money immediately, gradually returning the loan.

The main convenience is a minimum of bureaucracy and ease of application. You can use Cropty for these purposes - we act as a reliable intermediary between borrowers and lenders. Our main goal is simplicity and accessibility, while maintaining the security of transactions. We are a reliable partner who wants both parties to have a positive experience from interacting with the platform.

The borrower does not liquidate his own crypto assets, they remain his, which gives him the opportunity to be more flexible and better adapt to market situations. The absence of conventional lending will save time and minimize losses.

Cropty wallet combines technology, user-friendly interface and no unnecessary waiting, no risk of fraud and secure transactions.

Catizen Loan Calculator

Crypto Loans explained

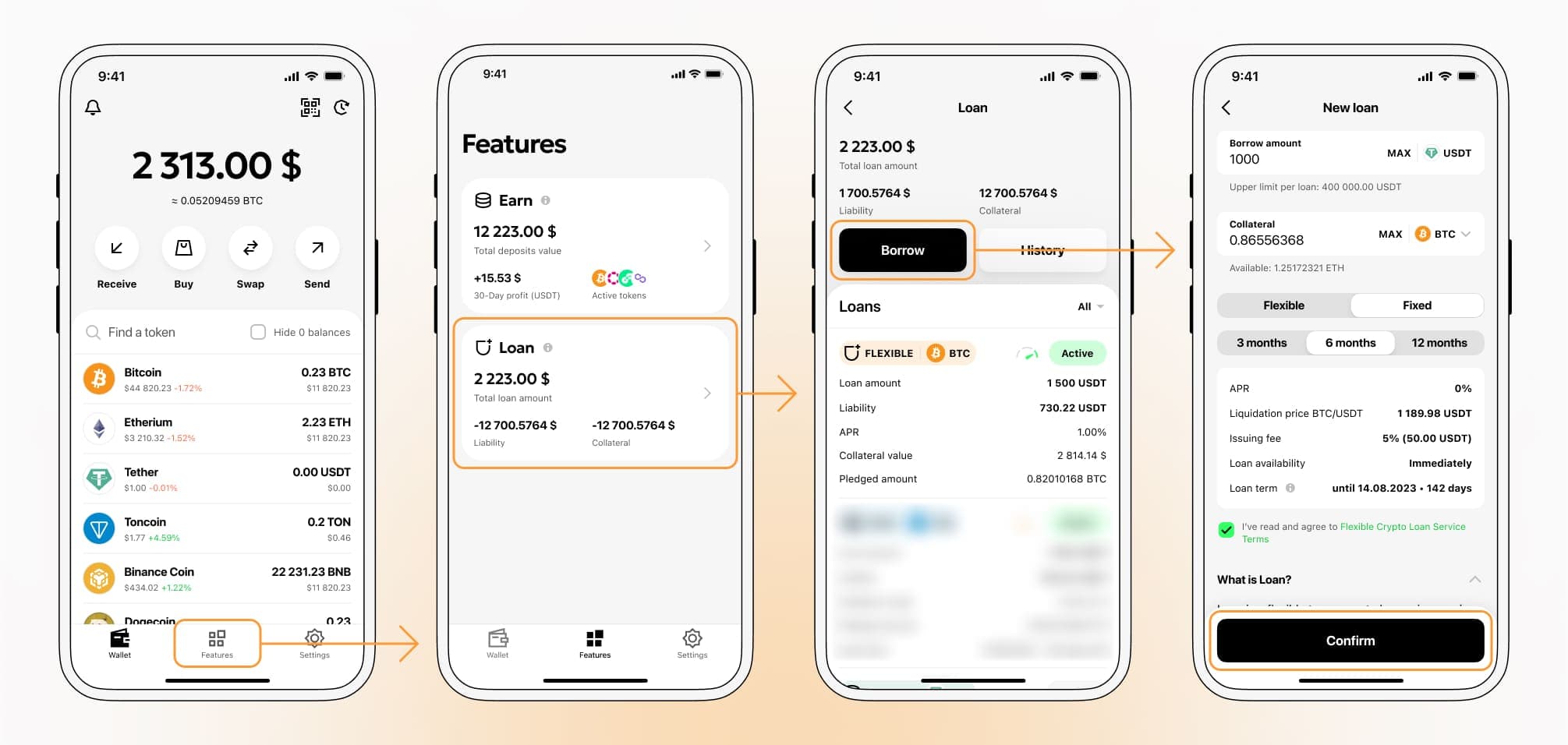

How to get a loan on Catizen? Borrow usd against Catizen on Cropty

The process of getting an Catizen cryptocurrency loan is quite simple. First, you need to create your account on Cropty, a platform that offers Catizen cryptocurrency lending services. Then, you need to provide your CATI as collateral and specify the loan amount you want to borrow. The platform then evaluates your collateral and gives you access to the required amount of Tether USDT.

Your creditworthiness is determined based on the value of your collateral, making the process of getting a cryptocurrency loan fast and convenient.

However, it is important to remember that Catizen cryptocurrency loans are not without risks. In case you default on the loan, your collateral can be seized. Therefore, you should carefully assess your repayment capacity before taking out a cryptocurrency loan.

To authorize an Catizen Crypto Loan, you will need to go to Features tab → Loan section → Borrow button

Choose the required loan amount the terms and conditions of the crypto loan, and apply for it by confirming it with a code from 2FA - application or E-mail or Telegram-bot.

Interest rates for loans secured by Catizen.

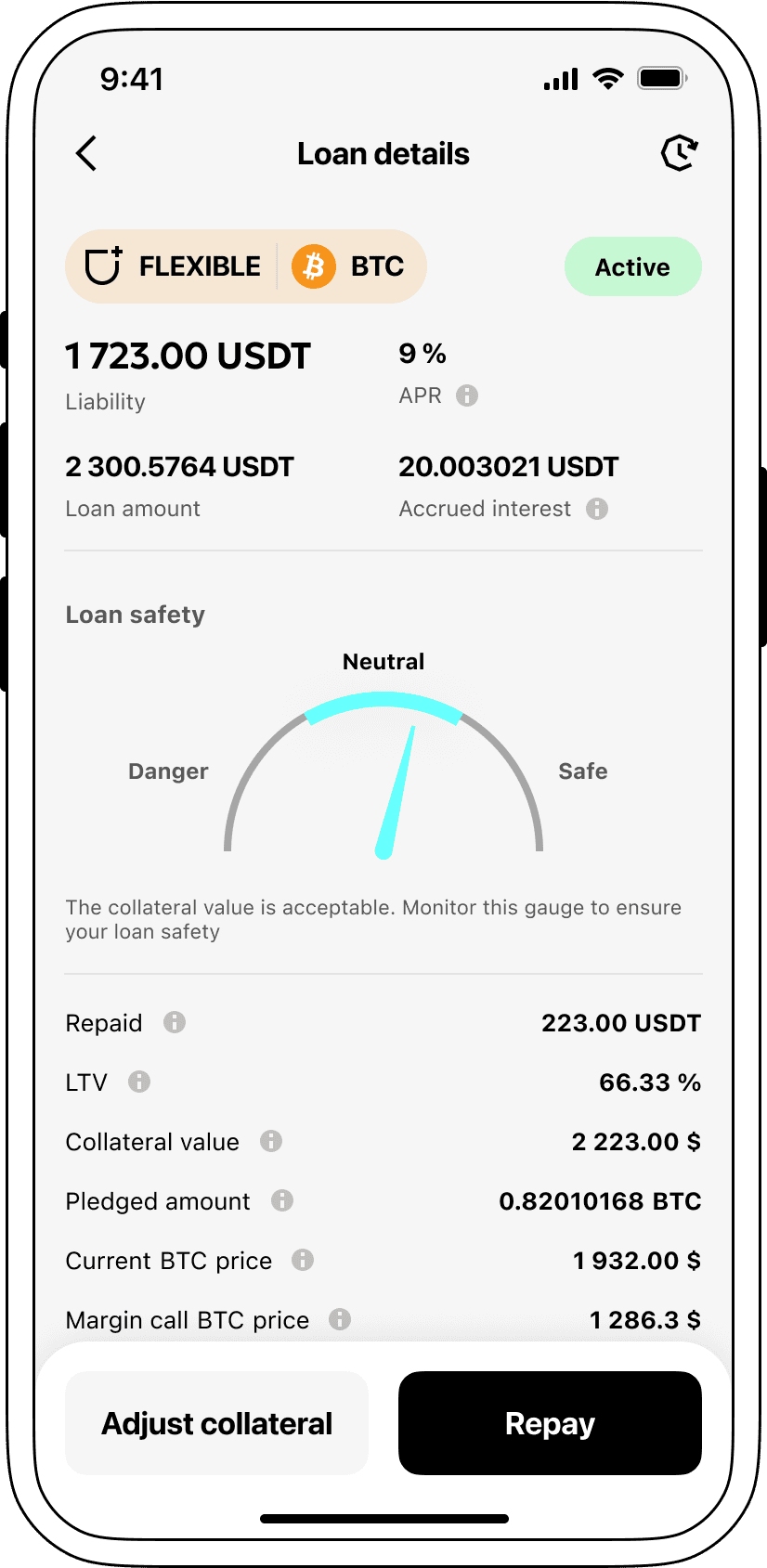

Competitive interest rates are the main standard of Cropty. We offer you loans secured by cryptocurrency with a rate of 9%. It does not matter whether you want to invest in your promising idea, finish building a business or finish the work of your life - our loans with a low interest rate will allow you to manage your own resources more effectively. Crypto loan is an economical and simple tool that can and should be used effectively, without the need to sell your precious cryptocurrency.

We have an extremely clear and simple collateralization method in Cropty. If the borrower does not repay the loan funds, then his coins go to Cropty, while USDT remains with him. This is the fairest recovery process that can protect all parties involved. In case your crypto asset depreciates greatly, we have implemented an asset liquidation mechanism - thus, we protect all parties - lenders and borrowers from losses during strong market downturns.

You can track the status of the loan through the dashboard, moreover, use all the usual lending tools: early repayment, increasing the collateral, or timely payments with the return of your increased assets. Take advantage of our instant loans, use Catizen to get a loan in USDT, manage your finances with our loans - a reliable tool to meet your financial needs.

Why choose Catizen Cropty Loan

FAQ

What is Cropty Catizen Crypto Loan?

How do I pledge my assets and start borrowing with Cropty Catizen Crypto Loan?

What is LTV, and how much can I borrow from Cropty Catizen Crypto Loan?

Are there limits to how much I can pledge and borrow?

What is loan liquidation, and what is the liquidation LTV?

What happens when a loan is liquidated?

What is a margin call?

Will I be notified in the event of margin calls or liquidations?

What interest rate applies to my loan?

How is interest accrued for my loan positions?

How do I repay my loan or adjust my LTV?

Which cryptocurrencies can I pledge or borrow on Cropty Crypto Loan?

What can I do with the cryptocurrencies borrowed from Cropty Catizen Crypto Loan?

More coins