What is Bitcoin?

Bitcoin was created as the first distributed consensus-based, censorship-resistant, permissionless, peer to peer payment network with an unprecedented scarce programable and native currency. The first digital currency in the world, without a central bank or administrator, is Bitcoin (BTC), the native asset of the Bitcoin blockchain. The bitcoin network is an emergent decentralized monetary institution that exists through the interplay of full miners, miners and developers. It is a newly emerged decentralized monetary institution that exists through the interplay between full nodes, miners, and developers. The social contract is created and opted into by the users of the network, hardened through game theory and cryptography. Bitcoin is the first, oldest and largest cryptocurrency in the world. It is the most popular, oldest, and largest cryptocurrency in the world.

How do loans backed by BTC works

Crypto-lending provides a straightforward approach for loan seekers and fund providers. Individuals looking for a loan can access funds in USDT, using their crypto stash as a security deposit while retaining ownership of their digital wealth. This eradicates the requirement for credit scrutiny and paperwork, thus accelerating the process while also making it cost-effective.

Fund providers can allocate their crypto assets, such as Bitcoin (BTC), to a specific account inside the Cropty framework. The custodian manages the transactions between loan seekers and fund providers, guaranteeing a safe process. The custodian acts as a dependable mediator, ensuring the protection of both parties' interests.

Loan seekers gain from this arrangement by acquiring funds without disposing of their cryptocurrency. This feature proves particularly valuable during market volatility, as it allows individuals to evade potential financial hits. The lending model also streamlines the borrowing process and eliminates the necessity for credit evaluations.

On the other hand, fund providers accrue interest from their portfolio through loan repayments. This model enables them to monetize their crypto holdings. It's a mutually beneficial scenario whereby loan seekers secure funds, and fund providers prosper from their participation.

Cropty's system monitors exchanges between loan seekers and fund providers, while the use of blockchain tech promotes safe transactions and eliminates the need for intermediaries. This strategy minimizes the chances of deceptive activities and facilitates a secure lending atmosphere.

Bitcoin Loan Calculator

Crypto Loans explained

How to get a loan on Bitcoin? Borrow usd against Bitcoin on Cropty

The process of getting an Bitcoin cryptocurrency loan is quite simple. First, you need to create your account on Cropty, a platform that offers Bitcoin cryptocurrency lending services. Then, you need to provide your BTC as collateral and specify the loan amount you want to borrow. The platform then evaluates your collateral and gives you access to the required amount of Tether USDT.

Your creditworthiness is determined based on the value of your collateral, making the process of getting a cryptocurrency loan fast and convenient.

However, it is important to remember that Bitcoin cryptocurrency loans are not without risks. In case you default on the loan, your collateral can be seized. Therefore, you should carefully assess your repayment capacity before taking out a cryptocurrency loan.

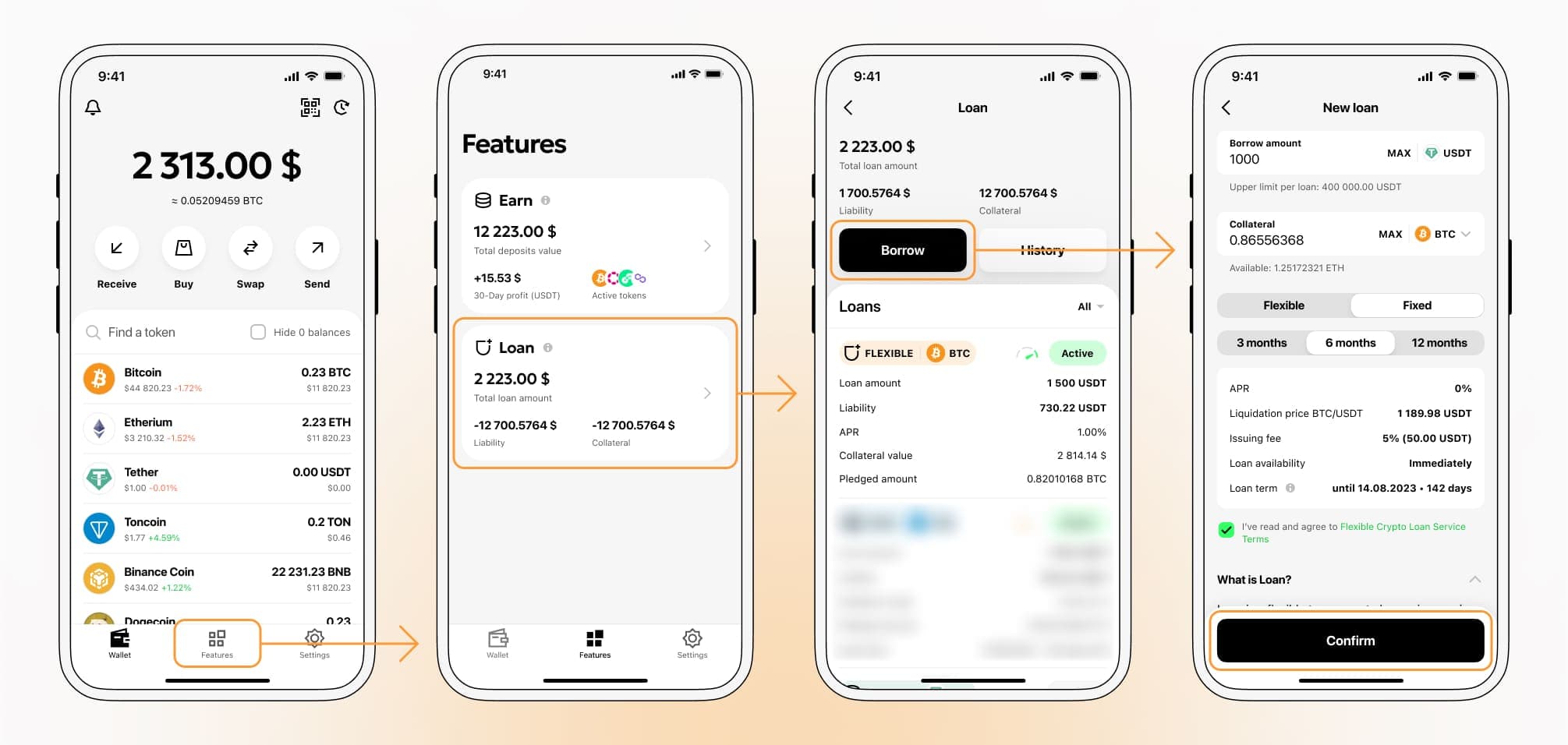

To authorize an Bitcoin Crypto Loan, you will need to go to Features tab → Loan section → Borrow button

Choose the required loan amount the terms and conditions of the crypto loan, and apply for it by confirming it with a code from 2FA - application or E-mail or Telegram-bot.

Learn more about BTC Crypto Loans

Interest rates of Bitcoin-secured loans.

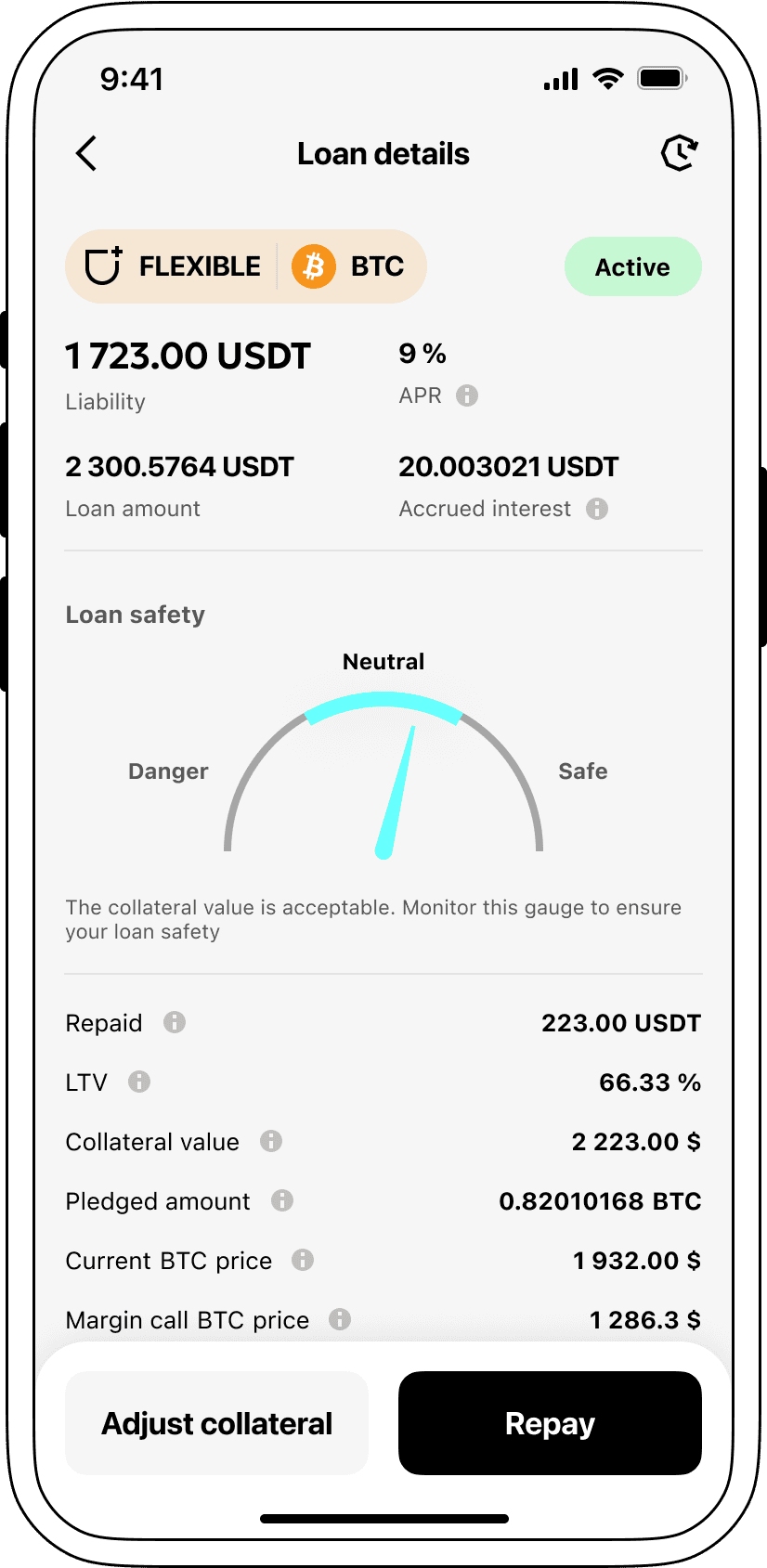

Cropty acknowledges the significance of providing competitive borrowing costs, hence we extend loans against digital currency at a compelling 9% interest proportion. Regardless of your goal, be it personal or for business operations, our economical loans grant an efficient strategy for gaining liquid cash without the necessity of disposing your prized cryptocurrencies.

One facet differentiating Cropty's blockchain-powered loans is our collateral-backed system. In the off chance of a borrower default, the collaterized Bitcoin stays with Cropty, meanwhile the debtor retains the issued Tether USDT. This constitutes an equitable structure that works for loan recoupment, benefitting all concerned parties.

Factoring in the possibility of Bitcoin taking a downturn, Cropty is armed with automated liquidation safeguards. When the collateral's performance slumps beneath its quantity indicator, auto-liquidation of the loan is enabled. This anticipatory step wards off detrimental losses for both the loaner and debtor incase of an unfavourable market swing.

In the details matter most to Cropty. Hence, users find immense value in our minimalist, navigable interface to track their loan status real-time. Offering a flexible arrangement, debtors can top-up their collaterals, prepay the loan, or conclude the loan agreement contingent on the settled amount plus interest accrued.

As for securing a loan against digital currency, opt for Cropty's expedited coin loans. Here, Bitcoin stands as your collateral leading to Tether USDT disbursement. Our blockchain-linked loans are designed for those keen on swift, hassle-free financial solutions.

Why choose Bitcoin Cropty Loan

FAQ

What is Cropty Bitcoin Crypto Loan?

How do I pledge my assets and start borrowing with Cropty Bitcoin Crypto Loan?

What is LTV, and how much can I borrow from Cropty Bitcoin Crypto Loan?

Are there limits to how much I can pledge and borrow?

What is loan liquidation, and what is the liquidation LTV?

What happens when a loan is liquidated?

What is a margin call?

Will I be notified in the event of margin calls or liquidations?

What interest rate applies to my loan?

How is interest accrued for my loan positions?

How do I repay my loan or adjust my LTV?

Which cryptocurrencies can I pledge or borrow on Cropty Crypto Loan?

What can I do with the cryptocurrencies borrowed from Cropty Bitcoin Crypto Loan?

More coins