Qu'est-ce que Tron ?

TRON est une plate-forme de contrat intelligent polyvalente qui permet la création et le déploiement d'applications décentralisées (dApps). Il dispose d'un mécanisme de consensus Proof-of-Stake (DPoS) délégué, un système qui offre une augmentation des performances tout en maintenant une véritable décentralisation et une résistance à la censure.

TRON est sans doute le plus célèbre pour sa capacité à faible coût à effectuer des transactions par rapport à d'autres solutions de couche 1 telles qu'Ethereum, bien qu'il soit toujours à la traîne dans l'adoption par les développeurs pour être encore considéré comme un rival sérieux.

<votre réponse doit contenir <text> tag xml avec le texte traduit en français> Texte que vous devez traduire en français: "Comment fonctionnent les prêts garantis par TRX"

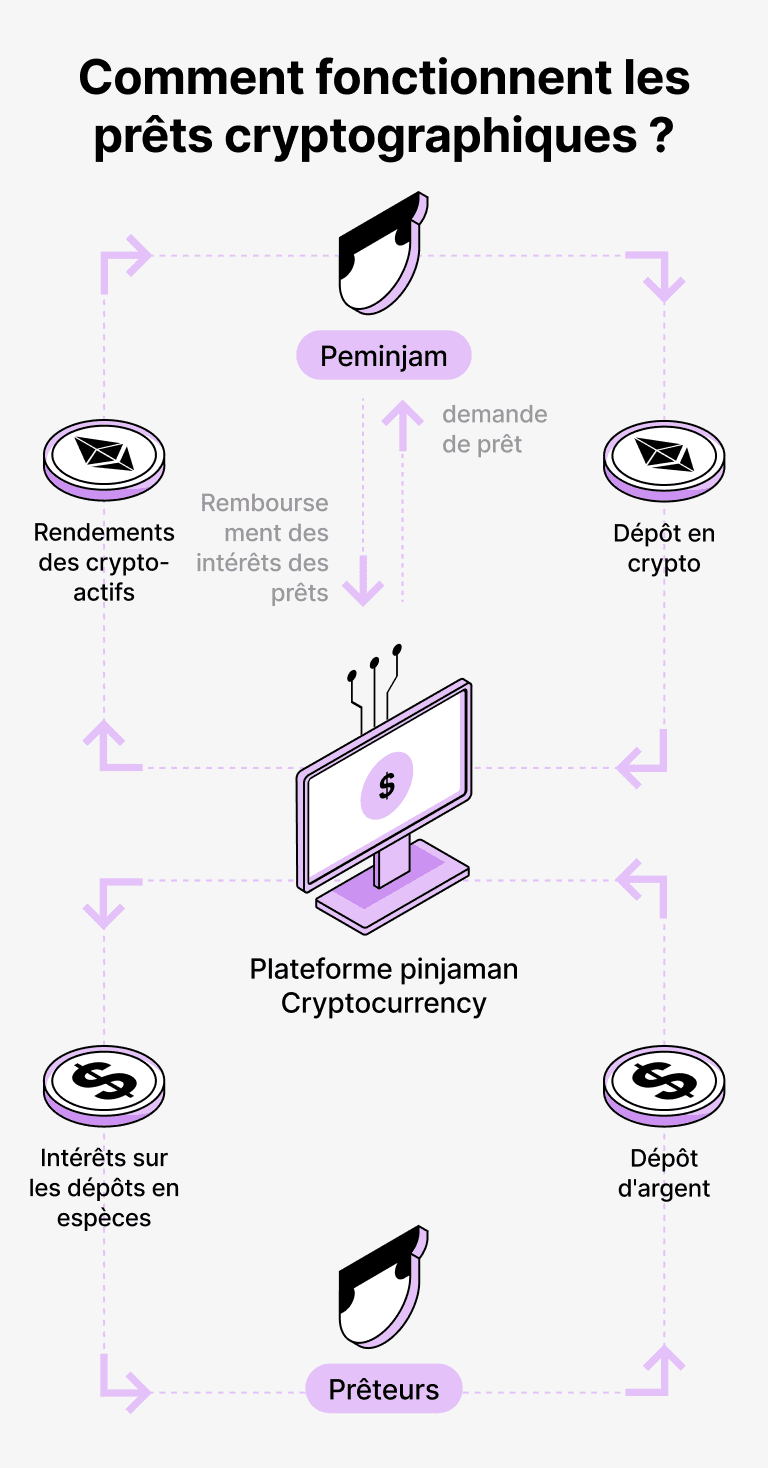

Le prêt soutenu par la crypto-monnaie présente une voie efficace tant pour les emprunteurs que pour les prêteurs. En utilisant leurs actifs crypto comme garantie, les emprunteurs pourraient recevoir des prêts en USDT tout en conservant la propriété de leurs monnaies numériques. L'élimination des longues vérifications de fond et des piles de paperwork accélère la transaction et la rend rentable.

Les prêteurs, d'autre part, sont libres de financer leurs avoirs en crypto-monnaie, tels que Tron (TRX), dans un compte désigné sur le réseau Cropty. Un dépositaire supervise les échanges entre les deux parties, accordant un cours d'action digne de confiance. Leur rôle fondamental garantit que les meilleurs intérêts de chaque partie sont protégés.

Un tel scénario confère aux emprunteurs le privilège d'obtenir des fonds sans se séparer de leurs pièces numériques. pendant des conditions de marché imprévisibles, cela pourrait parer à d'éventuels revers. Ce modèle de prêt affine le protocole de prêt, éliminant les analyses de crédit.

Pendant ce temps, les prêteurs réalisent des profits sur leurs actifs engagés par le biais de remboursements de prêts. Ils tirent des profits de leurs actifs crypto inactifs, créant une dynamique mutuellement bénéfique où les emprunteurs obtiennent des prêts et les prêteurs obtiennent des rendements monétaires de leurs investissements.

L'écosystème Cropty oriente le dialogue entre les emprunteurs et les prêteurs, protégé par la technologie du blockchain à toute épreuve, qui éradique le besoin d'intermédiaires. Cela diminue les chances de fraude et fait émerger une atmosphère de prêt fiable.

Calculateur de prêt Tron

Les prêts crypto expliqués

Comment obtenir un prêt sur Tron ? Empruntez des USD en mettant Tron en garantie sur Cropty

Le processus pour obtenir un prêt en Tron est assez simple. Tout d'abord, vous devez créer votre compte sur Cropty, une plateforme qui propose des services de prêt en Tron. Ensuite, vous devez fournir votre TRX en tant que garantie et préciser le montant du prêt que vous souhaitez emprunter. La plateforme évalue alors votre garantie et vous donne accès au montant requis en Tether USDT.

Votre solvabilité est déterminée en fonction de la valeur de votre garantie, rendant le processus d'obtention d'un prêt crypto rapide et pratique.

Pourtant, il est important de se rappeler que les prêts en crypto-monnaie Tron ne sont pas sans risques. En cas de défaut de paiement, votre garantie peut être saisie. Par conséquent, vous devez évaluer soigneusement votre capacité de remboursement avant de contracter un prêt en crypto-monnaie.

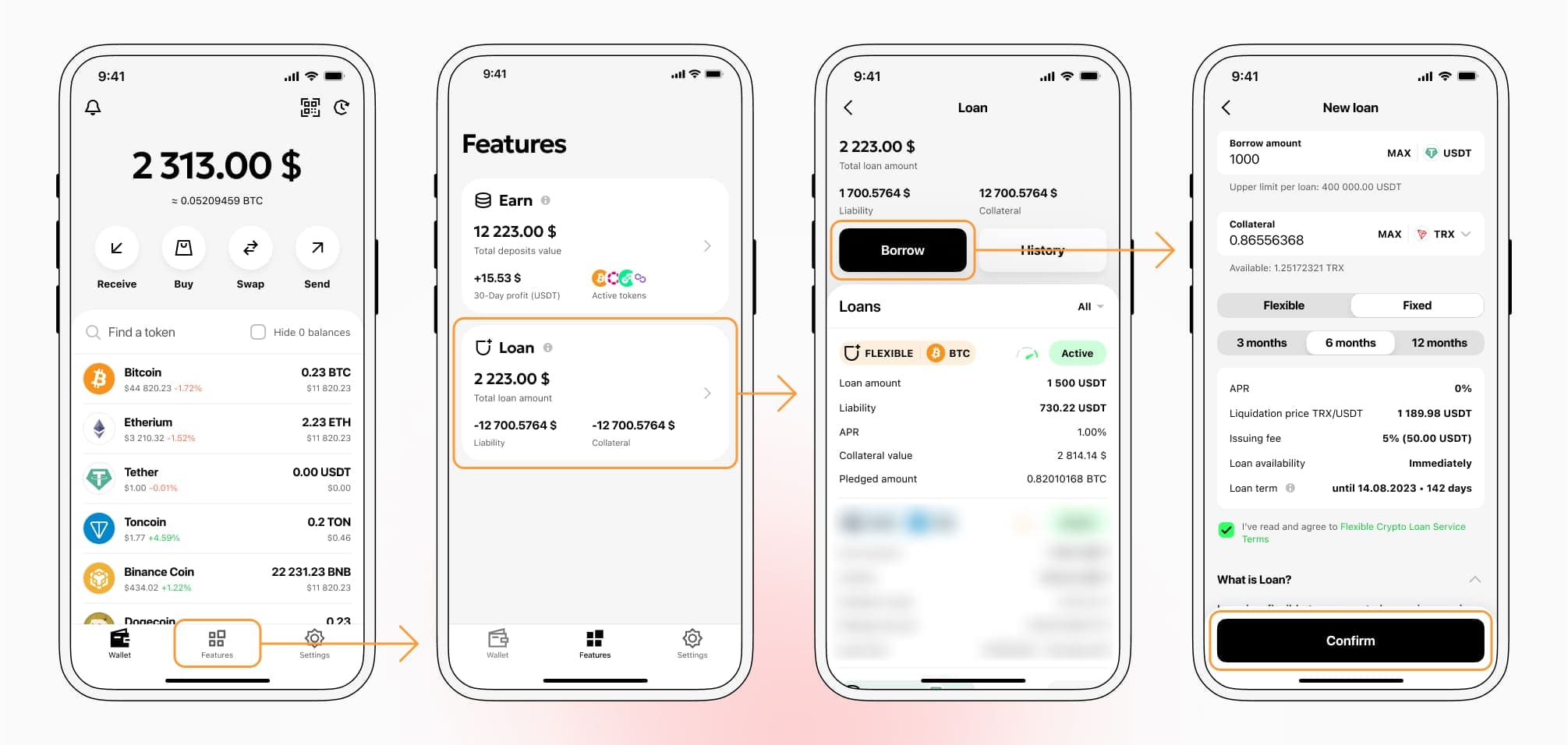

Pour autoriser un prêt Crypto Tron, rendez-vous dans l'onglet Fonctionnalités → section Prêt → bouton Emprunter

Choisissez le montant de prêt requis, acceptez les termes et conditions du prêt crypto, puis postulez en le confirmant avec un code 2FA — via l'application, par e-mail ou via le bot Telegram.

En savoir plus sur les prêts Crypto TRX

<votre réponse devrait contenir <texte> xml tag avec le texte traduit en français . Texte à traduire en français: ""Taux d'intérêt pour les prêts garantis par Tron

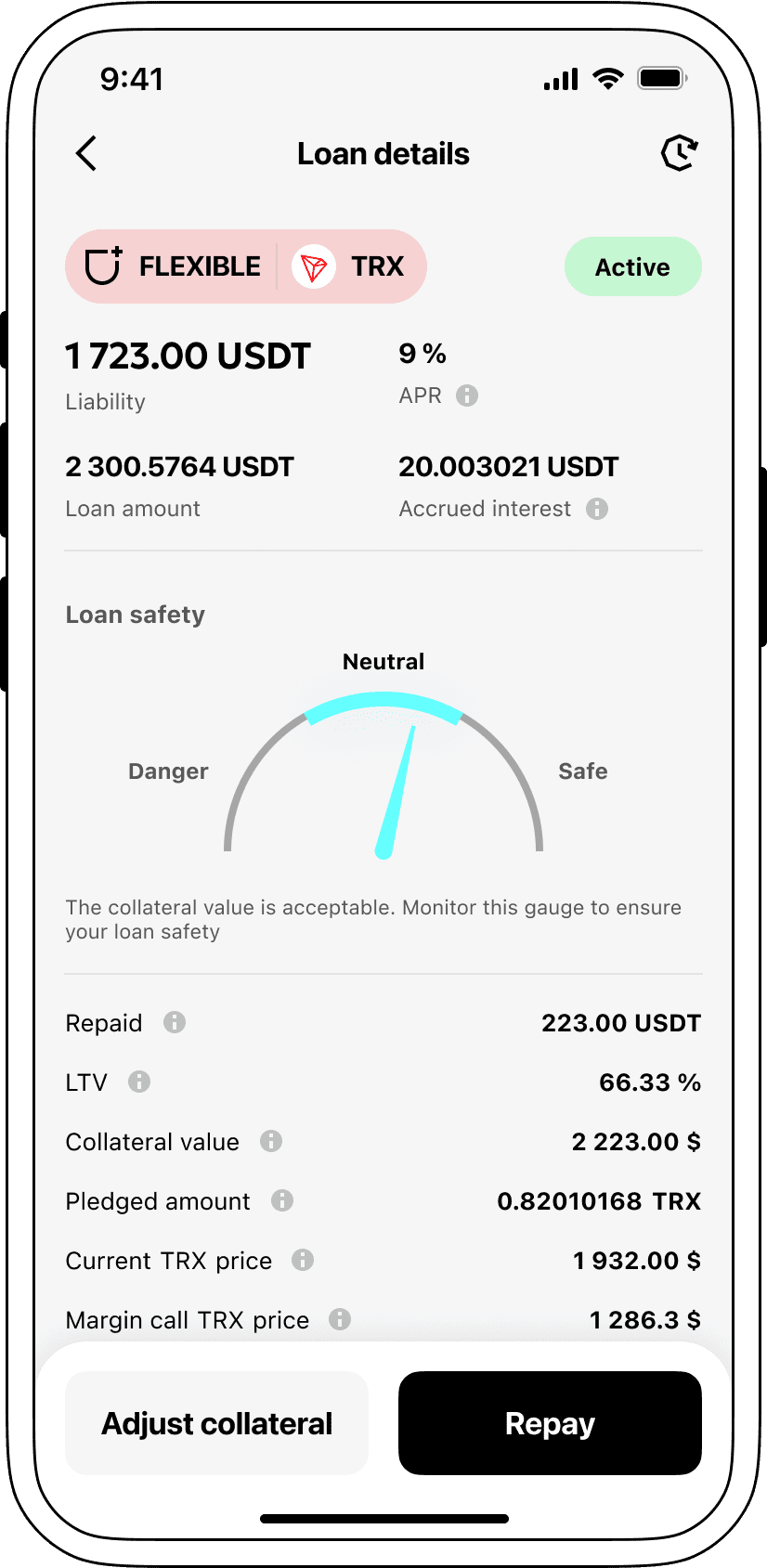

Ici, chez Cropty, nous valorisons un taux hautement compétitif et faiblement attractif de 9% pour les prêts garantis par des cryptomonnaies. Qu'il s'agisse de prêts personnels ou commerciaux, nos solutions de prêt à faible taux d'intérêt offrent une méthode rentable pour générer de la liquidité, ce qui signifie que vous conservez la possession de vos précieux investissements en cryptomonnaie tout en obtenant les fonds nécessaires.

Cropty se distingue par la structure de ses prêts garantis par des cryptomonnaies. Si un prêt est en défaut, la garantie TRX reste chez Cropty alors que l'emprunteur conserve le Tether USDT qui lui a été délivré. Cette approche assure un système équitable et réfléchi de résolution de prêt qui est avantageux pour toutes les parties concernées.

Pour protéger à la fois l'emprunteur et le prêteur des risques de dépréciation de Tron, Cropty utilise un processus de liquidation automatisé. Dans un événement où la valeur de la garantie mise en gage tombe en dessous d'un point critique, le prêt fait face à une liquidation, atténuant ainsi les pertes qui pourraient découler de la fluctuation du marché.

Chez Cropty, nous tenons en haute estime la transparence et la flexibilité. Nos utilisateurs peuvent facilement suivre l'état de leurs prêts en utilisant notre interface intuitive. Les emprunteurs bénéficient également d'options flexibles leur permettant d'augmenter leur garantie, de rembourser les prêts en avance ou de régler le prêt par le paiement des fonds empruntés et de tous les intérêts accumulés pendant la durée de vie du prêt.

Vous pensez à un prêt en cryptomonnaie ? Cropty propose des prêts basés sur la cryptomonnaie à l'échelle nationale. Obtenez un prêt garanti par votre Tron et recevez des Tether USDT - simplement et commodément. Nos prêts en cryptomonnaie sont conçus pour offrir des solutions rapides et pratiques à vos besoins financiers.

Pourquoi choisir le prêt Tron Cropty

FAQ

Qu'est-ce que Cropty Tron Crypto Loan ?

Comment mettre mes actifs en garantie et commencer à emprunter avec Cropty Tron Crypto Loan ?

Qu'est-ce que le LTV et combien puis-je emprunter avec Cropty Tron Crypto Loan ?

Existe-t-il des limites au montant que je peux mettre en garantie ou emprunter ?

Qu'est-ce que la liquidation d'un prêt et quel est le LTV de liquidation ?

Que se passe-t-il lorsqu'un prêt est liquidé ?

Qu'est-ce qu'un appel de marge ?

Serai-je informé en cas d'appels de marge ou de liquidations ?

Quel taux d'intérêt s'applique à mon prêt ?

Comment les intérêts sont-ils calculés pour mes positions de prêt ?

Comment puis-je rembourser mon prêt ou ajuster mon LTV ?

Quelles cryptomonnaies puis-je engager en garantie ou emprunter sur Cropty Crypto Loan ?

Que puis-je faire avec les cryptomonnaies empruntées auprès de Cropty Tron Crypto Loan ?

Plus de cryptos