What is Solana?

Solana is a public base-layer blockchain protocol that optimizes for scalability. Its goal is to provide a platform that enables developers to create decentralized applications (dApps) without needing to design around performance bottlenecks. Solana features a new timestamp system called Proof-of-History (PoH) that enables automatically ordered transactions. It also uses a Proof of Stake (PoS) consensus algorithm to help secure the network. Additional design goals include sub-second settlement times, low transaction costs, and support for all LLVM compatible smart contract languages.

How loans secured by SOL work

In essence, crypto loans provide an easy-to-drive mechanism, which serves well both parties, the borrowers, and the lenders. In doing so, the borrower will be able to take a loan in USDT (Tether) without getting rid of his/ her cryptocurrencies, which will be used as collateral; thus taking a loan means owning and not selling the cryptos. Such a mechanism eradicates the traditional system of assessments and paperwork and thus, less time and money are required to complete the transaction.

The establishments may opt for depositing their digital currencies such as Solana (SOL) in a dedicated Cropty platform account. The Custody oversees the deals between the borrowers and the lenders and ensures all transactions are totally safe. In the meanwhile, they are the loyal intermediaries who shield the two parties against all harm.

In this way, borrowers will obtain loans and still maintain ownership of their digital assets and as a result, they will not be excluded from the market, even if it fluctuates. Hence a loan given in the market helps the borrower prevent losing while at the same time lowering the cost of the operation and the credit scoring is erased.

The loan money is not lost but rather put to work, generating interest that accrues to the benefit of the creditors, thus, crypto assets become a great way for the owners to make profits. In such a manner, borrowers get money, while lenders get the interest generated on their accounts.

The Cropty platform is the middleman that allows the borrowers and lenders to interact, on the other hand, blockchain technologies, are the ones who provide security to transactions, without the need for third parties. This not only reduces the possibility of fraud to a minimum but also allows for the creation of a safe lending environment.

Solana Loan Calculator

Crypto Loans explained

How to get a loan on Solana? Borrow usd against Solana on Cropty

The process of getting an Solana cryptocurrency loan is quite simple. First, you need to create your account on Cropty, a platform that offers Solana cryptocurrency lending services. Then, you need to provide your SOL as collateral and specify the loan amount you want to borrow. The platform then evaluates your collateral and gives you access to the required amount of Tether USDT.

Your creditworthiness is determined based on the value of your collateral, making the process of getting a cryptocurrency loan fast and convenient.

However, it is important to remember that Solana cryptocurrency loans are not without risks. In case you default on the loan, your collateral can be seized. Therefore, you should carefully assess your repayment capacity before taking out a cryptocurrency loan.

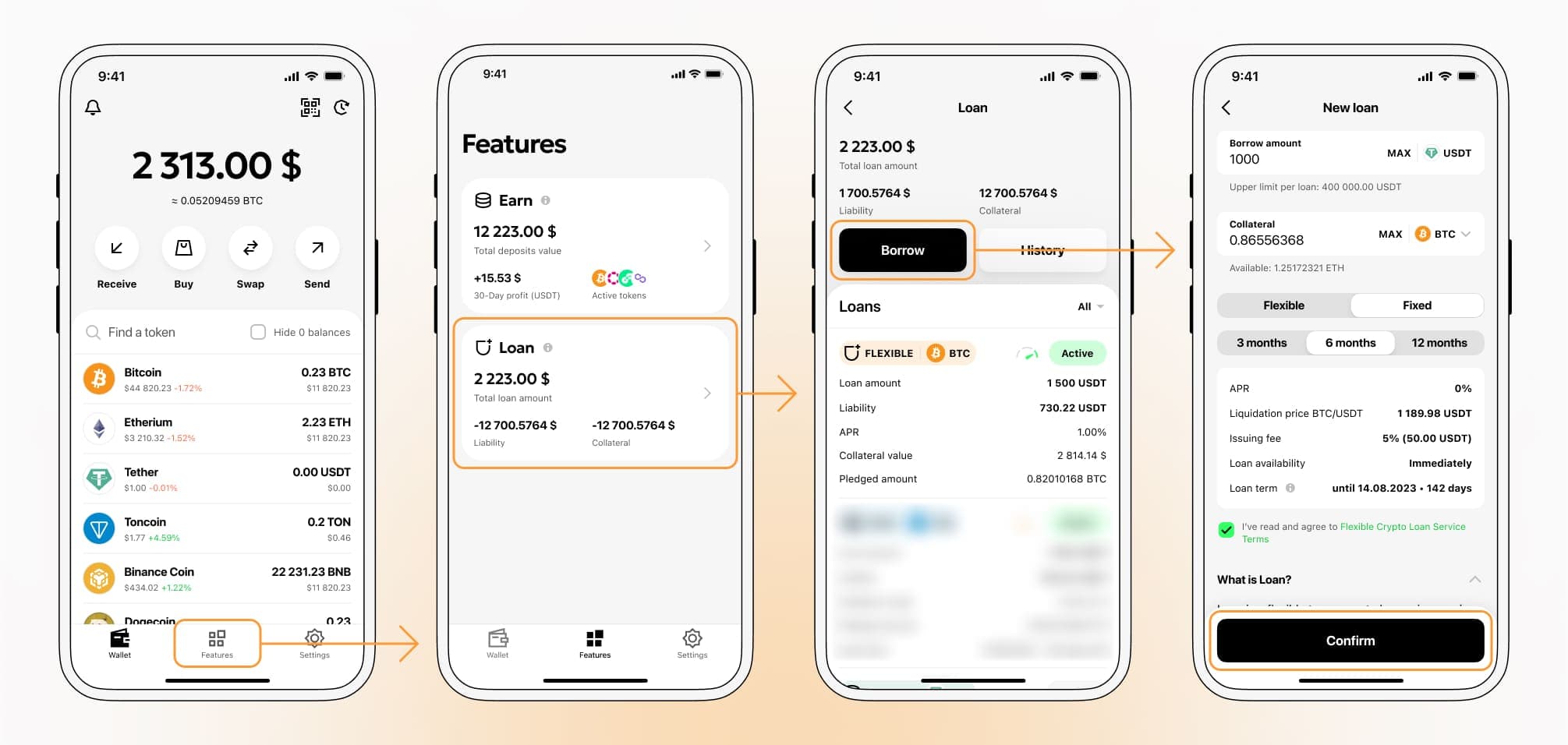

To authorize an Solana Crypto Loan, you will need to go to Features tab → Loan section → Borrow button

Choose the required loan amount the terms and conditions of the crypto loan, and apply for it by confirming it with a code from 2FA - application or E-mail or Telegram-bot.

Interest rates on Solana-backed loans.

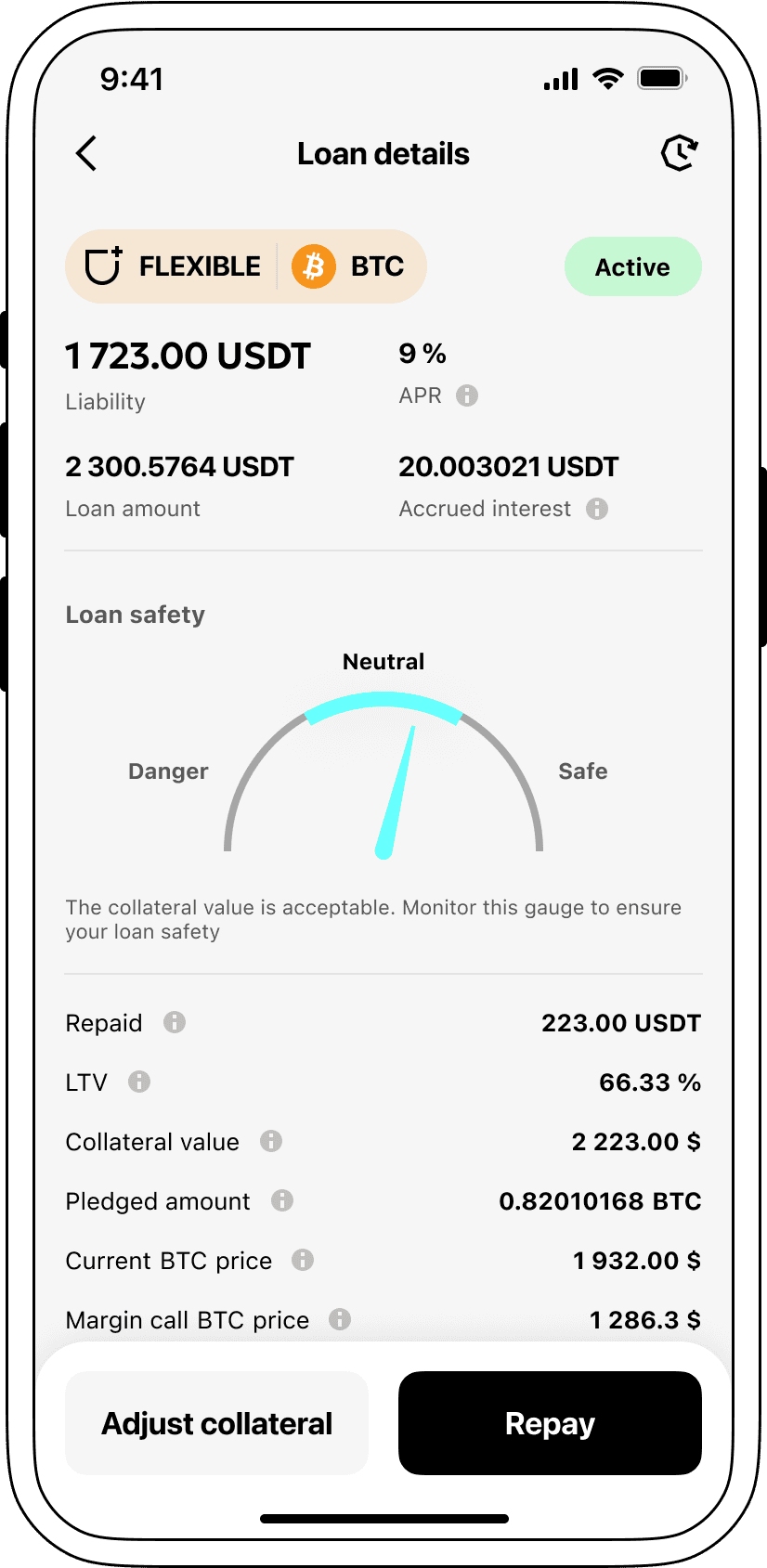

We at Cropty know very well that the best way to attract customers is to offer them great interest rates. That is why we are providing cryptocurrency loans with a very attractive rate of only 9%. In case you have to go for a personal or business loan, our low-interest-rate loans will make the cash available to you in an easy manner without you having to sacrifice your precious cryptos.

The flagship feature of Cropty crypto loans is the methodology deployed behind collateralization. In the case a borrower fails to meet the obligations of the loan, the collateral in SOL stays with Cropty, and the borrower keeps the received Tether USDT. This method encourages a system of loan repayment that is fair and benefits all parties involved in the transaction.

In order to mitigate the risk related to Solana price variation, Cropty has come up with a very good idea which is an automatic liquidation system. As a result of the collateral value falling below the critical level, the loan will be taken over by the bank. This safety measure shields both lenders and borrowers from the risk of losing money during the market's drop phase.

Cropty strives to be transparent and is always at the user's disposal. The status of a loan can be easily checked by a user with the help of the platform which has been designed and developed with great attention to the user's convenience. Moreover, in order to secure the loan, a borrower is allowed to bring more collateral; the loan can be repaid in advance; as a result of the repayment of the principal and the accrued interest, the loan can be terminated.

Suppose you are looking forward to a loan secured by cryptocurrency, then, Cropty is the one you should come to for an instant loan in coins. You can borrow a secured Solana loan and then get the Tether USDT in exchange. Our crypto-backed loans are a quick and convenient way to deal with your financial problems.

Why choose Solana Cropty Loan

FAQ

What is Cropty Solana Crypto Loan?

How do I pledge my assets and start borrowing with Cropty Solana Crypto Loan?

What is LTV, and how much can I borrow from Cropty Solana Crypto Loan?

Are there limits to how much I can pledge and borrow?

What is loan liquidation, and what is the liquidation LTV?

What happens when a loan is liquidated?

What is a margin call?

Will I be notified in the event of margin calls or liquidations?

What interest rate applies to my loan?

How is interest accrued for my loan positions?

How do I repay my loan or adjust my LTV?

Which cryptocurrencies can I pledge or borrow on Cropty Crypto Loan?

What can I do with the cryptocurrencies borrowed from Cropty Solana Crypto Loan?

More coins