What is TrueUSD?

TrueUSD is a fiat-collateralized stablecoin issued by the TrustToken platform that keeps USD funds in third party escrow accounts without direct access by TrustToken. TrueUSD is an ERC-20 token issued on the Ethereum and corresponds on a 1:1 basis with US Dollars sitting in bank accounts. TrueUSD is the only stablecoin offering real time audits.

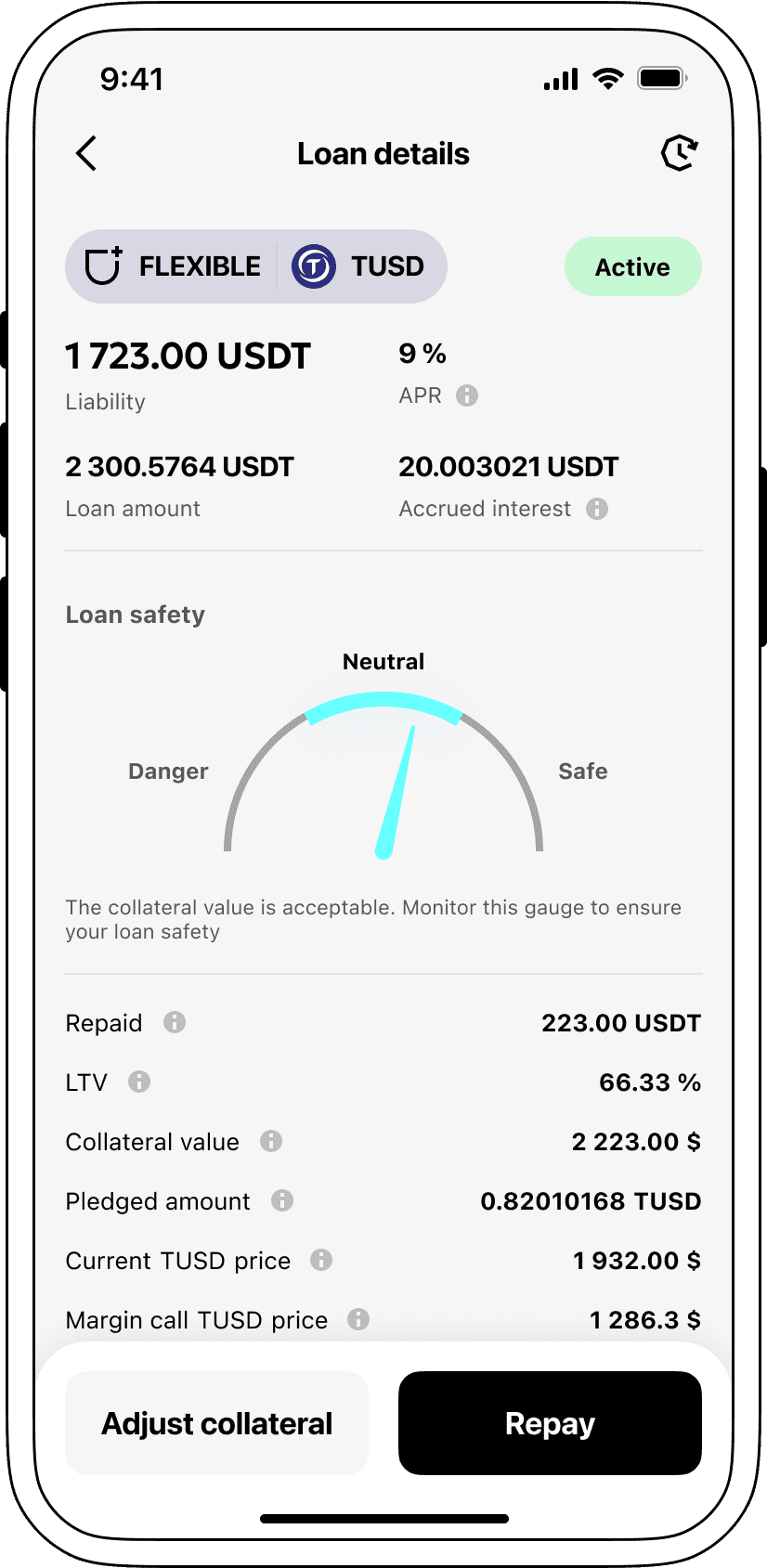

How do loans backed by TUSD works

Crypto-financing provides a straightforward method for those seeking loans and those providing it. By leveraging their crypto assets as guaranteed security, borrowers can easily receive loans in USDT while maintaining ownership of their digital holdings. This method cuts out the need for traditional credit inquiries and paper trails, vastly speeding up the process while cutting costs.

Lenders, on the other hand, can ensconce their cryptocurrency, such as TrueUSD (TUSD), within a dedicated Cropty platform account. The role of custodian is played out in this space – mediating interactions between the borrowing and lending parties to ensure the safety and security of all transactions. In this capacity, they ensure that the interests of both parties are upheld.

The unique benefits for borrowers underline the potential to access funds without disposing of their cryptocurrency. In an often volatile market, this fosters resiliency against potential losses. The simplified loan conveyor also removes credit checks from the equation.

On the flip side, lenders can see returns on their invested crypto through repayment of loans - producing profitable outcomes from their digital commodity. This creates an advantageous cycle where loan seekers get their lending needs met whilst lenders accrue benefits for their involvement.

In creating a regulated environment for lenders and borrowers, Cropty utilises blockchain tech for secure, intermediary-free transactions. This reduces the likelihood of fraud and establishes a safe space for loans transactions.

TrueUSD Loan Calculator

Crypto Loans explained

How to get a loan on TrueUSD? Borrow usd against TrueUSD on Cropty

The process of getting an TrueUSD cryptocurrency loan is quite simple. First, you need to create your account on Cropty, a platform that offers TrueUSD cryptocurrency lending services. Then, you need to provide your TUSD as collateral and specify the loan amount you want to borrow. The platform then evaluates your collateral and gives you access to the required amount of Tether USDT.

Your creditworthiness is determined based on the value of your collateral, making the process of getting a cryptocurrency loan fast and convenient.

However, it is important to remember that TrueUSD cryptocurrency loans are not without risks. In case you default on the loan, your collateral can be seized. Therefore, you should carefully assess your repayment capacity before taking out a cryptocurrency loan.

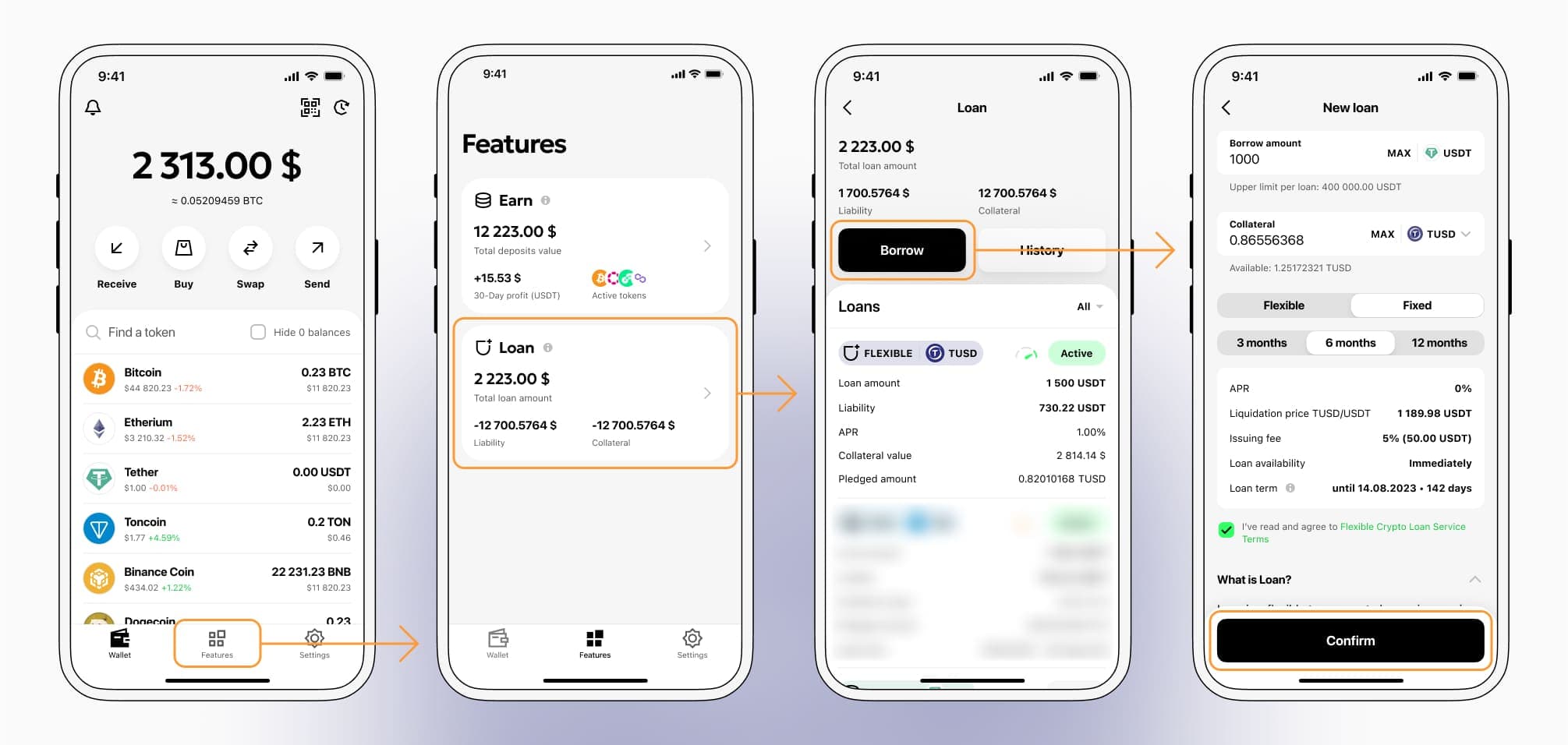

To authorize an TrueUSD Crypto Loan, you will need to go to Features tab → Loan section → Borrow button

Choose the required loan amount the terms and conditions of the crypto loan, and apply for it by confirming it with a code from 2FA - application or E-mail or Telegram-bot.

Learn more about TUSD Crypto Loans

Interest rates on TrueUSD secured crypto loans.

At Cropty, we acknowledge the significance of competitive lending rates. Therefore, we extend loans by leveraging digital currency at a remarkably enticing rate of just 9%. Whether your need centers on personal or commercial purposes, our manageable interest loans extend an economical answer for acquiring cash flow without selling your precious digital assets.

One distinctive aspect of Cropty's digital currency loans lies in the collateralization system. If an individual fails to repay the loan, Cropty retains the collateral TUSD, and the debtors secure the given Tether USDT. This guarantees a just and adequate approach for recovering loans, benefiting all engaged parties.

To contend with the potential devaluation risk of TrueUSD, Cropty employs an automatic liquidation feature. If the collateral's value decreases beyond a specific limit, it results in the loan's liquidation. This anticipatory step safeguards both lenders and borrowers from possible losses due to market fluctuations.

Cropty promotes clarity and ease of use. Our customers can seamlessly track their loan status via our intuitive platform. Besides, debtors enjoy the flexibility of contributing extra collateral, early loan repayment, or settling the loan by paying off the borrowed sum including accrued interest.

Should you ponder about securing a loan using digital currency, Cropty caters you with immediate coin loans. You can leverage against TrueUSD and receive Tether USDT. Our cryptocurrency backed loans afford a speedy and convenient remedy for your monetary requirements.

Why choose TrueUSD Cropty Loan

FAQ

What is Cropty TrueUSD Crypto Loan?

How do I pledge my assets and start borrowing with Cropty TrueUSD Crypto Loan?

What is LTV, and how much can I borrow from Cropty TrueUSD Crypto Loan?

Are there limits to how much I can pledge and borrow?

What is loan liquidation, and what is the liquidation LTV?

What happens when a loan is liquidated?

What is a margin call?

Will I be notified in the event of margin calls or liquidations?

What interest rate applies to my loan?

How is interest accrued for my loan positions?

How do I repay my loan or adjust my LTV?

Which cryptocurrencies can I pledge or borrow on Cropty Crypto Loan?

What can I do with the cryptocurrencies borrowed from Cropty TrueUSD Crypto Loan?

More coins