What is Chiliz?

Chiliz (CHZ) is a digital currency for sports and entertainment, powering the world’s first blockchain-based fan engagement & rewards platform Socios.com. Fans can purchase & trade branded Fan Tokens as well as having the ability to participate, influence, and vote in club-focused surveys & polls. Chiliz aims to foster a blockchain ecosystem built for sports and entertainment.

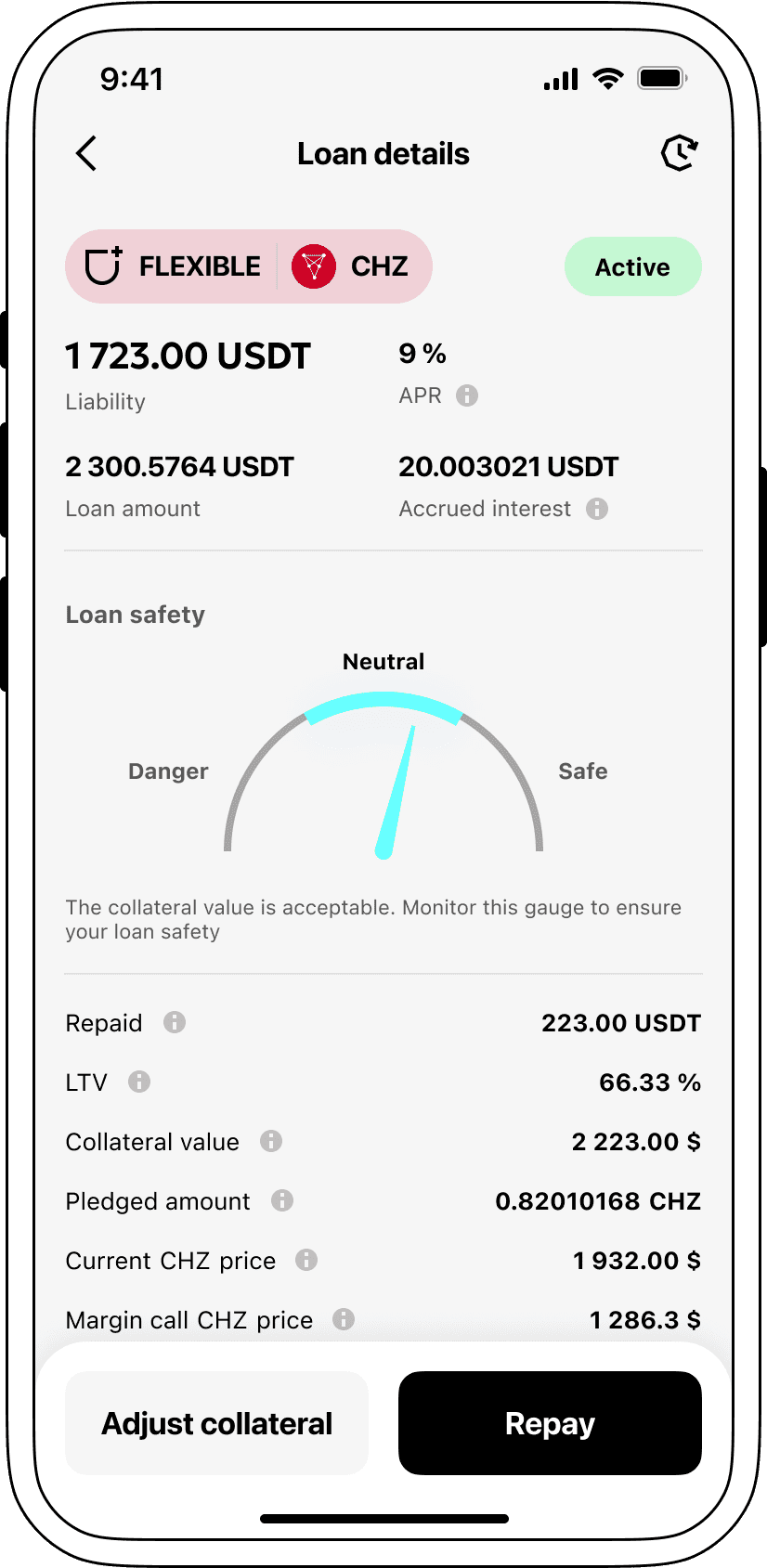

How do loans backed by CHZ works

Crypto-financing provides a straightforward resolution for those seeking and providing loans. Borrowers have the option to secure loans in USDT by using their crypto holdings, such as Chiliz (CHZ), as a guarantee, while retaining ownership of their digital wealth. This method bypasses the need for extensive credit assessments and paperwork, accelerating and streamlining the lending process.

On the lending side, participants can park their crypto fortune, for example Chiliz, in an exclusive account on Cropty's platform. The custodian presides over the proceedings between borrowers and lenders, ensuring a robust and secure transaction process. They operate as a dependable intermediary, securing the rights of all parties involved.

Borrowers gain from this system by receiving monetary support without the need to sell off their cryptocurrency. During periods of market instability, this can be invaluable as it avoids potential losses. The methodology also simplifies the lending cycle and negates the necessity for credit validations.

Lenders increase their assets through interest repayments on their lent funds, thereby profiting from their cryptocurrency holdings. This creates an equally beneficial situation where borrowers obtain funds, and lenders earn favorable returns from their involvement.

The Cropty platform regulates the exchange between borrowers and lenders, with blockchain technology facilitating secure transactions without unneeded third parties. This technology significantly diminishes fraud risk and fosters a safe borrowing and lending climate.

Chiliz Loan Calculator

Crypto Loans explained

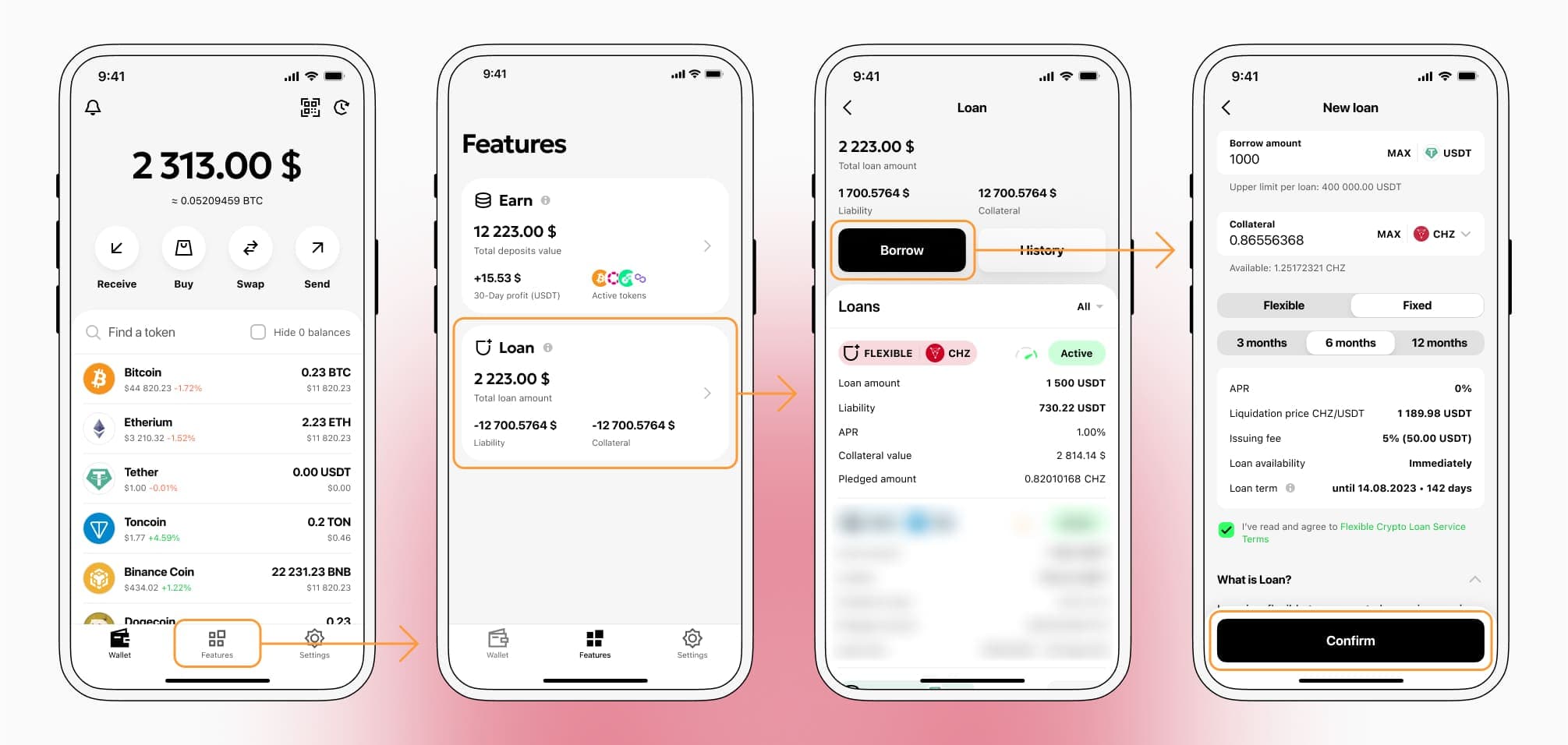

How to get a loan on Chiliz? Borrow usd against Chiliz on Cropty

The process of getting an Chiliz cryptocurrency loan is quite simple. First, you need to create your account on Cropty, a platform that offers Chiliz cryptocurrency lending services. Then, you need to provide your CHZ as collateral and specify the loan amount you want to borrow. The platform then evaluates your collateral and gives you access to the required amount of Tether USDT.

Your creditworthiness is determined based on the value of your collateral, making the process of getting a cryptocurrency loan fast and convenient.

However, it is important to remember that Chiliz cryptocurrency loans are not without risks. In case you default on the loan, your collateral can be seized. Therefore, you should carefully assess your repayment capacity before taking out a cryptocurrency loan.

To authorize an Chiliz Crypto Loan, you will need to go to Features tab → Loan section → Borrow button

Choose the required loan amount the terms and conditions of the crypto loan, and apply for it by confirming it with a code from 2FA - application or E-mail or Telegram-bot.

Learn more about CHZ Crypto Loans

Interest rates for loans secured by Chiliz.

At Cropty, we emphasize offering competitive rates for our loans backed by cryptocurrency, prominently featuring a superb rate of 9%. Regardless of whether you require capital for individual or business ventures, our low-interest crypto loans provide a cost-efficient method for obtaining cash while holding onto your precious digital currencies.

A particular feature with Cropty’s crypto loans is the idea of collateralization. Should a borrower fail to meet loan repayments, the CHZ collateral remains with us at Cropty, and the borrower retains the issued Tether USDT. This structure guarantees an equitable path for retrieving debts, advantageous to all involved parties.

Mitigating the danger linked with Chiliz devaluation, at Cropty we employ a self-activating Liquidation Mechanism. If the worth of the provided collateral reduces beyond a defined limit, liquidation of the loan is triggered. This not only safeguards both lender and borrower from prospective losses in a market decline but also encourages proactive measures.

Another inherent quality at Cropty is our dedication to transparency and user comfort. Our clients can effortlessly supervise the status of their crypto loans via our interactive user interface. Additionally, partners have the leverage to increase their collateral, settle the debt before due, or cease the loan by settling the borrowed sums and accompanying interest.

Should the question arise about acquiring a loan with cryptocurrency, Cropty has the answer with our swift coin loans. Here you can lend against Chiliz and receive Tether USDT. Our digital-currency affiliated loans offer a prompt and user-friendly financial solution that suits your fiscal requirements.

Why choose Chiliz Cropty Loan

FAQ

What is Cropty Chiliz Crypto Loan?

How do I pledge my assets and start borrowing with Cropty Chiliz Crypto Loan?

What is LTV, and how much can I borrow from Cropty Chiliz Crypto Loan?

Are there limits to how much I can pledge and borrow?

What is loan liquidation, and what is the liquidation LTV?

What happens when a loan is liquidated?

What is a margin call?

Will I be notified in the event of margin calls or liquidations?

What interest rate applies to my loan?

How is interest accrued for my loan positions?

How do I repay my loan or adjust my LTV?

Which cryptocurrencies can I pledge or borrow on Cropty Crypto Loan?

What can I do with the cryptocurrencies borrowed from Cropty Chiliz Crypto Loan?

More coins