What is Decentralized USD?

USDD is a stablecoin issued by the TRON DAO Reserve. It’s pegged to the value of the US dollar and aims to provide a reliable, decentralized cryptocurrency for blockchain transactions. USDD can be used for payments, trading, staking and as a value store.

USDD is backed by a number of cryptocurrencies, including Bitcoin, Ethereum and TRON. To ensure stability and security, the reserve is over-collateralized, meaning that it holds more assets than the amount of USDD currently in circulation.

How do loans backed by USDD works

Cryptocurrency loans offer a simple choice for borrowers as well as for the counterparties. The former can get USDT loans while they use their crypto to back up the debt, thus the latter can maintain possession of their digital assets. The usual delay of credit checks and voluminous paperwork is eliminated. The transactions are faster and less costly.

For instance, a lender can take his digital currency, e.g., Decentralized USD (USDD), and deposit it into a tailored account on the Cropty platform. The appointed custodian manages the contractual relationship between the borrowers and the lenders, thus ensuring a safe encounter. They function as reliable intermediaries, thus enabling the protection of the interests of both parties.

As the borrower can take advantage of the loan offer without selling the cryptocurrency, the strategy is to be highly appreciated during the crisis in the market, thus helping the borrower avoid losses. The loan program not only makes the borrowing experience easier but also gets rid of the need for credit checks.

The lenders have the possibility to earn the interests on the money they have invested as loans are gradually repaid. It enables them to make a profit off their crypto holdings. It is a win-win situation where the borrowers get access to loans and the lenders get their returns from the amounts they contribute.

Cropty's platform is responsible for the completions of the orders between the borrowers and the lenders while using the blockchain technology to assure the security of the transactions without the presence of middlemen. This reduces the risk of fraud and generates a safe lending environment.

Decentralized USD Loan Calculator

Crypto Loans explained

How to get a loan on Decentralized USD? Borrow usd against Decentralized USD on Cropty

The process of getting an Decentralized USD cryptocurrency loan is quite simple. First, you need to create your account on Cropty, a platform that offers Decentralized USD cryptocurrency lending services. Then, you need to provide your USDD as collateral and specify the loan amount you want to borrow. The platform then evaluates your collateral and gives you access to the required amount of Tether USDT.

Your creditworthiness is determined based on the value of your collateral, making the process of getting a cryptocurrency loan fast and convenient.

However, it is important to remember that Decentralized USD cryptocurrency loans are not without risks. In case you default on the loan, your collateral can be seized. Therefore, you should carefully assess your repayment capacity before taking out a cryptocurrency loan.

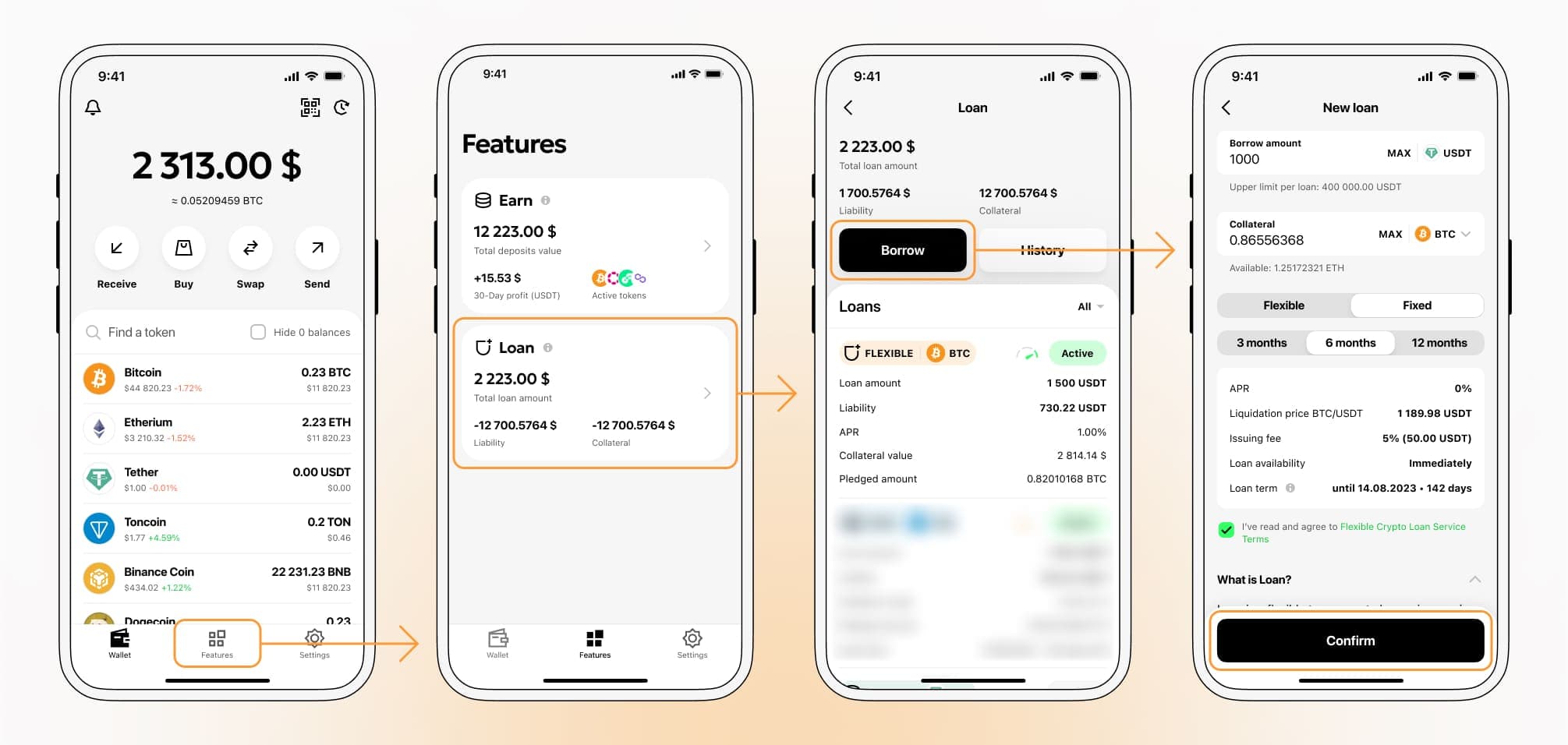

To authorize an Decentralized USD Crypto Loan, you will need to go to Features tab → Loan section → Borrow button

Choose the required loan amount the terms and conditions of the crypto loan, and apply for it by confirming it with a code from 2FA - application or E-mail or Telegram-bot.

Loans secured by Decentralized USD offer competitive interest rates.

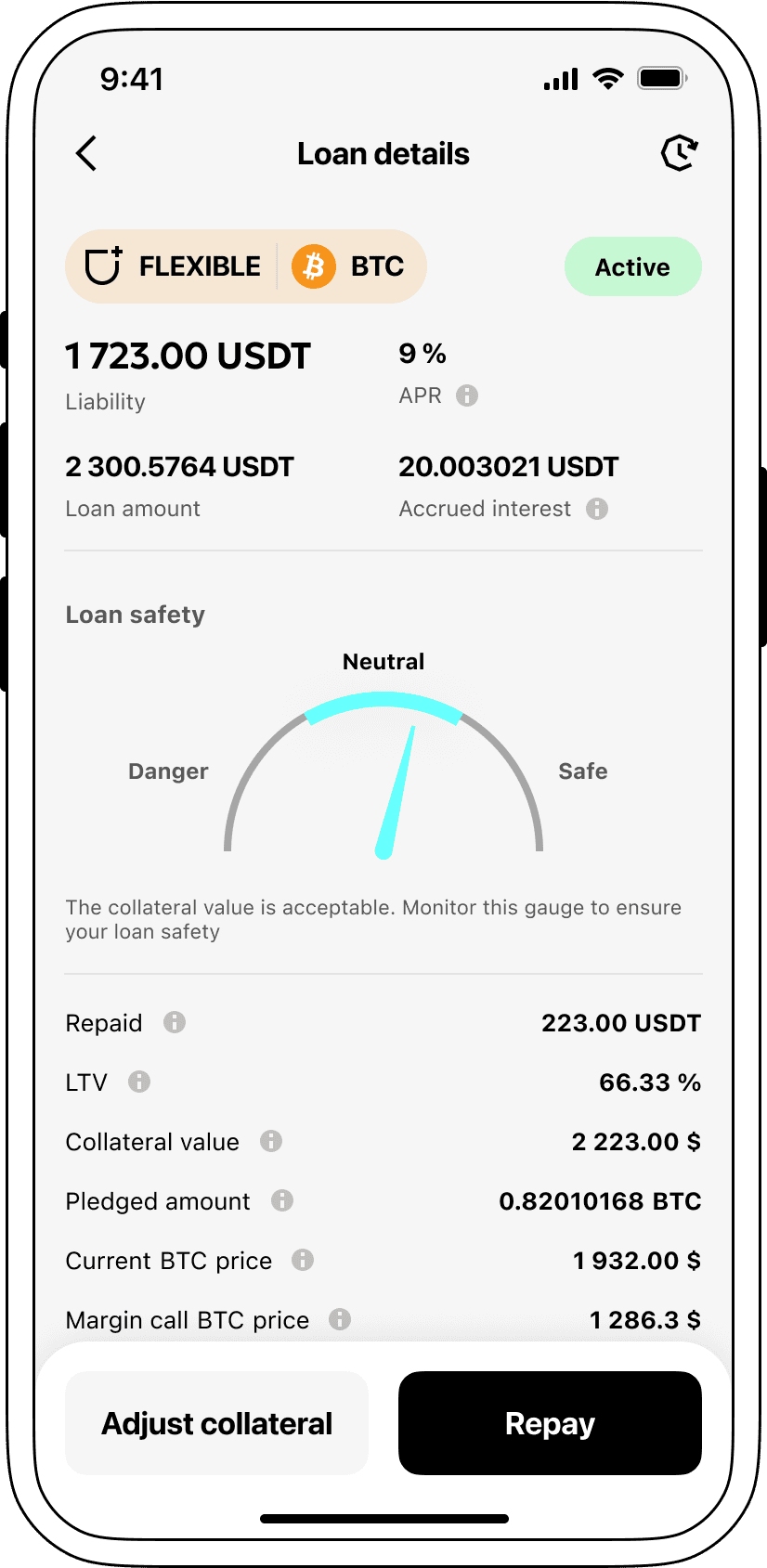

At Cropty, we have great consideration for the fact that the attractive interest rate plays a very important role. This is the reason we lend in cryptocurrency at a very attractive rate of only 9%. In case you need money for a private or business venture, our low-interest loans represent a less expensive option to have cash access without selling your precious cryptocurrencies.

One of the main characteristics that differentiate Cropty's collateral crypto loans from others is the collateral process. If the borrower does not repay, the USDD collateral remains with Cropty, while the borrower holds the Tether USDT that was issued to him/her. That way, an entirely fair and just method of loan recovery is at work, which helps both parties to the transaction.

In order to lower the risk of Dcentralized USD going down in value, Cropty decides an automatic liquidation system is the best measure. If the worth of the collateral falls under a certain limit, the loan that is backed by the collateral concerned will be immediately liquidated. This move made ahead of time keeps the lender and the borrower safe from losing a share of their assets during the market downturn.

Even so, Cropty makes everyone take the big swing in favor of the users in terms of transparency and simplicity. Through our user-friendly platform, our users can easily monitor the status of their loans. Additionally, borrowers who have allowed their debt to go into default will be able to use the funds to increase the collateral, actually pay off the loan early, or even discharge the loan by repaying the borrowed amount plus the interest accrued.

If you are interested in getting a crypto loan, Cropty offers you the possibility of getting a coin loan immediately. The use of Decentralized USD as collateral will allow you to obtain funds and get Tether USDT in return. Our crypto-backed loans are designed in a way that makes your solutions fast and easy.

Why choose Decentralized USD Cropty Loan

FAQ

What is Cropty Decentralized USD Crypto Loan?

How do I pledge my assets and start borrowing with Cropty Decentralized USD Crypto Loan?

What is LTV, and how much can I borrow from Cropty Decentralized USD Crypto Loan?

Are there limits to how much I can pledge and borrow?

What is loan liquidation, and what is the liquidation LTV?

What happens when a loan is liquidated?

What is a margin call?

Will I be notified in the event of margin calls or liquidations?

What interest rate applies to my loan?

How is interest accrued for my loan positions?

How do I repay my loan or adjust my LTV?

Which cryptocurrencies can I pledge or borrow on Cropty Crypto Loan?

What can I do with the cryptocurrencies borrowed from Cropty Decentralized USD Crypto Loan?

More coins