What is BNB?

Binance Coin is digital asset native to the Binance blockchain and launched by the Binance online exchange.

How do loans backed by BNB works

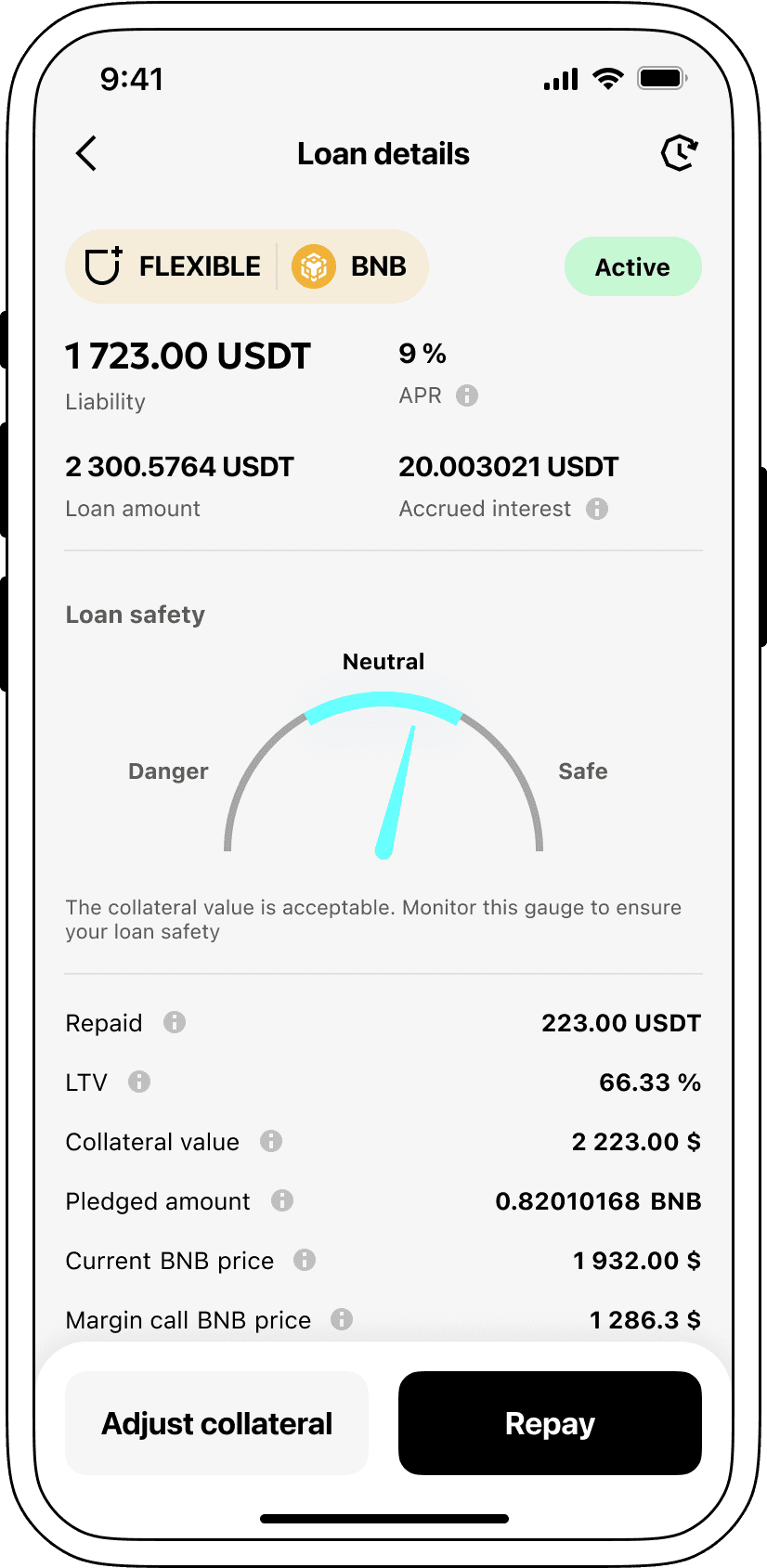

Cropty Loans offer a unique and simple mechanism. You can use your BNB tokens as collateral for your loan issued in USDT. At the same time, you retain absolutely all rights to your crypto assets - all your coins will be stored with us, as an intermediary of the process, with a guaranteed return of your funds, if the debt is repaid on time. We have minimized the bureaucratic process, due to which, loan approval takes a minimum of time. Your creditworthiness is calculated based on the collateral amount.

The process of obtaining a loan is very simple, you send your BNB to the Cropty Wallet, and then use them to receive USDT. Cropty automatically calculates the potential loan amount depending on the current value of the assets.

However, you can act on Cropty not only as a borrower, but also as an investor. By lending your money to potential borrowers, you can receive deductions and earn on your own crypto assets.

Cropty Wallet is a reliable mediator between moneylenders and borrowers. Our secure transactions will allow you to minimize theft, fraud or dishonest work of unknown intermediaries.

BNB Loan Calculator

Crypto Loans explained

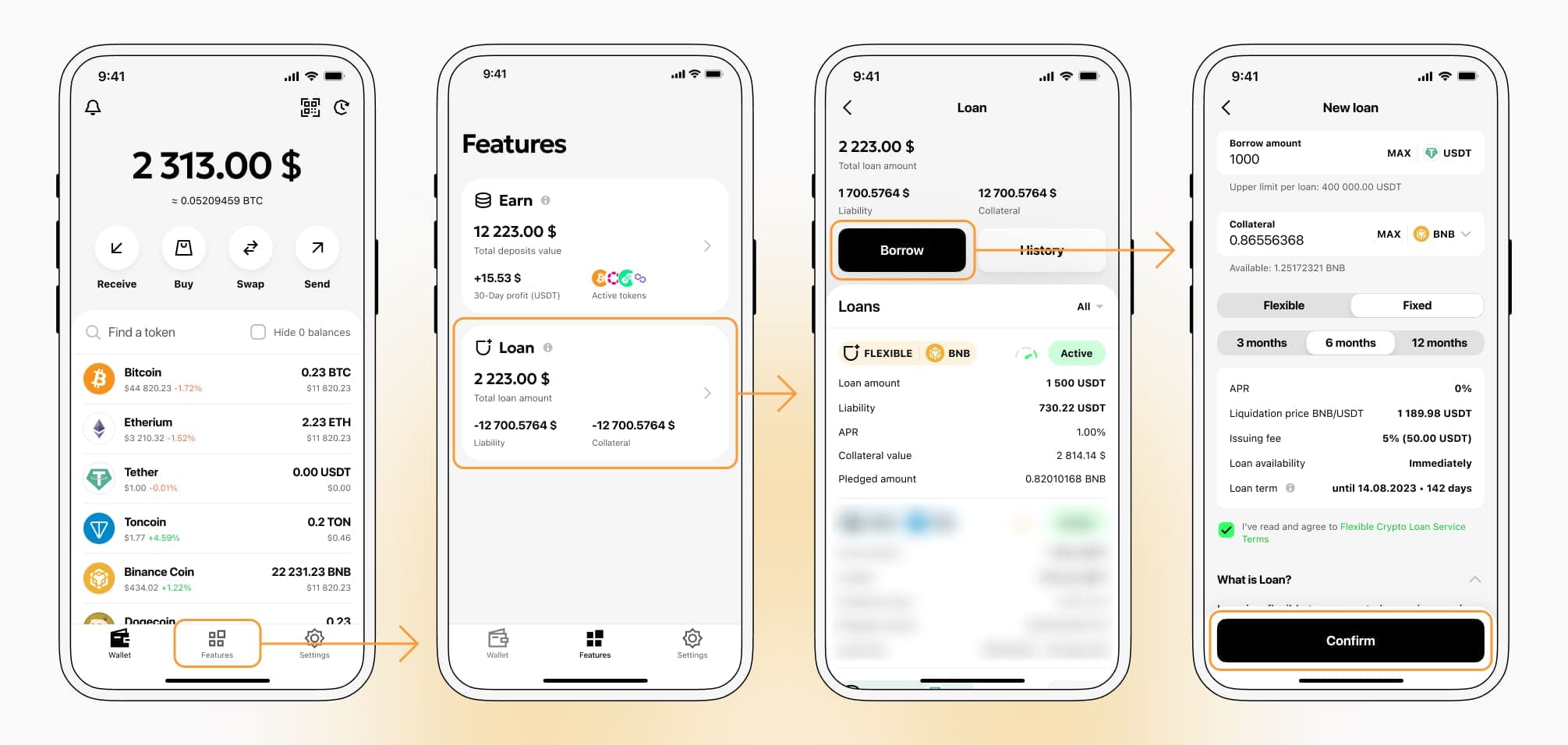

How to get a loan on BNB? Borrow usd against BNB on Cropty

The process of getting an BNB cryptocurrency loan is quite simple. First, you need to create your account on Cropty, a platform that offers BNB cryptocurrency lending services. Then, you need to provide your BNB as collateral and specify the loan amount you want to borrow. The platform then evaluates your collateral and gives you access to the required amount of Tether USDT.

Your creditworthiness is determined based on the value of your collateral, making the process of getting a cryptocurrency loan fast and convenient.

However, it is important to remember that BNB cryptocurrency loans are not without risks. In case you default on the loan, your collateral can be seized. Therefore, you should carefully assess your repayment capacity before taking out a cryptocurrency loan.

To authorize an BNB Crypto Loan, you will need to go to Features tab → Loan section → Borrow button

Choose the required loan amount the terms and conditions of the crypto loan, and apply for it by confirming it with a code from 2FA - application or E-mail or Telegram-bot.

Learn more about BNB Crypto Loans

Interest rates on loans secured by BNB.

Cropty prioritizes favorable interest rates so that everyone can use our service without any problems. That is why we set our loan rate at 9%. This is a modest figure for similar services, providing the borrower with the opportunity not to renounce the rights to precious BNB.

Our collateral system is what ensures that the entire lending process is honest and fair. In the event that the borrower is unable to repay their loan, the funds are transferred to Cropty, but the borrower retains all the USDT that they received earlier.

We also have automatic loan liquidation in the event that the asset shows high volatility, so we guarantee that neither you nor Cropty will lose your own funds. All participants, both the lender and the borrower, do not lose money in the event of a sharp devaluation of assets. This applies to absolutely all tokens presented in the loan section on Cropty and BNB in particular.

The most important thing for us is simplicity, honesty and transparency, which will allow you to use our service and return to it. User-friendly interface, clear dashboard, which gives you access to all the tools, including the possibility of early repayment - all this makes us an indispensable assistant on the way to your financial freedom and pleasure from using advanced tools.

Why choose BNB Cropty Loan

FAQ

What is Cropty BNB Crypto Loan?

How do I pledge my assets and start borrowing with Cropty BNB Crypto Loan?

What is LTV, and how much can I borrow from Cropty BNB Crypto Loan?

Are there limits to how much I can pledge and borrow?

What is loan liquidation, and what is the liquidation LTV?

What happens when a loan is liquidated?

What is a margin call?

Will I be notified in the event of margin calls or liquidations?

What interest rate applies to my loan?

How is interest accrued for my loan positions?

How do I repay my loan or adjust my LTV?

Which cryptocurrencies can I pledge or borrow on Cropty Crypto Loan?

What can I do with the cryptocurrencies borrowed from Cropty BNB Crypto Loan?

More coins