What is Avalanche?

Avalanche is an open-source platform for launching decentralized finance applications and enterprise blockchain deployments in one interoperable, scalable ecosystem. Developers who build on Avalanche can create applications and custom blockchain networks with complex rulesets or build on existing private or public subnets.

How do loans secured by AVAX work?

Cryptoloans provide a straightforward and efficient solution that is attractive to both the borrowing and lending sides of the market. By taking out a loan in USDT, the borrowers can use their crypto assets as collateral and at the same time they can keep ownership of their crypto funds. There is no need for a comprehensive credit check or tons of paperwork which usually take a long time and are complicated; this way, the process is much easier and cheaper.

Lenders can in return, for example, transfer their cryptocurrencies like Avalanche (AVAX) to the correctly selected account on the Cropty network. Moreover, a third party is hired to keep track of the cooperative connection between the borrower and the creditor. This third party provides assistance in maintaining fairness as well as in defending the interests of the two parties.

It is on the borrower side that this brings a huge advantage since he or she is able to have the money he or she needs at hand without the need to sell his or her crypto assets. This fact is very advantageous in the case of market volatility, as this alternative acts as a shield against unexpected financial losses. Furthermore, the credit system is made simpler by the fact that it completely gets rid of the checks on the borrower's creditworthiness.

On the other hand, the lenders will get a profit out of their invested digital assets in the form of interest payments. The situation presents the option of maximising the potential of their digital assets to them, therefore, they are able to get the most of it. As a result, the win-win scenario occurs i.e. the borrowers can get the loans they need, whereas lenders can get the benefits advanced above.

Cropty is a platform that aids in the easy performance and checking of operations between borrowing and lending parties. It takes advantage of the blockchain technology to make sure that the transactions are secure and peer-to-peer.

Avalanche Loan Calculator

Crypto Loans explained

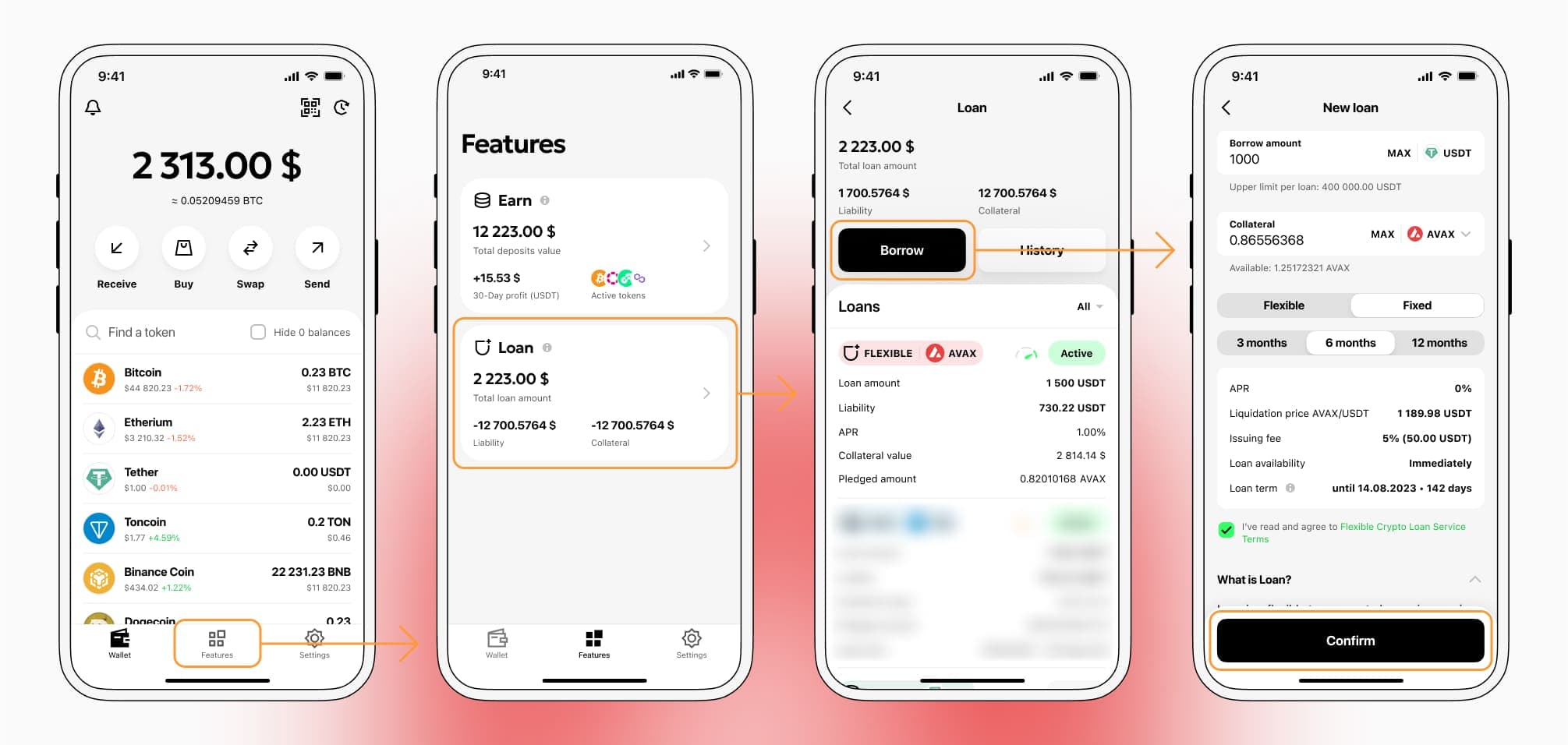

How to get a loan on Avalanche? Borrow usd against Avalanche on Cropty

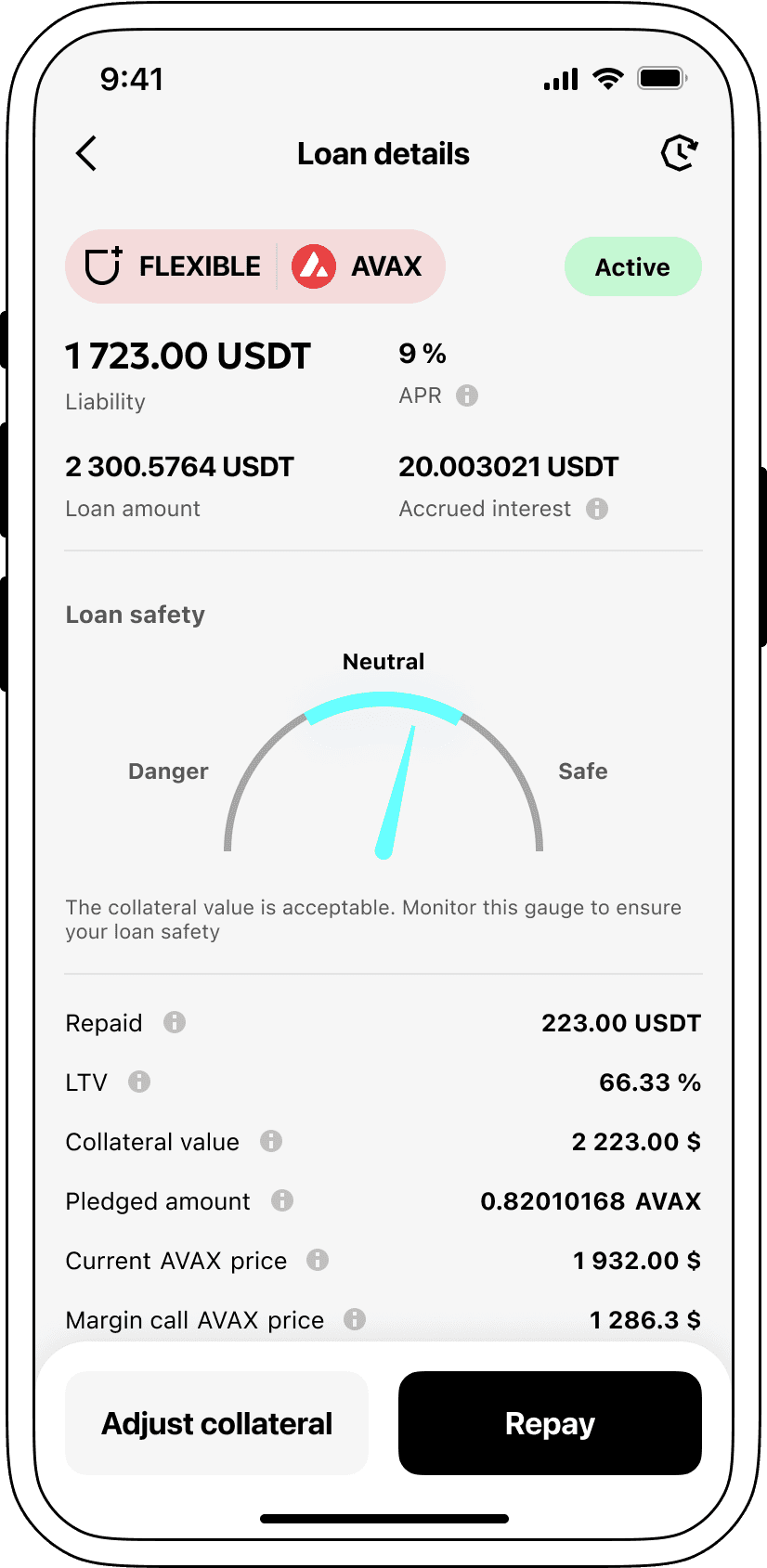

The process of getting an Avalanche cryptocurrency loan is quite simple. First, you need to create your account on Cropty, a platform that offers Avalanche cryptocurrency lending services. Then, you need to provide your AVAX as collateral and specify the loan amount you want to borrow. The platform then evaluates your collateral and gives you access to the required amount of Tether USDT.

Your creditworthiness is determined based on the value of your collateral, making the process of getting a cryptocurrency loan fast and convenient.

However, it is important to remember that Avalanche cryptocurrency loans are not without risks. In case you default on the loan, your collateral can be seized. Therefore, you should carefully assess your repayment capacity before taking out a cryptocurrency loan.

To authorize an Avalanche Crypto Loan, you will need to go to Features tab → Loan section → Borrow button

Choose the required loan amount the terms and conditions of the crypto loan, and apply for it by confirming it with a code from 2FA - application or E-mail or Telegram-bot.

Learn more about AVAX Crypto Loans

Interest rates on loans secured by Avalanche.

Avalanche or AVAX is increasingly turning out to be a more attractive option for loans in the crypto space. Without going through the process of selling the assets, a user can have instant access to the money that is securely stored on their Avalanche wallet. Apart from that, it is also possible to borrow in USD with your Avalanche wallet as a security - the most liquid and handy way to solve your financial needs. People keep asking how does this work? Users first have to secure their loans with Avalanche as their backing. They will be given a loan worth a certain percentage of the value of Avalanche. Such crypto loans are a perfect way to take a short-term loan in USD while your Blaze remains untouched.

We at Cropty are aware that the rate of interest is a very important factor. This is the very reason why we offer a loan in crypto at the very agreeable rate of 9%. Whether for personal or business purposes, our economical low-interest loans are a perfect way to get liquid assets without selling your digital ones.

With Cropty it's fascinating to see the use of your crypto as security for a loan. In the event that the borrower defaults, the backup — AVAX will be with Cropty, whereas the borrower will have the Tether USDT issued. So, the process of getting the loan back done in this way is fair, and both parties win a "green hand".

To lower the risk of a drop in value, the Avalanche Cropty employs a fully automated liquidation system. If the value of the collateral drops and hits the pre-agreed boundary, the liquidation of the loan is activated. This anticipatory move shields both the lender and the borrower from the decrease of a market that is going down during the crash.

Concerned about taking out a digital currency loan? Cropty offers quick loans in the form of coins. Take a pledge on Avalanche, get Tether USDT, and unlock your wallet instantly with our collateralized crypto loans.

Why choose Avalanche Cropty Loan

FAQ

What is Cropty Avalanche Crypto Loan?

How do I pledge my assets and start borrowing with Cropty Avalanche Crypto Loan?

What is LTV, and how much can I borrow from Cropty Avalanche Crypto Loan?

Are there limits to how much I can pledge and borrow?

What is loan liquidation, and what is the liquidation LTV?

What happens when a loan is liquidated?

What is a margin call?

Will I be notified in the event of margin calls or liquidations?

What interest rate applies to my loan?

How is interest accrued for my loan positions?

How do I repay my loan or adjust my LTV?

Which cryptocurrencies can I pledge or borrow on Cropty Crypto Loan?

What can I do with the cryptocurrencies borrowed from Cropty Avalanche Crypto Loan?

More coins