What is Huobi Token?

Huobi Token is an ecosystem token launched by Huobi Global, offering benefits such as trading fee and margin discounts and access to certain trading events. Huobi has committed to using 20% of exchange revenues every quarter to buy HT in the open market and subsequently burn. They also burn tokens used in FastTrack to vote on token listings as well as for ticket sales from Huobi Prime Initial Exchange Offerings (IEO)

How do loans backed by HT works

Cryptocurrency lending presents an uncomplicated avenue for both creditors and borrowers. Borrowers can leverage their digital currency as collateral for USDT loans, continuing to retain ownership of their digital holdings. This wipes away the hassiness from credit assessments and paperwork, making the route faster and more cost-effective.

Creditors can lodge their digital currencies, such as Huobi Token (HT), in a specific account on the Cropty framework. An authoritative custodian manages the dealings between creditors and borrowers, ensuring the course is safeguarded. They intervene as a trustworthy middle ground, securing the parties' best interests.

This feature aids borrowers by giving them financial access without selling their digital holdings. This benefit is particularly significant during unstable market occurrences, as potential losses can be skirted. The credit blueprint likewise simplifies the borrowing process and obliterates the roles of credit analysis.

Lenders profit from the interest accumulated on their deposited assets via loan paybacks. This yields them benefits from their cryptocurrency holdings. The situation serves both parties where borrowers secure loans while lenders profit from their participation. Cropty's infrastructure establishes governance over borrowers and lenders interactions with blockchain technology providing security for transactions sans middlemen. This mitigates fraud risks and cultivates a safer lending atmosphere.

Huobi Token Loan Calculator

Crypto Loans explained

How to get a loan on Huobi Token? Borrow usd against Huobi Token on Cropty

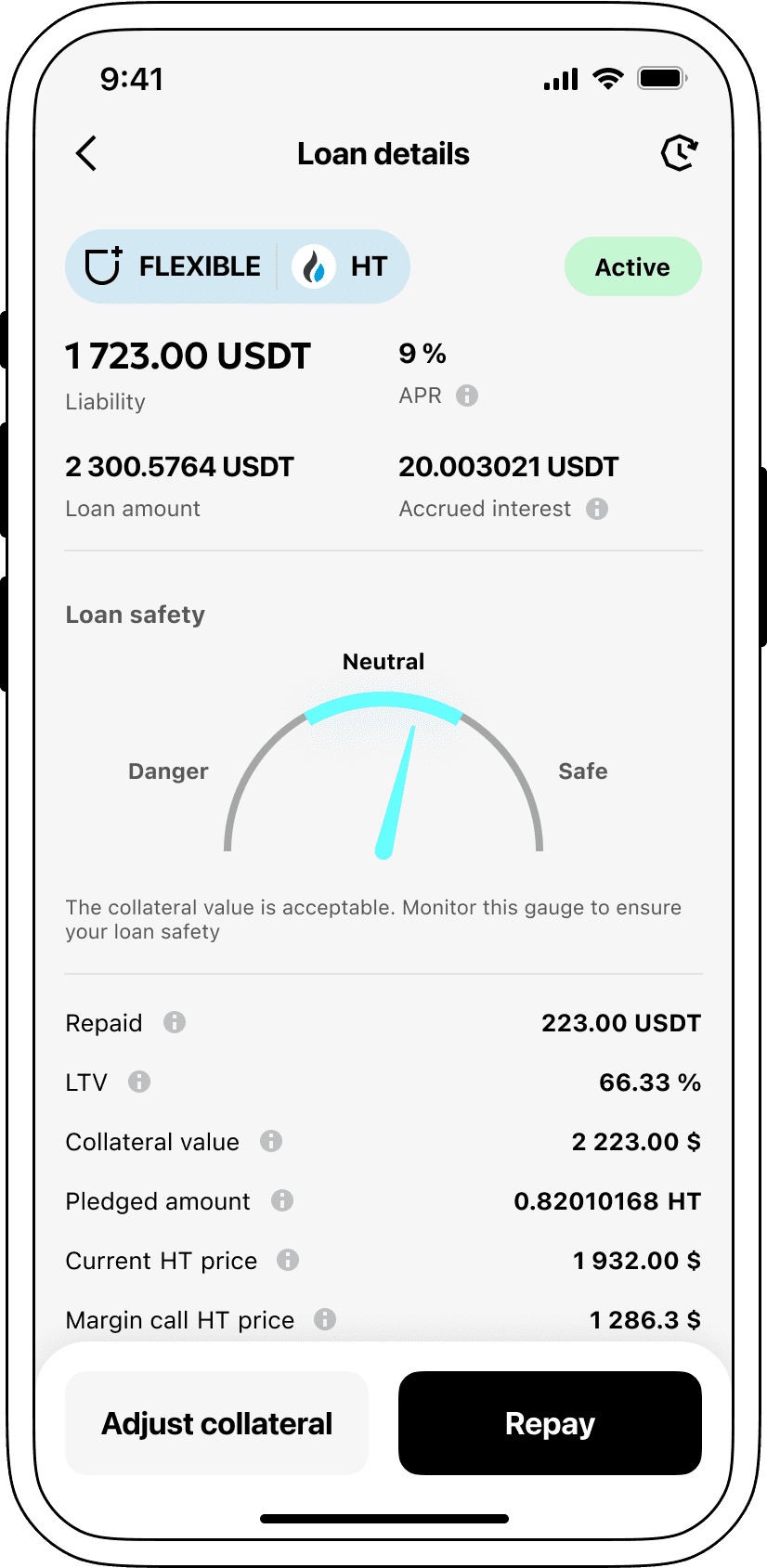

The process of getting an Huobi Token cryptocurrency loan is quite simple. First, you need to create your account on Cropty, a platform that offers Huobi Token cryptocurrency lending services. Then, you need to provide your HT as collateral and specify the loan amount you want to borrow. The platform then evaluates your collateral and gives you access to the required amount of Tether USDT.

Your creditworthiness is determined based on the value of your collateral, making the process of getting a cryptocurrency loan fast and convenient.

However, it is important to remember that Huobi Token cryptocurrency loans are not without risks. In case you default on the loan, your collateral can be seized. Therefore, you should carefully assess your repayment capacity before taking out a cryptocurrency loan.

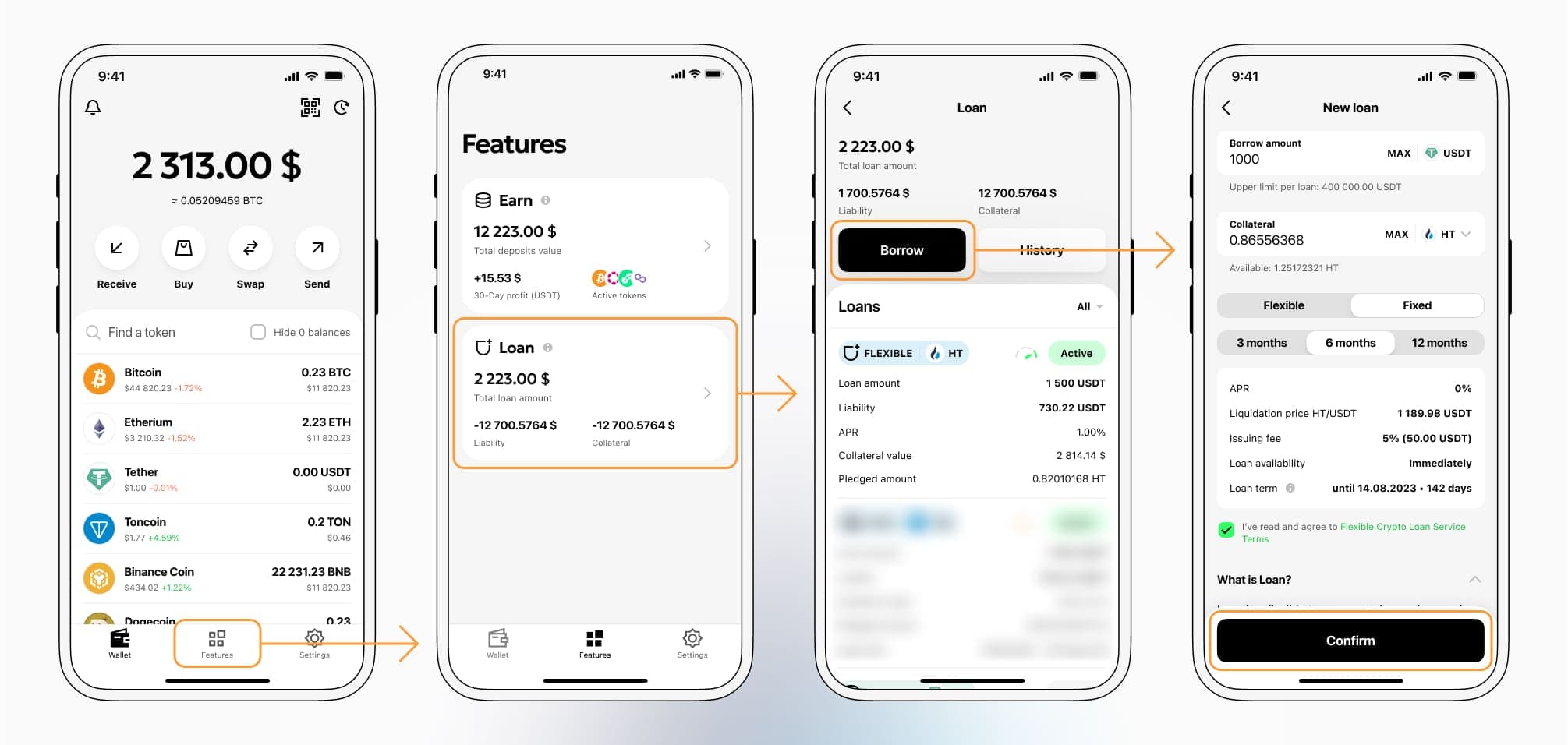

To authorize an Huobi Token Crypto Loan, you will need to go to Features tab → Loan section → Borrow button

Choose the required loan amount the terms and conditions of the crypto loan, and apply for it by confirming it with a code from 2FA - application or E-mail or Telegram-bot.

Learn more about HT Crypto Loans

Interest rates on loans secured by Huobi Token

At Cropty, we underscore the significance of budget-friendly interest rates. Hence, we furnish loans via cryptocurrency with a compelling interest rate of merely 9%. Our reasonably priced loans are an efficient strategy for sourcing liquidity, whether for personal or entrepreneurial undertakings, without the need to let go of your valuable digital assets.

A distinctive element of Cropty's crypto loans lies within the security protocol. When a loanster fails to meet the payment obligations, the collateral in the form of Huobi Token remains in Cropty's possession. The debtor, however, retains the issued Tether USDT, forging a fair guise for loan recourse beneficial to all invested parties.

Mitigating the risk of Huobi Token markdown, Cropty implements an automatic liquidation mechanism. If the collateral's market worth dips under a certain limit, liquidation of the loan is triggered. This preemptive action shields both involved parties from likely losses in a potential market slump.

Cropty prioritizes honesty and accessibility. Our clients can easily track their loan products' status via our intuitive user interface. Loansters can also choose to increase the collateral, repay the loan earlier than planned, or finalize the loan by paying back the primary amount and accumulated interest.

Eager to grasp how to obtain a loan utilizing cryptocurrency? Cropty furnishes immediate coin loans. Borrow against your Huobi Token and receive Tether USDT in exchange. Our crypto-guaranteed loans offer speedy and hassle-free solutions for your monetary requirements.

Why choose Huobi Token Cropty Loan

FAQ

What is Cropty Huobi Token Crypto Loan?

How do I pledge my assets and start borrowing with Cropty Huobi Token Crypto Loan?

What is LTV, and how much can I borrow from Cropty Huobi Token Crypto Loan?

Are there limits to how much I can pledge and borrow?

What is loan liquidation, and what is the liquidation LTV?

What happens when a loan is liquidated?

What is a margin call?

Will I be notified in the event of margin calls or liquidations?

What interest rate applies to my loan?

How is interest accrued for my loan positions?

How do I repay my loan or adjust my LTV?

Which cryptocurrencies can I pledge or borrow on Cropty Crypto Loan?

What can I do with the cryptocurrencies borrowed from Cropty Huobi Token Crypto Loan?

More coins