What is Cardano?

Cardano is an open-source, smart-contract platform that aims to provide multiple features through layered design. Its modularization will eventually allow for network delegation, sidechains, and light client data structures. Cardano uses a version of Proof-of-Stake (PoS) called Ouroboros to secure the network and manage the block production process. The network features a native token called ADA that gives stakers a claim on new issuance in proportion to their holdings and allows users to pay for transactions.

How do loans backed by ADA works

A win-win paradigm, crypto lending, provides an effortless workaround for both loan seekers and providers. Using their digital virtual assets as security, borrowers have the opportunity to obtain loans in the form of USDT, maintaining their ownership rights. By bypassing credit assessment and paperwork, the process becomes swifter and cost-effective.

Digital asset publishers, using currencies such as Cardano (ADA), have the option to put their currency into a distinct account within the Cropty platform. A custodian facilitates the interaction between the two parties, thereby ensuring a secure transaction. Acting as a reliable go-between, the custodian guarantees the protection of both parties' interests.

Holders of cryptocurrency can acquire funds without selling their digital assets – a major boon during unpredictable market movements, as it can deter potential financial loss. The loan mechanisms also streamline the borrowing process, voiding the requirement of a credit rating assessment.

Loan providers gain from interest earned via the repayment of loans, permitting them to turn a profit from their crypto resources. In this manner, both the borrower and the lender reap mutual benefits — the former acquire the loan, and the latter profits from participation.

The Cropty platform mediates the interplay between loan seekers and providers, utilizing blockchain technology to ensure the security of transactions without third-party involvement, mitigating the potential for fraudulent activities, and cultivating a safe lending habitat.

Cardano Loan Calculator

Crypto Loans explained

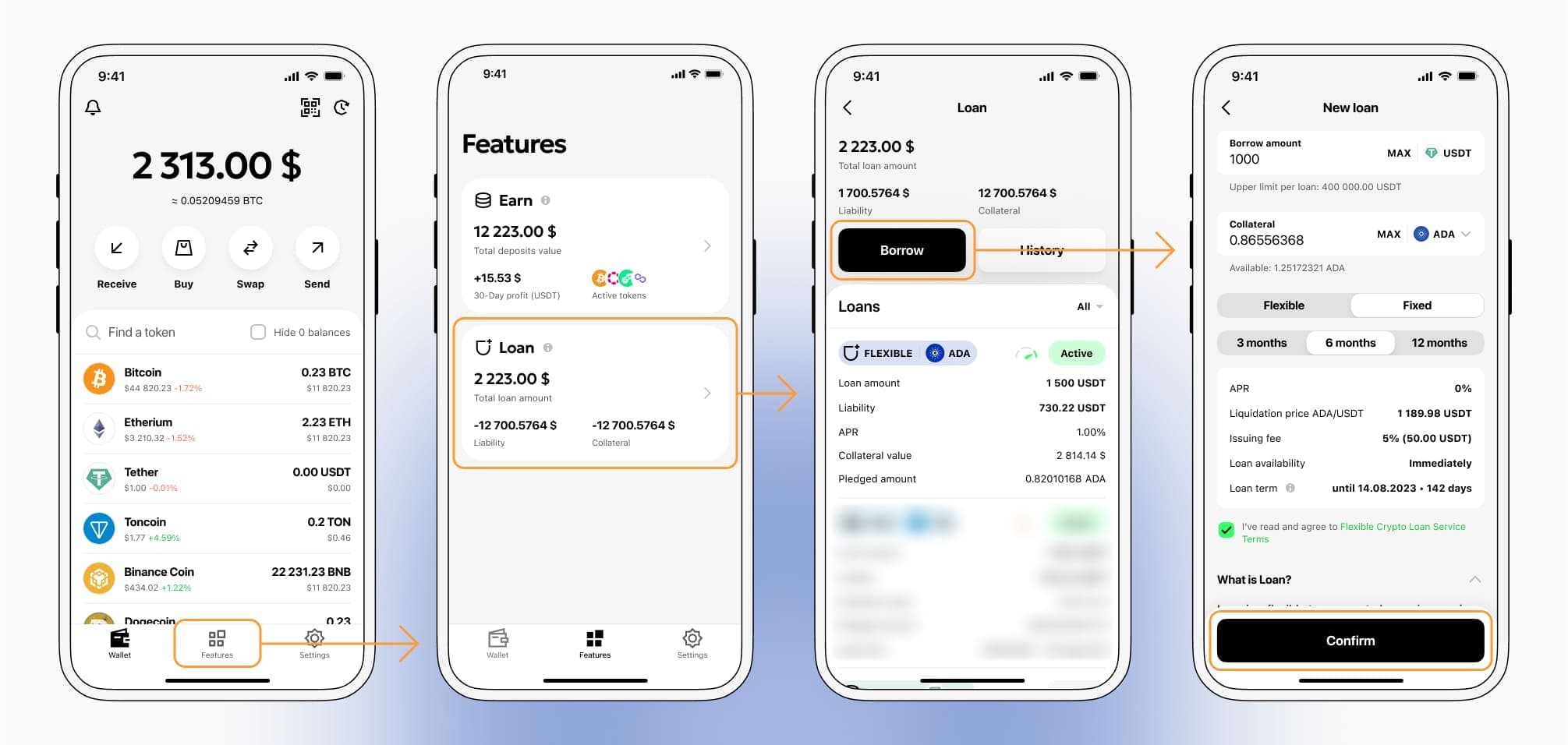

How to get a loan on Cardano? Borrow usd against Cardano on Cropty

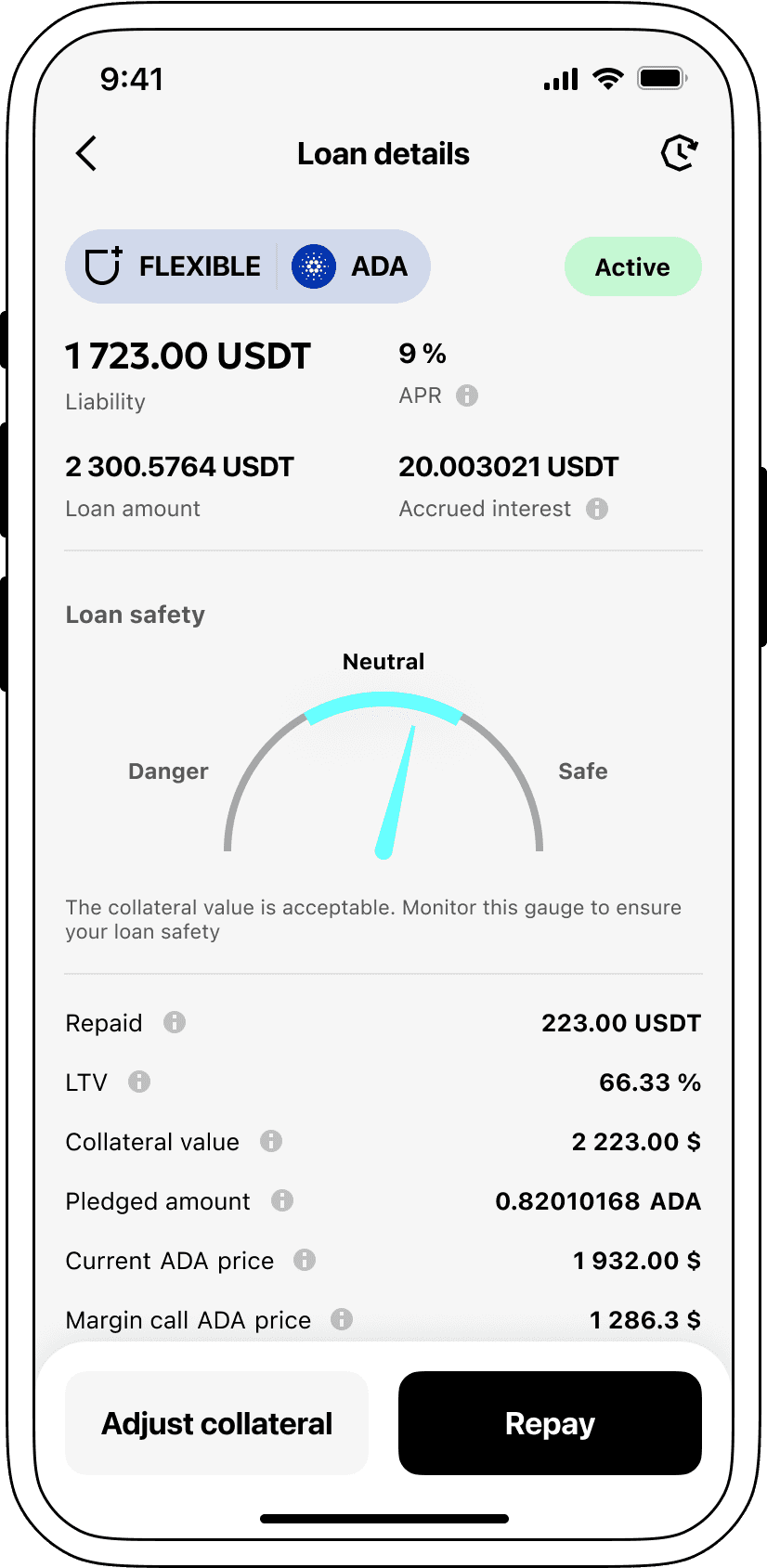

The process of getting an Cardano cryptocurrency loan is quite simple. First, you need to create your account on Cropty, a platform that offers Cardano cryptocurrency lending services. Then, you need to provide your ADA as collateral and specify the loan amount you want to borrow. The platform then evaluates your collateral and gives you access to the required amount of Tether USDT.

Your creditworthiness is determined based on the value of your collateral, making the process of getting a cryptocurrency loan fast and convenient.

However, it is important to remember that Cardano cryptocurrency loans are not without risks. In case you default on the loan, your collateral can be seized. Therefore, you should carefully assess your repayment capacity before taking out a cryptocurrency loan.

To authorize an Cardano Crypto Loan, you will need to go to Features tab → Loan section → Borrow button

Choose the required loan amount the terms and conditions of the crypto loan, and apply for it by confirming it with a code from 2FA - application or E-mail or Telegram-bot.

Learn more about ADA Crypto Loans

Interest rates of loans secured by Cardano.

Cropty understands the significance of competitive loan costs in the rapidly evolving blockchain landscape. For this reason, we provide loans that are backed up by cryptocurrency, specifically Cardano, at the irresistible interest rate of 9%. Our affordable loan solutions cater to your liquidity requirements, whether personal or business-related, without the need to offload your valuable digital assets.

A unique aspect of Cropty's Cardano-collateralized loan offerings is its secure process. If a loaner is unable to meet the payment deadline, the Cardano used as collateral stays with Cropty while the borrower continues to hold the Tether USDT provided. Such an approach safeguards fairness in the loan repayment process, creating a win-win situation for all involved.

To manage unavoidable risks such as Cardano depreciation, Cropty administration employs an automatic liquidation policy. In the event that the value of the collateral drops beyond a predetermined limit, the loan undergoes liquidation to prevent significant financial losses for both the lender and borrower during market declines.

At Cropty, we prioritize both transparency and efficiency, making it stress-free for our customers to keep track of their Cardano-backed loan operations via a clear and intuitive interface. Even more, our system allows borrowers the autonomy to boost their collateral, repay loans faster if feasible, or end the loan by settling the debt plus the accumulated interest.

At Cropty, getting a crypto- loan does not need to be strenuous. We offer immediate loans against your Cardano and provide you with Tether USDT. Thus, Cropty’s loan provisions are the go-to for secure, swift, and adaptable financial solutions to your needs.

Why choose Cardano Cropty Loan

FAQ

What is Cropty Cardano Crypto Loan?

How do I pledge my assets and start borrowing with Cropty Cardano Crypto Loan?

What is LTV, and how much can I borrow from Cropty Cardano Crypto Loan?

Are there limits to how much I can pledge and borrow?

What is loan liquidation, and what is the liquidation LTV?

What happens when a loan is liquidated?

What is a margin call?

Will I be notified in the event of margin calls or liquidations?

What interest rate applies to my loan?

How is interest accrued for my loan positions?

How do I repay my loan or adjust my LTV?

Which cryptocurrencies can I pledge or borrow on Cropty Crypto Loan?

What can I do with the cryptocurrencies borrowed from Cropty Cardano Crypto Loan?

More coins