What is USD Coin?

USD Coin (USDC) is fiat-collateralized stablecoin that offers the advantages of transacting with blockchain-based assets while mitigating price risk. Each USDC is issued as an ERC-20 token on the Ethereum blockchain and is 100% collateralized by a corresponding USD held in accounts subject to regular public reporting of reserves.

How do loans backed by USDC works

Crypto lending provides a straightforward approach for loan seekers and loan providers. Borrowers have the advantage of securing loans in USDT while pledging their digital currencies, retaining ownership of their digital wealth. This leads to a quicker, cost-effective process without necessitating credit inspections or documentation.

Loan providers have the ability to sink their digital assets, like USD Coin (USDC), into a specified account within the Cropty ecosystem. The Guardian coordinates the engagement between loan seekers and providers, enhancing the security of the process. They serve as a reliable go-between, ensuring the protection of both parties' interests.

Borrowers profit from this arrangement by unlocking capital reserves without disposing of their digital currencies. This proves beneficial during market instability, helping them skirt around potential losses. The lending model also streamlines the loan mechanism, pulling away the necessity for credit evaluations.

Lenders procure returns from the loans paid back, thereby making gains from their cryptocurrency wealth. It's a mutually beneficial circumstance, with borrowers obtaining loans and lenders securing profits from engagement.

Cropty's framework governs the exchange between loan seekers and providers, and blockchain tech upholds secure deals without third-party involvement. This diminishes fraud probabilities, setting up a safe lending ambiance.

USD Coin Loan Calculator

Crypto Loans explained

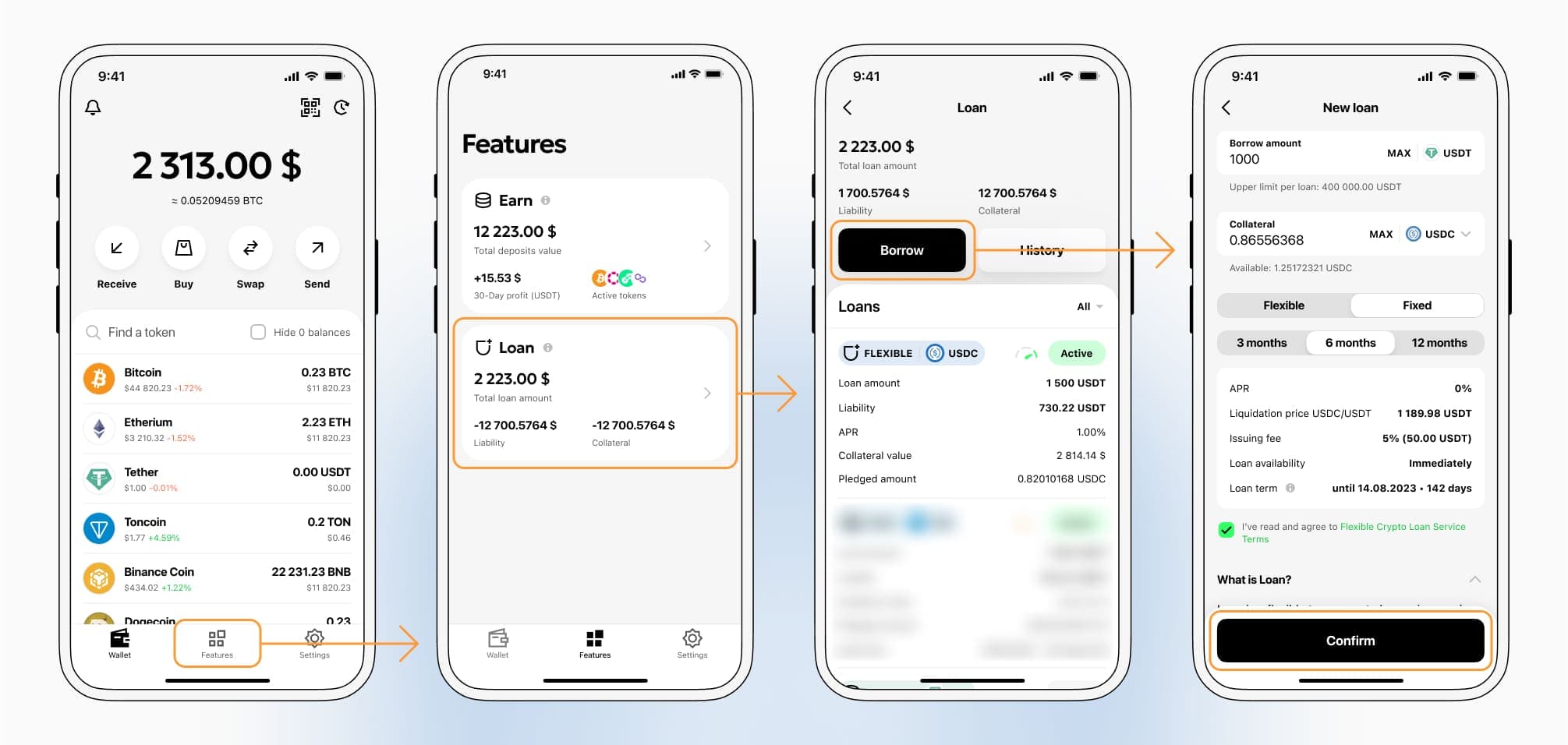

How to get a loan on USD Coin? Borrow usd against USD Coin on Cropty

The process of getting an USD Coin cryptocurrency loan is quite simple. First, you need to create your account on Cropty, a platform that offers USD Coin cryptocurrency lending services. Then, you need to provide your USDC as collateral and specify the loan amount you want to borrow. The platform then evaluates your collateral and gives you access to the required amount of Tether USDT.

Your creditworthiness is determined based on the value of your collateral, making the process of getting a cryptocurrency loan fast and convenient.

However, it is important to remember that USD Coin cryptocurrency loans are not without risks. In case you default on the loan, your collateral can be seized. Therefore, you should carefully assess your repayment capacity before taking out a cryptocurrency loan.

To authorize an USD Coin Crypto Loan, you will need to go to Features tab → Loan section → Borrow button

Choose the required loan amount the terms and conditions of the crypto loan, and apply for it by confirming it with a code from 2FA - application or E-mail or Telegram-bot.

Learn more about USDC Crypto Loans

Interest rates of loans secured by USD Coin.

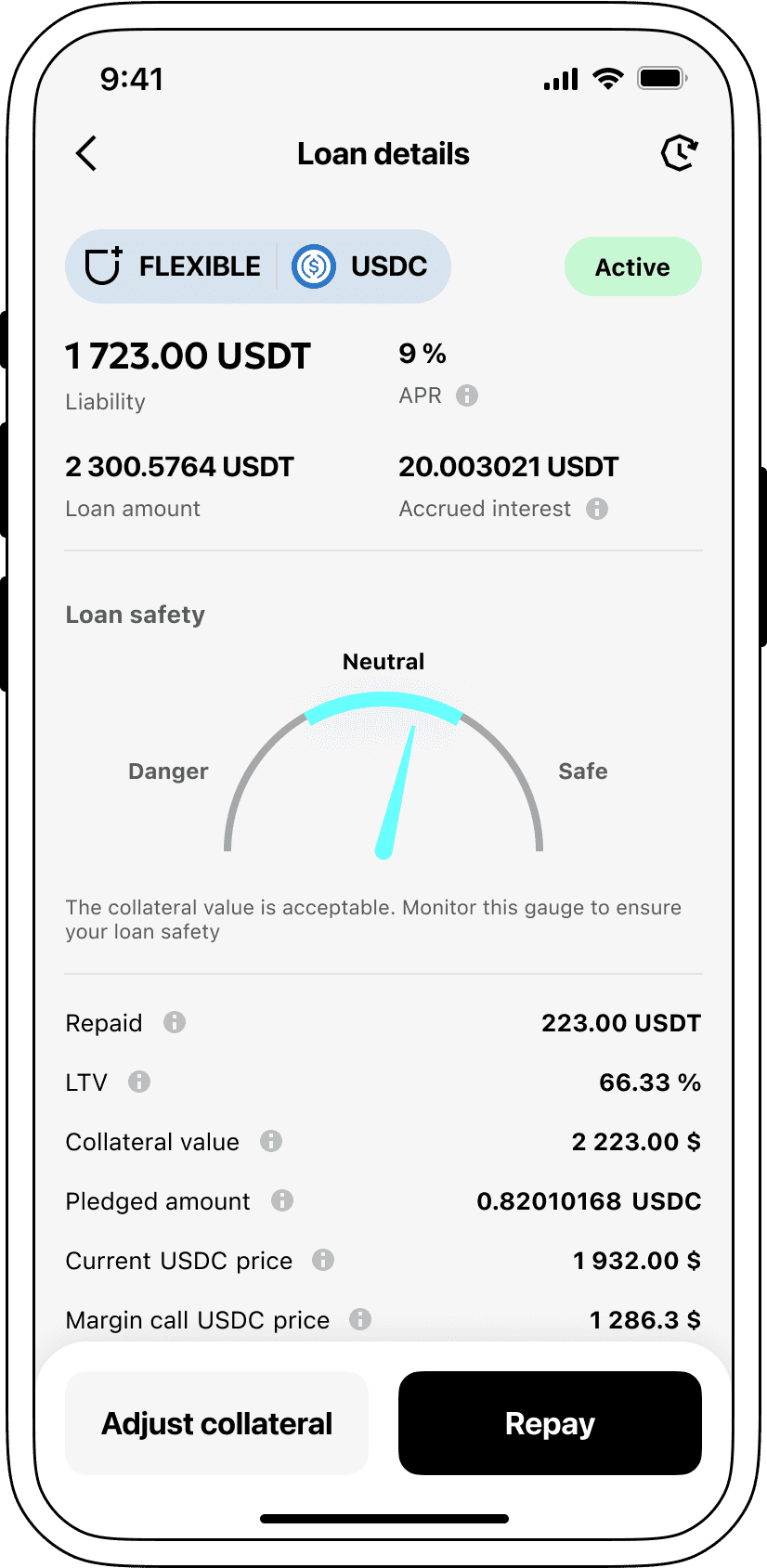

At Cropty, we acknowledge the critical role of lucrative interest rates. Consequently, we avail lending services through cryptocurrency with an unbeatable rate of 9%. If you seek monetary aid for private or commercial needs, our low-rate loans serve as an economical avenue for acquiring liquidity without parting with your precious cryptocurrencies.

The distinctive aspect of Cropty's crypto lending mechanism lies in its collateralization procedure. In case of a loan default, the USDC collateral remains secure with Cropty, while the debtor retains the given Tether USDT. This constituent offers a steady-handed method for loan recovery, profiting all stakeholders involved.

Facing USD Coin depreciation risk, Cropty incorporates an automated liquidation tool. Once the collateral’s value plunges beyond a set boundary, the loan enters liquidation. This anticipatory step safeguards the lender as well as the debtor against probable setbacks during a market decline.

Cropty sets its precedence on openness and simplicity. Customers can seamlessly oversee their loan product status via our intuitive platform. Moreover, debtors enjoy the liberty to commit more collateral, settle the loan prematurely, or resolve the loan with the repayment of the borrowed sum including cumulative interest.

In case you're pondering obtaining a loan through cryptocurrency, Cropty extends instant coin loans. You're permitted to pledge the USD Coin and secure Tether USDT. Our crypto-anchored loans constitute a swift and easy solution for your financial necessities.

Why choose USD Coin Cropty Loan

FAQ

What is Cropty USD Coin Crypto Loan?

How do I pledge my assets and start borrowing with Cropty USD Coin Crypto Loan?

What is LTV, and how much can I borrow from Cropty USD Coin Crypto Loan?

Are there limits to how much I can pledge and borrow?

What is loan liquidation, and what is the liquidation LTV?

What happens when a loan is liquidated?

What is a margin call?

Will I be notified in the event of margin calls or liquidations?

What interest rate applies to my loan?

How is interest accrued for my loan positions?

How do I repay my loan or adjust my LTV?

Which cryptocurrencies can I pledge or borrow on Cropty Crypto Loan?

What can I do with the cryptocurrencies borrowed from Cropty USD Coin Crypto Loan?

More coins