What is Bitcoin Cash?

Bitcoin Cash is a Bitcoin hard fork advocating for and building towards a literal interpretation of Bitcoin as a "peer-to-peer electronic cash system". It views cheap peer to peer transactions as the core value proposition of the network and is dedicated to increasing block sizes and on-chain transaction throughput in pursuit of this goal. Bitcoin Cash believes that starting as a medium of exchange is the superior route to becoming money in opposition to Bitcoin's strategy of first optimizing for securely storing value.

How do loans backed by BCH works

Crypto-loan brings an apt resolve for both debtors and lenders. Debts in USDT can be procured by debtors while leveraging their crypto for security, importantly, while retaining the possession of their crypto-coins. This cuts down the necessity for credit evaluations and paperwork, bringing speed and affordability into action.

Through Cropty's platform, lenders store their crypto-assets like Bitcoin Cash (BCH) in a separate account. A guardian supervises all interactions between debtors and creditors, assuring a contamination-free functionality. They take the responsibility of a reliable middleman, safeguarding the welfare of each party involved.

More importantly, it renders borrowers with immediate fund access without having to trade in their virtual assets. This comes in handy amidst volatile market states, enabling them to circumvent probable losses. Furthermore, this lending system demystifies the loan process by eliminating credit evaluations.

Lenders, on the other hand, reap interest from loan regains on deposited cryptocurrency, profiting from their virtual portfolio. It pans out to a mutual gain scenario: borrowers acquire loans and lenders gain from such participation.

Cropty's infrastructure supervises all traders and borrowers association, and blockchain tech guarantees robust transactions lacking unnecessary in-betweens. This drops down the odds of deceit, creating a well-secured lending milieu.

Bitcoin Cash Loan Calculator

Crypto Loans explained

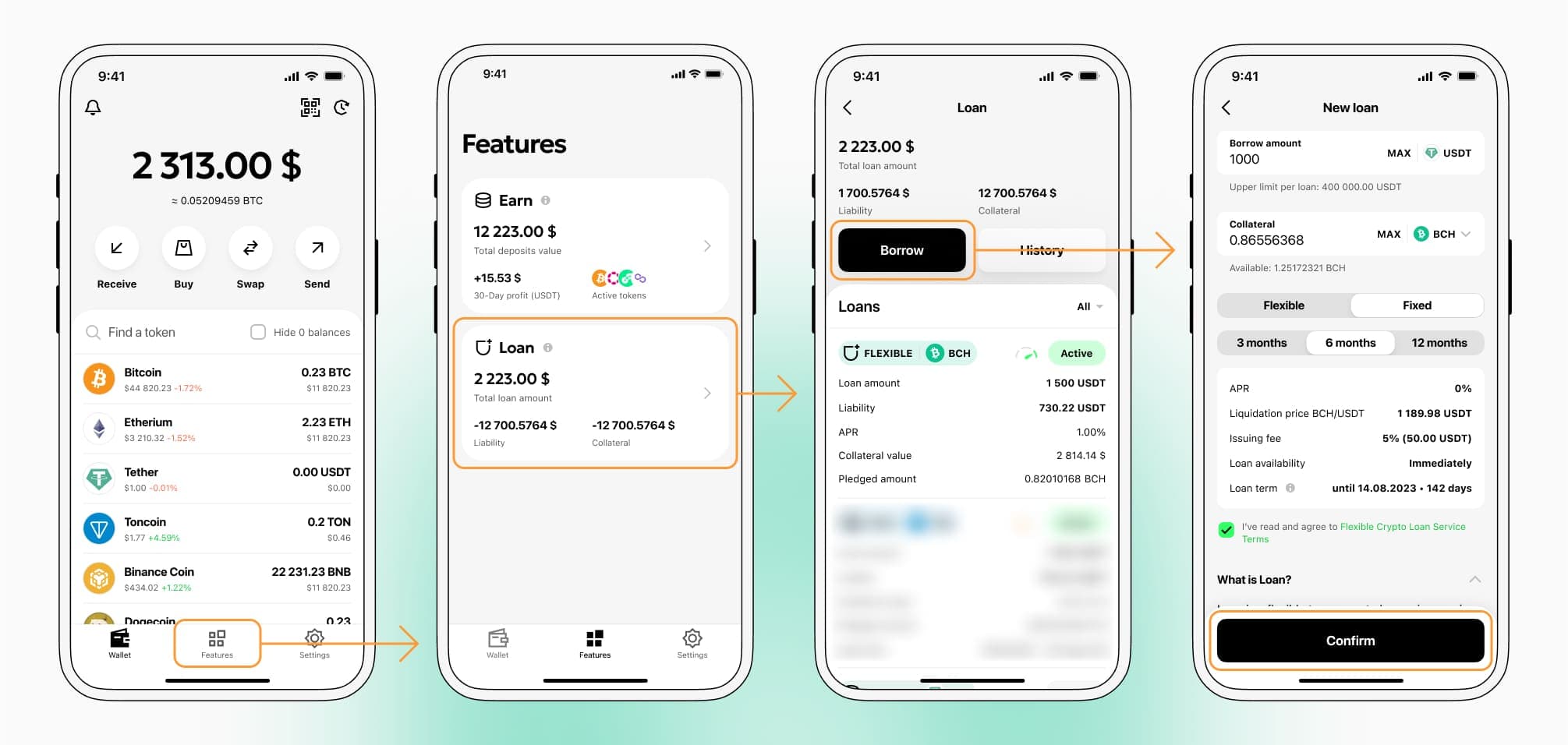

How to get a loan on Bitcoin Cash? Borrow usd against Bitcoin Cash on Cropty

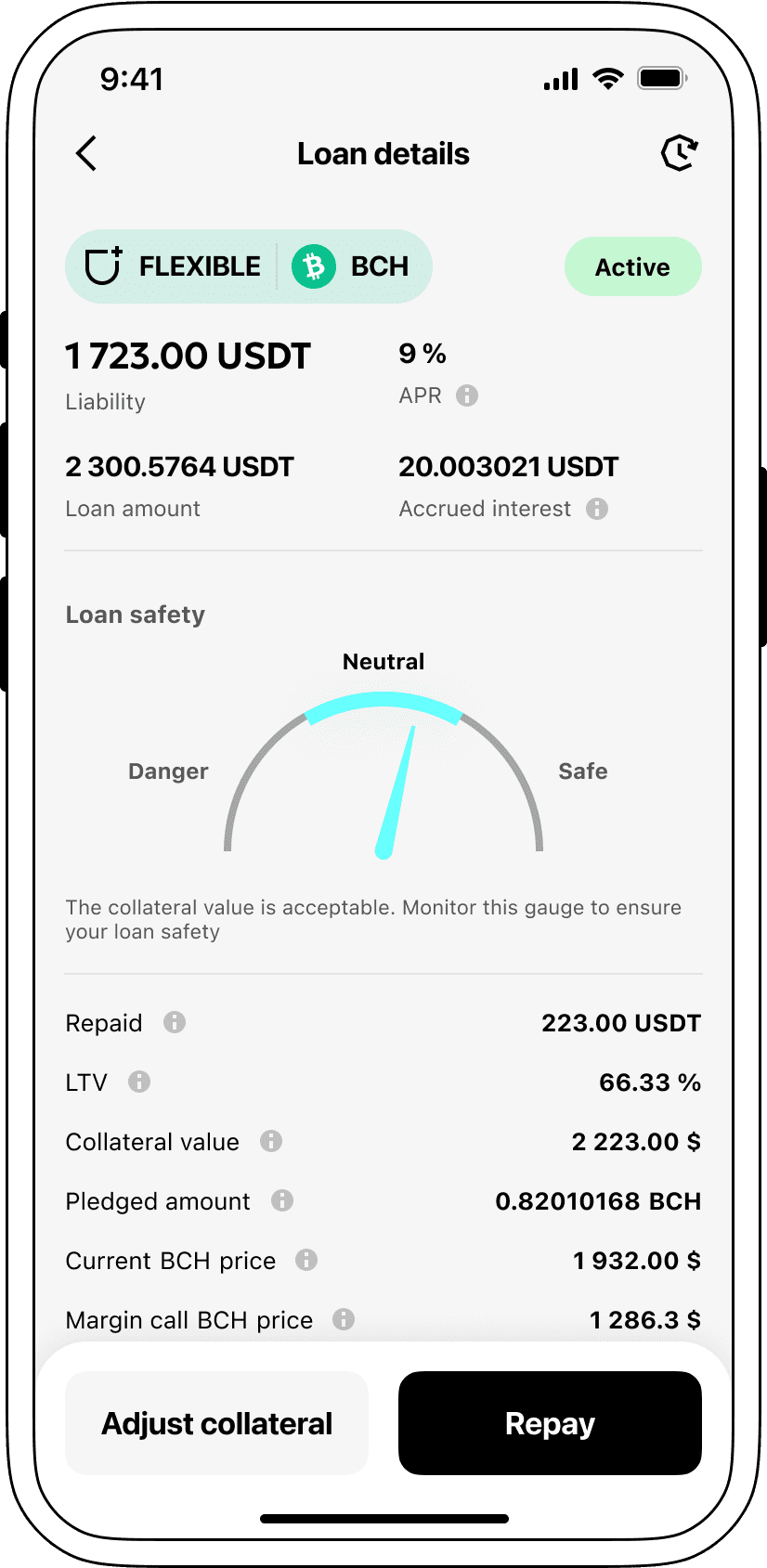

The process of getting an Bitcoin Cash cryptocurrency loan is quite simple. First, you need to create your account on Cropty, a platform that offers Bitcoin Cash cryptocurrency lending services. Then, you need to provide your BCH as collateral and specify the loan amount you want to borrow. The platform then evaluates your collateral and gives you access to the required amount of Tether USDT.

Your creditworthiness is determined based on the value of your collateral, making the process of getting a cryptocurrency loan fast and convenient.

However, it is important to remember that Bitcoin Cash cryptocurrency loans are not without risks. In case you default on the loan, your collateral can be seized. Therefore, you should carefully assess your repayment capacity before taking out a cryptocurrency loan.

To authorize an Bitcoin Cash Crypto Loan, you will need to go to Features tab → Loan section → Borrow button

Choose the required loan amount the terms and conditions of the crypto loan, and apply for it by confirming it with a code from 2FA - application or E-mail or Telegram-bot.

Learn more about BCH Crypto Loans

Interest rates for loans secured by Bitcoin Cash".

At Cropty, we prioritize competitive and attractive rates. We supply loans using cryptocurrencies with an appealable interest rate of 9%. Regardless of whether the necessity arises from personal or business demands, our low-rate loans offer a budget-friendly avenue accessible without needing to relinquish your treasured cryptos.

A distinguishing aspect of crypto loans from Cropty is the process of collateralization. Should a borrower default their loan, the BCH collateral stays at Cropty, yet the Tether USDT given out remains with the borrower. This cultivates a universally favorable strategy to reclaim the loan whilst servicing both parties involved.

Guarding against Bitcoin Cash deprecations, an automatic liquidation model is employed by Cropty. When the collateral worth dips beneath a vital level, the loan gets liquidated. This initiative safeguards both lender and borrower against potential drawbacks following market declines.

At Cropty, we hold transparency and user-experience high. Our customers can effortlessly track the activities of their loans via our intuitive platform. Moreover, borrowes have the latitude to enlarge their collateral, repay before the loan timelines, or terminate the loan by settling the initial amount coupled with compiled interest.

Wondering about securing a loan harnessing cryptocurrency? Cropty delivers prompt coin loans. Borrow against your Bitcoin Cash and obtain Tether USDT. Our backing of loans with crypto allows speedy and accessible financial solutions.

Why choose Bitcoin Cash Cropty Loan

FAQ

What is Cropty Bitcoin Cash Crypto Loan?

How do I pledge my assets and start borrowing with Cropty Bitcoin Cash Crypto Loan?

What is LTV, and how much can I borrow from Cropty Bitcoin Cash Crypto Loan?

Are there limits to how much I can pledge and borrow?

What is loan liquidation, and what is the liquidation LTV?

What happens when a loan is liquidated?

What is a margin call?

Will I be notified in the event of margin calls or liquidations?

What interest rate applies to my loan?

How is interest accrued for my loan positions?

How do I repay my loan or adjust my LTV?

Which cryptocurrencies can I pledge or borrow on Cropty Crypto Loan?

What can I do with the cryptocurrencies borrowed from Cropty Bitcoin Cash Crypto Loan?

More coins