What is Ethereum?

Ethereum is a distributed blockchain computing platform for smart contracts and decentralized applications. Its native token is ether (ETH), which primarily serves as a means of payment for transaction fees and as collateral for borrowing specific ERC-20 tokens within the decentralized finance (DeFi) sector.

How ETH-backed loans work

Cryptolending opens up an easier way to attract funds as well as lend surplus money. Digital asset owners, like those of Ethereum (ETH), are allowed to use it as a guarantee for a USDT loan and simultaneously keep it. As a result, a creditworthiness assessment and paperwork become unnecessary and at the same time the speed of the process goes up and it becomes more cost-effective.

Lenders deposit their virtual money, for example, ETH, into a special account supported by Cropty. The custodian carries out the exchange between the two parties, thus ensuring a safe transaction. They are the trustworthy middlemen who take care of the rights of both sides.

Loan takers apply this method to get the money they need without the need to sell their digital assets. It is particularly important during the fluctuation of the market in which they are able not to lose money. The borrowing system also makes the applicants credit-free as there is no need to check a credit report anymore.

The loan providers, in their turn, receive the interest portion of the loan which in its turn is reinvested thereby they make a good business out of their Ethereum assets. The result is double-win, and therefore the system of loans made on the blockchain fosters the birth of win-win situations.

The Cropty interface is responsible for these parties' interactions, while the blockchain technology ensures that no third party is involved in the transaction making it safe. This, in turn, lowers the risk of fraud to a minimum and creates a safe financial environment.

Ethereum Loan Calculator

Crypto Loans explained

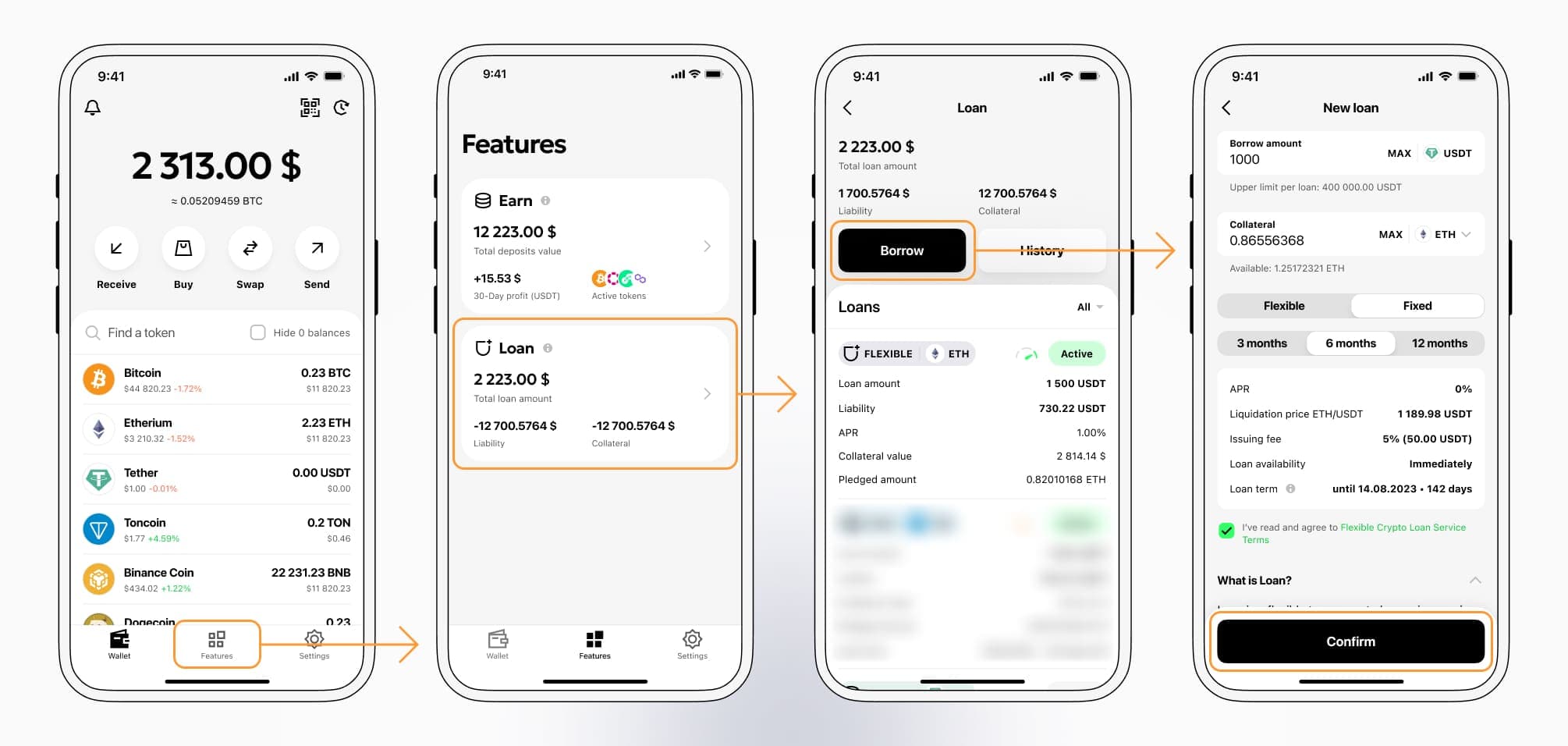

How to get a loan on Ethereum? Borrow usd against Ethereum on Cropty

The process of getting an Ethereum cryptocurrency loan is quite simple. First, you need to create your account on Cropty, a platform that offers Ethereum cryptocurrency lending services. Then, you need to provide your ETH as collateral and specify the loan amount you want to borrow. The platform then evaluates your collateral and gives you access to the required amount of Tether USDT.

Your creditworthiness is determined based on the value of your collateral, making the process of getting a cryptocurrency loan fast and convenient.

However, it is important to remember that Ethereum cryptocurrency loans are not without risks. In case you default on the loan, your collateral can be seized. Therefore, you should carefully assess your repayment capacity before taking out a cryptocurrency loan.

To authorize an Ethereum Crypto Loan, you will need to go to Features tab → Loan section → Borrow button

Choose the required loan amount the terms and conditions of the crypto loan, and apply for it by confirming it with a code from 2FA - application or E-mail or Telegram-bot.

Learn more about ETH Crypto Loans

Interest rates on loans secured by Ethereum.

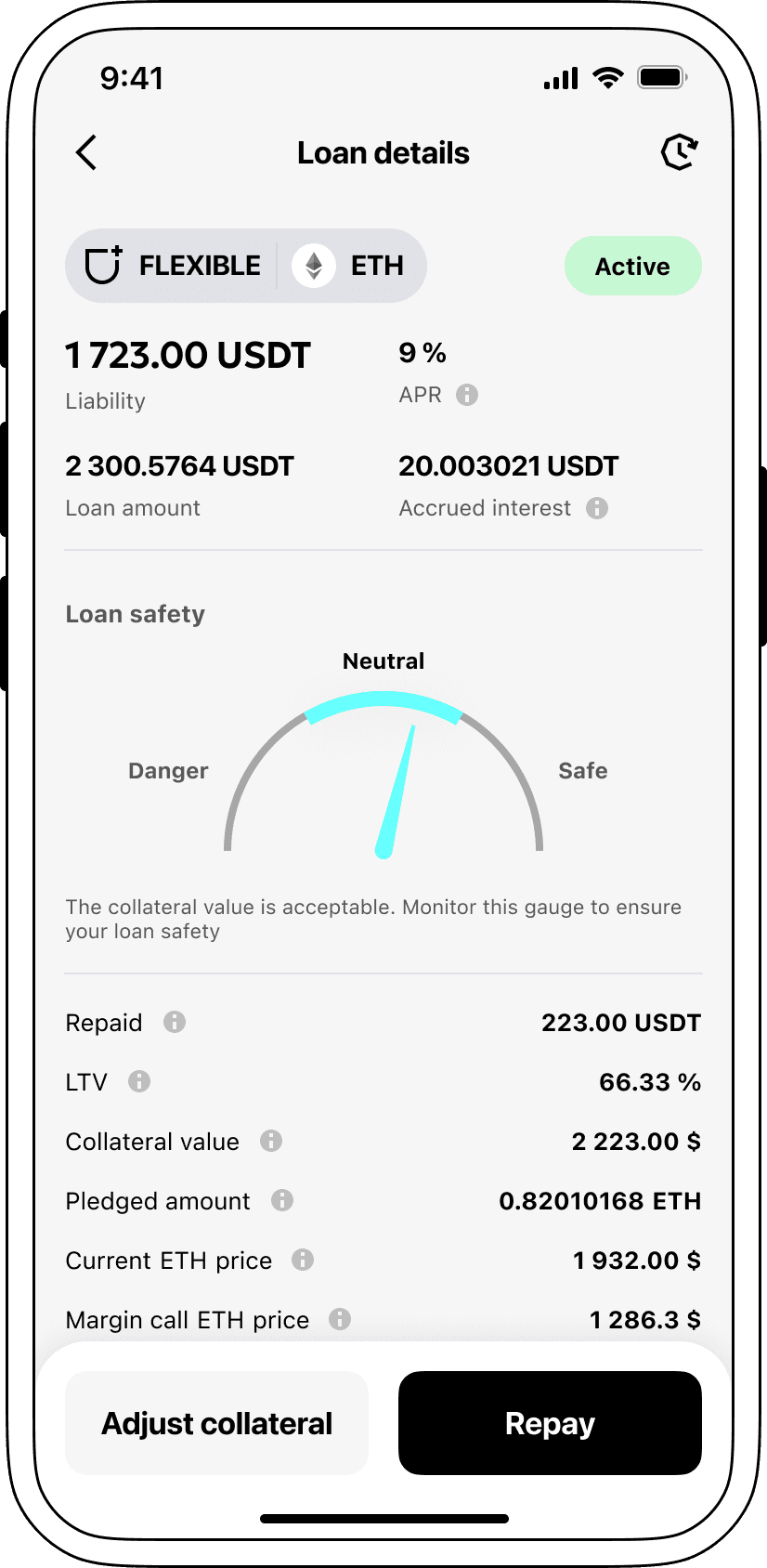

Cropty is attentive to your financial needs and is well aware that excellent interest rates are of great importance, that's why we are offering crypto-backed loans at a very attractive rate of 9%. Whether it is a personal or a business loan, our loans with a fair interest rate are the easiest way to have more cash at your disposal without selling your digital assets that are of great value.

One of the features that makes Cropty loans so different is their focus on cryptocurrency lol is the method by which the loan is secured with collateral. In case the borrower is not able to complete his part, Ethereum kept as a backup continues to be the property of Cropty, while the borrower gets the issued Tether USDT. By this means, a fair and balanced loan repayment system is created that is at everyone's disposal.

Cropty is employing an automated liquidation mechanism to safeguard against the potential decline of the value of Ethereum. When the value of the secured asset drops to the preset limit, the loan is automatically liquidated. This basic action carriers the parties involved from the danger of losing money in case of a market downturn.

Cropty is committed to openness and ease-of-use. Through our user-friendly platform, users can readily monitor the progress of their loan. Moreover, borrowers can be promoted with the option of adding more security to their loan, paying it off ahead of schedule, or ending the loan agreement by paying the sum borrowed plus the interest accrued.

If you are intent on a loan backed by your cryptocurrency, Cropty is the place to be. Cropty coin loans are readily available in the twinkle of an eye. Just put up your Ethereum loan as a safety net and accept Tether USDT. These crypto-backed loans are the quickest and easiest way to meet your financial needs.

Why choose Ethereum Cropty Loan

FAQ

What is Cropty Ethereum Crypto Loan?

How do I pledge my assets and start borrowing with Cropty Ethereum Crypto Loan?

What is LTV, and how much can I borrow from Cropty Ethereum Crypto Loan?

Are there limits to how much I can pledge and borrow?

What is loan liquidation, and what is the liquidation LTV?

What happens when a loan is liquidated?

What is a margin call?

Will I be notified in the event of margin calls or liquidations?

What interest rate applies to my loan?

How is interest accrued for my loan positions?

How do I repay my loan or adjust my LTV?

Which cryptocurrencies can I pledge or borrow on Cropty Crypto Loan?

What can I do with the cryptocurrencies borrowed from Cropty Ethereum Crypto Loan?

More coins