What is Dai Stablecoin?

Dai a fully collateralized stablecoin native to Maker's decentralized autonomous organization (DAO).

How do loans backed by DAI works

Crypto-financing is a simple success solution for both financial recipients and clients. Borrowers can get a loan in USDT, while the collateral for their digital currency remains the security of which is, so they stay in control of their digital assets. In this case, credit checks and forms are not required; therefore, the process becomes both faster and cost-efficient.

Cropty is such a decentralized platform that the traditional investors can transfer their cryptocurrencies (for example - Dai Stablecoin (DAI)) to a special account on it. Then an authorized officer/manager organizes the communication between the financial recipients and the investors, thus ensuring the safety of the process. In fact, the power is acting as the judge of the court, therefore, the two parties' interests are maintained at a safe level.

Users of such financial contracts form can, therefore, access liquid assets without selling their digital currency. It, thus, becomes a perfect situation during market turbulence, for they will not be facing possible shortages. The lending blueprint streamlines the loan procedure and abolishes the need for credit analyses.

Investors receive interest on the loans they have made from the capital that is returned to them. This way they can make money out of their digital currency holdings. As a result, a win-win situation occurs where the borrower gets the loan and the lender gets the rewards from his participation.

The Cropty system is the link that connects borrowers with lenders. Apart from that, blockchain technology enables completely secure and fraud-free trades without any intermediaries and, therefore, it lowers the risk of fraud and creates a safe environment for lending.

Dai Stablecoin Loan Calculator

Crypto Loans explained

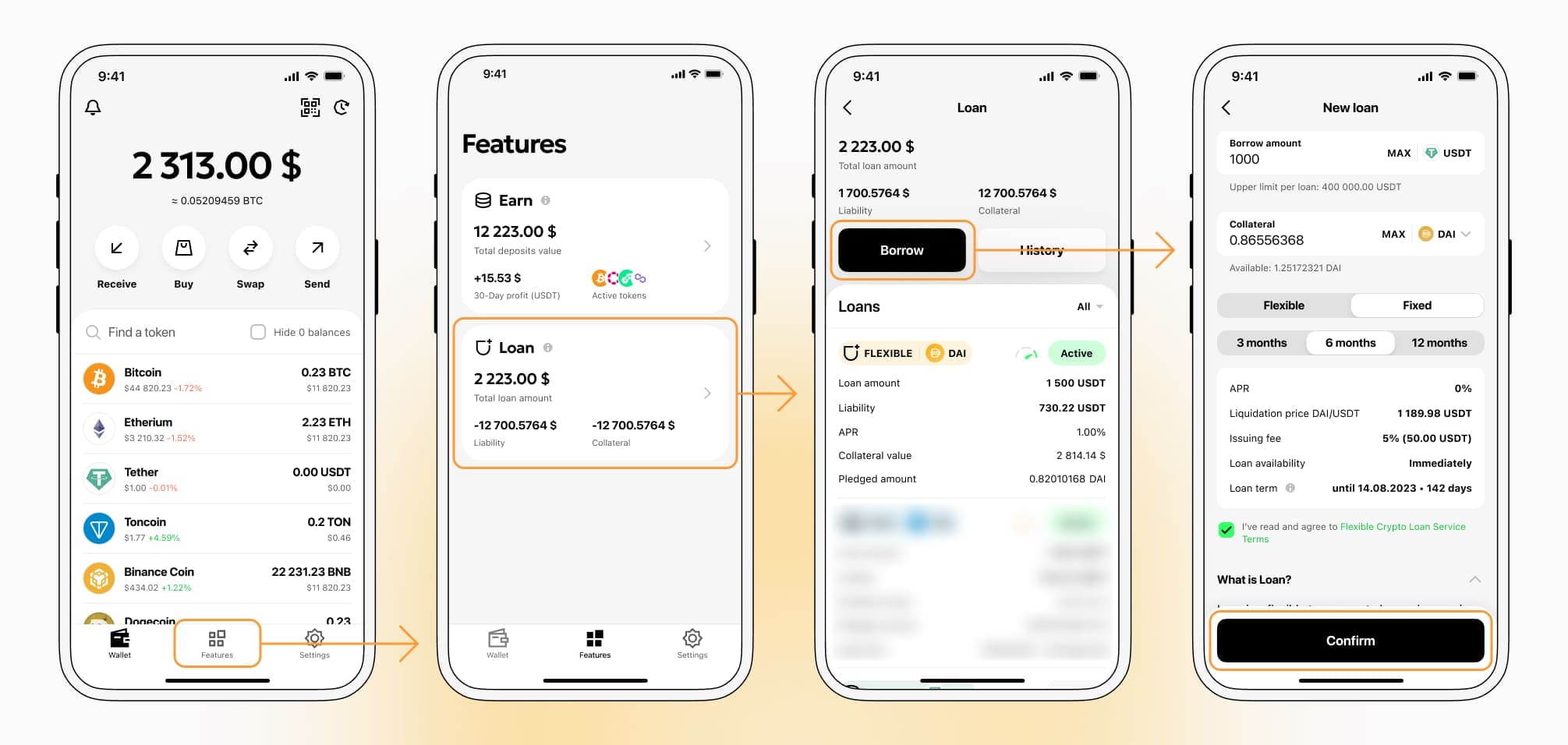

How to get a loan on Dai Stablecoin? Borrow usd against Dai Stablecoin on Cropty

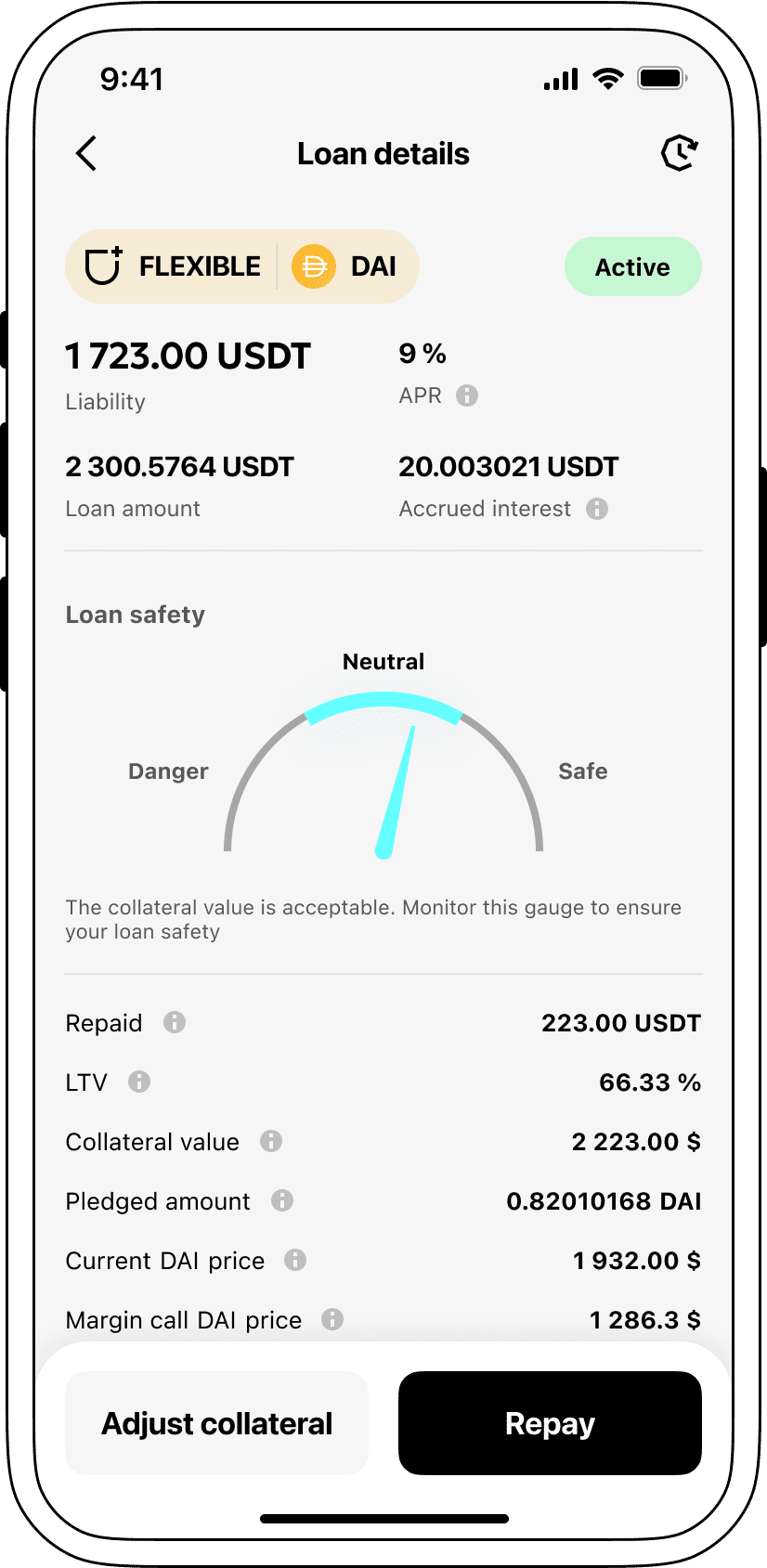

The process of getting an Dai Stablecoin cryptocurrency loan is quite simple. First, you need to create your account on Cropty, a platform that offers Dai Stablecoin cryptocurrency lending services. Then, you need to provide your DAI as collateral and specify the loan amount you want to borrow. The platform then evaluates your collateral and gives you access to the required amount of Tether USDT.

Your creditworthiness is determined based on the value of your collateral, making the process of getting a cryptocurrency loan fast and convenient.

However, it is important to remember that Dai Stablecoin cryptocurrency loans are not without risks. In case you default on the loan, your collateral can be seized. Therefore, you should carefully assess your repayment capacity before taking out a cryptocurrency loan.

To authorize an Dai Stablecoin Crypto Loan, you will need to go to Features tab → Loan section → Borrow button

Choose the required loan amount the terms and conditions of the crypto loan, and apply for it by confirming it with a code from 2FA - application or E-mail or Telegram-bot.

Learn more about DAI Crypto Loans

Interest rates for loans secured by Dai Stablecoin

The use of the crypto-backed loan that utilizes the Dai Stablecoin, or DAI, is becoming more popular day by day. Tools that allow for lending with the Dai Stablecoin enable persons to take on the role of borrowesrs or lenders, thereby generating a profit through the interest charged. They offer great advantages such as the ability to get a loan against one's Dai Stablecoin without having to sell the assets. In addition, borrowers are permitted to take out their loans in USD against DAI, thus guaranteeing fluidity and diversity.

Anyway, how does the Dai Stablecoin loan work? To the point, folks wrap their DAI as a safeguard, thus getting a loan as per the recognized market value. This money crypto-induced lending practice is a more convenient option for those who need the money quickly but who are still hesitating to give up their DAI investments.

Cropty is a top player when it comes to competitive lending rates, offering loans backed by digital currency at an attractive rate of 9%. Our low-interest crypto loans are the cheapest way of getting quick cash without selling your cryptocurrencies whether the need is for a personal or a trade-related pursuit.

The Cropty unique lending method provides one - the collateralization process involving the Dai stablecoin, which is a clear advantage. In case the loaner cannot perform the loan, the collateral DAI is kept at Cropty, while the Tether USDT that was originally issued stays with the loaner.

Such structuring stages in an impartial loan recovery process, which benefits all parties.

To protect against any decline in the value of Dai Stablecoin, Cropty has a feature that will automatically liquidate the loan if the value of the collateral falls below a certain threshold. In such a case, the loan will be immediately sold, thus ensuring safety for the lender and the borrower against a possible drop in the market.

Why choose Dai Stablecoin Cropty Loan

FAQ

What is Cropty Dai Stablecoin Crypto Loan?

How do I pledge my assets and start borrowing with Cropty Dai Stablecoin Crypto Loan?

What is LTV, and how much can I borrow from Cropty Dai Stablecoin Crypto Loan?

Are there limits to how much I can pledge and borrow?

What is loan liquidation, and what is the liquidation LTV?

What happens when a loan is liquidated?

What is a margin call?

Will I be notified in the event of margin calls or liquidations?

What interest rate applies to my loan?

How is interest accrued for my loan positions?

How do I repay my loan or adjust my LTV?

Which cryptocurrencies can I pledge or borrow on Cropty Crypto Loan?

What can I do with the cryptocurrencies borrowed from Cropty Dai Stablecoin Crypto Loan?

More coins