What is Maker?

Maker is a peer-to-contract lending platform enabling over-collateralized loans by locking Ether in a smart contract and minting Dai, a stablecoin pegged to the US dollar. Dai's stability is achieved through a dynamic system of collateralized debt positions, autonomous feedback mechanisms and incentives for external actors. Once generated, Dai can be freely sent to others, used as payments for goods and services, or held as long term savings.

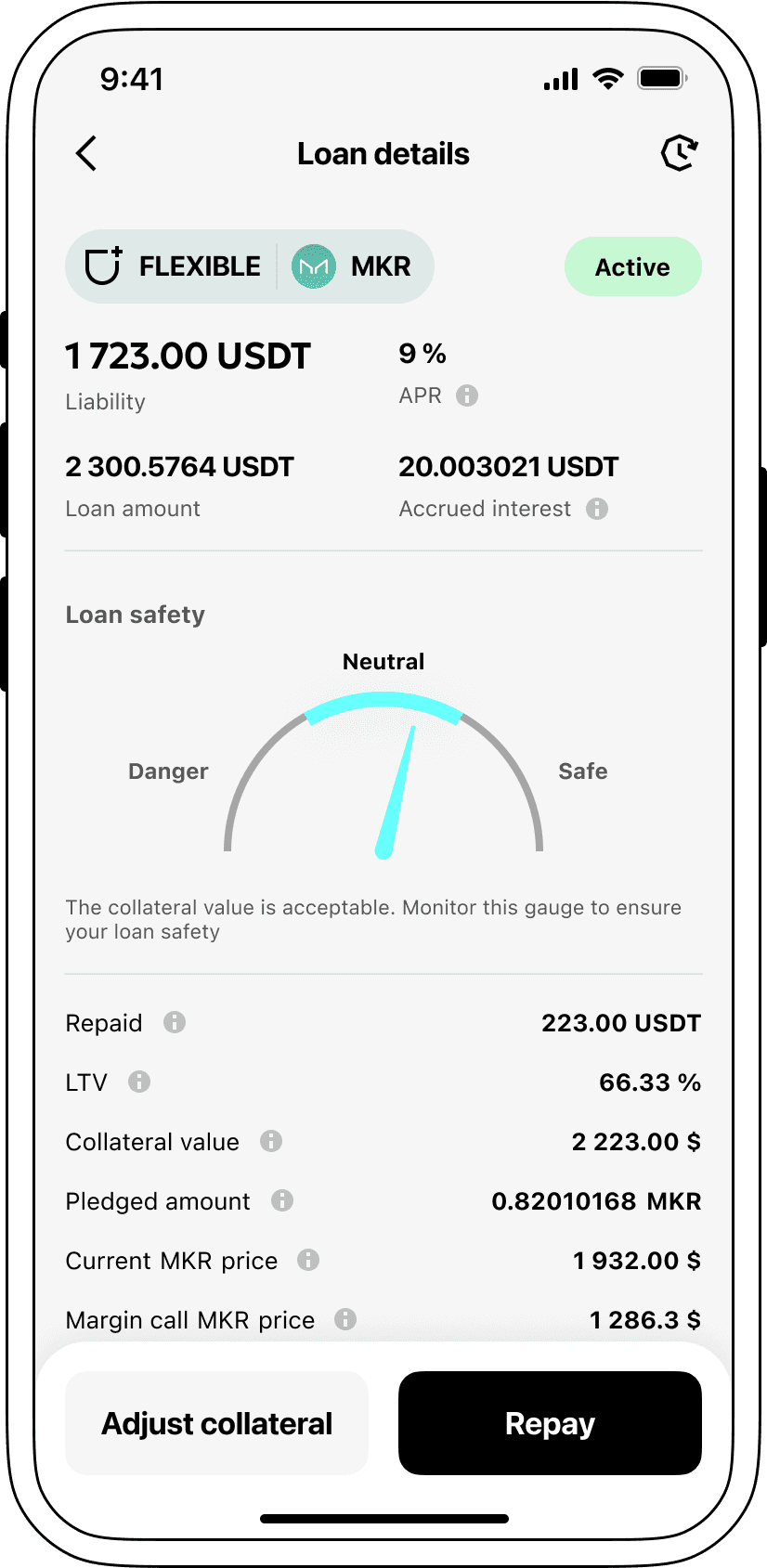

How MKR loans work

The crypto lending scheme is an easy-to-use tool that is suitable both for individuals who want to take out a loan and those who are willing to lend money. The borrowers can receive a loan in USDT by pledging their cryptocurrency as the loan's security. Meanwhile, the ownership of their digital assets is retained. With this method, credit checks and paperwork are out of the question — everything is done in a faster and cheaper way.

In turn, the investors can put their cryptocurrency (for example, Maker/MKR) into a special account on the Cropty platform. A custodian - an authorized intermediary who manages the transactions between the borrowers and the investors and ensures the safety of both parties - oversees this process.

Thus, for the debtors, it is profitable: they get the money they need without selling their crypto. The most significant thing in a volatile market is the sharp price which leads to the losses of the holders of digital assets. Besides, the loan transfiring stage here is much simpler - the credit part is not required.

The investors also receive their benefits: they make a return on the capital through the interest on the loan, thereby turning their cryptocurrencies into money-generating instruments. Ultimately, the result is win-win: the debtors get the money they need, and the lenders cash in.

The Cropty platform controls the whole system and is responsible for safe and secure transactions with the use of the blockchain technology. The operations are done without any intermediaries and the possibility of fraudulent actions is minimal - everything is fair, transparent, and reliable.

Maker Loan Calculator

Crypto Loans explained

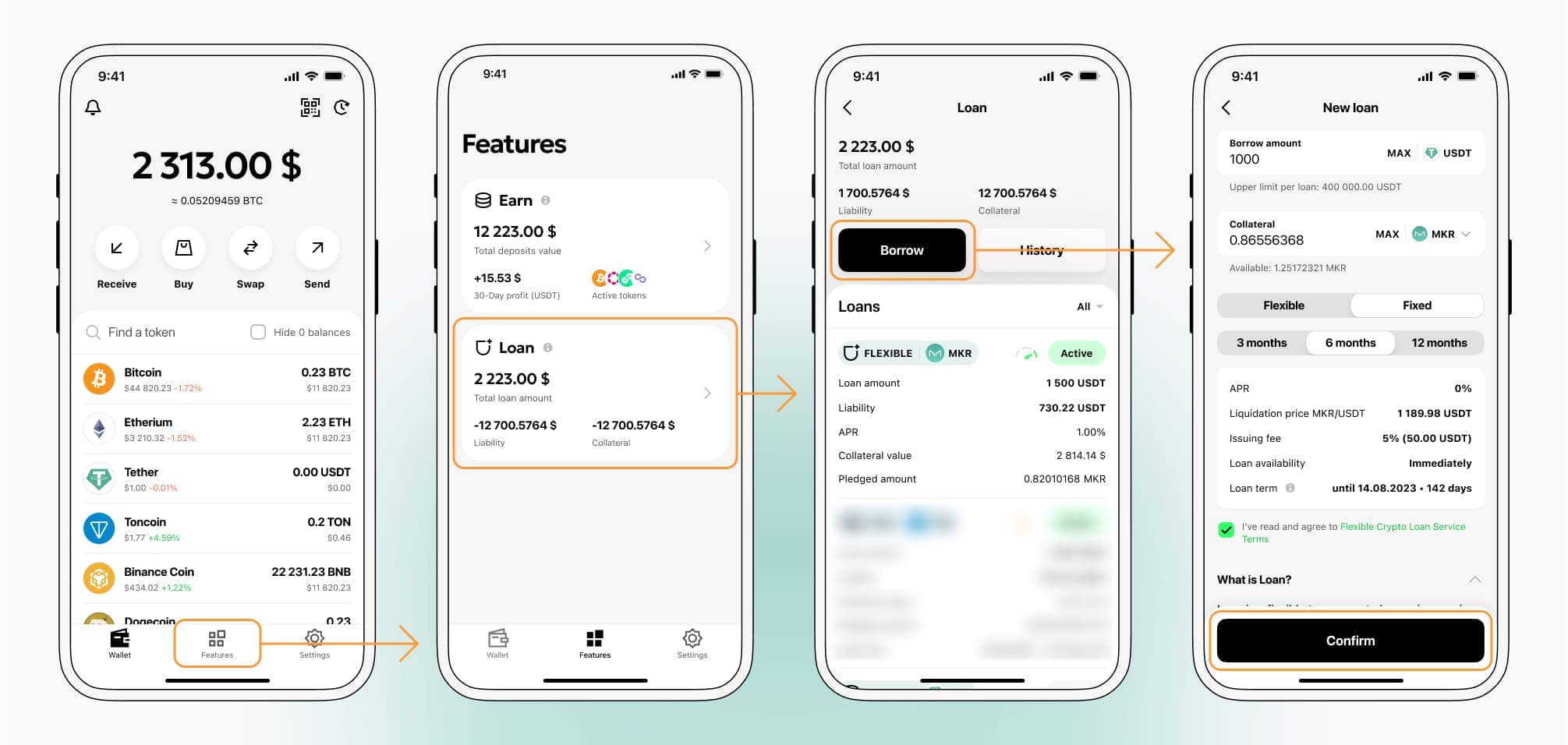

How to get a loan on Maker? Borrow usd against Maker on Cropty

The process of getting an Maker cryptocurrency loan is quite simple. First, you need to create your account on Cropty, a platform that offers Maker cryptocurrency lending services. Then, you need to provide your MKR as collateral and specify the loan amount you want to borrow. The platform then evaluates your collateral and gives you access to the required amount of Tether USDT.

Your creditworthiness is determined based on the value of your collateral, making the process of getting a cryptocurrency loan fast and convenient.

However, it is important to remember that Maker cryptocurrency loans are not without risks. In case you default on the loan, your collateral can be seized. Therefore, you should carefully assess your repayment capacity before taking out a cryptocurrency loan.

To authorize an Maker Crypto Loan, you will need to go to Features tab → Loan section → Borrow button

Choose the required loan amount the terms and conditions of the crypto loan, and apply for it by confirming it with a code from 2FA - application or E-mail or Telegram-bot.

Learn more about MKR Crypto Loans

Interest rates on loans secured by Maker

At Cropty, we are proud that we are able to provide our customers with interest rates that are among the lowest in the market. For cryptographic money loans, we offer a rate of only 9% annually. Hence, whether it is for your private or business needs, with our loans, you will be able to access cash fast without having to part with your valuable crypto assets.

The distinctive feature of Cropty loans is the method of dealing with collateral. If the borrower defaults, the pledged Maker (MKR) tokens stay with Cropty while the USDT (Tether) previously issued is repossessed by the borrower. By this, the system enables conditions for fair repayment while, at the same time, ensuring the protection of the interests of both sides.

In order to eliminate losses due to a possible decrease in Maker's price, an automatic liquidation system has been introduced by us. At an agreed point, if the value of the collateral falls below the mark, the closing of the loan will be done automatically. So both the borrower and the lender are protected from risk arising from sudden changes in the market.

Additionally, the platform considers convenience and transparency as its strengths. The easy and quick way to track the loan status is by using the

Cropty platform which comes with a simple and user-friendly interface. Moreover, borrowers are empowered with the following options: increasing the collateral at any time, paying off the debt ahead of schedule, or completely finishing the loan together with the accrued interest.

If you're looking for a trustworthy and comfortable way to get a crypto loan secured by your assets, Cropty is the solution that will bring you such a chance. You may put down Maker as security and get Tether USDT. It is a prompt, solid, and straightforward way to handle your financial plight.

Why choose Maker Cropty Loan

FAQ

What is Cropty Maker Crypto Loan?

How do I pledge my assets and start borrowing with Cropty Maker Crypto Loan?

What is LTV, and how much can I borrow from Cropty Maker Crypto Loan?

Are there limits to how much I can pledge and borrow?

What is loan liquidation, and what is the liquidation LTV?

What happens when a loan is liquidated?

What is a margin call?

Will I be notified in the event of margin calls or liquidations?

What interest rate applies to my loan?

How is interest accrued for my loan positions?

How do I repay my loan or adjust my LTV?

Which cryptocurrencies can I pledge or borrow on Cropty Crypto Loan?

What can I do with the cryptocurrencies borrowed from Cropty Maker Crypto Loan?

More coins