What is Immutable X?

Immutable X operates as the first-ever Layer 2 scaling solution for NFTs on the Ethereum blockchain. Utilizing zk rollup technology, Immutable X aims to solve high gas fee and scalability concerns when minting and trading NFTs.

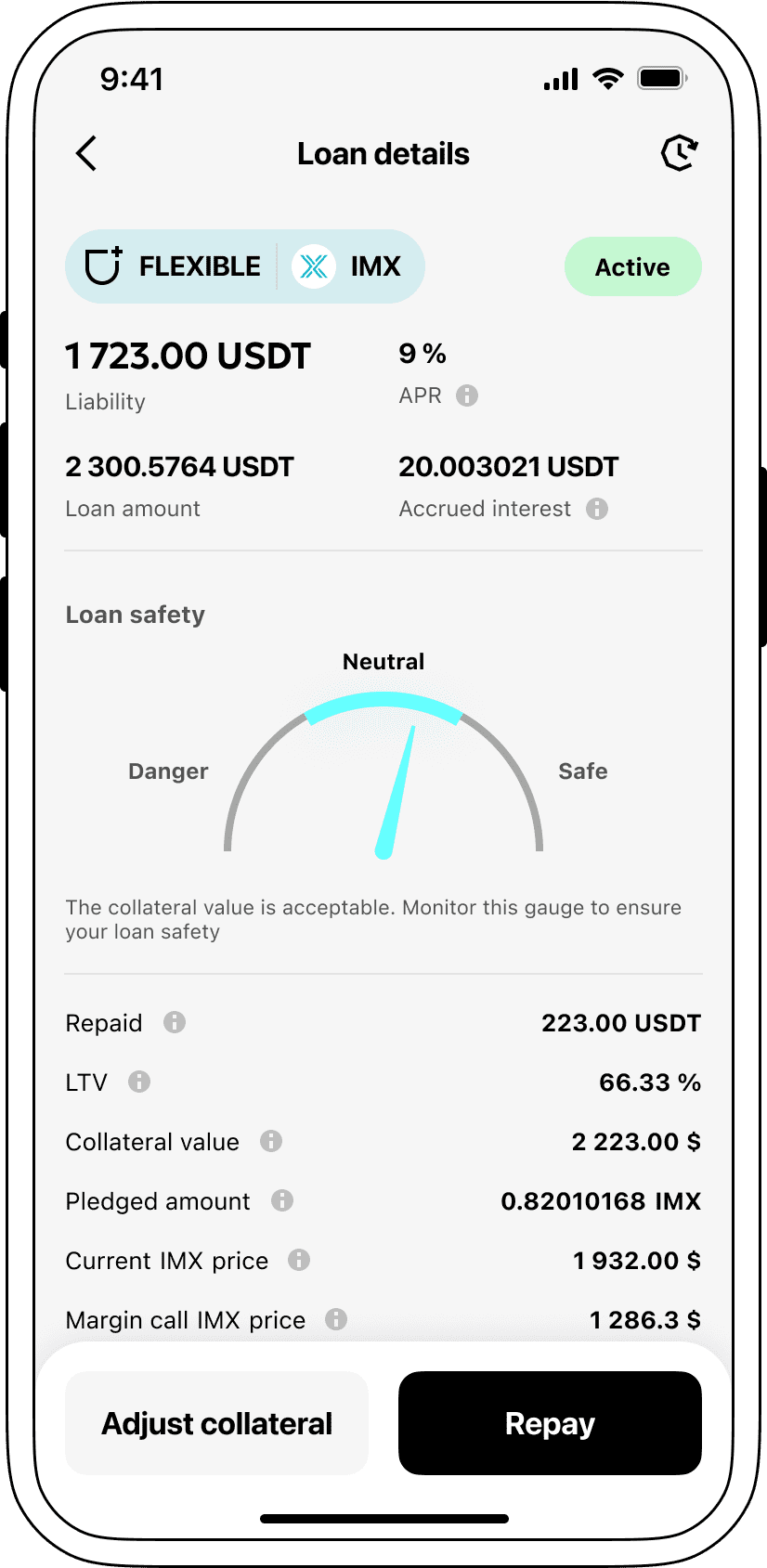

How do loans backed by IMX works

Crypto lending brings a streamlined option tailored for both the debtor and creditor. Individuals can put their crypto wealth, such as Immutable X (IMX), in the form of USDT-backed loans all the while retaining possession of the coins. This entirely bypasses the requirement for meticulous credit evaluations and endless bureaucracy, culminating in a swifter, more economical process.

With Cropty's platform, credit providers confer their cryptos, IMX for instance, into an isolated account. A custodial entity then governs the transactions between the lenders and debtors, thereby providing a robust and secure conduit for interaction. They serve as an unbiased intermediary to ensure all parties involved retain their core interests.

This arrangement profits borrowers by availing liquidity without compelled sales of their coveted coke. An ideal case especially amid extreme crypto trading trajectories where the risk of incurring losses is high. The adopted model expedited loan exchanges and does away with the pervasive credit scrutiny.

For lenders, it's an opportunity to capitalize on their cryptocurrencies through an interest-accumulative funds' repayment framework. Essentially, it's a reciprocal beneficial system with debtors assuming loans while creditors augment their crypto portfolio proceeds.

The Cropty platform manages the cross-interactivity between both creditor and debtor, and the infallibility of blockchain underlines safe, intermediary-free dealings. The negligible likelihood of deceitful activities ensures a secure lending atmosphere for all.

Immutable X Loan Calculator

Crypto Loans explained

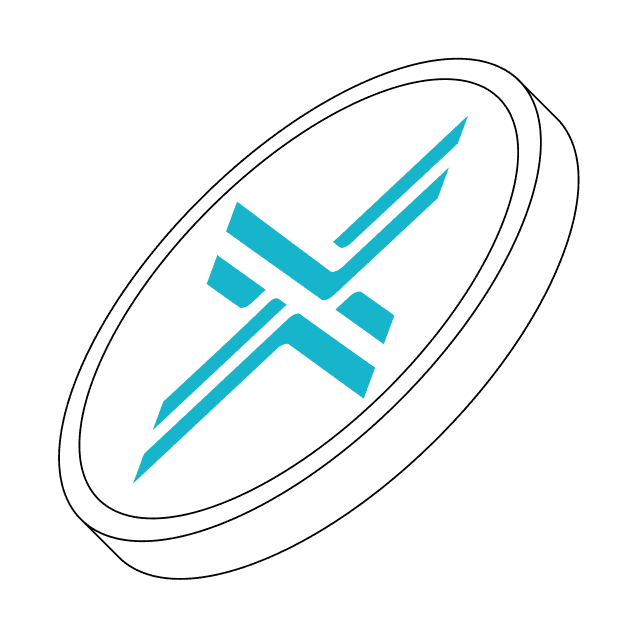

How to get a loan on Immutable X? Borrow usd against Immutable X on Cropty

The process of getting an Immutable X cryptocurrency loan is quite simple. First, you need to create your account on Cropty, a platform that offers Immutable X cryptocurrency lending services. Then, you need to provide your IMX as collateral and specify the loan amount you want to borrow. The platform then evaluates your collateral and gives you access to the required amount of Tether USDT.

Your creditworthiness is determined based on the value of your collateral, making the process of getting a cryptocurrency loan fast and convenient.

However, it is important to remember that Immutable X cryptocurrency loans are not without risks. In case you default on the loan, your collateral can be seized. Therefore, you should carefully assess your repayment capacity before taking out a cryptocurrency loan.

To authorize an Immutable X Crypto Loan, you will need to go to Features tab → Loan section → Borrow button

Choose the required loan amount the terms and conditions of the crypto loan, and apply for it by confirming it with a code from 2FA - application or E-mail or Telegram-bot.

Learn more about IMX Crypto Loans

Interest rates on loans secured by Immutable X.

Cropty recognizes the pivotal role of competitive interest rates in the financial sphere. Consequently, it presents the opportunity of acquiring loans via cryptocurrency at an extremely appealing rate of 9%. Regardless of whether the necessity of funds is personal or commercial, our cost-efficient, low-interest loans are a practical alternative to liquidate your assets without parting with your precious cryptocurrencies.

A distinguishing feature of crypto loans by Cropty is the collateralization process. In case of a loan default, the backup IMX stays with Cropty, whereas the borrower retains the issued Tether USDT to them. This mechanism embodies a just and harmonic way of loan recovery, is advantageous for all the parties involved.

To effectively tackle any decline in value of Immutable X, Cropty incorporates an automatic liquidation procedure. If the worth of the collateral descends below a crucial borderline, the loan will be liquidated immediately. This anticipatory strategy safeguards both, the lender and the borrower against unforeseen damages arising from market downturns.

Cropty prioritizes transparency and ease of use. Through our intuitive interface, users can smoothly keep a tab on their loan product status. Moreover, borrowers have the leeway to supplement more collateral, clear the loan before its due time or settle the loan by paying back the principal amount along with any interest generated.

For those questioning how to receive a loan using cryptocurrency, Cropty proposes immediate digital coin loans. You can pledge Immutable X and obtain Tether USDT in return. Our loans backed by cryptocurrency assure a swift and handy solution for catering to your monetary requirements.

Why choose Immutable X Cropty Loan

FAQ

What is Cropty Immutable X Crypto Loan?

How do I pledge my assets and start borrowing with Cropty Immutable X Crypto Loan?

What is LTV, and how much can I borrow from Cropty Immutable X Crypto Loan?

Are there limits to how much I can pledge and borrow?

What is loan liquidation, and what is the liquidation LTV?

What happens when a loan is liquidated?

What is a margin call?

Will I be notified in the event of margin calls or liquidations?

What interest rate applies to my loan?

How is interest accrued for my loan positions?

How do I repay my loan or adjust my LTV?

Which cryptocurrencies can I pledge or borrow on Cropty Crypto Loan?

What can I do with the cryptocurrencies borrowed from Cropty Immutable X Crypto Loan?

More coins