What is Ethereum Classic?

Ethereum Classic is a decentralized computing platform designed to execute smart contracts, which are applications that run as programmed without the possibility of censorship or third-party interference. It is a distributed network consisting of a blockchain ledger, a native cryptocurrency (called ETC), and an ecosystem of on-chain applications and services. Ethereum Classic is the legacy chain that split from Ethereum following a contentious hard fork, known as The DAO fork, in Jul. 2017. Like its sister chain, Ethereum Classic features an execution engine optimized for smart contract processing (known as the Ethereum Virtual Machine or EVM) and a Proof of Work (PoW) consensus system. While it shares some aspects with Ethereum, Ethereum Classic offers a more defined monetary policy and inflation schedule.

How do loans backed by ETC works

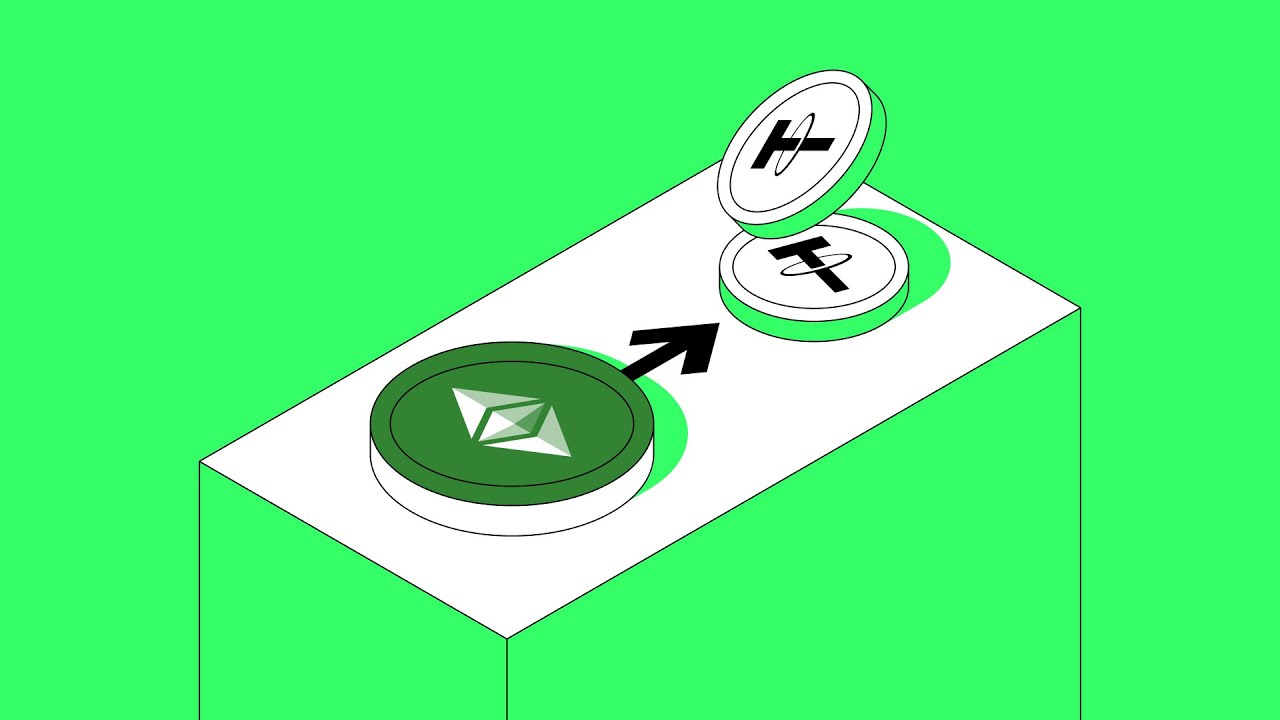

Crypto loans provide a hassle-free avenue for both loan-seekers and investors. Those in need of a loan can utilize their digital cryptocurrency, such as Ethereum Classic (ETC), as a guarantee to obtain loans in USDT, retaining their cryptocurrency ownership. It discards the need for tedious paperwork and credit assessments usually involved in traditional loans.

Similarly, investors can commit their digital assets like the Ethereum Classic, into a secure account on the Cropty platform. As the guardian of assets, this setup safeguards interactions between lending and borrowing parties and ensures a smooth operation with utmost care for both parties' interests.

Such assured access to capital in precarious market conditions spur the borrower's potential, while ensuring zero cryptocurrency sale, mitigating any potential losses. The process simplifies the lending process, reducing paperwork and credit assessments usually involved in traditional loans.

On the other end of the spectrum, lenders enjoy the benefit of interest payments on their deposited cryptocurrencies, enabling them to profit from their digital assets. This arrangement creates a mutually beneficial lending arena, where borrowers and lenders both enjoy privileges.

Being the orchestrator of these interactions, Cropty employs blockchain technology guaranteeing secure, peer-to-peer transactions, and reducing the possibility of fraudulent activities to create a safe Ethereum Classic-secured lending enclave.

Ethereum Classic Loan Calculator

Crypto Loans explained

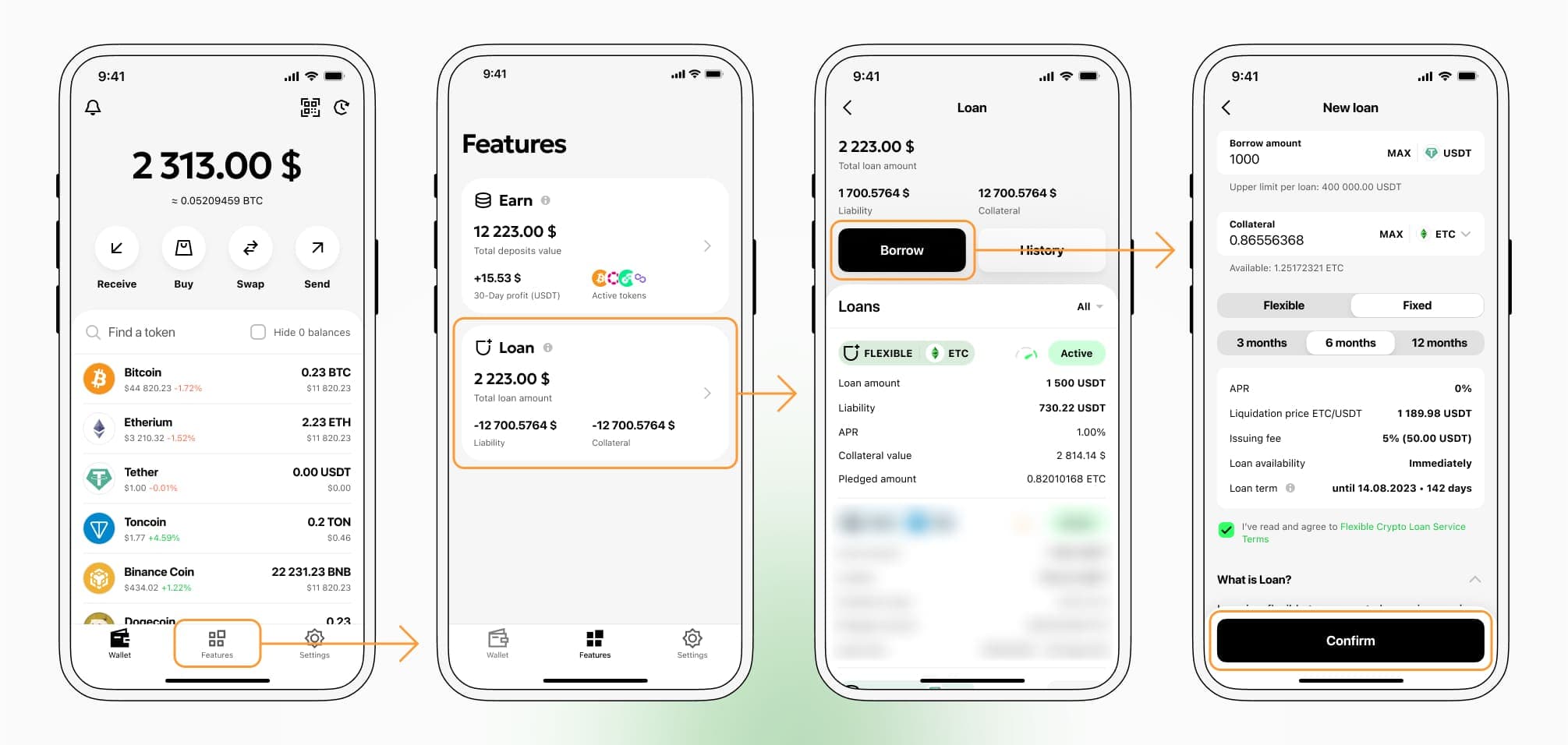

How to get a loan on Ethereum Classic? Borrow usd against Ethereum Classic on Cropty

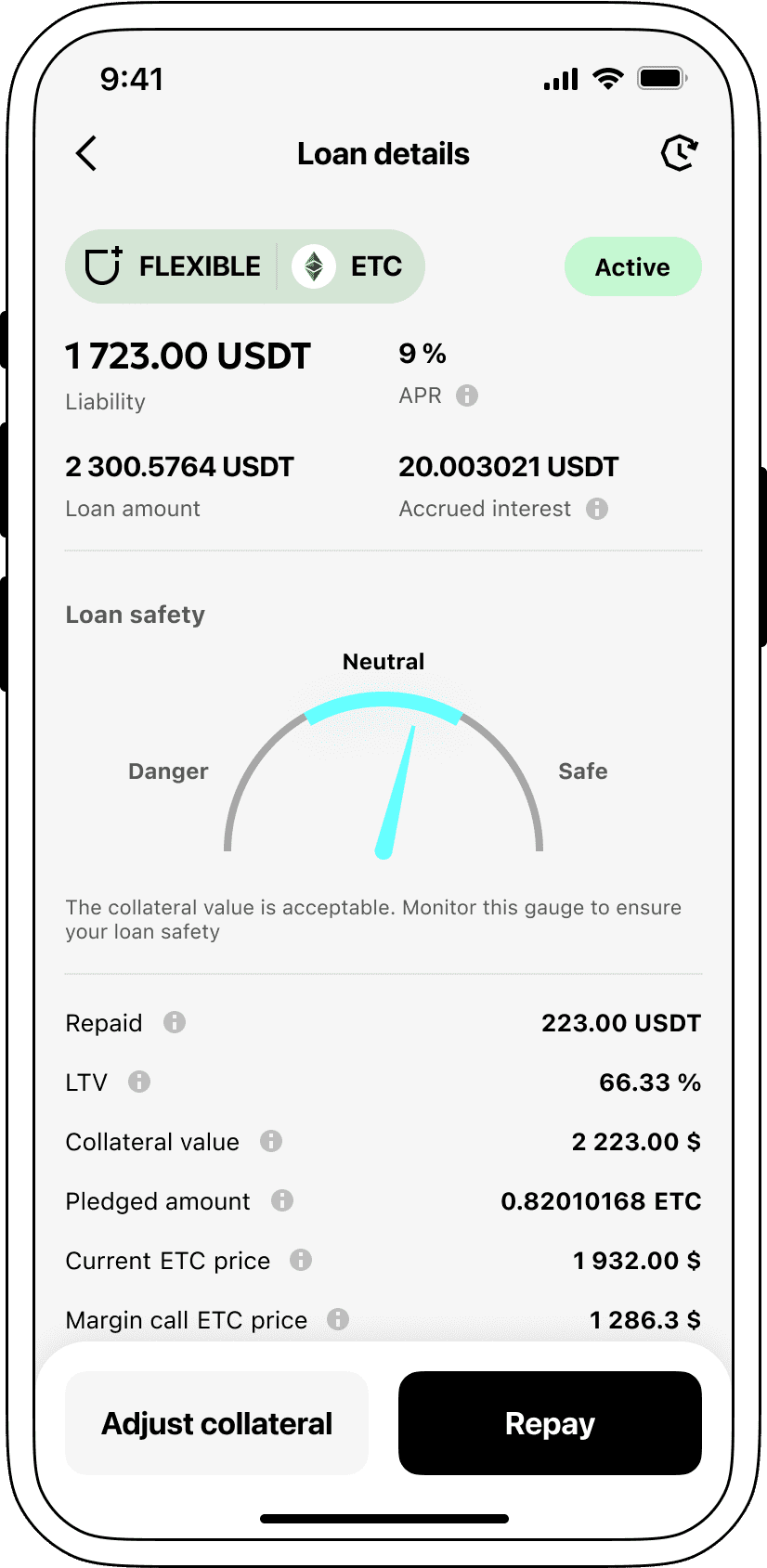

The process of getting an Ethereum Classic cryptocurrency loan is quite simple. First, you need to create your account on Cropty, a platform that offers Ethereum Classic cryptocurrency lending services. Then, you need to provide your ETC as collateral and specify the loan amount you want to borrow. The platform then evaluates your collateral and gives you access to the required amount of Tether USDT.

Your creditworthiness is determined based on the value of your collateral, making the process of getting a cryptocurrency loan fast and convenient.

However, it is important to remember that Ethereum Classic cryptocurrency loans are not without risks. In case you default on the loan, your collateral can be seized. Therefore, you should carefully assess your repayment capacity before taking out a cryptocurrency loan.

To authorize an Ethereum Classic Crypto Loan, you will need to go to Features tab → Loan section → Borrow button

Choose the required loan amount the terms and conditions of the crypto loan, and apply for it by confirming it with a code from 2FA - application or E-mail or Telegram-bot.

Learn more about ETC Crypto Loans

Interest rates on loans secured by Ethereum Classic.

At Cropty, we appreciate the significance of offering competitive lending rates. We, therefore, provide loan facilities based on cryptocurrency at an appealing rate of 9%. Regardless of your funding needs, be it personal or business-related, our economical loans offer an efficient way to acquire liquidity without disposing of your precious cryptocurrencies.

Notably, collateralization is a distinct aspect of Cropty's crypto loan system. In an event where the borrower fails to meet their loan obligations, the collateral, in this case, ETC, remains with Cropty, while the borrower retains Tether USDT issued. This guarantees an equitable process in managing default loans, ensuring mutual benefit.

Due to the risk of Ethereum Classic losing value, Cropty incorporates an automated sell-off feature. This kicks in when the collateral's worth goes below a given level, instigating immediate liquidation of the loan. Such a foresight mechanism safeguards both lender and borrower against potential drawbacks following a market slump.

At the heart of Cropty's core values are openness and convenience. Our customers can effortlessly keep track of their loan status through our intuitively designed platform. Additionally, we offer borrowers the leverage to supplement collateral, plan an early repayment, or terminate the loan by settling the borrowed sum along with the accrued interest.

Thinking of crypto loans? Cropty dispenses instant coin-based loans. You have an opportunity to borrow against Ethereum Classic, obtaining Tether USDT in return. Our crypto-secured loans offer a prompt and handy solution to meet your financial necessities.

Why choose Ethereum Classic Cropty Loan

FAQ

What is Cropty Ethereum Classic Crypto Loan?

How do I pledge my assets and start borrowing with Cropty Ethereum Classic Crypto Loan?

What is LTV, and how much can I borrow from Cropty Ethereum Classic Crypto Loan?

Are there limits to how much I can pledge and borrow?

What is loan liquidation, and what is the liquidation LTV?

What happens when a loan is liquidated?

What is a margin call?

Will I be notified in the event of margin calls or liquidations?

What interest rate applies to my loan?

How is interest accrued for my loan positions?

How do I repay my loan or adjust my LTV?

Which cryptocurrencies can I pledge or borrow on Cropty Crypto Loan?

What can I do with the cryptocurrencies borrowed from Cropty Ethereum Classic Crypto Loan?

More coins