What is Uniswap?

Uniswap is a decentralized exchange built on Ethereum that utilizes an automated market making system rather than a traditional order-book. Instead of matching individual buy and sell orders, users can pool together two assets that are then traded against, with the price determined based on the ratio between the two.

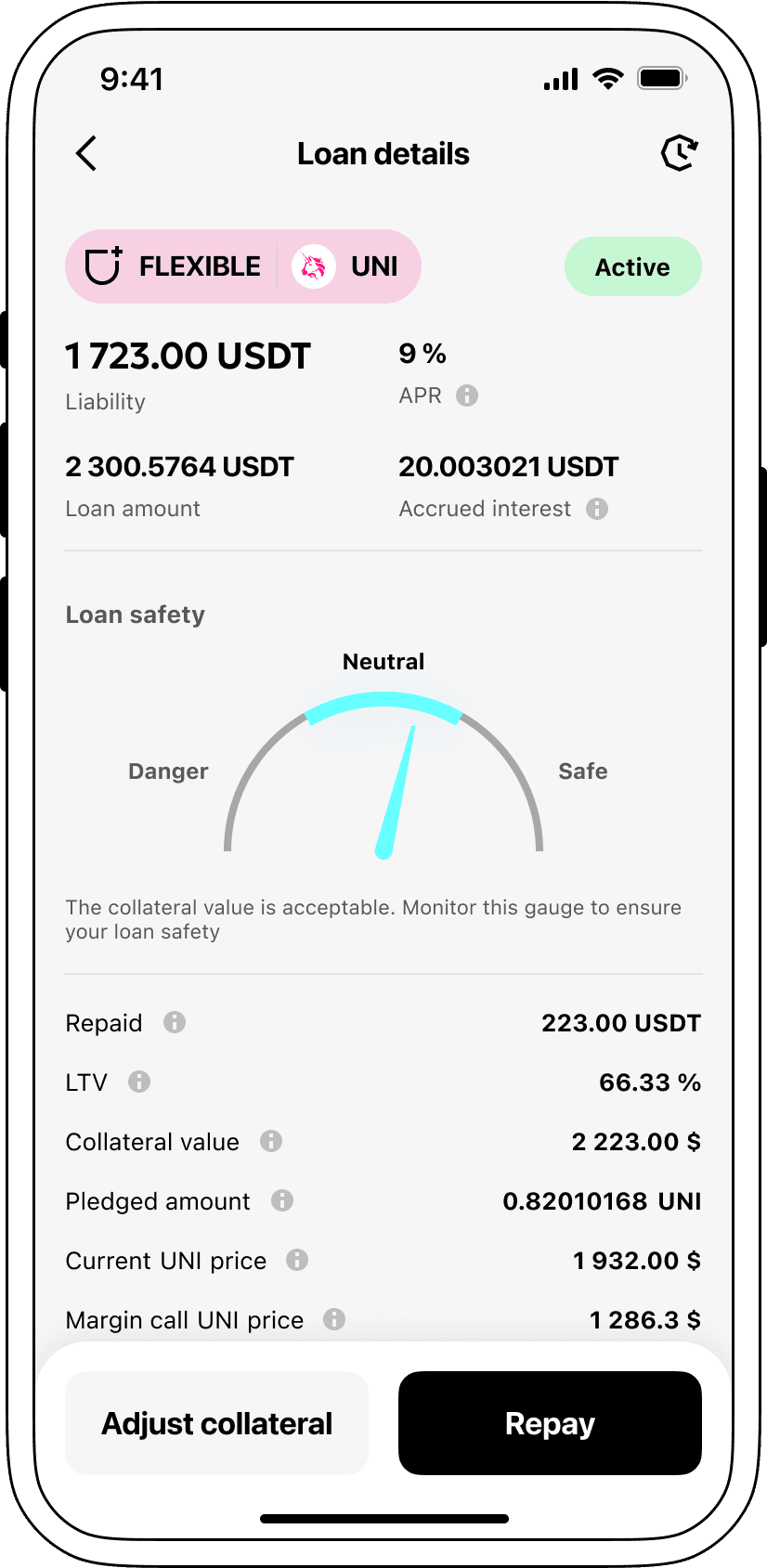

How do loans backed by UNI works

Securing crypto-loans offers a clear-cut strategy for loan seekers and providers. Those in need can rack up loans in USDT, leveraging their crypto resources without losing their digital assets. It waves off the requirement for credit authentication and documentation, accelerating and cheapening the process.

Investors are authorized to store their cryptocurrencies, such as Uniswap (UNI), in a specific Cropty account. A trustworthy custodian governs the liaison between borrowers and lenders, promising a fortified procedure. As a reliable go-between, it ensures the protection of both parties' stakes.

Beneficiaries can tap into funds without needing to offload their cryptocurrencies. This proves particularly valuable amid market turbulence, keeping potential losses at bay. Moreover, it decomplicates the lending procedure and waives off credit screening requirements.

Investors accrue earnings on their parked funds via loan paybacks, thereby monetizing their crypto holdings. It's an advantageous setup where borrowers obtain loans and lenders reap benefits through involvement.

Crypto maintains the engagement between borrowers and investors, with blockchain technology guaranteeing secure exchanges devoid of middlemen. This significantly minimizes deception risks and fosters a secure lending milieu.

Uniswap Loan Calculator

Crypto Loans explained

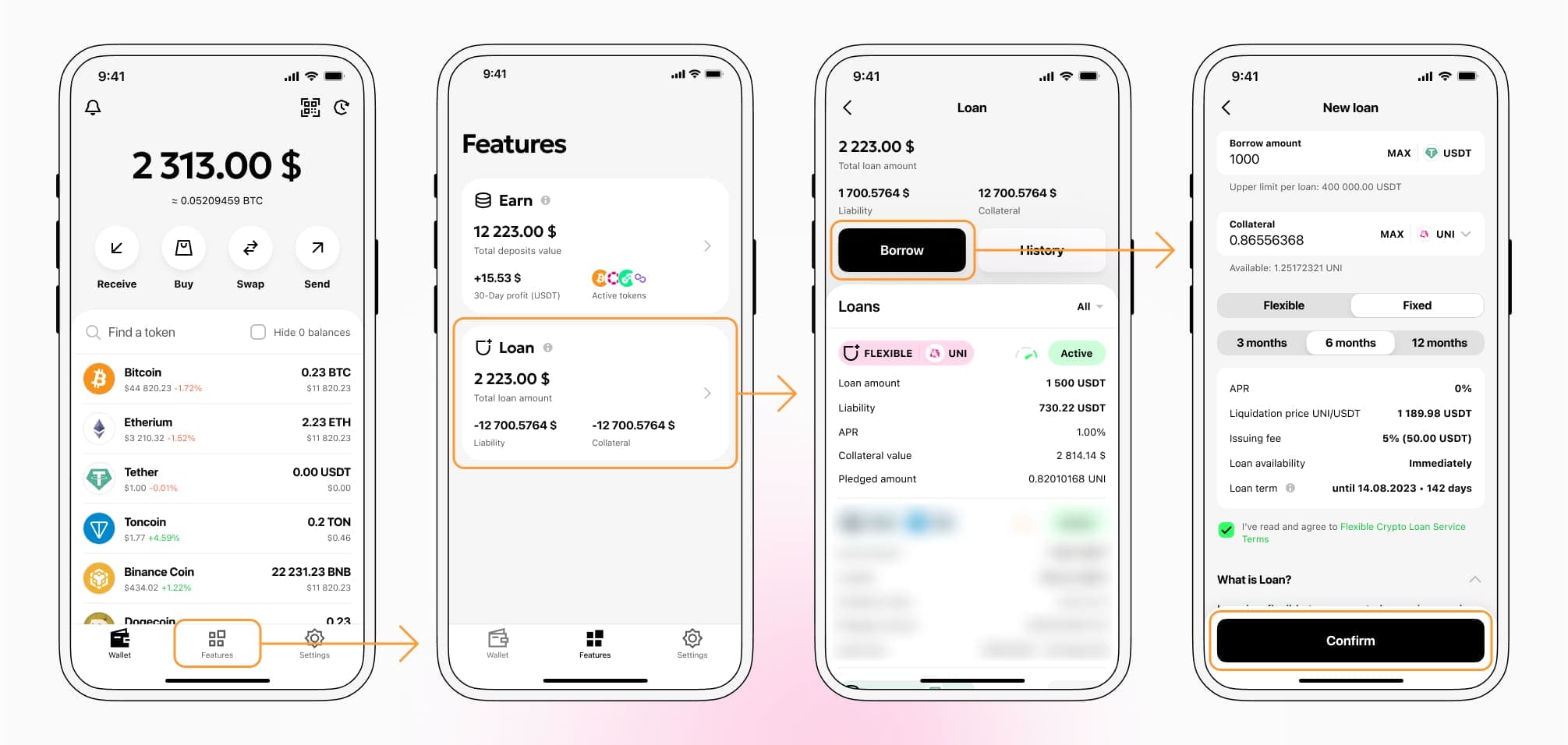

How to get a loan on Uniswap? Borrow usd against Uniswap on Cropty

The process of getting an Uniswap cryptocurrency loan is quite simple. First, you need to create your account on Cropty, a platform that offers Uniswap cryptocurrency lending services. Then, you need to provide your UNI as collateral and specify the loan amount you want to borrow. The platform then evaluates your collateral and gives you access to the required amount of Tether USDT.

Your creditworthiness is determined based on the value of your collateral, making the process of getting a cryptocurrency loan fast and convenient.

However, it is important to remember that Uniswap cryptocurrency loans are not without risks. In case you default on the loan, your collateral can be seized. Therefore, you should carefully assess your repayment capacity before taking out a cryptocurrency loan.

To authorize an Uniswap Crypto Loan, you will need to go to Features tab → Loan section → Borrow button

Choose the required loan amount the terms and conditions of the crypto loan, and apply for it by confirming it with a code from 2FA - application or E-mail or Telegram-bot.

Learn more about UNI Crypto Loans

Interest rates for loans secured by Uniswap.

Cropty recognizes the significance of offering competitive lending rates in the market. Hence, we extend cryptocurrency-based loans at a fantastic low rate of 9%. This affordable offering is a suitable alternative for those seeking liquidity solutions for personal or enterprise pursuits without having to dispose of their treasured cryptos.

Uniquely, Cropty's crypto loans entail a collateralization feature. If loan repayment falls through, Cropty retains custody of the UNI collateral while the borrower still has the Tether USDT that was given out. This method ensures equitable loan recovery, advantaging all participants involved.

Cropty manages Uniswap depreciation risks via an automated liquidation procedure. If the provided collateral's worth drops below a crucial level, loan liquidation kicks in. This strategic safeguard shields both the lender and debtor against potential market downturn losses.

Transparency and user-friendliness are attributes upheld by Cropty. Clients can effortlessly track their loan statuses via our intuitive platform. Plus, borrowers can freely augment their collaterals, repay their loans early, or pay off the loans entirely including the accrued interest.

In search of a hassle-free crypto loan experience? Cropty provides instant token loans. Uniswap can be your collateral in exchange for Tether USDT. Our swift crypto-secured loans can efficiently cater to your various finance necessities.

Why choose Uniswap Cropty Loan

FAQ

What is Cropty Uniswap Crypto Loan?

How do I pledge my assets and start borrowing with Cropty Uniswap Crypto Loan?

What is LTV, and how much can I borrow from Cropty Uniswap Crypto Loan?

Are there limits to how much I can pledge and borrow?

What is loan liquidation, and what is the liquidation LTV?

What happens when a loan is liquidated?

What is a margin call?

Will I be notified in the event of margin calls or liquidations?

What interest rate applies to my loan?

How is interest accrued for my loan positions?

How do I repay my loan or adjust my LTV?

Which cryptocurrencies can I pledge or borrow on Cropty Crypto Loan?

What can I do with the cryptocurrencies borrowed from Cropty Uniswap Crypto Loan?

More coins