What is OKB?

OKB is the native exchange token of OKEx that provides discounts on trading fees, access to the OK Jumpstart initial exchange offering (IEO) platform, and voting rights for tokens to be listed on the exchange. In the future, it will be used to pay transaction fees on the OKChain blockchain as well as decentralized exchange OKDEX.

How do loans backed by OKB works

Crypto-backed lending presents a straightforward option for loan seekers and investors. Utilizing their crypto assets as security, borrowers can procure loans quoted in USDT while retaining ownership of their digital portfolios. This breakthrough eliminates the necessity for exhaustive credit investigations and paperwork, massively expediting the process and reducing costs.

Investors can transfer their cryptocurrencies, including OKB, into a reserved account on the Cropty Exchange. An appointed custodian facilitates and controls the engagement between borrowers and lenders, guaranteeing a pierrot and reliable transaction process since they function as a trustworthy arbitrator safeguarding the interests of all parties involved.

Borrowers capitalize on the system by achieving instant liquidity without relinquishing their digital assets. They gain particular leverage in volatile markets as they can avert potential depreciation. The lending structure streamlines the loan procedure and abolishes requirements for credit evaluations.

Lenders yield income on their staked crypto through loan reimbursements, enabling them to cultivate returns on their crypto investments. It poses a mutually advantageous scenario where borrowers access loans while lenders accrue rewards through their engagement.

The Cropty platform administers the interplay between the two factions, and blockchain technology fortifies the secure execution of transactions without mediators. This approach curtails any potential fraud risk, thereby solidifying a secure lending ecosystem.

OKB Loan Calculator

Crypto Loans explained

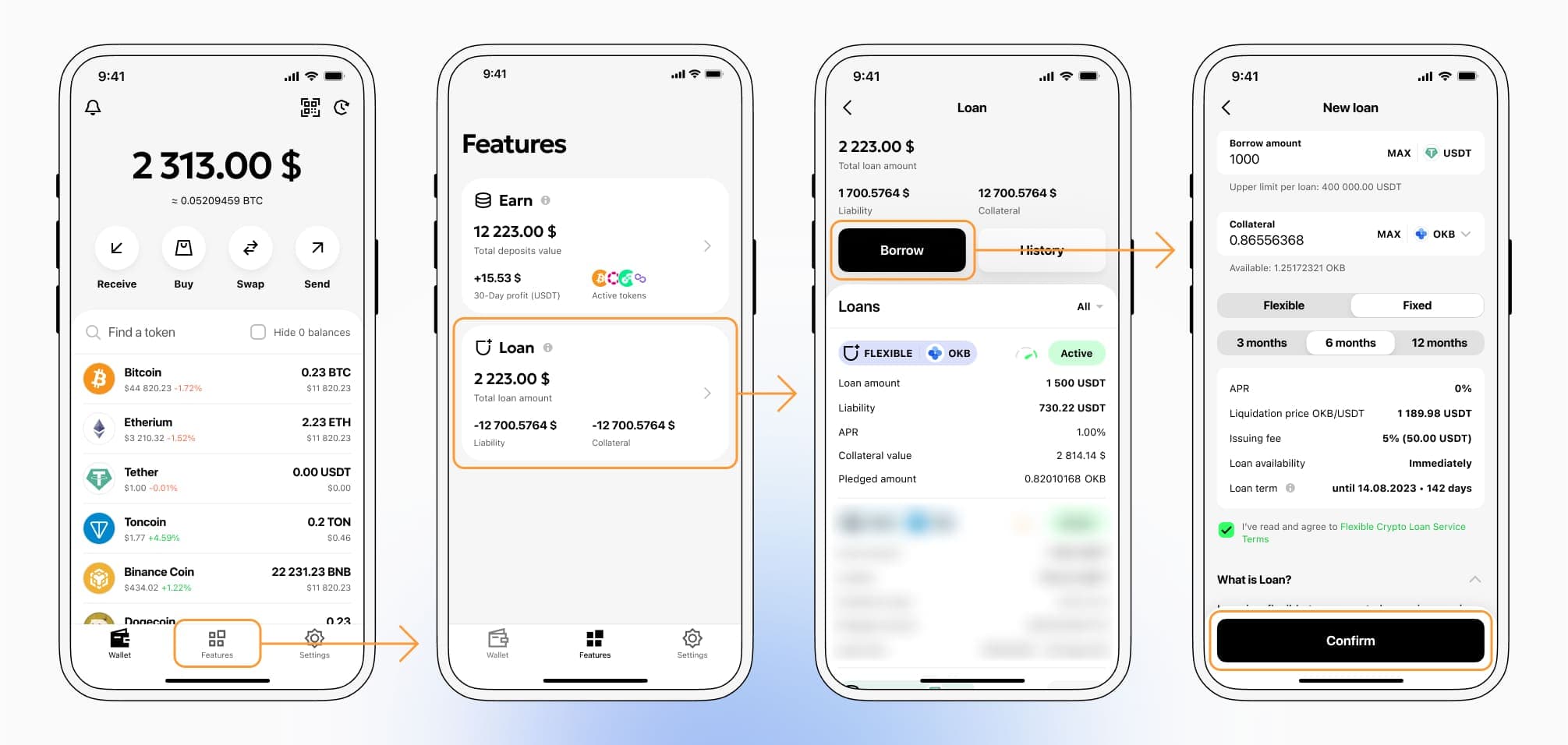

How to get a loan on OKB? Borrow usd against OKB on Cropty

The process of getting an OKB cryptocurrency loan is quite simple. First, you need to create your account on Cropty, a platform that offers OKB cryptocurrency lending services. Then, you need to provide your OKB as collateral and specify the loan amount you want to borrow. The platform then evaluates your collateral and gives you access to the required amount of Tether USDT.

Your creditworthiness is determined based on the value of your collateral, making the process of getting a cryptocurrency loan fast and convenient.

However, it is important to remember that OKB cryptocurrency loans are not without risks. In case you default on the loan, your collateral can be seized. Therefore, you should carefully assess your repayment capacity before taking out a cryptocurrency loan.

To authorize an OKB Crypto Loan, you will need to go to Features tab → Loan section → Borrow button

Choose the required loan amount the terms and conditions of the crypto loan, and apply for it by confirming it with a code from 2FA - application or E-mail or Telegram-bot.

Learn more about OKB Crypto Loans

Interest rates on loans secured by OKB.

Cropty comprehends the pivotal role competitive interest rates play. Hence we extend crypto-backed loans at the compelling rate of 9%. Whether you require funds for personal use or your business, our low-interest loans offer an affordable way to gain liquidity without the necessity to sell your precious cryptocurrencies.

A unique attribute of crypto loans at Cropty lies in its collateral scheme. In circumstances where a borrower fails to pay back the loan, Cropty retains the collateral OKB, whereas the borrower holds on to the dispensed Tether USDT. This furthers a just and equal recovery of loan process, advantageous to all parties.

Essential to mitigating the risk stemming from OKB devaluation, Cropty integrates an automatic liquidation system. Should the collateral value dwindle below an essential level, the loan undergoes liquidation. This preemptive step safeguards both lender and borrower against potential losses during market fluctuations.

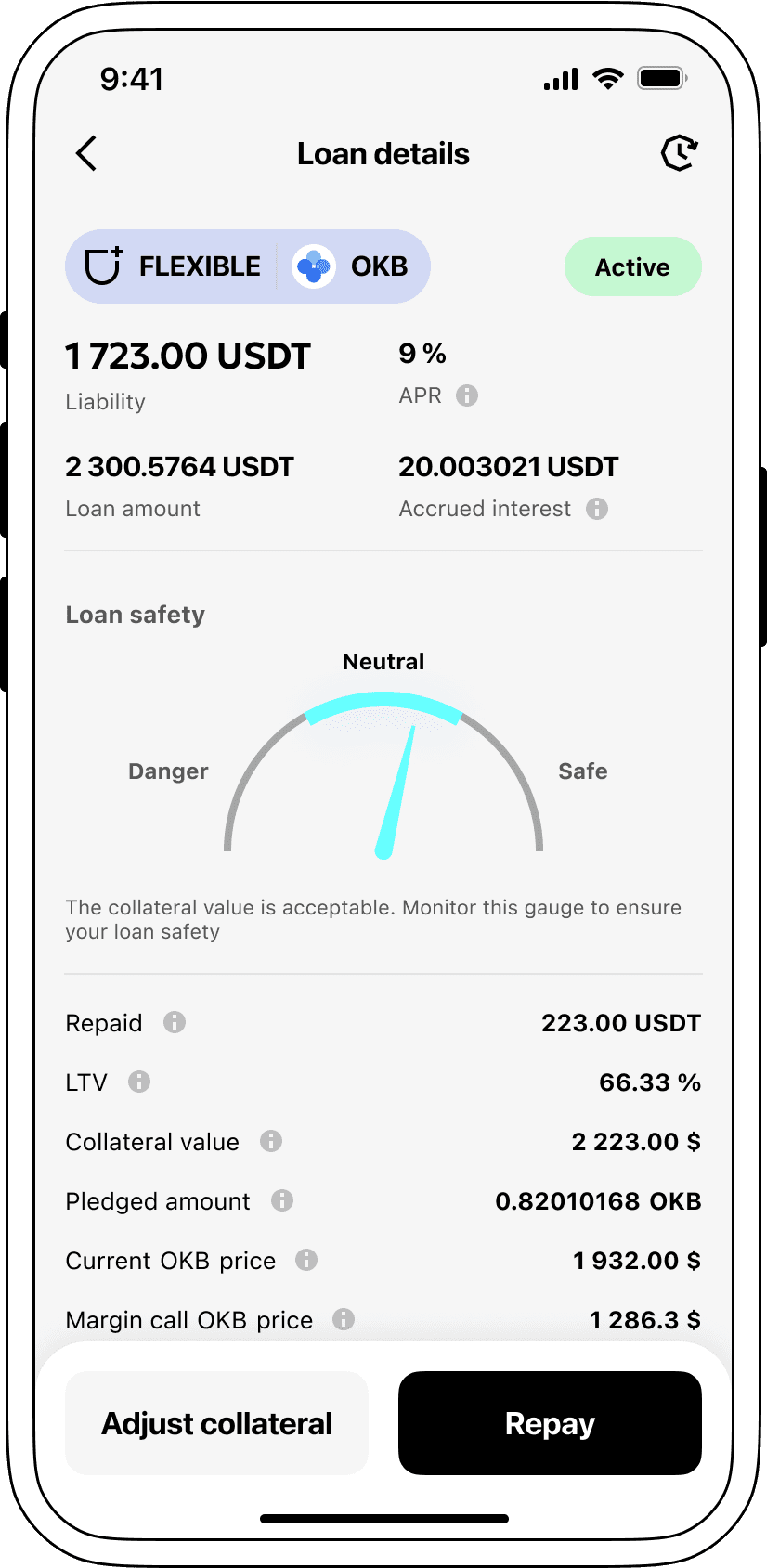

At Cropty, we champion transparency and ease-of-use. We offer a handy UI where users can seamlessly track their loan status. Borrowers also have the option to supplement more collateral, expedite loan repayment or cancel the loan by settling the borrowed sum together with the accumulated interest.

Should you ponder about procuring a loan employing cryptocurrency, Cropty offers immediate coin loans. Borrow against your OKB and receive Tether USDT. Our loans underpinned by cryptocurrency furnish a fast and hassle-free resolution for your monetary necessities.

Why choose OKB Cropty Loan

FAQ

What is Cropty OKB Crypto Loan?

How do I pledge my assets and start borrowing with Cropty OKB Crypto Loan?

What is LTV, and how much can I borrow from Cropty OKB Crypto Loan?

Are there limits to how much I can pledge and borrow?

What is loan liquidation, and what is the liquidation LTV?

What happens when a loan is liquidated?

What is a margin call?

Will I be notified in the event of margin calls or liquidations?

What interest rate applies to my loan?

How is interest accrued for my loan positions?

How do I repay my loan or adjust my LTV?

Which cryptocurrencies can I pledge or borrow on Cropty Crypto Loan?

What can I do with the cryptocurrencies borrowed from Cropty OKB Crypto Loan?

More coins