What is First Digital USD?

First Digital USD (FDUSD) is a stablecoin pegged to the US dollar. It is a digital currency that aims to provide a stable and trustworthy alternative to traditional currencies, while also offering the benefits of fast, secure, and transparent transactions that are characteristic of blockchain technology.

FDUSD is backed by an equivalent amount of US dollars held in reserve by FD121 Limited, a subsidiary of Hong Kong-based financial firm First Digital Limited. This reserve is regularly audited by independent auditors to ensure that FDUSD is fully backed and maintains its 1:1 peg to the US dollar.

FDUSD is currently available on the Ethereum and BNB Chain blockchains, with plans to expand to other blockchains in the future. It can be used for a variety of purposes, including:

- Making payments: FDUSD can be used to make payments for goods and services online and in person.

- Trading: FDUSD can be traded on cryptocurrency exchanges like Binance and Huobi.

- Storing value: FDUSD can be held as a store of value, similar to how people hold US dollars or other fiat currencies.

FDUSD is a relatively new stablecoin, but it has already gained traction in the cryptocurrency market due to its strong backing and commitment to transparency. If you are looking for a stable and trustworthy digital currency, FDUSD is a good option to consider.

Here are some of the benefits of using FDUSD:

- Stability: FDUSD is pegged to the US dollar, which is one of the most stable currencies in the world. This means that the value of FDUSD is unlikely to fluctuate wildly, making it a good option for storing value and making payments.

- Transparency: FDUSD is backed by an equivalent amount of US dollars held in reserve, and this reserve is regularly audited by independent auditors. This transparency helps to ensure that FDUSD is a trustworthy and reliable currency.

- Security: FDUSD is based on blockchain technology, which is a secure and tamper-proof way of storing and transacting digital assets. This makes FDUSD a safe and secure way to store your money.

- Speed and efficiency: Transactions with FDUSD are fast and efficient, thanks to the power of blockchain technology. This makes FDUSD a good option for making payments and other transactions.

How do loans backed by FDUSD works

Crypto-financing provides a seamless solution for lenders and borrowers alike. Borrowers can secure credits in USDT via their cryptocurrency assets as collateral, all the while maintaining ownership of their digital holdings. This bypasses the standard need for credit assessments and paperwork, thus accelerating and reducing the cost of the process.

Lenders, on the other hand, are allowed to lodge their cryptocurrencies, such as First Digital USD (FDUSD), into a specified account on Cropty's platform. A custodian supervises the interchange between the lenders and borrowers, creating a secured process. Their role, as a reputable intermediary, ensures the protection of both parties.

Borrowers stand to gain from this by unlocking liquid funds without the need to sell their digital assets. This proves advantageous during market volatility, as potential losses can be eschewed. Additionally, this lending model streamlines the loan process and forgoes the requirement for credit studies.

Lenders receive profits from their deposited cryptocurrencies via loan paybacks, making their digital assets lucrative. The formula pays off for both borrowers, who access loans, and lenders, who make a gain from their participation.

The interactions between the lenders and borrowers on Cropty's platform are orchestrated, securing all transactions with the blockchain technology, sans any intermediaries. This curtails fraudulent activities and crafts a secure credit provision scenario.

First Digital USD Loan Calculator

Crypto Loans explained

How to get a loan on First Digital USD? Borrow usd against First Digital USD on Cropty

The process of getting an First Digital USD cryptocurrency loan is quite simple. First, you need to create your account on Cropty, a platform that offers First Digital USD cryptocurrency lending services. Then, you need to provide your FDUSD as collateral and specify the loan amount you want to borrow. The platform then evaluates your collateral and gives you access to the required amount of Tether USDT.

Your creditworthiness is determined based on the value of your collateral, making the process of getting a cryptocurrency loan fast and convenient.

However, it is important to remember that First Digital USD cryptocurrency loans are not without risks. In case you default on the loan, your collateral can be seized. Therefore, you should carefully assess your repayment capacity before taking out a cryptocurrency loan.

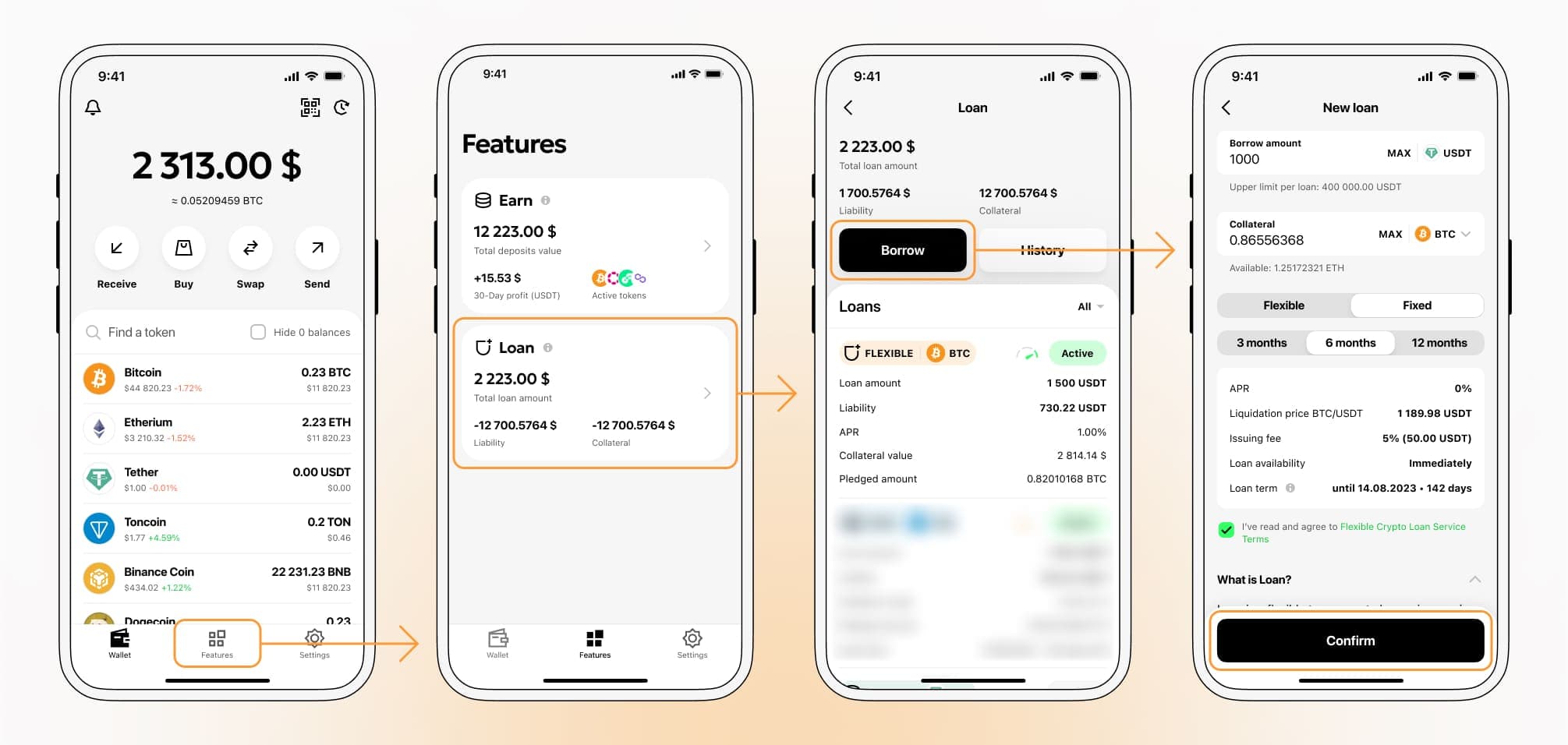

To authorize an First Digital USD Crypto Loan, you will need to go to Features tab → Loan section → Borrow button

Choose the required loan amount the terms and conditions of the crypto loan, and apply for it by confirming it with a code from 2FA - application or E-mail or Telegram-bot.

Interest rates for loans secured by First Digital USD

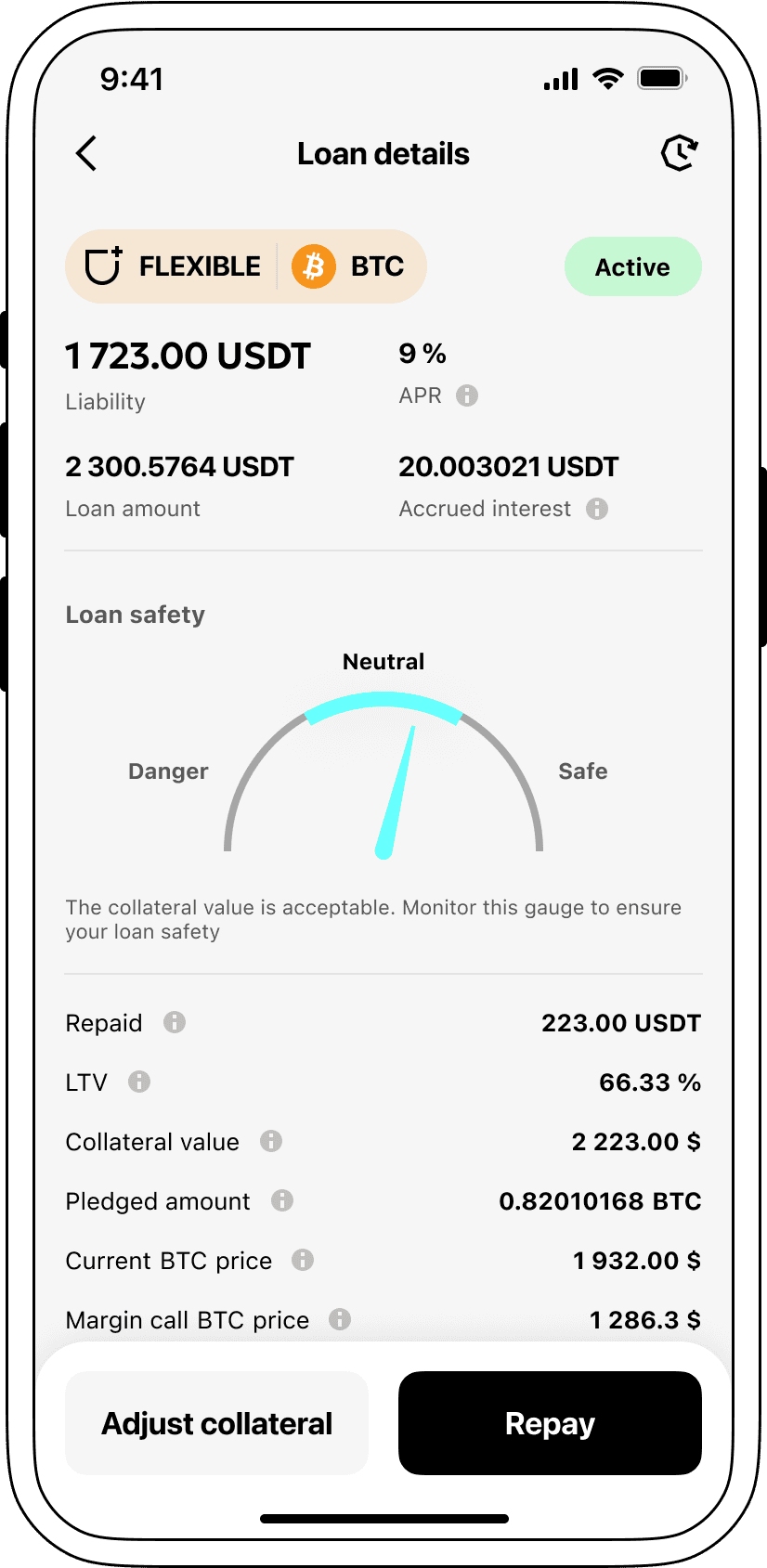

At Cropty, we recognise the significance of competitive lending rates. Hence, we furnish loans backed by cryptocurrency at an impressive interest rate of 9%. Whether you seek funds for personal or commercial purposes, our affordable rate loans are an efficient avenue to obtain liquidity and retain your valuable cryptos.

What sets apart Cropty's crypto loans is our collateralization procedure. In instances where a borrower fails to repay the loan, the reserve FDUSD stays with Cropty while the Tether USDT issued prior is retained by the borrower. This promotes an equitable recovery system for the loan, bringing advantages to all parties included.

Cropty utilises an automatic clearance mechanism to counteract the risk of First Digital USD depreciation. If the collateral value descends beneath a critical mark, the loan undergoes liquidation. This preemptive strategy defends both lenders and borrowers from possible losses during a market decline.

We at Cropty prioritize clarity and convenience for our users. Through our user-friendly interface, loan product status monitoring is a breeze. Borrowers are given flexibilities as well - additional collateral can be added, the loan can be settled earlier than planned, or they can opt to close out the loan, covering the borrowed sum plus the interest that has accumulated.

Contemplating how to secure a loan utilizing cryptocurrency? Cropty avails immediate coin loans. Borrow against the First Digital USD to receive Tether USDT in haste. Our cryptojourney loans cater for a swift and user-friendly financial solution to your needs.

Why choose First Digital USD Cropty Loan

FAQ

What is Cropty First Digital USD Crypto Loan?

How do I pledge my assets and start borrowing with Cropty First Digital USD Crypto Loan?

What is LTV, and how much can I borrow from Cropty First Digital USD Crypto Loan?

Are there limits to how much I can pledge and borrow?

What is loan liquidation, and what is the liquidation LTV?

What happens when a loan is liquidated?

What is a margin call?

Will I be notified in the event of margin calls or liquidations?

What interest rate applies to my loan?

How is interest accrued for my loan positions?

How do I repay my loan or adjust my LTV?

Which cryptocurrencies can I pledge or borrow on Cropty Crypto Loan?

What can I do with the cryptocurrencies borrowed from Cropty First Digital USD Crypto Loan?

More coins