How do loans backed by CRO works

Borrowers and lenders both gain from the streamlined solution provided by Crypto-financing. Without forfeiting their digital possessions, borrowers can procure USDT loans, employing their crypto as security. This bypasses the traditional requirement of extensive background checks and exhaustive documentation, thereby accelerating and economizing the modus operandi.

Depositing their currency, such as Cronos (CRO), into a unique account on the Cropty arena is how the lenders partake. The custodian plays a pivotal role in regulating the interactions between these two parties, thereby guaranteeing a safe pathway. They serve as a reliable go-between, dutifully safeguarding the interests of both.

This scheme provides borrowers the opportunity to access much-needed capital without having to relinquish their cryptocurrency holdings. During uncertain market trends, they can dodge potential losses. Moreover, the simplified procedure negates necessity any credit screenings.

Lenders, on the other hand, reap dividends on their deposited funds through the receipt of loan pay-offs. It affords them an opportunity to monetize their crypto holdings. In essence, it’s an equitable situation where both the borrowers obtain loans while the lenders have a share of profits.

Cropty shapes the interplay between them and the utilization of blockchain technology guarantees worry-free trading devoid of third parties. Consequently, fraud risks dwindle, cultivating a secure lending atmosphere.

Cronos Loan Calculator

Crypto Loans explained

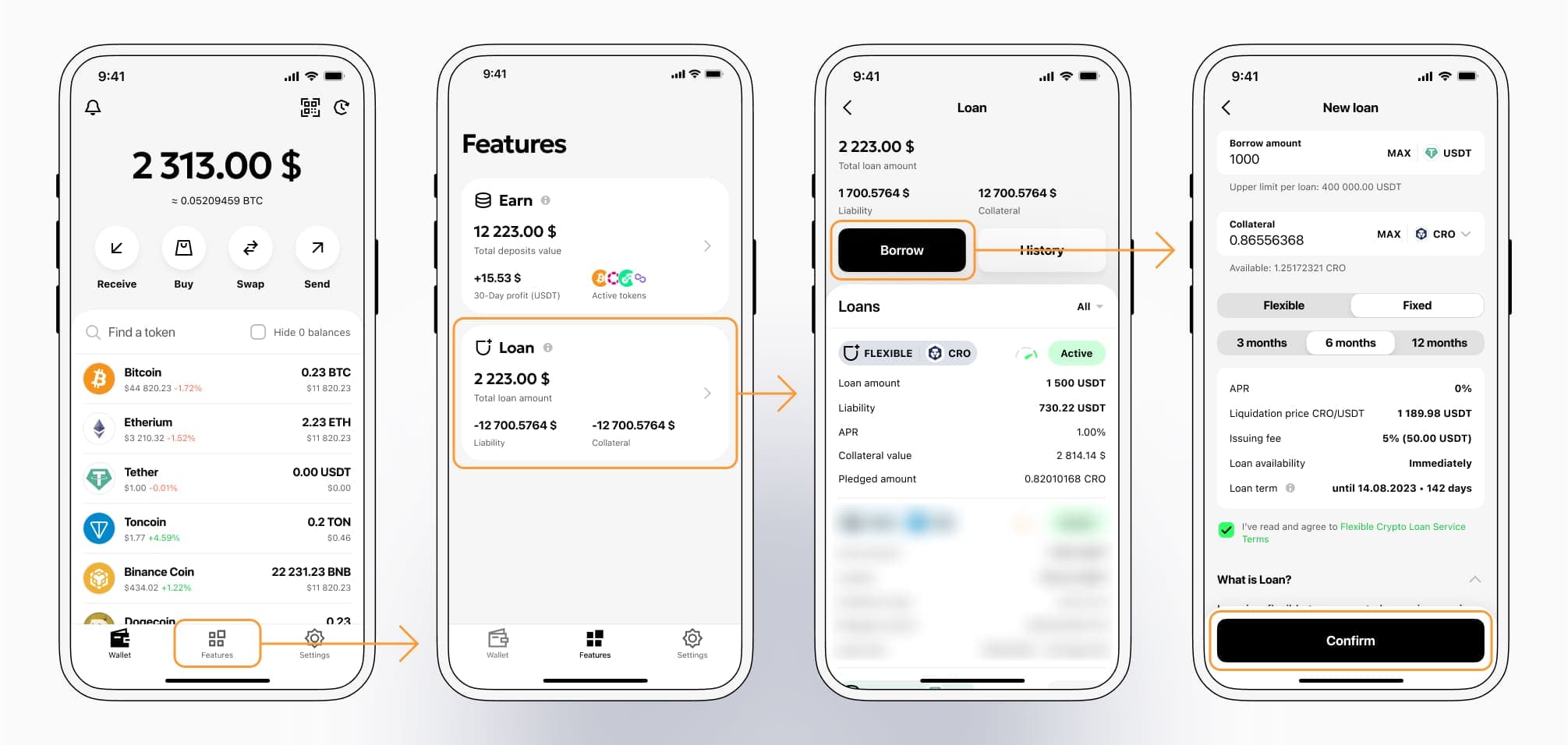

How to get a loan on Cronos? Borrow usd against Cronos on Cropty

The process of getting an Cronos cryptocurrency loan is quite simple. First, you need to create your account on Cropty, a platform that offers Cronos cryptocurrency lending services. Then, you need to provide your CRO as collateral and specify the loan amount you want to borrow. The platform then evaluates your collateral and gives you access to the required amount of Tether USDT.

Your creditworthiness is determined based on the value of your collateral, making the process of getting a cryptocurrency loan fast and convenient.

However, it is important to remember that Cronos cryptocurrency loans are not without risks. In case you default on the loan, your collateral can be seized. Therefore, you should carefully assess your repayment capacity before taking out a cryptocurrency loan.

To authorize an Cronos Crypto Loan, you will need to go to Features tab → Loan section → Borrow button

Choose the required loan amount the terms and conditions of the crypto loan, and apply for it by confirming it with a code from 2FA - application or E-mail or Telegram-bot.

Learn more about CRO Crypto Loans

Interest rates for Cronos secured loans.

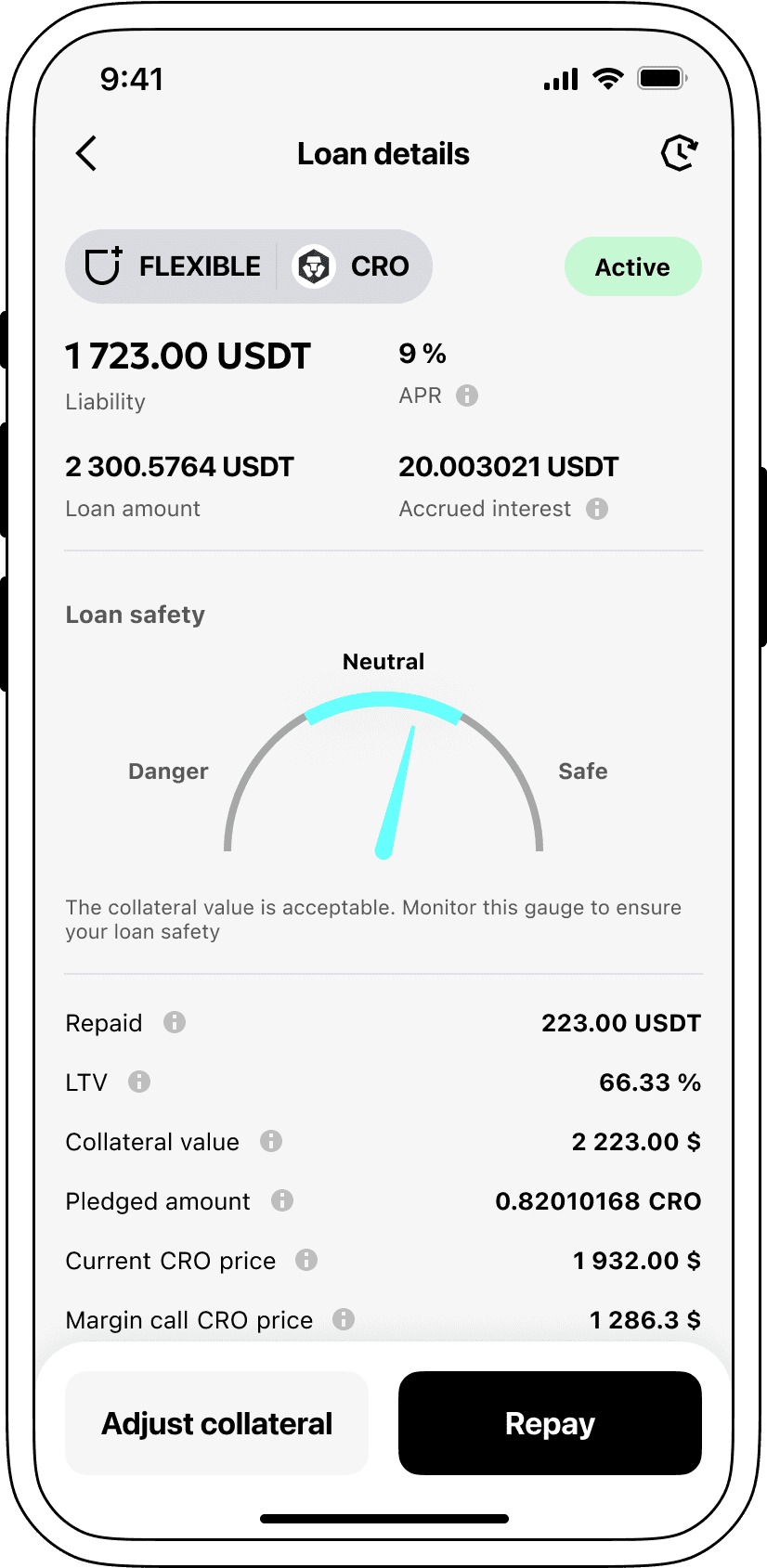

"Cropty wholly grasps the significance of desirable loan rates. In a move to appease our clientele, we provide borrowing services utilizing cryptocurrency at an enticing 9% interest rate. Regardless of whether you require extra cash flow for personal needs or entrepreneurial projects, our affordable-interest loans are an efficient approach to procure funds, all the while retaining your precious crypto assets.

Cropty's crypto loans exhibit a one-of-a-kind feature - the securement procedure. Should a loan-taker fail to meet the repayment terms, the pledged Cronos (CRO) stays grounded with Cropty, while Tether USDT distributed during the loan issuance remains with the borrower. This tactic maintains justness and equilibrium for loan redemption, to the advantage of both counterparts.

To guard against potential Cronos value depreciation, Cropty incorporated an automated liquidation tool. If the worth of the secured asset drops below a certain point, the loan undergoes immediate liquidation - a proactive approach to protect both lender and borrower from impending losses amidst a market slump.

Built on the virtues of transparency and convenience, Cropty offers a user-centric platform where clients can easily track the journey of their loan products. Borrowers enjoy flexible terms with the opportunity to increase their collateral, prepay the loan, or conclude the loan term by reimbursing the loan amount inclusive of any accrued interest.

Are you curious about accessing a loan using cryptocurrency? Cropty presents effortless coin loans, where you can raise money against your Cronos possession and receive Tether USDT in return. Our crypto-secured loans offer an efficient solution to your imminent financial requirements."

Why choose Cronos Cropty Loan

FAQ

What is Cropty Cronos Crypto Loan?

How do I pledge my assets and start borrowing with Cropty Cronos Crypto Loan?

What is LTV, and how much can I borrow from Cropty Cronos Crypto Loan?

Are there limits to how much I can pledge and borrow?

What is loan liquidation, and what is the liquidation LTV?

What happens when a loan is liquidated?

What is a margin call?

Will I be notified in the event of margin calls or liquidations?

What interest rate applies to my loan?

How is interest accrued for my loan positions?

How do I repay my loan or adjust my LTV?

Which cryptocurrencies can I pledge or borrow on Cropty Crypto Loan?

What can I do with the cryptocurrencies borrowed from Cropty Cronos Crypto Loan?

More coins