What is ChainLink?

Chainlink is a decentralized oracle network. It aims to serve as a middleware between smart contracts on smart contracting platforms and external data sources, allowing smart contracts to securely access off-chain data feeds.

How do loans backed by LINK works

Crypto-credit advances a straightforward solution for loan seekers and fund providers. Borrowers can leverage their chain-linked digital wealth, securing a loan in USDT, while still retaining their ownership of these digital commodities. This rectifies long waits for credit assessments and document processing, imparting a faster and cost-effective method.

Loan providers can place their crypto, including ChainLink (LINK), within a specific Cropty platform account. The managing custodian mediates the dealings between both sides, guaranteeing a well-protected execution. This facilitator acts as a vital go-between, safeguarding the mutual interests of loan providers and borrowers.

The borrower community is at an advantage by having immediate capital at their disposal, all without the necessity of offloading their crypto finance. Most appreciated during unsteady market conditions, borrowers steer clear of probable financial setbacks. The lending model also unravels complex loan procedures and abandons credit scrutinizing.

Lenders also draw an earning from the repayments received on their invested capital, allowing them to tap into the earning potential of their crypto finance. It's a well-balanced circumstance benefiting both ends; the borrowers acquire their loans while the lenders gain through their participations.

In this regulated Cropty environment, transactions between borrowers and lenders are tracked and verified by a blockchain technology, eliminating middlemen and thereby mitigating any hazard of deception, cultivating a highly protected lending habitat.

ChainLink Loan Calculator

Crypto Loans explained

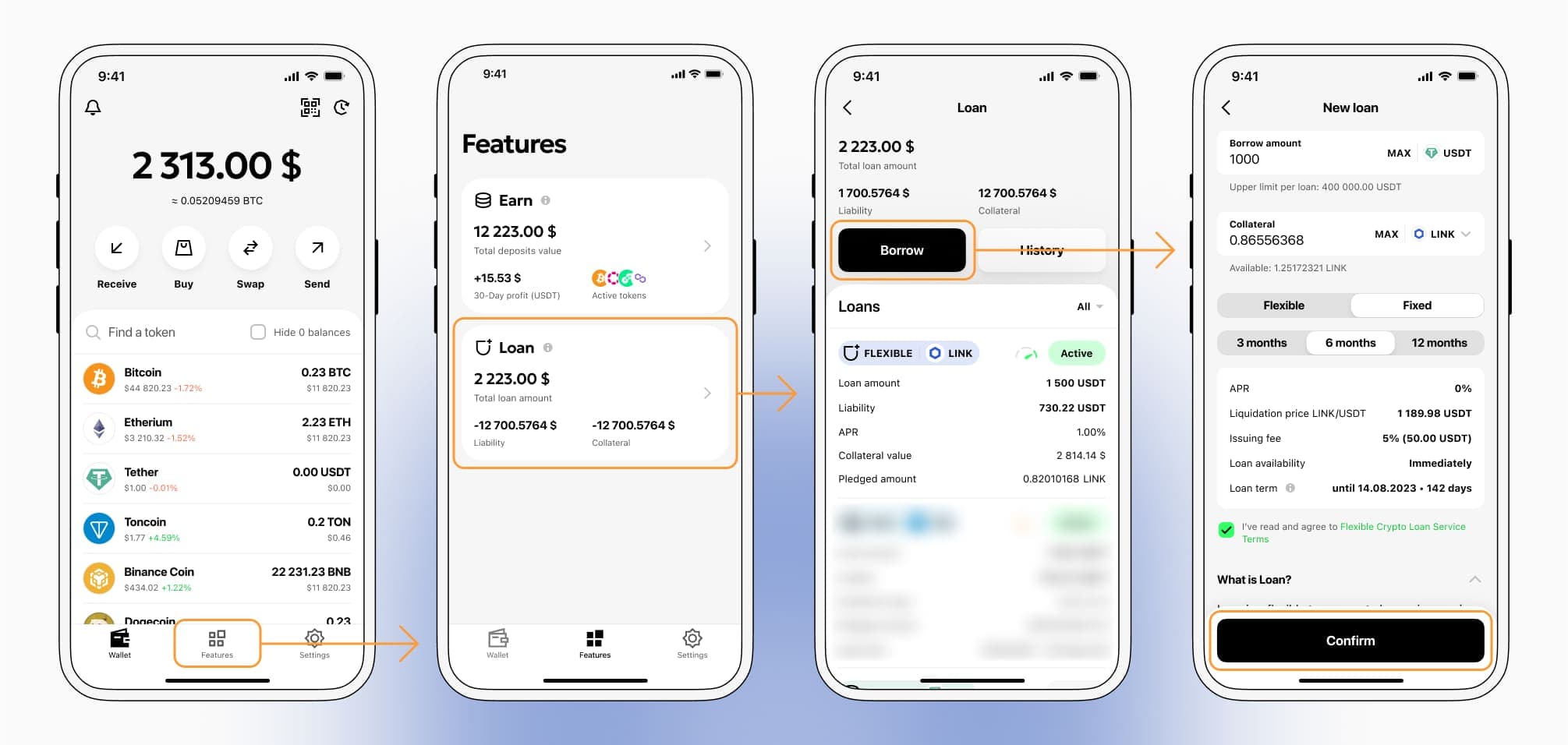

How to get a loan on ChainLink? Borrow usd against ChainLink on Cropty

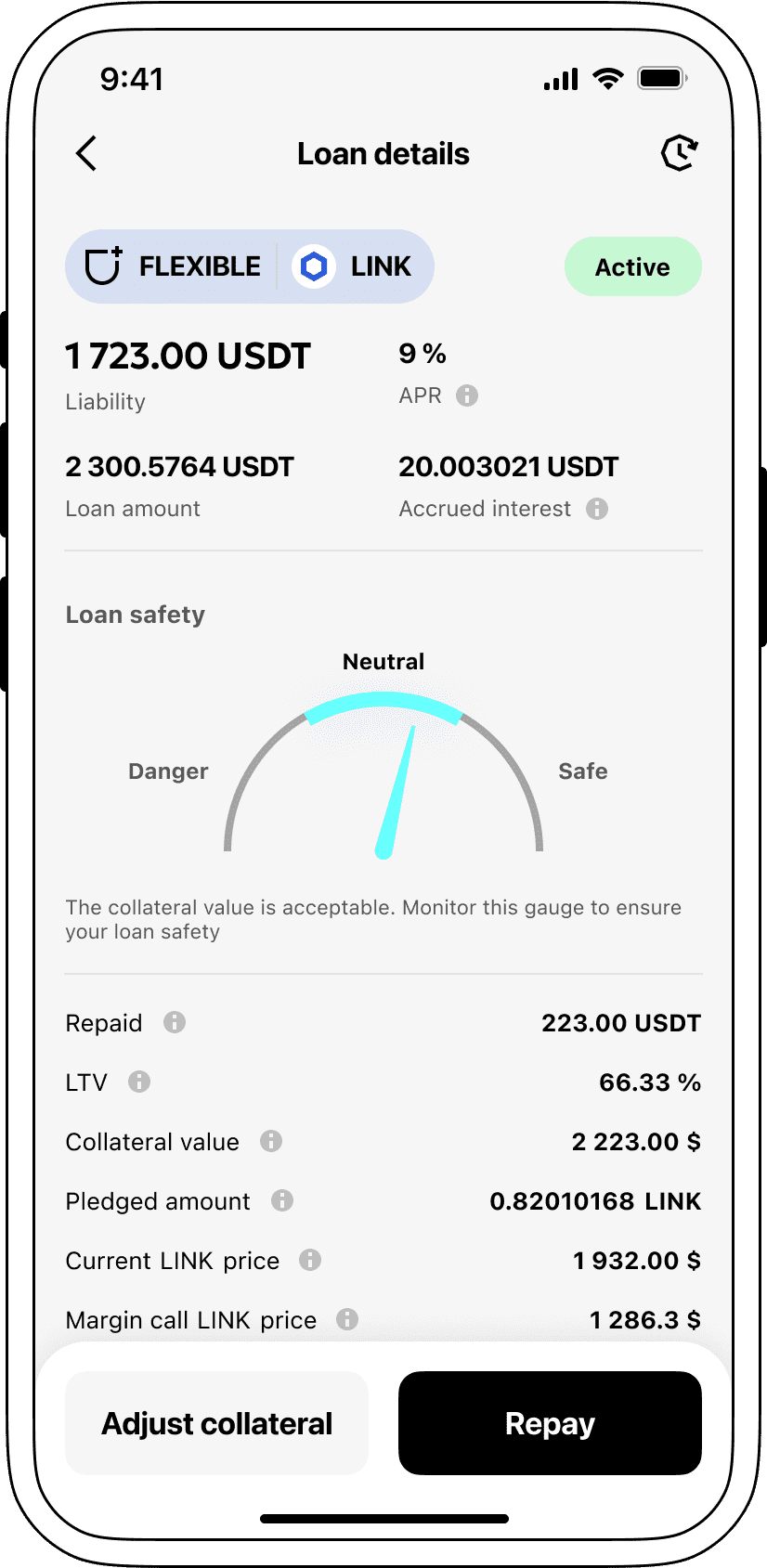

The process of getting an ChainLink cryptocurrency loan is quite simple. First, you need to create your account on Cropty, a platform that offers ChainLink cryptocurrency lending services. Then, you need to provide your LINK as collateral and specify the loan amount you want to borrow. The platform then evaluates your collateral and gives you access to the required amount of Tether USDT.

Your creditworthiness is determined based on the value of your collateral, making the process of getting a cryptocurrency loan fast and convenient.

However, it is important to remember that ChainLink cryptocurrency loans are not without risks. In case you default on the loan, your collateral can be seized. Therefore, you should carefully assess your repayment capacity before taking out a cryptocurrency loan.

To authorize an ChainLink Crypto Loan, you will need to go to Features tab → Loan section → Borrow button

Choose the required loan amount the terms and conditions of the crypto loan, and apply for it by confirming it with a code from 2FA - application or E-mail or Telegram-bot.

Learn more about LINK Crypto Loans

Interest rates on ChainLink secured loans

Cropty realizes how crucial competitive interest rates are to borrowers. Consequently, we furnish loans built on cryptocurrency, boasting a highly favorable 9% interest rate. Whether you require resources for personal usage or business undertakings, our low-interest loans present a pocket-friendly resort for gaining liquidity without the stress of ridding your esteemed cryptocurrencies.

Our crypto loans stand out, thanks to the Collateralization arrangement. If the borrower falls off the repayment ladder, the pledged LINK stays in Cropty's possession, while the borrower retains the Tether USDT we assigned them. This protocol upholds a fair and evenly matched strategy towards loan recovery, benefitting both transaction ends.

To ward off the risk coming from ChainLink depreciation, Cropty arms itself with an instantaneous liquidation operation. If the collateral's worth plummets below a danger line, loan liquidation is initiated. This preemptive plan safeguards both the creditor and debtor from potential market plunge losses.

We at Cropty prioritize straightforwardness and comfort. Lenders can track the progress of their loan items seamlessly via our user-friendly dashboard. Furthermore, borrowers can top up collateral, settle up the loan prematurely, or close it off by returning the borrowed sum along with the accumulated interest.

If the question of procuring a loan using cryptocurrency is troubling you, then worry no more. Cropty introduces instant ChainLink-backed loans, giving you the power to borrow against ChainLink and receive Tether USDT. Our crypto collateralized loans offer a swift and convenient financial remedy for your monetary necessities.

Why choose ChainLink Cropty Loan

FAQ

What is Cropty ChainLink Crypto Loan?

How do I pledge my assets and start borrowing with Cropty ChainLink Crypto Loan?

What is LTV, and how much can I borrow from Cropty ChainLink Crypto Loan?

Are there limits to how much I can pledge and borrow?

What is loan liquidation, and what is the liquidation LTV?

What happens when a loan is liquidated?

What is a margin call?

Will I be notified in the event of margin calls or liquidations?

What interest rate applies to my loan?

How is interest accrued for my loan positions?

How do I repay my loan or adjust my LTV?

Which cryptocurrencies can I pledge or borrow on Cropty Crypto Loan?

What can I do with the cryptocurrencies borrowed from Cropty ChainLink Crypto Loan?

More coins