What is Cosmos?

Cosmos is a network of sovereign blockchains that communicate via IBC, an interoperability protocol modeled after TCP/IP, for secure data and value transfer. The Cosmos Hub, also known as "Gaia," is a proof of stake chain with a native token, ATOM, that serves as a hub for IBC packet routing among blockchains within the Cosmos network. The Cosmos Hub, like the majority of blockchains in the Cosmos network, is secured by the Byzantine Fault-Tolerant (BFT) Proof-of-Stake consensus algorithm, Tendermint.

How do loans backed by ATOM works

Crypto-financing provides a straightforward remedy for the needs of both borrowers and lenders. Borrowers can acquire loans in USDT, collateralized by their cryptocurrency, while retaining ownership of their digital assets. This bypasses the need for credit vetting and paperwork, rendering the system quicker and cost-effective.

Lenders can park their Cryptos, such as Cosmos (ATOM), into a dedicated account on the Cropty platform. The custodian supervises the lenders and borrowers' interaction, facilitating a secure transaction. They serve as a reliable third-party, safeguarding the interests of both parties.

Borrowers have the advantage of fund access without selling their crypto assets—an essential feature during market volatilities aiding to avert possible losses. The lending platform eliminates the loan intricacies and rules out credit vetting requirements, making it simpler.

Lenders garner interest on the deposited fund via loan repayments, which gives a financial boost to their crypto assets. It creates an advantageous situation for all—borrowers secure loans and lenders profit from their participation.

Cropty's platform governs the relationship between borrowers and lenders, and blockchain technology imparts secure transactions devoid of middlemen, minimizing the fraud risk and fostering a safe lending atmosphere.

Cosmos Loan Calculator

Crypto Loans explained

How to get a loan on Cosmos? Borrow usd against Cosmos on Cropty

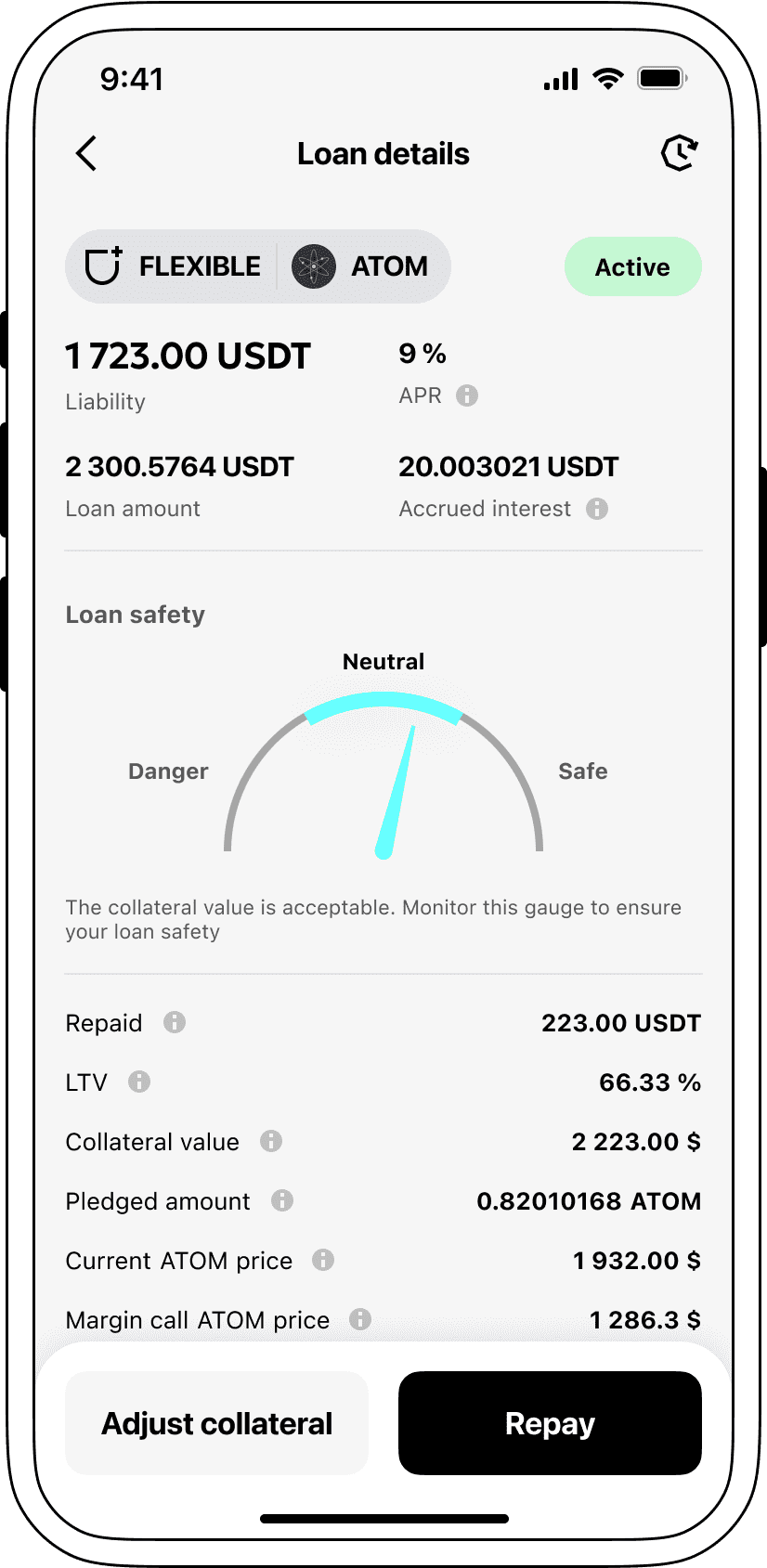

The process of getting an Cosmos cryptocurrency loan is quite simple. First, you need to create your account on Cropty, a platform that offers Cosmos cryptocurrency lending services. Then, you need to provide your ATOM as collateral and specify the loan amount you want to borrow. The platform then evaluates your collateral and gives you access to the required amount of Tether USDT.

Your creditworthiness is determined based on the value of your collateral, making the process of getting a cryptocurrency loan fast and convenient.

However, it is important to remember that Cosmos cryptocurrency loans are not without risks. In case you default on the loan, your collateral can be seized. Therefore, you should carefully assess your repayment capacity before taking out a cryptocurrency loan.

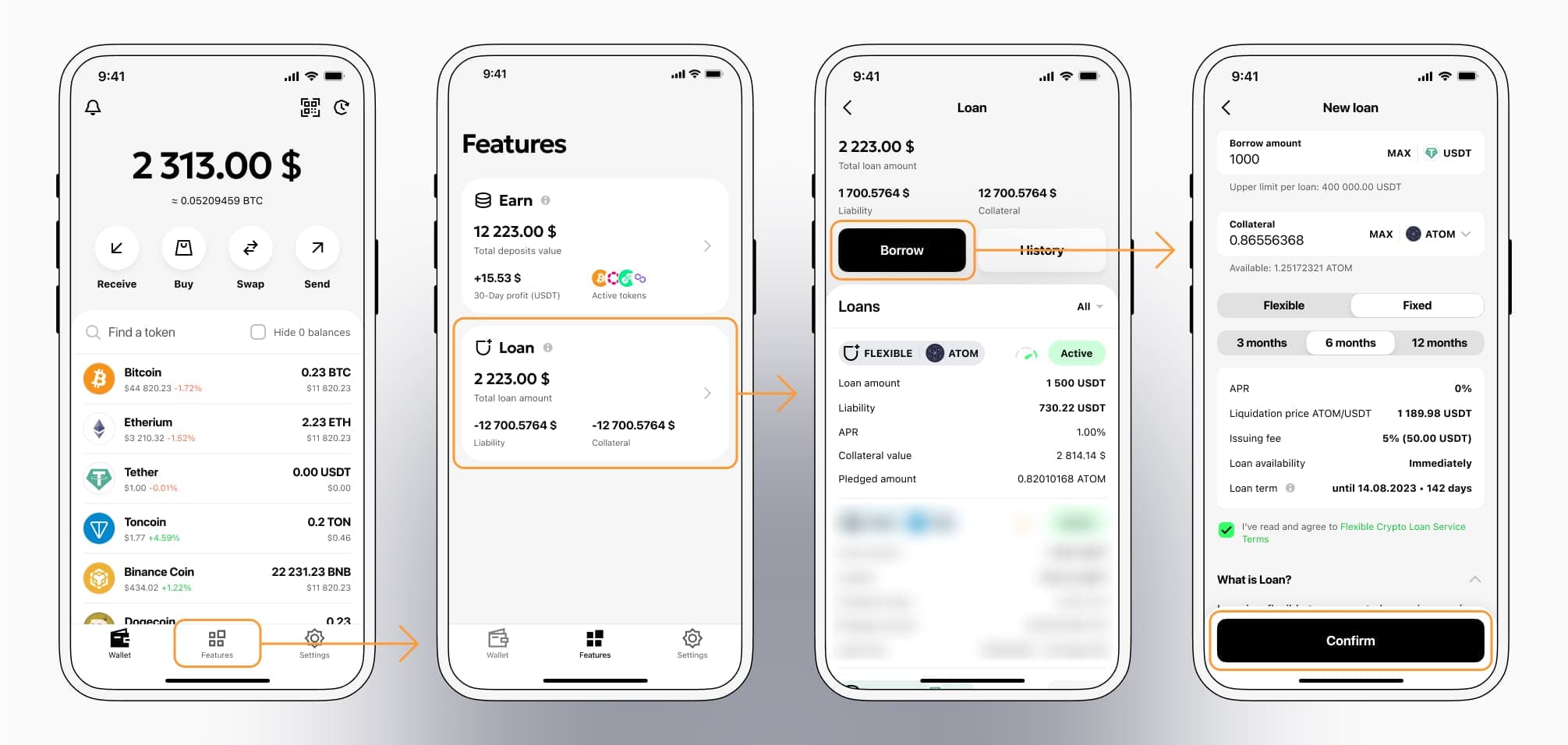

To authorize an Cosmos Crypto Loan, you will need to go to Features tab → Loan section → Borrow button

Choose the required loan amount the terms and conditions of the crypto loan, and apply for it by confirming it with a code from 2FA - application or E-mail or Telegram-bot.

Learn more about ATOM Crypto Loans

Interest rates on loans secured by Cosmos.

Trumpeting Cropty's key values of competitive pricing, we proudly present our crypto loans service, featuring an amazing interest rate of 9%. Regardless of whether you require funds for personal necessities or business endeavors, our low-interest loans offer a cost-effective alternative to gaining liquidity without liquidating your precious cryptocurrencies.

Cropty's cryptographic loans bear a unique attribute - the collateralization procedure. In unfortunate events, such as loan defaults from the borrower, the collateral ATOM still resides with Cropty, whereas the borrower retains the issued Tether USDT. This approach postures a balanced loan recovery system, posing a viable advantage for both stakeholders involved.

To protect against possible Cosmos devaluation threats, Cropty incorporates an automated liquidation process. Consequent to a potential degradation of the collateral value below a critical point, the load shall undergo prompt liquidation. This precautionary step safeguards both lender and borrower from probable financial pitfalls due to market instabilities.

Transparency and ease-of-use are among the key pillars of Cropty's commitment to customers. Not only can our clients effortlessly track their loan status via our intuitive interface, but borrowers also enjoy the flexibility to bolster their collateral. They can also pay off the loan prematurely or clear the loan by settling the borrowed amount plus the accumulated interest.

Still pondering over acquiring a cryptocurrency loan? With Cropty's speedy coin loans, you can confidently secure loans against Cosmos and receive Tether USDT. Particularly, our crypto-guaranteed loans offer quick, hassle-free financial solutions to suit your needs.

Why choose Cosmos Cropty Loan

FAQ

What is Cropty Cosmos Crypto Loan?

How do I pledge my assets and start borrowing with Cropty Cosmos Crypto Loan?

What is LTV, and how much can I borrow from Cropty Cosmos Crypto Loan?

Are there limits to how much I can pledge and borrow?

What is loan liquidation, and what is the liquidation LTV?

What happens when a loan is liquidated?

What is a margin call?

Will I be notified in the event of margin calls or liquidations?

What interest rate applies to my loan?

How is interest accrued for my loan positions?

How do I repay my loan or adjust my LTV?

Which cryptocurrencies can I pledge or borrow on Cropty Crypto Loan?

What can I do with the cryptocurrencies borrowed from Cropty Cosmos Crypto Loan?

More coins