What is World Liberty Financial?

World Liberty Financial (WLF) is a US-based decentralized platform pioneering a new era of Decentralized Finance (DeFi), inspired by the vision of Donald J. Trump. Its core mission is to democratize access to financial opportunities for mainstream users while fortifying the global status of the US Dollar. The WLF Protocol aims to achieve this by supporting US dollar-based stablecoins and providing users with information and access to third-party DeFi applications. The native ERC-20 token, $WLFI, serves as a governance token, granting holders the right to vote on protocol matters and shape the future of the ecosystem, which is presented as a decentralized alternative to Central Bank Digital Currencies (CBDCs) built on American ideals of liberty and privacy.

How Loans Secured by WLFI Work

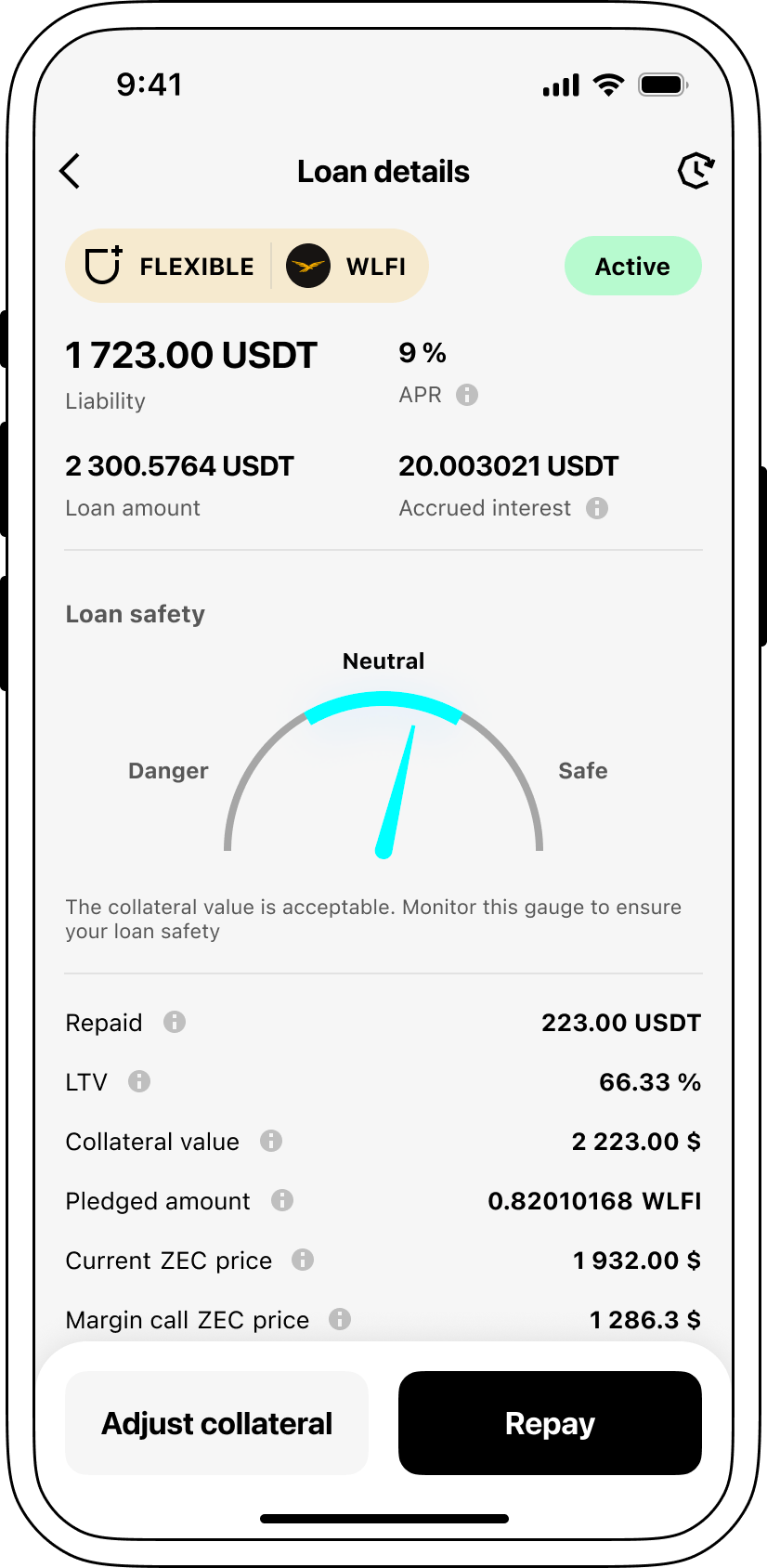

WLFI-backed loans allow you to use the token as collateral and obtain liquidity without selling it. The borrower pledges their WLFI on the selected platform and takes a loan in USDT or other stable assets. Additionally, the borrower retains ownership of the collateral. They can repay the funds when they settle the debt. Thus, the cryptocurrency used as collateral is unlocked and transferred back to the borrower's balance.

For example, in the Cropty Wallet crypto wallet, the collateral is stored within the platform: all transactions are recorded on the blockchain, and the user sees the loan status in real time. All this helps make the lending process transparent and convenient.

Creditors provide their funds and receive income in the form of interest. Borrowers get money without selling assets. Everyone benefits!

Thanks to blockchain technologies, services providing crypto lending have a high level of security. As for Cropty Wallet, this crypto wallet uses the most reliable protection protocols, ensuring the safety of borrowers' funds.

World Liberty Financial Loan Calculator

Crypto Loans explained

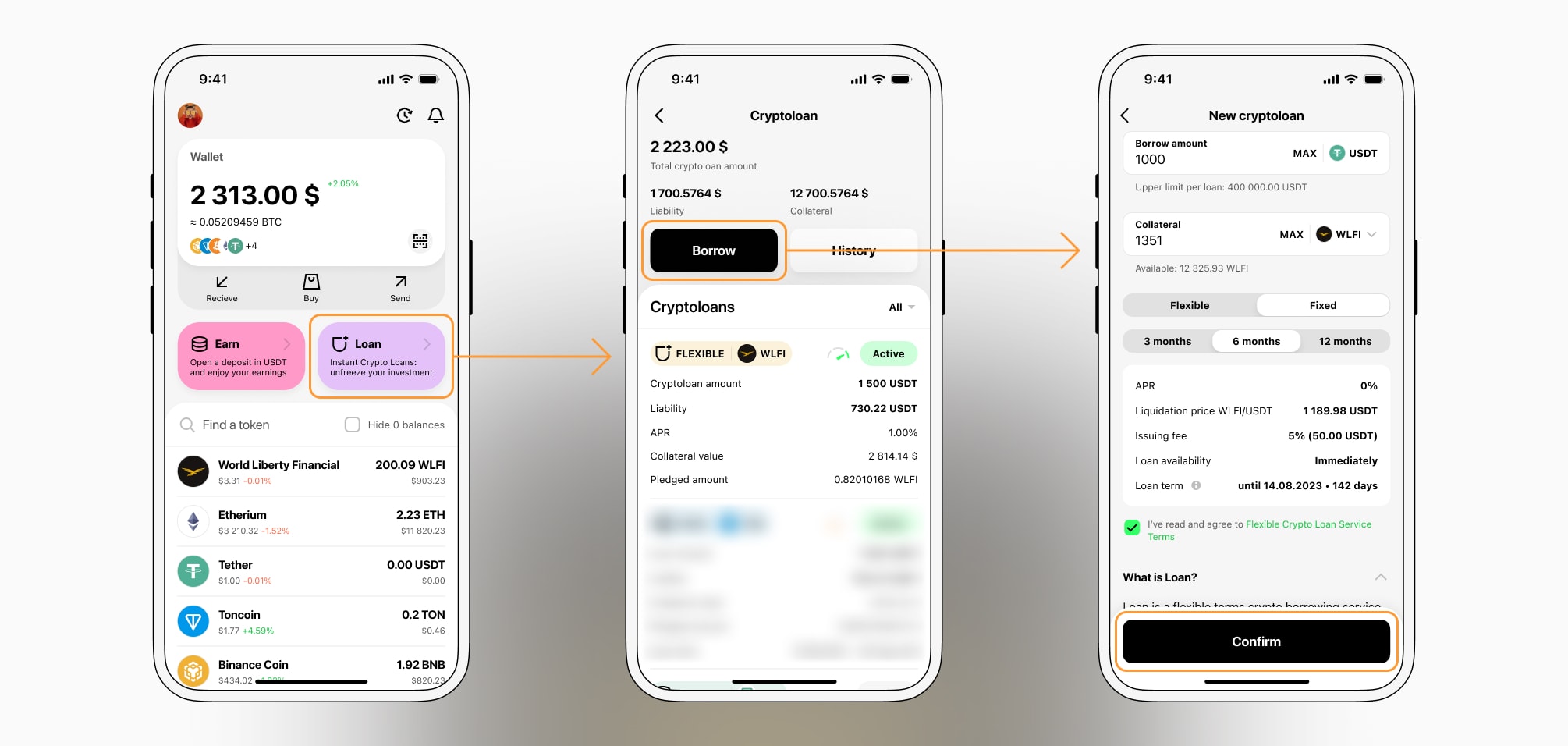

How to get a loan on World Liberty Financial? Borrow usd against World Liberty Financial on Cropty

The process of getting an World Liberty Financial cryptocurrency loan is quite simple. First, you need to create your account on Cropty, a platform that offers World Liberty Financial cryptocurrency lending services. Then, you need to provide your WLFI as collateral and specify the loan amount you want to borrow. The platform then evaluates your collateral and gives you access to the required amount of Tether USDT.

Your creditworthiness is determined based on the value of your collateral, making the process of getting a cryptocurrency loan fast and convenient.

However, it is important to remember that World Liberty Financial cryptocurrency loans are not without risks. In case you default on the loan, your collateral can be seized. Therefore, you should carefully assess your repayment capacity before taking out a cryptocurrency loan.

To authorize an World Liberty Financial Crypto Loan, you will need to go to Features tab → Loan section → Borrow button

Choose the required loan amount the terms and conditions of the crypto loan, and apply for it by confirming it with a code from 2FA - application or E-mail or Telegram-bot.

Interest rates on loans secured by WLFI

In Cropty Wallet, interest rates on loans secured by WLFI are formed dynamically and depend on supply and demand within the platform. The more users want to take out loans, the higher the rate can be, and vice versa - with high demand, it decreases.

The terms are clear and transparent: the rate is displayed immediately when creating a loan. Interest is accrued based on the conditions.

Two formats of lending secured by WLFI are available in Cropty Wallet - fixed and flexible.

Fixed lending: the fee is known in advance and depends on the loan term:

• 3 months — 4%

• 6 months — 6%

• 12 months — 10%

Flexible lending: interest is accrued daily and may fluctuate. The rate depends on the demand for WLFI, liquidity volume, and market conditions. This option is convenient because the borrower can repay the funds early without overpaying for the entire term.

Borrowers have a choice: either lock in loan expenses in advance and be confident in the final amount, or opt for flexible lending and enjoy greater freedom in managing the loan.

Cropty Wallet makes the lending system convenient and fair: you can monitor the loan status in real time, and all metrics are fully transparent thanks to blockchain technologies.

Why choose World Liberty Financial Cropty Loan

FAQ

What is Cropty World Liberty Financial Crypto Loan?

How do I pledge my assets and start borrowing with Cropty World Liberty Financial Crypto Loan?

What is LTV, and how much can I borrow from Cropty World Liberty Financial Crypto Loan?

Are there limits to how much I can pledge and borrow?

What is loan liquidation, and what is the liquidation LTV?

What happens when a loan is liquidated?

What is a margin call?

Will I be notified in the event of margin calls or liquidations?

What interest rate applies to my loan?

How is interest accrued for my loan positions?

How do I repay my loan or adjust my LTV?

Which cryptocurrencies can I pledge or borrow on Cropty Crypto Loan?

What can I do with the cryptocurrencies borrowed from Cropty World Liberty Financial Crypto Loan?

More coins