What is Tether Gold?

Tether Gold (XAU₮) is a digital asset issued by Tether Ltd., representing ownership of one troy ounce of fine gold on a specific gold bar held in professional vaults in Switzerland. Each XAU₮ token is backed 1:1 by physical gold that meets LBMA Good Delivery standards, providing investors with the stability of gold combined with the efficiency of blockchain technology.

Built on the Ethereum (ERC-20) network, XAU₮ allows fractional ownership, seamless global transfers, and 24/7 liquidity without the logistical barriers of traditional gold markets. Token holders can verify their holdings directly on Tether’s transparency portal and, under certain conditions, redeem physical gold bars.

By bridging the gap between tangible assets and the digital economy, Tether Gold offers an accessible on-chain alternative for investors seeking exposure to gold’s long-term value and inflation hedge characteristics, while maintaining the portability and programmability of crypto assets.

How do loans backed by XAUT works

Crypto loans provide an easy way for both borrowers and lenders to connect. Borrowers can receive loans in USDT by using their cryptocurrency as security, while still keeping ownership of their digital coins. This removes the need for credit checks and paperwork, making everything quicker and more cost-effective.

Lenders have the option to place their crypto assets, such as Tether Gold (XAUT), into a special account on the Cropty platform. A custodian manages the relationship between borrowers and lenders, ensuring the process stays safe and reliable. Acting as a trusted middleman, the custodian protects the interests of both sides.

For borrowers, this means gaining access to funds without having to sell their cryptocurrency. This is especially valuable when markets are shaky, helping them avoid losses during price drops. Plus, the loan process is streamlined with no credit checks required.

Meanwhile, lenders earn interest on the funds they provide through loan repayments. This lets them make money from their cryptocurrency holdings. It’s a mutually beneficial setup—borrowers get cash, and lenders generate income.

The Cropty platform carefully handles borrower and lender interactions, using blockchain technology for secure, transparent transactions without relying on third parties. This lowers fraud risks and offers a trustworthy lending experience.

Tether Gold Loan Calculator

Crypto Loans explained

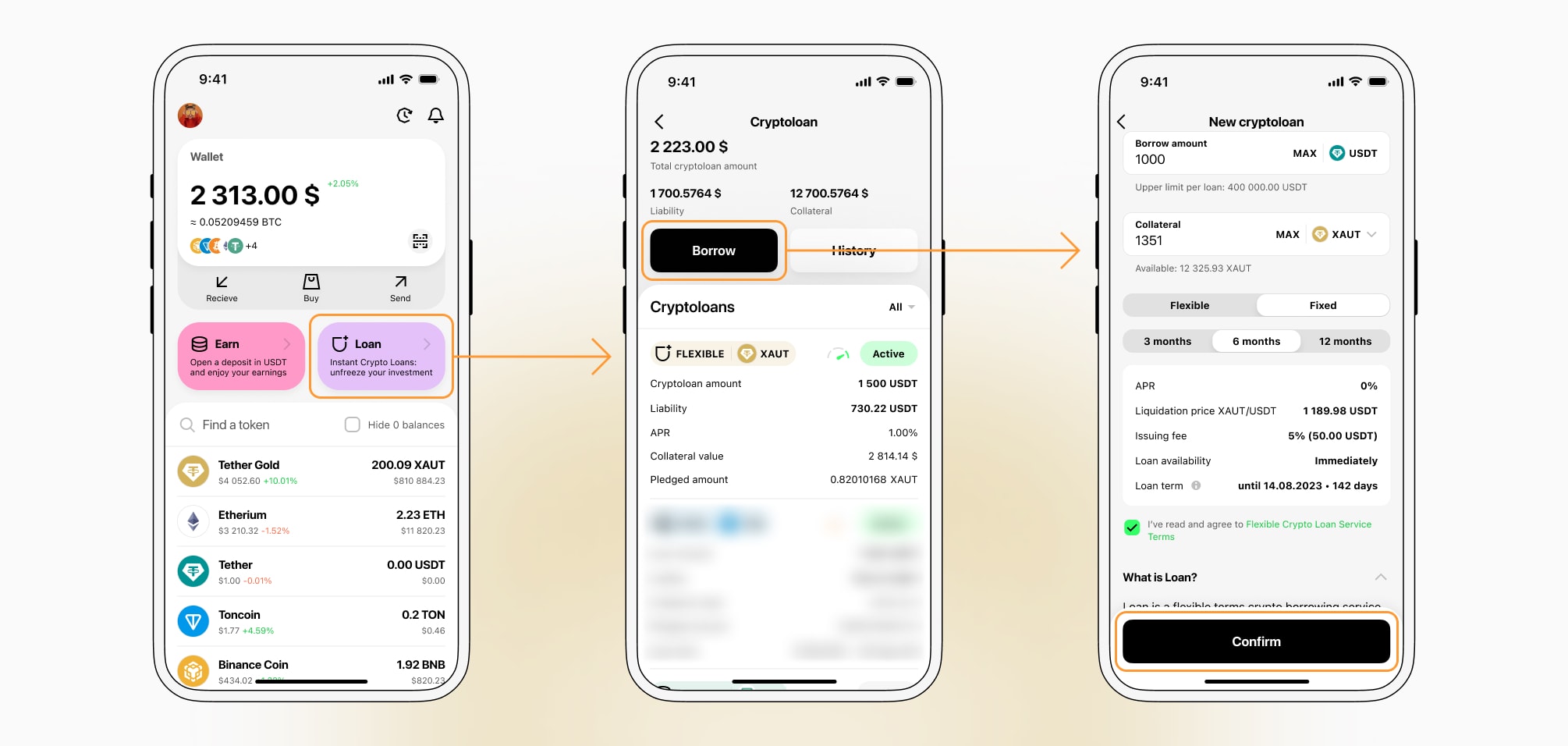

How to get a loan on Tether Gold? Borrow usd against Tether Gold on Cropty

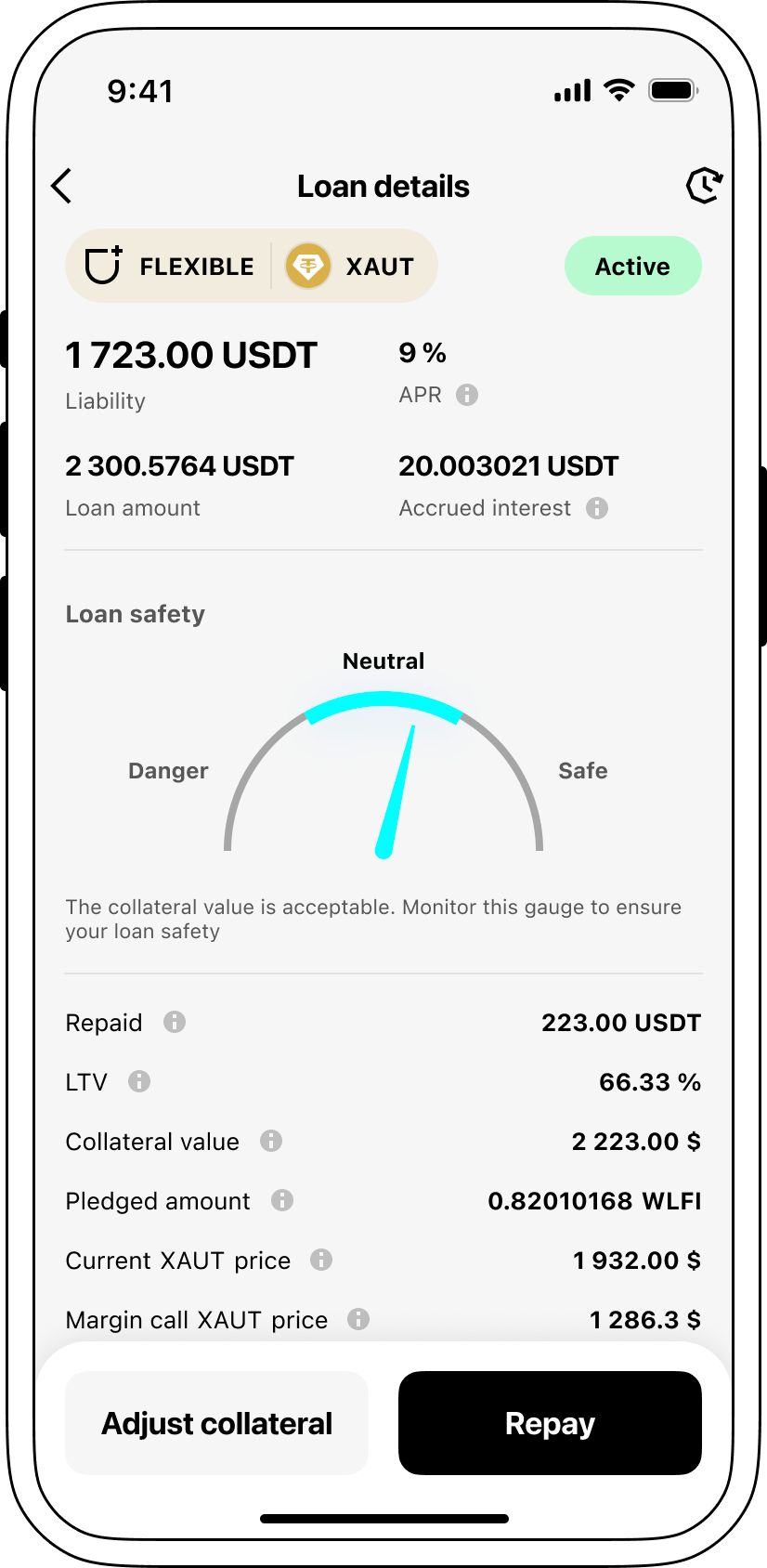

The process of getting an Tether Gold cryptocurrency loan is quite simple. First, you need to create your account on Cropty, a platform that offers Tether Gold cryptocurrency lending services. Then, you need to provide your XAUT as collateral and specify the loan amount you want to borrow. The platform then evaluates your collateral and gives you access to the required amount of Tether USDT.

Your creditworthiness is determined based on the value of your collateral, making the process of getting a cryptocurrency loan fast and convenient.

However, it is important to remember that Tether Gold cryptocurrency loans are not without risks. In case you default on the loan, your collateral can be seized. Therefore, you should carefully assess your repayment capacity before taking out a cryptocurrency loan.

To authorize an Tether Gold Crypto Loan, you will need to go to Features tab → Loan section → Borrow button

Choose the required loan amount the terms and conditions of the crypto loan, and apply for it by confirming it with a code from 2FA - application or E-mail or Telegram-bot.

Loans secured by Tether Gold offer competitive interest rates today.

At Cropty, we know how crucial it is to offer low interest rates. That's why we provide crypto loans at a very attractive 9% rate. Whether you require money for personal use or business purposes, our affordable loans give you access to funds without needing to sell your precious cryptocurrencies.

A standout feature of Cropty’s crypto loans is how the collateral works. When you take a loan, your Tether Gold (XAUT) acts as security. If you cannot repay the loan, Cropty keeps the XAUT collateral, while you retain the Tether USDT that was given to you. This fair system benefits both borrowers and the platform.

To protect everyone from market changes, Cropty uses an automatic liquidation system. If the value of your Tether Gold drops too low, your loan can be liquidated to avoid major losses. This safety net helps shield both you and Cropty from risks during price dips.

Cropty values simplicity and clarity. Our platform makes it easy for users to track their loan details through a simple and clear interface. Borrowers can also add more collateral if needed, repay early without hassle, or close their loan by paying back the borrowed amount plus any interest earned.

If you’re curious about borrowing with crypto, Cropty offers instant loans against Tether Gold. You receive Tether USDT instantly, making it a swift and practical way to meet your financial needs while keeping your crypto assets safe.

Why choose Tether Gold Cropty Loan

FAQ

What is Cropty Tether Gold Crypto Loan?

How do I pledge my assets and start borrowing with Cropty Tether Gold Crypto Loan?

What is LTV, and how much can I borrow from Cropty Tether Gold Crypto Loan?

Are there limits to how much I can pledge and borrow?

What is loan liquidation, and what is the liquidation LTV?

What happens when a loan is liquidated?

What is a margin call?

Will I be notified in the event of margin calls or liquidations?

What interest rate applies to my loan?

How is interest accrued for my loan positions?

How do I repay my loan or adjust my LTV?

Which cryptocurrencies can I pledge or borrow on Cropty Crypto Loan?

What can I do with the cryptocurrencies borrowed from Cropty Tether Gold Crypto Loan?

More coins