What is Polkadot?

Polkadot is a blockchain network designed to support various interconnected, application-specific sub-chains called parachains (short for parallelized chains). Each chain built within Polkadot uses Parity Technologies' Substrate modular framework, which allows developers to select specific components that suit their application-specific chain best. Polkadot refers to the entire ecosystem of parachains that plug into a single base platform known as the Relay Chain. This base platform, which also leverages Substrate, does not support application functionality but instead provides security to the network's parachains and contains Polkadot's consensus, finality, and voting logic.

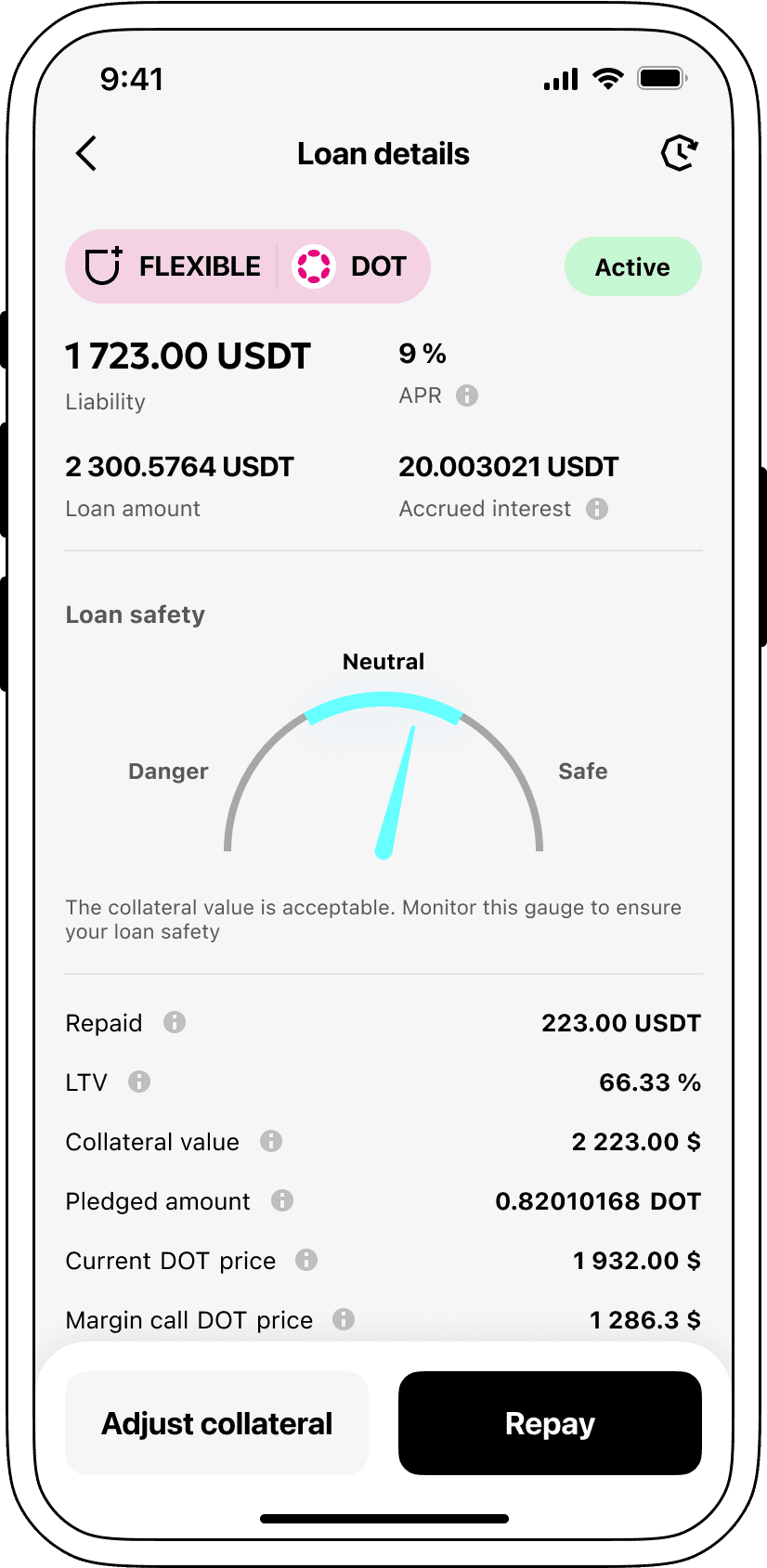

How do loans secured by DOT work?

Cryptoloan is a convenient tool for both borrowers and lenders. The borrower gets USDT (a stable digital currency) and at the same time uses their crypto as a pledge. However, they do not sell their digital assets but simply temporarily "freeze" them as collateral for the loan — therefore, they still remain the owners of the assets.

This solution allows investors to skip numerous issues that appear in credit history checks and the amount of paperwork involved. Everything happens faster, easier, and more cost-effective.

Lenders, those who like to make a profit, can deposit their cryptocurrency e.g. Polkadot / DOT into a special account on the Cropty platform. A trustee is in charge of the operations between borrowers and lenders. They ensure the security of the transactions and act as an agent that protects the rights of both parties.

This is a very favorable situation for the borrower, as they get the opportunity to have the money without selling their crypto. It is trumps in the case of volatility in the market – there is no anxiety that the crypto will lose its value, as it can be sold very quickly if necessary. This system allows the loan to be approved more rapidly and does not require any credit evaluations.

On the other hand, creditors are also in a win-win situation: they get the interest payments on the loans granted, and their crypto starts bringing them money. It turns out to be a combination of advantages for both sides — one group gets access to the required funds, while the other sphere makes a profit.

The Cropty platform is responsible for all activities that are done between the two parties, and the system itself is based on blockchain technology. This means there is no need for intermediaries, the risk of fraud is reduced, and a safe lending environment is created.

Polkadot Loan Calculator

Crypto Loans explained

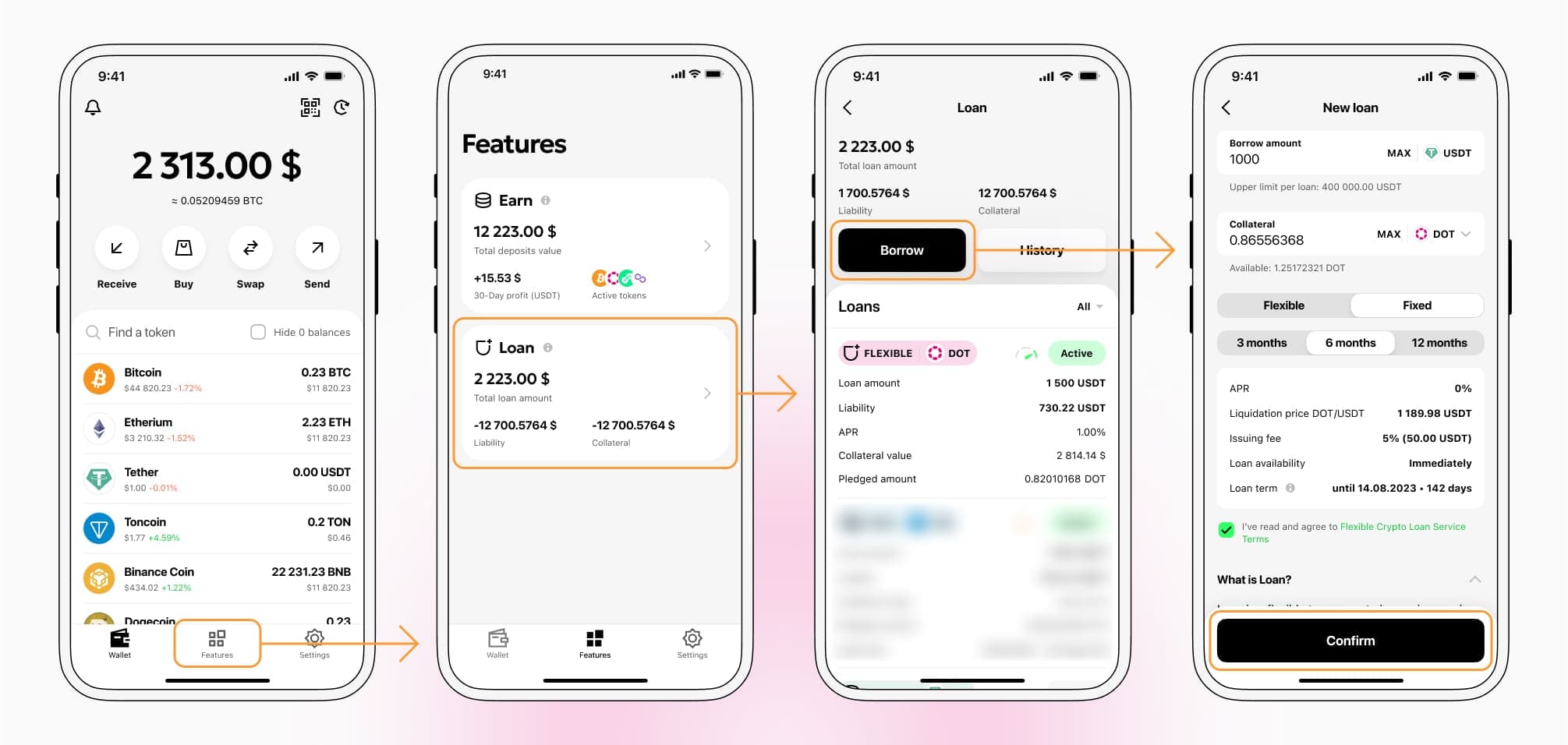

How to get a loan on Polkadot? Borrow usd against Polkadot on Cropty

The process of getting an Polkadot cryptocurrency loan is quite simple. First, you need to create your account on Cropty, a platform that offers Polkadot cryptocurrency lending services. Then, you need to provide your DOT as collateral and specify the loan amount you want to borrow. The platform then evaluates your collateral and gives you access to the required amount of Tether USDT.

Your creditworthiness is determined based on the value of your collateral, making the process of getting a cryptocurrency loan fast and convenient.

However, it is important to remember that Polkadot cryptocurrency loans are not without risks. In case you default on the loan, your collateral can be seized. Therefore, you should carefully assess your repayment capacity before taking out a cryptocurrency loan.

To authorize an Polkadot Crypto Loan, you will need to go to Features tab → Loan section → Borrow button

Choose the required loan amount the terms and conditions of the crypto loan, and apply for it by confirming it with a code from 2FA - application or E-mail or Telegram-bot.

Learn more about DOT Crypto Loans

Interest rates on loans secured by Polkadot

At Cropty, we know how important it is to have an advantageous deal. For this reason, we provide you with a cryptocurrency-backed loan at an attractive rate — 9% only.

Do you need a loan for personal use or the development of your business? Our low-interest loans will provide you with the amount you need, allowing you to keep your precious crypto assets.

The thing that makes our loans amazing is our approach to the use of your property as security. In the event of non-payment of the loan (default), the DOT that was used as security remains with us and the borrower keeps the USDT that was received. This is a balanced and harmonious plan that allows for mutual benefit.

In order to safeguard our members against the decline in the value of Polkadot, we have put in place a system for automatic liquidation. If the price of DOT tanked quite rapidly and as a result, the collateral lost its value, the loan would be immediately terminated. This measure is intended to keep the lender and the borrower from incurring losses due to the volatility of the market.

We highlight fair play and ease of use as our core values. A simple and transparent interface is all that is required for the complete process to be tracked. The borrower is permitted to (i) bring in more collateral, (ii) pay off the loan ahead of time, and (iii) do a full loan closure with the interest portion included.

Thinking of a loan with crypto as collateral? Cropty can give you an on-the-spot loan backed by Polkadot and the money will be sent to you in USDT. This is an easy, quick, and user-friendly method of overcoming monetary difficulties.

Why choose Polkadot Cropty Loan

FAQ

What is Cropty Polkadot Crypto Loan?

How do I pledge my assets and start borrowing with Cropty Polkadot Crypto Loan?

What is LTV, and how much can I borrow from Cropty Polkadot Crypto Loan?

Are there limits to how much I can pledge and borrow?

What is loan liquidation, and what is the liquidation LTV?

What happens when a loan is liquidated?

What is a margin call?

Will I be notified in the event of margin calls or liquidations?

What interest rate applies to my loan?

How is interest accrued for my loan positions?

How do I repay my loan or adjust my LTV?

Which cryptocurrencies can I pledge or borrow on Cropty Crypto Loan?

What can I do with the cryptocurrencies borrowed from Cropty Polkadot Crypto Loan?

More coins