How loans secured by QNT work

Crypto lending is a very straightforward way for a person to take a loan and for a person to invest. In particular, a USDT loan can be easily obtained by the borrowers, in which they are asked to mortgage their digital tokens as collateral and thus, keep the ownership of their digital assets. Document-free transactions. Everything gets to be easier, more convenient, and more accessible!

On the other hand, an investor can do one thing that is to freeze his crypto-assets like Quant (QNT) in a specific Cropty network account. The curator manages the interaction between the investors and the borrowers, thus loan processing becomes safe and secure. They are Intermediaries that are trustworthy, among the rest, the only ones who take care of the business interests of both sides.

Borrowers will have full control of their funds. Moreover, this is a perfect and handy solution in a situation where the market is unstable and thus, the borrowers taking out the loans will be able to avoid losses. Furthermore, the lending model expedites the financial processes without the need for a creditworthiness assessment.

Investors will get an income from the money that they have frozen in the form of a loan repayment. This creates a very easy way for them to generate income from their crypto-assets. This is a situation in which the borrowers get the loans while the investors get the benefits from their participation. Win-win!

Cropty governs the engagement between the loan applicants and the lenders, whereas the blockchain technology ensures a safe transaction without the presence of any middlemen. This not only limits the chances of fraud but also makes it possible to have a safe lending chamber.

Quant Loan Calculator

Crypto Loans explained

How to get a loan on Quant? Borrow usd against Quant on Cropty

The process of getting an Quant cryptocurrency loan is quite simple. First, you need to create your account on Cropty, a platform that offers Quant cryptocurrency lending services. Then, you need to provide your QNT as collateral and specify the loan amount you want to borrow. The platform then evaluates your collateral and gives you access to the required amount of Tether USDT.

Your creditworthiness is determined based on the value of your collateral, making the process of getting a cryptocurrency loan fast and convenient.

However, it is important to remember that Quant cryptocurrency loans are not without risks. In case you default on the loan, your collateral can be seized. Therefore, you should carefully assess your repayment capacity before taking out a cryptocurrency loan.

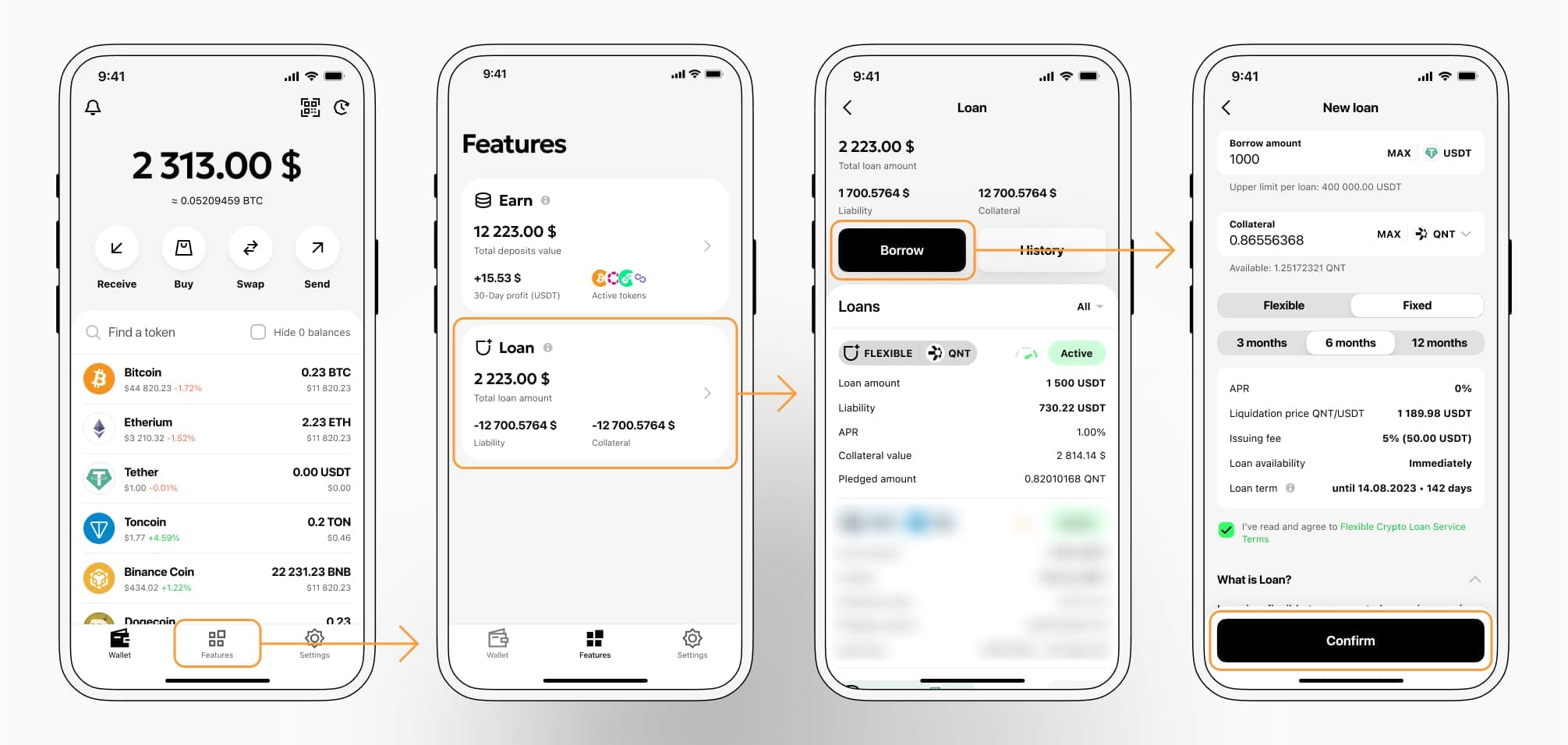

To authorize an Quant Crypto Loan, you will need to go to Features tab → Loan section → Borrow button

Choose the required loan amount the terms and conditions of the crypto loan, and apply for it by confirming it with a code from 2FA - application or E-mail or Telegram-bot.

Learn more about QNT Crypto Loans

Loan rates secured by Quant

Quant or QNT has captivated many with its idea of crypto-backed loans. Through the platforms that are tailored just for Quant loaning, the clients can loan out Quant to accrue interest income or can simply get a loan in return for Quant. Getting money by using QNT is like having an instant liquidity wagon coming into town, no need to sell your assets. They say the best deals come in the toughest times, so USD-taken loans with your trusty collateral might just be what you need next. So, how is a QNT loan executed? The user is required to go through the steps of using their

QNT as the pledge, upon which they will be given a loan that matches the value of their QNT. Well, that is a smart and hassle-free way for people to use cash right away and at the same time keep their QNT intact.

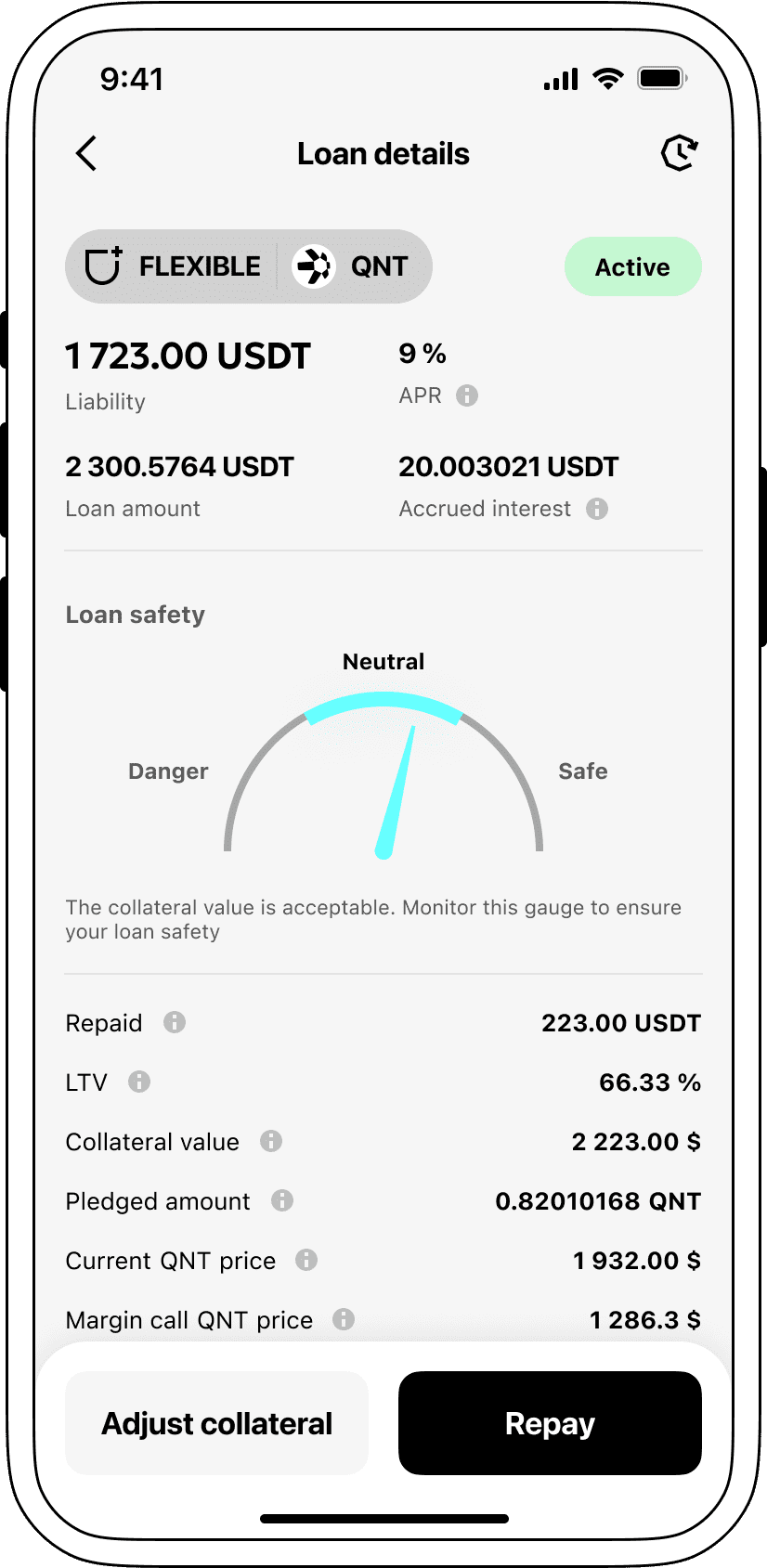

In the world of Cropty, lending rates that can compete with the best on the market take the center stage. Therefore, we are always ready to back up your crypto loans at a super-low and attractive interest rate of 9%. Our low-interest crypto loans might just be the key to your personal or commercial money needs, letting you enjoy the liquidity without having to give up your digital treasure.

One of Cropty's strongest points of its lending system is a scheme that employs a special process for the collateral. If, for some reason, the loan conditions are not met by the borrower, the collateralized QNT is then at the disposal of Cropty, while the borrower is in possession of the obtained Tether USDT. This method ensures that the loan is being repaid on time, thus, the hand that gives and the hand that takes both benefit from it.

To mitigate the risk associated with a drop in Quant's value, Cropty has introduced an automatic liquidation feature. If the value of the collateral falls below a predetermined limit, the loan goes through a liquidation process - a safety measure that shields both parties from losses during a market decline.

Why choose Quant Cropty Loan

FAQ

What is Cropty Quant Crypto Loan?

How do I pledge my assets and start borrowing with Cropty Quant Crypto Loan?

What is LTV, and how much can I borrow from Cropty Quant Crypto Loan?

Are there limits to how much I can pledge and borrow?

What is loan liquidation, and what is the liquidation LTV?

What happens when a loan is liquidated?

What is a margin call?

Will I be notified in the event of margin calls or liquidations?

What interest rate applies to my loan?

How is interest accrued for my loan positions?

How do I repay my loan or adjust my LTV?

Which cryptocurrencies can I pledge or borrow on Cropty Crypto Loan?

What can I do with the cryptocurrencies borrowed from Cropty Quant Crypto Loan?

More coins