What is TON Coin?

Apart from processing millions of transactions per second, TON blockchain-based ecosystem has all the chances to give rise to a genuine Web3.0 Internet with decentralized storage, anonymous network, DNS, instant payments and various decentralized services.

As the ecosystem expands, we see a huge potential of TON coin and numerous ways for it to work in the new economy. We expect it to go beyond a means of payment.

Stakes deposited by validators to be eligible to validate transactions and generate new blocks and coins. Voting power to support or oppose changes in the parameters of the protocol. Income (gas) paid to validator nodes as reward for processing transactions and smart contracts under the PoS consensus. Loans to validators extended against a share of their reward. Payment for services and options implemented by TON Services, TON Storage, TON DNS, TON Proxy, TON WWW. In particular, for bypassing censorship, storing data, hiding identity, using blockchain-based domain names.

How do loans backed by TON works

Crypto loans are a simple and clear solution for borrowers and investors. Loan seekers can use their cryptocurrency, securing loans in USDT, while remaining in ownership of their crypto-assets. It reduces any requirements for credit score checks and complex procedures, which leads to quicker and more cost-effective operations.

Investors have the ability to transfer their virtual currency, e.g. TON, into a secured account, operated by Cropty Wallet. As a middleman, Cropty leads the operations between loan borrowers and investors, guaranteeing a smooth and secure process. It acts as a dependable middle-party ensuring mutual entrustment, and ensuring that interests of both parties are safeguarded.

Loan seekers reap the benefits of this arrangement as it grants them the ability to access funds without the necessity of liquidating their crypto assets. This proves beneficial during unpredictable market shifts, aiding them to dodge potential financial mishaps. It also simplifies the loan-acquisition procedure, abolishing the need for credit assessments.

However, investors can profit from their cryptocurrency investments by earning returns on their deposited funds through loan repayments. This results in a win-win scenario where investors gain from their participation and loan applicants acquire funding.

Cropty is crucial in guiding the interaction between investors and loan seekers on the platform, utilizing blockchain technology to create secure transactions without intermediaries. This reduces the likelihood of fraud, thereby promoting a reliable environment for lending.

TON Coin Loan Calculator

Crypto Loans explained

How to get a loan on TON Coin? Borrow usd against TON Coin on Cropty

The process of getting an TON Coin cryptocurrency loan is quite simple. First, you need to create your account on Cropty, a platform that offers TON Coin cryptocurrency lending services. Then, you need to provide your TON as collateral and specify the loan amount you want to borrow. The platform then evaluates your collateral and gives you access to the required amount of Tether USDT.

Your creditworthiness is determined based on the value of your collateral, making the process of getting a cryptocurrency loan fast and convenient.

However, it is important to remember that TON Coin cryptocurrency loans are not without risks. In case you default on the loan, your collateral can be seized. Therefore, you should carefully assess your repayment capacity before taking out a cryptocurrency loan.

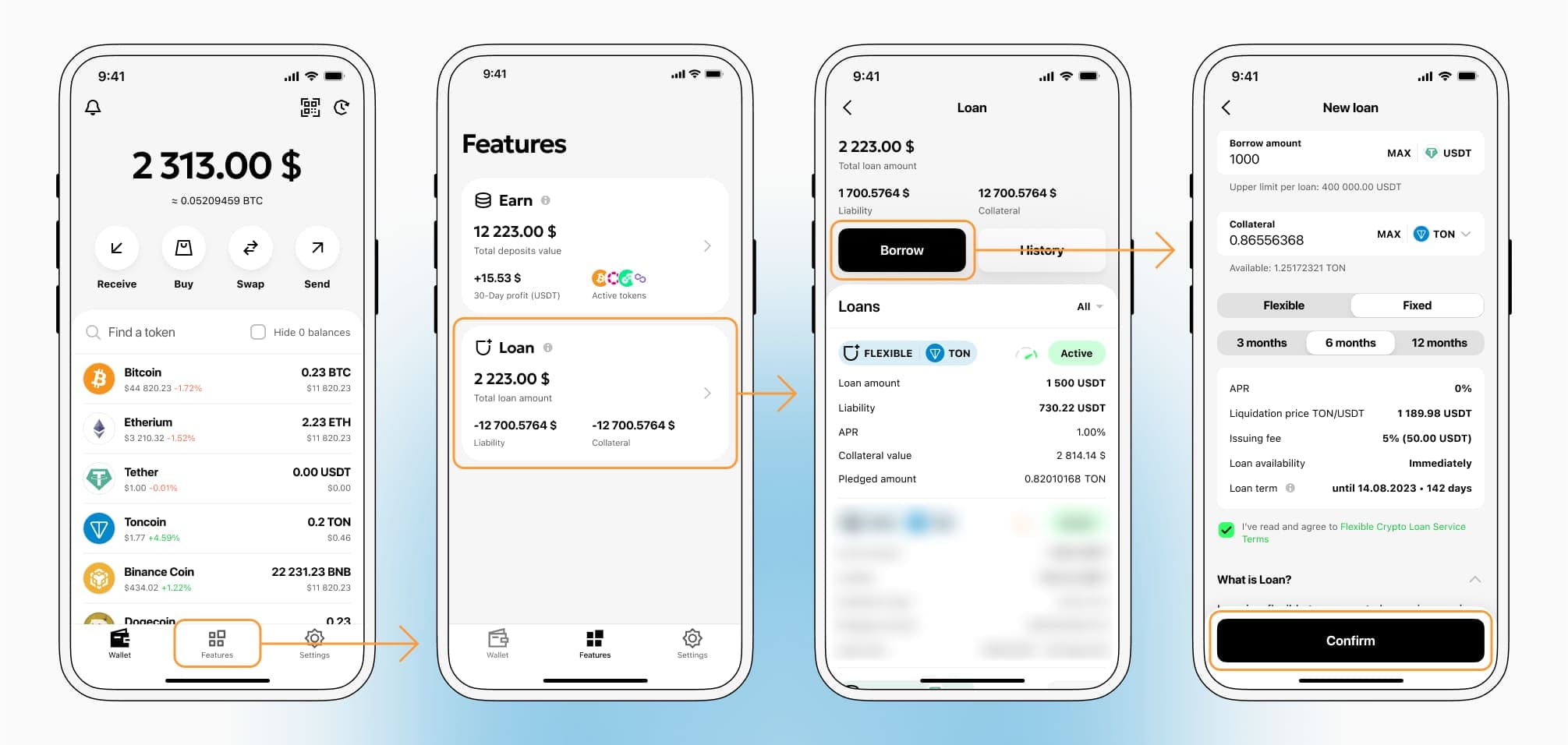

To authorize an TON Coin Crypto Loan, you will need to go to Features tab → Loan section → Borrow button

Choose the required loan amount the terms and conditions of the crypto loan, and apply for it by confirming it with a code from 2FA - application or E-mail or Telegram-bot.

Learn more about TON Crypto Loans

Interest rates for loans secured by TON Coin.

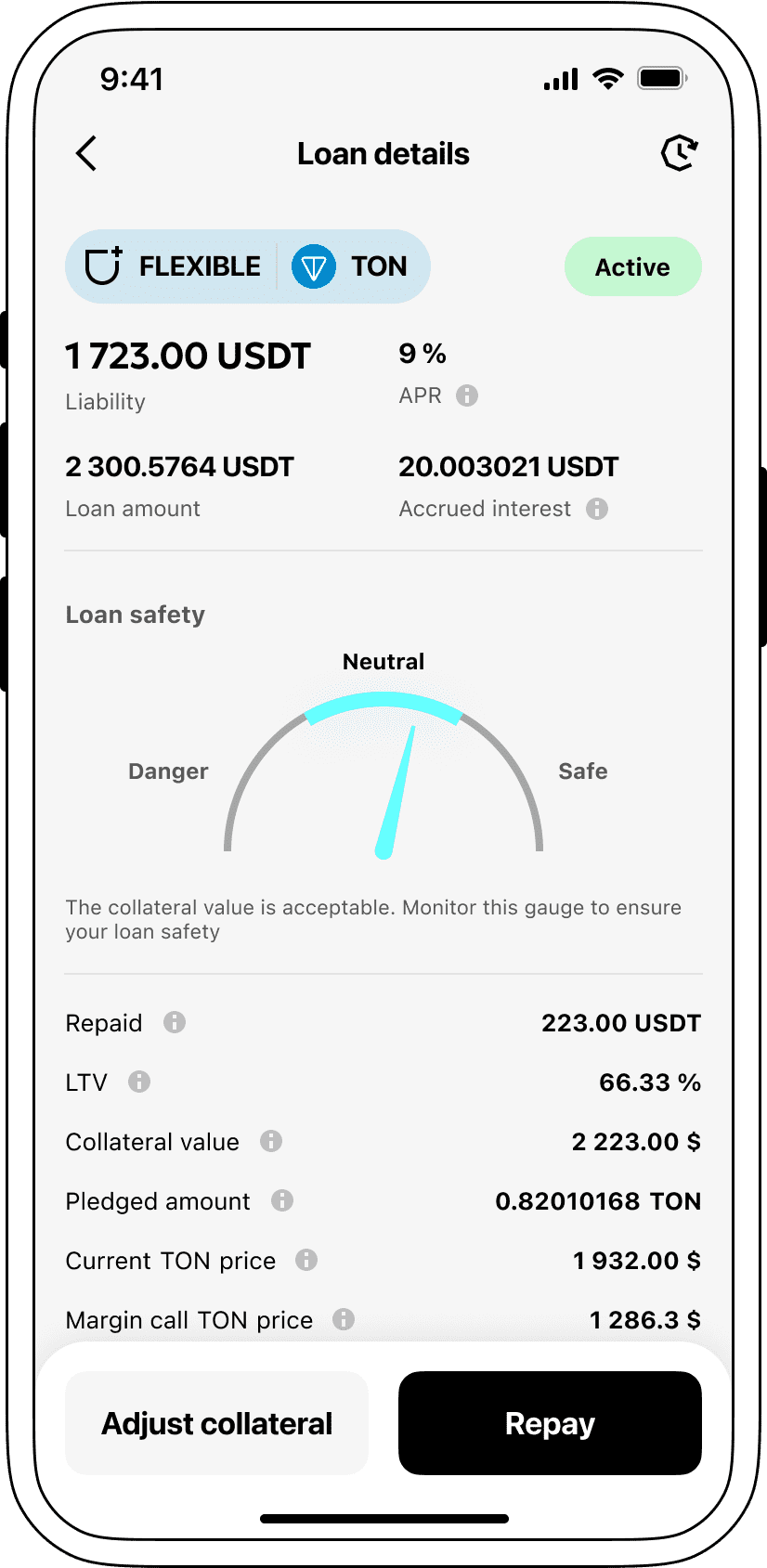

At Cropty, we understand how important it is to have good interest rates.That's why we offer TON loans at a low interest rate of just 9%.With our fair rates, you can get cash quickly without having to sell your valuable cryptocurrency, whether you need it for personal or business reasons.

One unique feature of our crypto loans is how we manage the collateral. The borrower gets to keep the Tether USDT they borrow, but if they don't repay the loan, Cropty keeps the TON coins that were used as collateral. This makes the process fair and works smoothly for all parties involved. To protect against TON Coin dropping in value, Cropty has an automatic liquidation system.

If the value of the collateral goes below a certain level, the loan will be automatically liquidated. This helps both the lender and the borrower avoid losses if the market gets worse. We believe in being clear and easy to work with. Users can easily check the status of their loans through our simple and easy-to-use interface.

Borrowers can also add more collateral, pay back the loan early, or close the loan completely by paying the borrowed amount plus the interest.

If you're thinking about getting a loan using cryptocurrency, Cropty offers instant coin loans.With us, you can take a loan against TON Coin and use a trusted wallet to manage your loan safely. Our crypto-backed loans give you a quick and easy solution for your financial needs.

Why choose TON Coin Cropty Loan

FAQ

What is Cropty TON Coin Crypto Loan?

How do I pledge my assets and start borrowing with Cropty TON Coin Crypto Loan?

What is LTV, and how much can I borrow from Cropty TON Coin Crypto Loan?

Are there limits to how much I can pledge and borrow?

What is loan liquidation, and what is the liquidation LTV?

What happens when a loan is liquidated?

What is a margin call?

Will I be notified in the event of margin calls or liquidations?

What interest rate applies to my loan?

How is interest accrued for my loan positions?

How do I repay my loan or adjust my LTV?

Which cryptocurrencies can I pledge or borrow on Cropty Crypto Loan?

What can I do with the cryptocurrencies borrowed from Cropty TON Coin Crypto Loan?

More coins