What is Tezos?

Tezos is a multi-purpose blockchain which aims to combine a self-amending protocol and on-chain governance to manage future changes and implementations to the network. It supports the creation of new tokens and smart contracts (thus decentralized applications or dApps). The on-chain governance system enables token holders to make decisions together and improve the network over time, as opposed to the less-inclusive off-chain governance models used by Bitcoin and Ethereum.

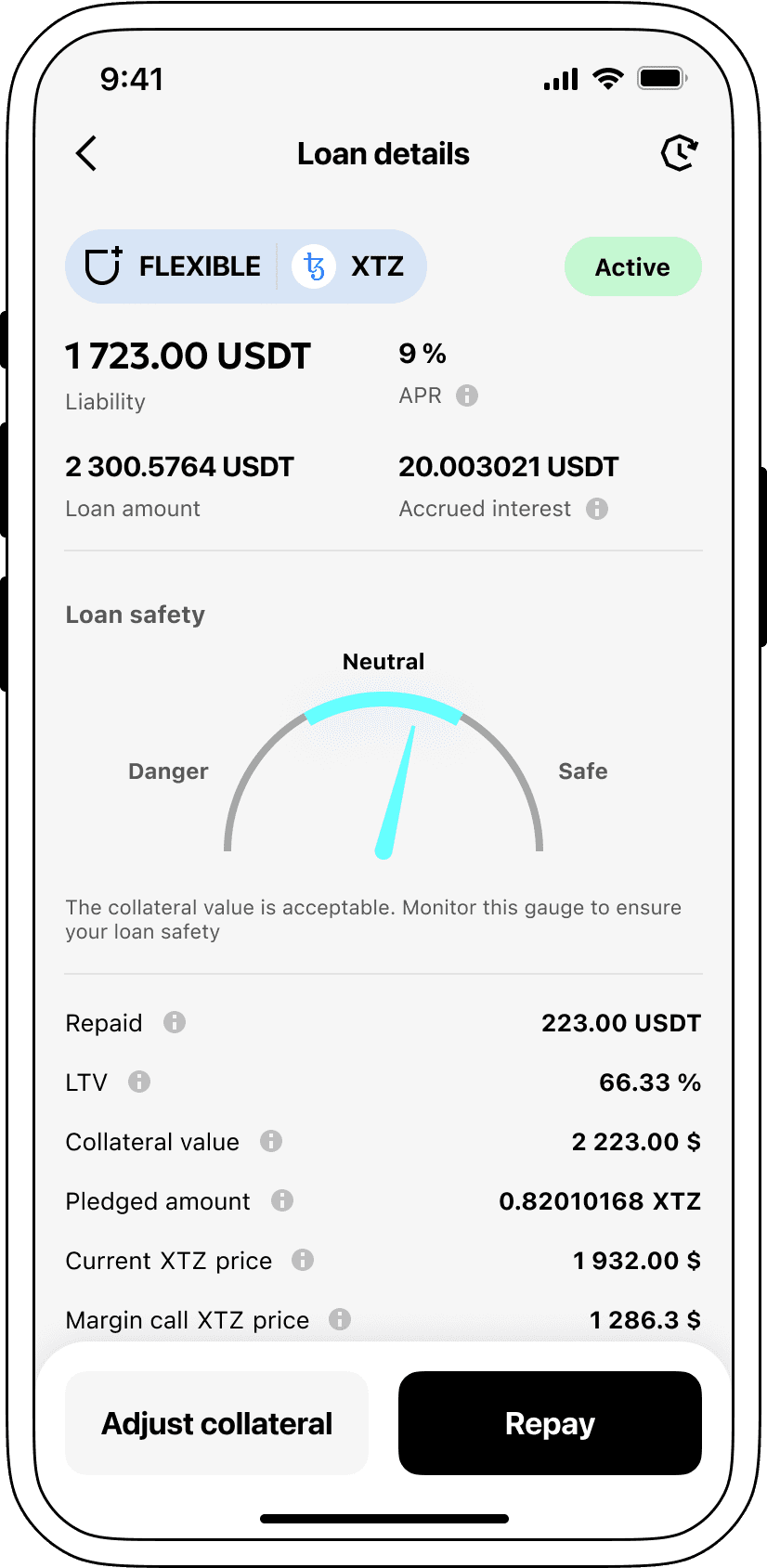

How do loans supported by XTZ work?

Cryptocurrency lending is a great model for both borrowers and lenders. Lenders can get loans in USDT using their digital currency as collateral. This way, lenders can own cryptocurrency and avoid the need for additional checks. No bureaucracy!

Investors can place their digital assets, such as Tezos (XTZ), in a separate portfolio on the Cropty platform. A banking custodian oversees interactions between lenders and borrowers, ensuring the reliability of the process. They act as a trusted intermediary, providing protection for both parties.

Creditors can benefit from this by receiving funds without selling their cryptocurrency. This is very convenient in volatile market conditions, as it helps to avoid potential losses.

Investors earn returns from the repayment of the funds they invested through loan repayment. This allows them to benefit from their digital assets. It is advantageous for both parties, as lenders receive funding, and investors gain from their participation.

The Cropty platform monitors the actions of lenders and investors, and the distributed ledger technology ensures secure exchanges without intermediaries. This reduces the likelihood of fraudulent activities and creates a safe environment for lending.

Tezos Loan Calculator

Crypto Loans explained

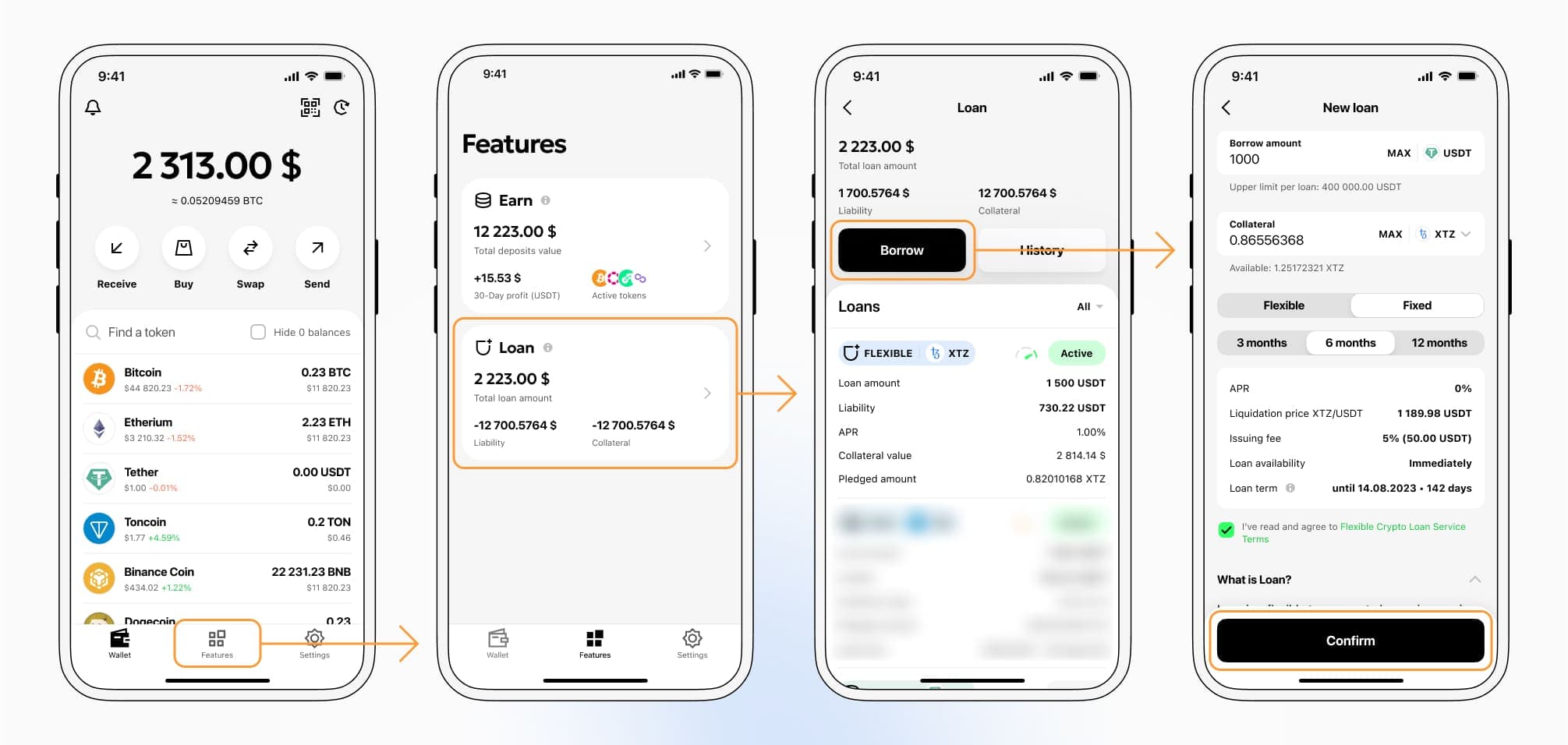

How to get a loan on Tezos? Borrow usd against Tezos on Cropty

The process of getting an Tezos cryptocurrency loan is quite simple. First, you need to create your account on Cropty, a platform that offers Tezos cryptocurrency lending services. Then, you need to provide your XTZ as collateral and specify the loan amount you want to borrow. The platform then evaluates your collateral and gives you access to the required amount of Tether USDT.

Your creditworthiness is determined based on the value of your collateral, making the process of getting a cryptocurrency loan fast and convenient.

However, it is important to remember that Tezos cryptocurrency loans are not without risks. In case you default on the loan, your collateral can be seized. Therefore, you should carefully assess your repayment capacity before taking out a cryptocurrency loan.

To authorize an Tezos Crypto Loan, you will need to go to Features tab → Loan section → Borrow button

Choose the required loan amount the terms and conditions of the crypto loan, and apply for it by confirming it with a code from 2FA - application or E-mail or Telegram-bot.

Learn more about XTZ Crypto Loans

Interest rates on loans secured by Tezos.

At Cropty, we recognize the need for competitive interest rates on loans. That’s why we offer loans using digital currency at an attractive rate of 9%. Whether you need funds for personal or business purposes, our low-interest loans provide a financially advantageous way to obtain liquid assets without having to part with your valuable cryptocurrencies.

An important feature of Cropty's blockchain loans is the securitization process. In case the client fails to repay the loan, the collateral XTZ remains with us at Cropty, while they retain control over the received Tether USDT. This model provides a fair and equitable method of loan recovery, beneficial for all parties.

To reduce the risk of Tezos devaluation, Cropty uses an automated liquidation model. If the value equivalent to the pledged Tezos falls below the set critical point, the loan will be liquidated. This timely intervention ensures safety for both us, the lender, and the client, the borrower, from impending losses during market downturns.

Cropty values clarity and user convenience. Our clients can easily monitor the status of their loan portfolio using our intuitive platform. Additionally, clients have the freedom to increase collateral, repay the loan early, or terminate the loan agreement by paying the borrowed amount plus accumulated transcription fees.

If you have been wondering how to get a loan using digital currency, look no further. Cropty offers instant coin loans. You have the option to pledge Tezos and receive Tether USDT. Our crypto-related loans provide a fast and convenient solution for your financial needs.

Why choose Tezos Cropty Loan

FAQ

What is Cropty Tezos Crypto Loan?

How do I pledge my assets and start borrowing with Cropty Tezos Crypto Loan?

What is LTV, and how much can I borrow from Cropty Tezos Crypto Loan?

Are there limits to how much I can pledge and borrow?

What is loan liquidation, and what is the liquidation LTV?

What happens when a loan is liquidated?

What is a margin call?

Will I be notified in the event of margin calls or liquidations?

What interest rate applies to my loan?

How is interest accrued for my loan positions?

How do I repay my loan or adjust my LTV?

Which cryptocurrencies can I pledge or borrow on Cropty Crypto Loan?

What can I do with the cryptocurrencies borrowed from Cropty Tezos Crypto Loan?

More coins