What is World Liberty Financial USD?

USD1 is a stablecoin launched by World Liberty Financial Inc. in March 2025.

Key facts:

- U.S. Dollar Peg — each USD1 is fully backed by cash, U.S. Treasury bills, and cash equivalents. Redeemable 1:1 for U.S. dollars.

- Reserves & Transparency — reserves are held via BitGo and Fidelity, with regular attestations and audits.

- Multi-Chain Availability — currently available on Ethereum and Binance Smart Chain (BSC), with expansion plans.

- High Liquidity — within months of launch, USD1 reached a market cap of ~$2–2.2B, with daily trading volumes exceeding $1B, especially active on PancakeSwap and other exchanges.

- Partnerships & Infrastructure — integrated with Chainlink CCIP for secure cross-chain transfers; listed on MEXC, PancakeSwap, and supported by DeFi protocols like ListaDAO.

- Controversy & Influence — closely associated with Donald Trump’s family, raising concerns over potential centralization and conflicts of interest. The token launched without public governance voting, which has drawn criticism.

How do loans backed by USD1 works

Crypto-credit provides an easy option for both borrowers and lenders. Borrowers can obtain loans in USDT by pledging their cryptocurrency as collateral, while still keeping ownership of their digital assets. This removes the need for credit checks and complex paperwork, making the process quicker and more cost-effective.

Lenders can place their cryptocurrency, such as World Liberty Financial USD (USD1), into a special account on the Cropty platform. A custodian manages the relationship between borrowers and lenders, ensuring a safe and smooth process. Acting as a reliable middleman, they protect the interests of both sides.

Borrowers gain the advantage of getting funds without selling their crypto, which can be very useful in times of market volatility by helping them avoid losses. The loan system also streamlines the lending process and takes away the requirement for credit approval.

On the other hand, lenders earn interest from money paid back on the loans. This allows them to generate income using their cryptocurrency holdings. It’s a clear benefit for both parties: borrowers receive cash loans, and lenders earn rewards from their investments.

The Cropty platform controls how borrowers and lenders interact, while blockchain technology guarantees safe and transparent transactions without middlemen. This reduces the chance of fraud and ensures a trustworthy lending environment.

World Liberty Financial USD Loan Calculator

Crypto Loans explained

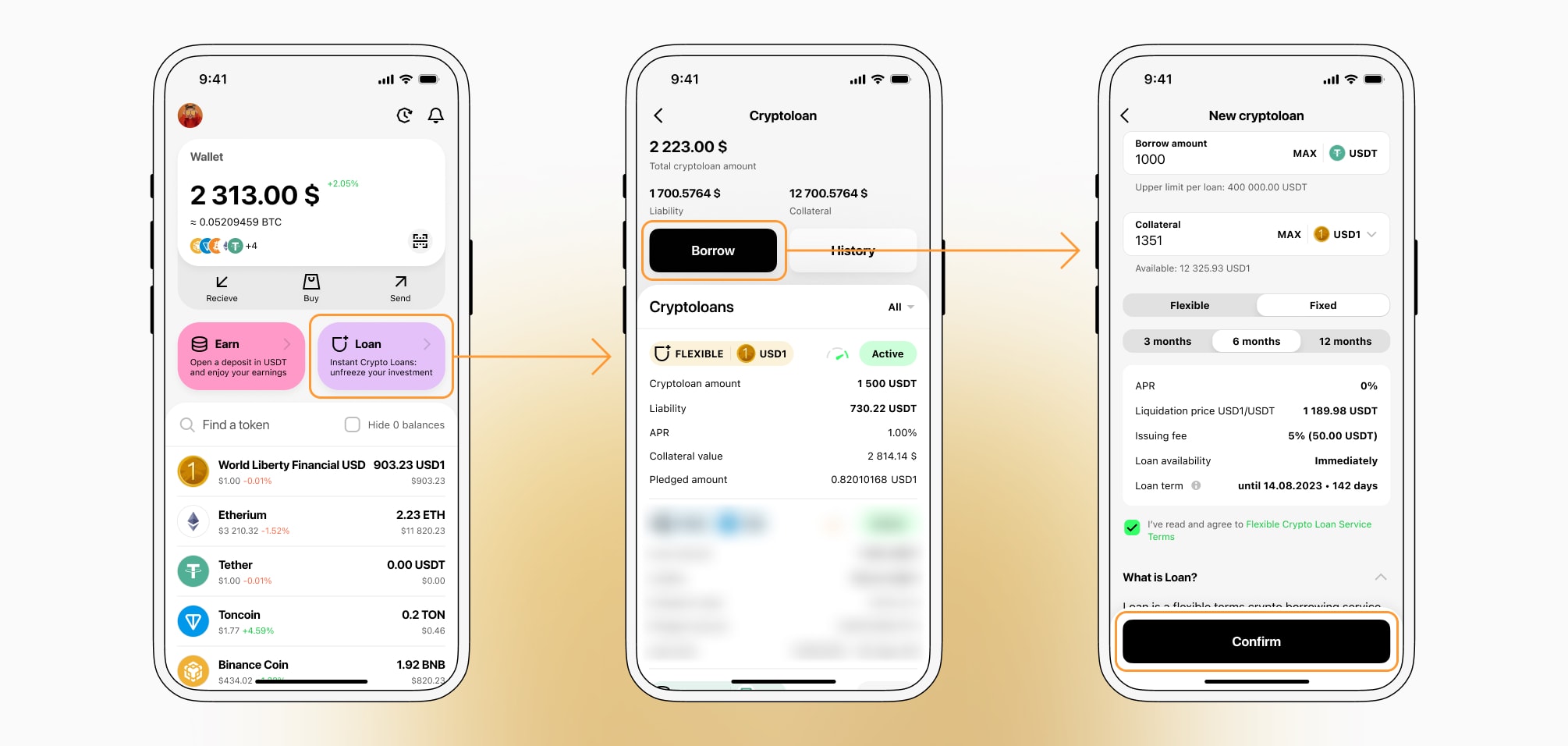

How to get a loan on World Liberty Financial USD? Borrow usd against World Liberty Financial USD on Cropty

The process of getting an World Liberty Financial USD cryptocurrency loan is quite simple. First, you need to create your account on Cropty, a platform that offers World Liberty Financial USD cryptocurrency lending services. Then, you need to provide your USD1 as collateral and specify the loan amount you want to borrow. The platform then evaluates your collateral and gives you access to the required amount of Tether USDT.

Your creditworthiness is determined based on the value of your collateral, making the process of getting a cryptocurrency loan fast and convenient.

However, it is important to remember that World Liberty Financial USD cryptocurrency loans are not without risks. In case you default on the loan, your collateral can be seized. Therefore, you should carefully assess your repayment capacity before taking out a cryptocurrency loan.

To authorize an World Liberty Financial USD Crypto Loan, you will need to go to Features tab → Loan section → Borrow button

Choose the required loan amount the terms and conditions of the crypto loan, and apply for it by confirming it with a code from 2FA - application or E-mail or Telegram-bot.

Loans backed by World Liberty Financial USD offer competitive crypto interest rates.

At Cropty, we know how crucial it is to have low interest rates. That’s why we provide crypto loans at an appealing rate of just 9%. Whether you need money for personal use or your business, our affordable loans let you access cash without selling your precious cryptocurrencies.

A standout feature of Cropty’s crypto loans is how the collateral works. If a borrower fails to repay, the USD1 collateral stays with Cropty, while the borrower keeps the Tether USDT they received. This system creates a balanced way to handle loan defaults, benefiting both sides fairly.

To guard against the risk of World Liberty Financial USD losing value, Cropty uses an automatic liquidation system. When the collateral’s worth drops below a set limit, the loan is liquidated. This safety step ensures both lender and borrower avoid big losses during tough market shifts.

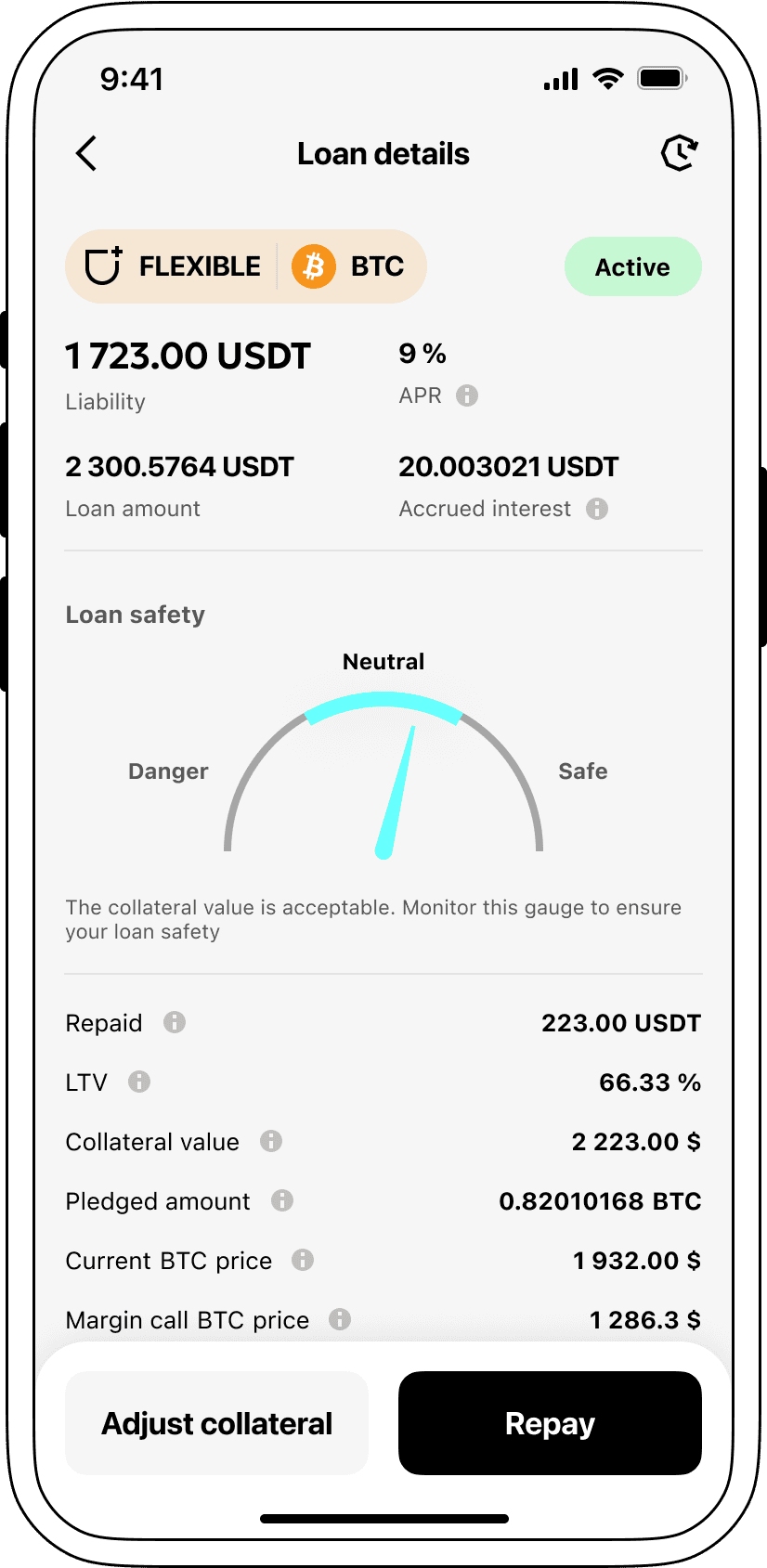

Cropty focuses on clear and easy-to-use services. Users can track their loans effortlessly with our simple platform. Borrowers also have options to add more collateral, repay early, or fully close their loan by paying back the original sum plus any interest.

If you’re looking for fast loans secured by cryptocurrency, Cropty has you covered with instant coin loans. You can get funds using World Liberty Financial USD as collateral and receive Tether USDT in return. Our crypto-backed loans offer a quick and convenient way to meet your financial goals.

Why choose World Liberty Financial USD Cropty Loan

FAQ

What is Cropty World Liberty Financial USD Crypto Loan?

How do I pledge my assets and start borrowing with Cropty World Liberty Financial USD Crypto Loan?

What is LTV, and how much can I borrow from Cropty World Liberty Financial USD Crypto Loan?

Are there limits to how much I can pledge and borrow?

What is loan liquidation, and what is the liquidation LTV?

What happens when a loan is liquidated?

What is a margin call?

Will I be notified in the event of margin calls or liquidations?

What interest rate applies to my loan?

How is interest accrued for my loan positions?

How do I repay my loan or adjust my LTV?

Which cryptocurrencies can I pledge or borrow on Cropty Crypto Loan?

What can I do with the cryptocurrencies borrowed from Cropty World Liberty Financial USD Crypto Loan?

More coins